It’s earnings season in the US. Some of the world’s largest companies are reporting results for the last quarter of 2021. Today, we start with Apple’s and Tesla’s quarterly earnings.

Strong earnings despite supply chain disruptions

In the past year, supply chain disruptions have been one of the biggest sources of headache for companies selling goods in the real world. Generally, there are two ways to solve this problem without losing sales or hampering profitability: (1) be so big that you will get prioritized by your vendors (Apple) or (2) have vertical integration such that you can be nimble and adapt to disruption (Tesla).

Apple’s strongest earnings yet

Apple reported another record breaking earnings, generating $123.9 billion in revenue, up 11% year-over-year. When analyzing Apple, there are three things that you want to pay attention to.

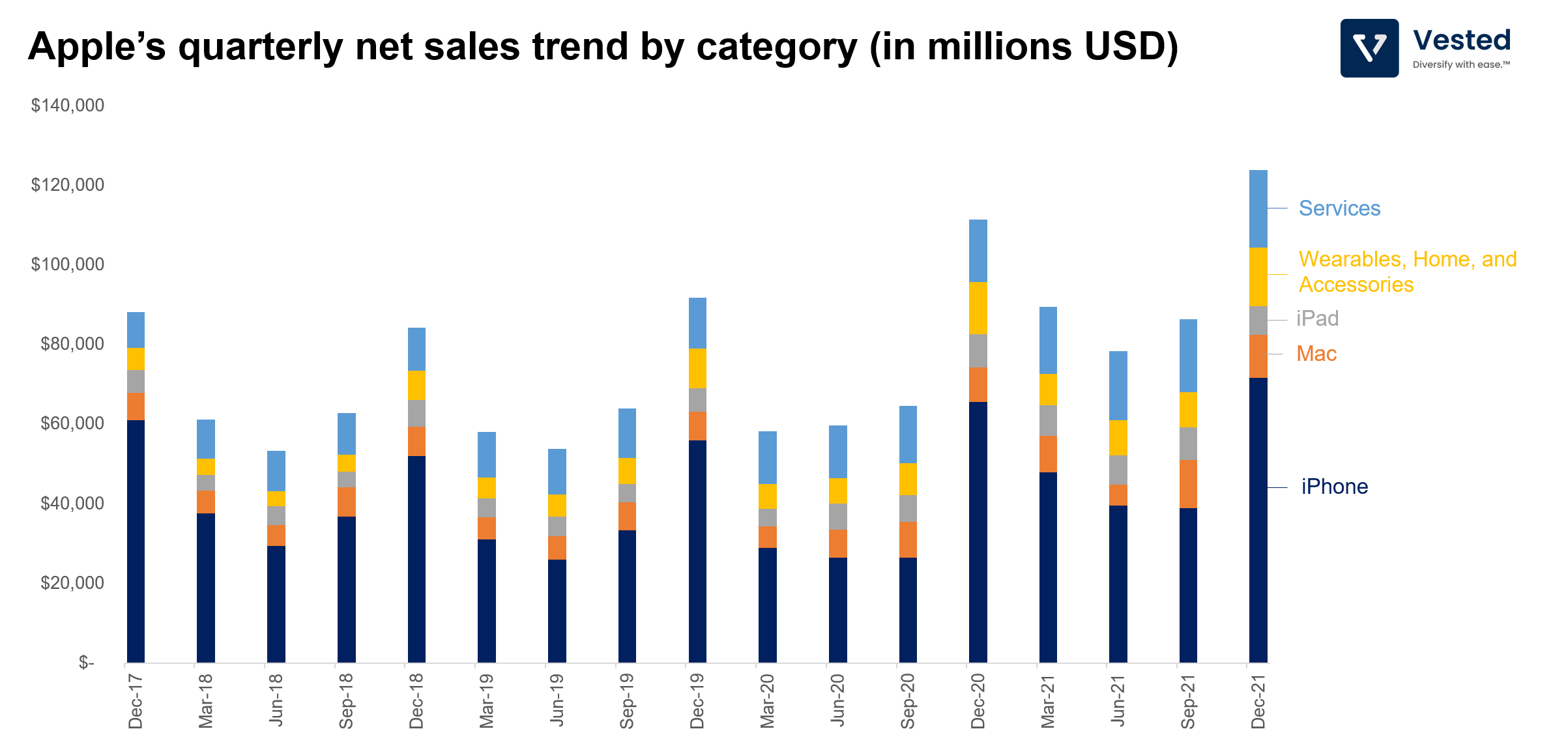

The first thing to pay attention to is what hardware is driving growth. Continued growth of iPhone sales is key. iPhone is the primary compute platform for Apple that anchors sales of other peripherals (AirPods, Apple Watch, iPad, etc) and subscription services (more on this in a bit).

In the quarter ending in December 2021, Apple’s iPhone sales were strong (up 8% year-over-year), thanks to the accelerated upgrade cycle prompted by the 5G transition (see Figure 1 above). Sales of Mac computers were also strong (up 20% year-over-year). Mac has been outperforming its PC counterparts in both performance and power consumption, thanks to Apple’s own chip design and TSMC’s superior production capabilities (as opposed to Intel who makes chips for the rest of the PC industry). In this semiconductor primer article, we talk about TSMC as a tide that lifts all boats, enabling outperformance of all Intel’s competitors’ chips (chief among them are Apple, AMD, and NVIDIA).

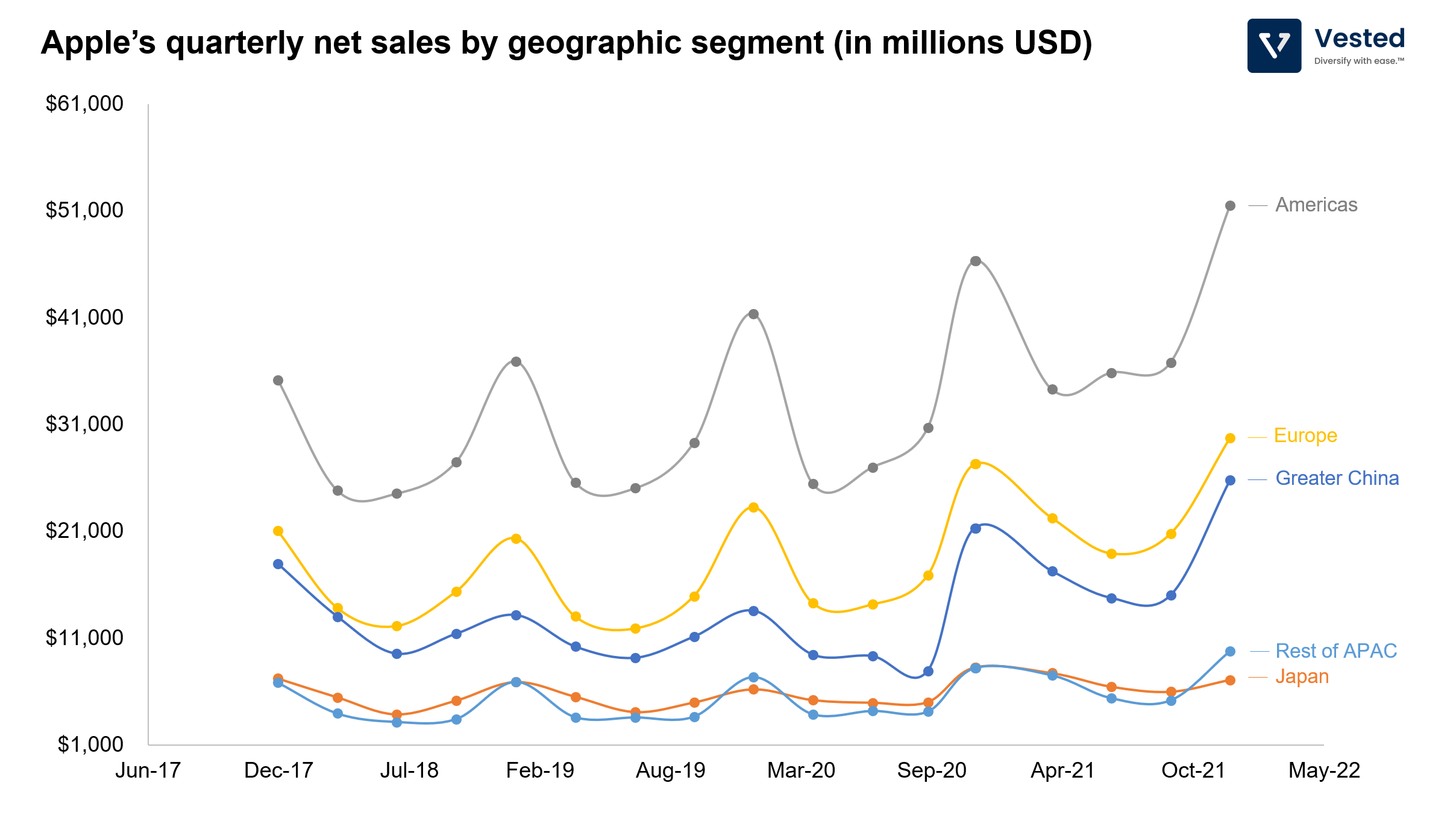

The second thing to pay attention to is which geographic region is driving growth. It’s a given that the Americas and Europe are two important regions. These two are the largest geographic revenue segments. But the region that is most important for continued sales expansion is the Greater China region (Figure 2 above). Up until September 2020, sales in China were in decline. But, in the past five quarters, the trend has reversed. This is because of two reasons: (1) the transition to 5G (China leads the world in the 5G deployment), and (2) Huawei, one of Apple’s chief competitors for the premium smartphone market in China, lost its ability to produce flagship phones due to US sanctions.

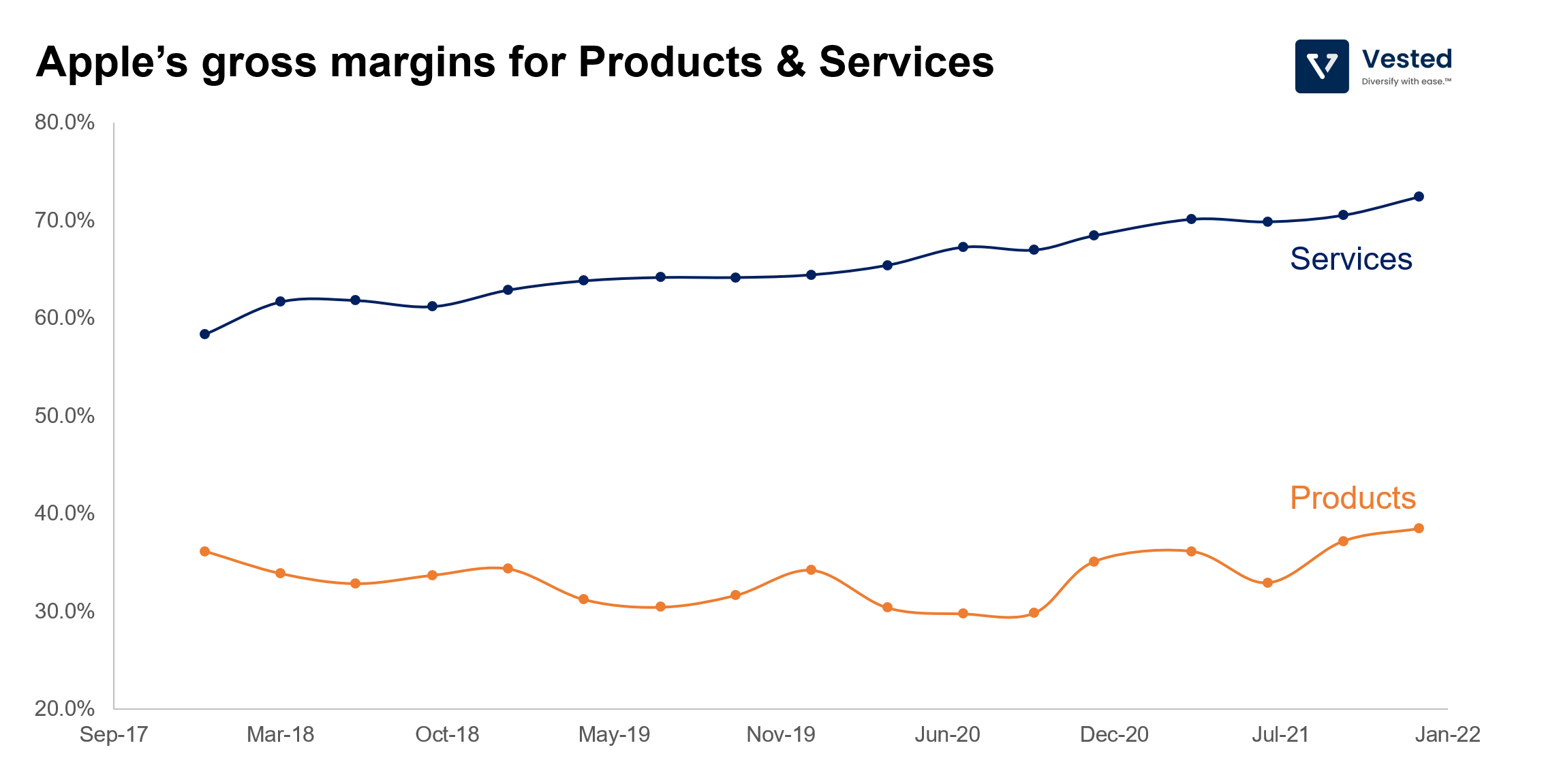

The third thing to pay attention to is growth in the Services segment. We’ve covered Apple’s Services narrative before. Apple Services revenue is derived from App Store fees, subscription services (Apple TV+, News, Music, etc) and is predicated on a large install base of Apple devices (currently at 1.8 billion devices, up ~9% year-over-year). It is a way to extract high margin revenue from its customers. Over the last quarter, services revenue went up 24% year-over-year, with increasing margin profile (blue line – Figure 3 above).

However, the App Store revenue might face regulatory scrutiny moving forward. A large portion of this revenue is Apple taking a 30% cut of sales from apps by mandating the use of Apple’s payment system. This practice is facing regulator push back in various countries. But the company is not resting on its laurels – it continues to expand the iPhone and add more services. One of the latest is to turn iPhones into payment terminals (to compete with Block/Square).

Tesla’s strong earnings that do not matter

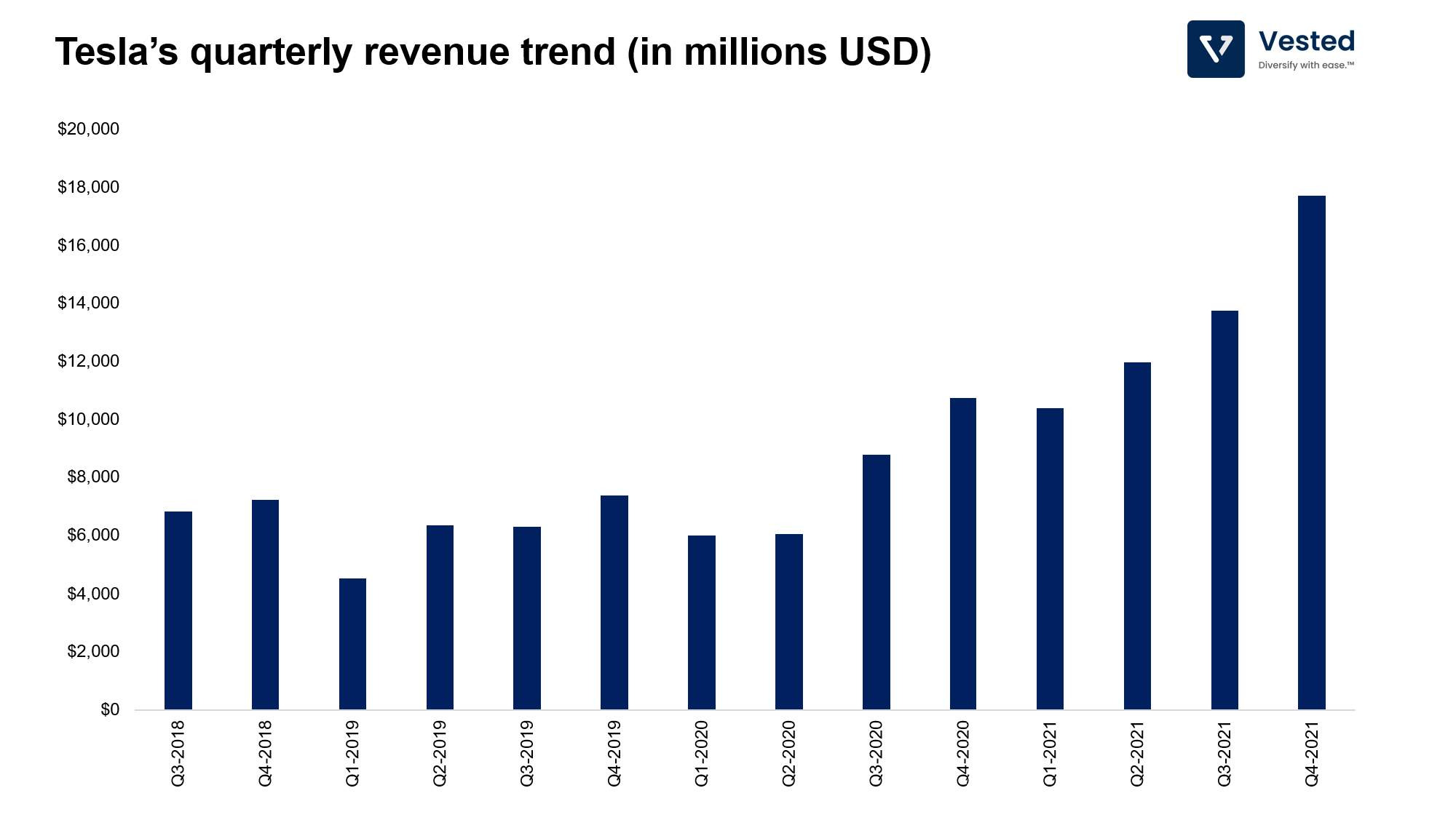

The second way to navigate your way out of supply chain constraints is to vertically integrate software and hardware and modify things on the fly to prevent production bottlenecks. This is what Tesla has done. A few weeks ago, the company reported record car deliveries, and this past week, it reported record earnings and profitability.

For the quarter ending in December 2021, Tesla generated $17.7 billion in revenue, a 65% increase year-over-year (Figure 4).

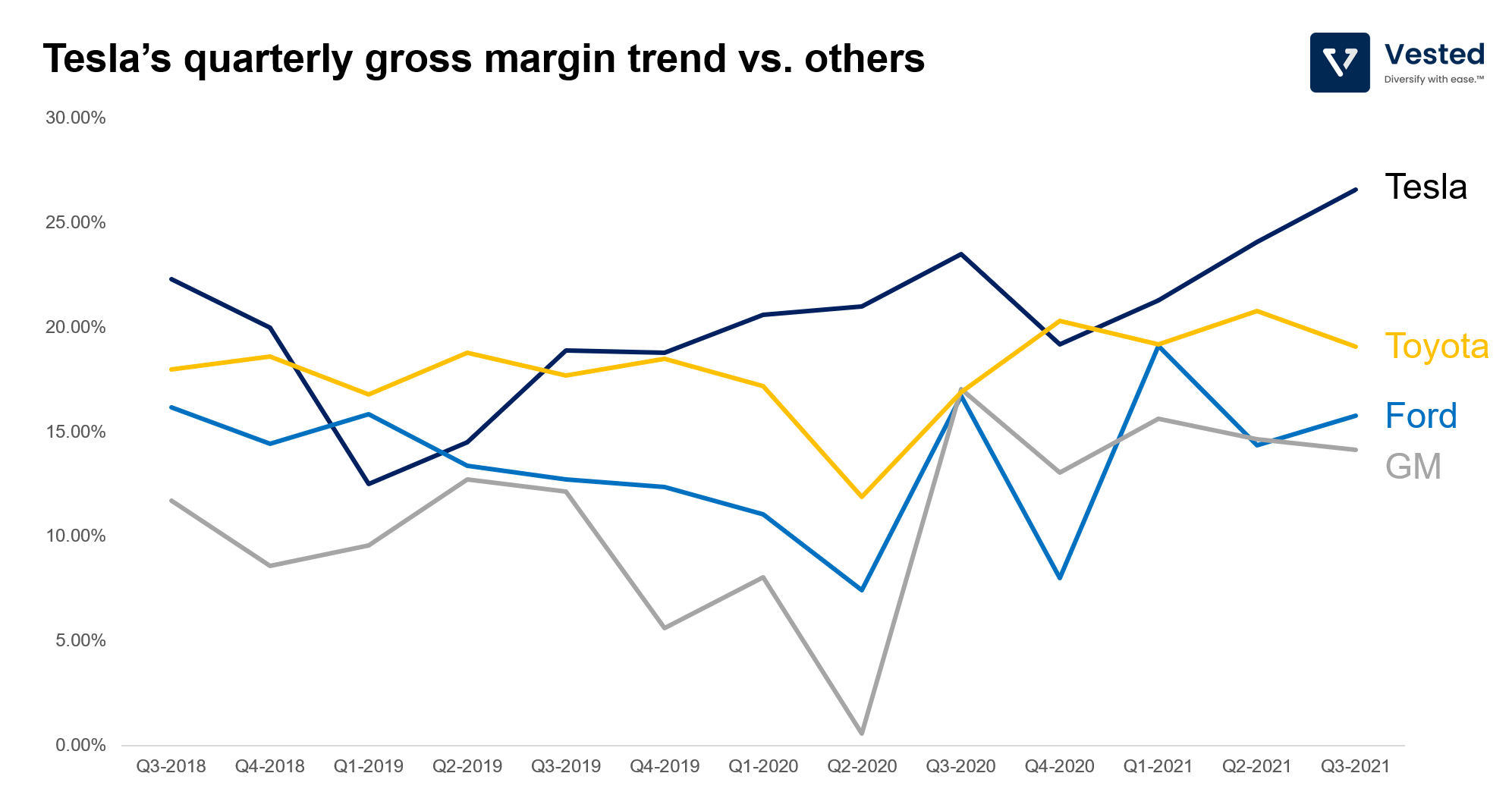

But what is more impressive is the level of gross margins that the company achieved in 2021 (Figure 5 below). By the end of 2021, Tesla’s gross margins were the highest compared to that at other scale car makers – almost double that of Ford and GM, demonstrating that EVs can be more profitable than combustion engine vehicles.

None of the above matters though. Tesla is the original meme stock. It’s market capitalization and valuation is divorced from its fundamentals. Thus, despite the outperformance in Q4 2021, the stock fell after the earnings announcement, especially after the company commented that 2022 might be the year where it is impacted by supply chain issues in a more significant way.