It’s earnings week here in the US. Some of the largest companies in their sectors are reporting Q4 2022 earnings. Let’s review a few and see how they broadly reflect these sectors’ health.

In this Blog, we will be discussing the following:

- Meta’s (Facebook’s) earnings and the overall digital ads sector

- Amazon’s AWS slowdown

- AMD and Intel

The turnaround: Meta’s Q4 2022 earnings

When Meta announced its latest earnings, its share price rallied, jumping more than 25%. The company’s share price has doubled since its low point in November 2022. Why? Two broad reasons:

- The first is messaging. Mark Zuckerberg is showing that Meta is finally listening to investors and that it will focus on efficiency (and returning cash flow to shareholders).

- The second is product updates. Meta is showing progress in user engagement and can overcome the revenue headwinds caused by the privacy block Apple instituted.

The year of efficiency

In October 2022, Altimeter Capital sent an open letter to Zuckerberg to renew the company’s focus and reign in excess spending. The letter seemed to have fallen on deaf ears. Meta continued to operate as normal, despite a steep decline in its share price (at the time of the open letter, Meta’s share price had declined by 55%). Meetings between institutional investors and company management only roused more investors’ frustrations.

In November 2022, Meta finally relented. The company announced that it was laying off more than 11,000 people (or a 13% reduction in its workforce). The stock price jumped when the news broke. And when Zuckerberg renewed his pledge on efficiency during the earnings call:

“Before getting into our product priorities, I want to discuss my management theme for 2023, which is the “year of efficiency”. We closed last year with some difficult layoffs and restructuring some teams. When we did this, I said clearly that this was the beginning of our focus on efficiency and not the end.” — Mark Zuckerberg (Q4 2022 earnings call)

The reduction in spending does not just stop at headcount but also extends to capital expenditures. The company plans to reduce capex by about $3 billion annually (to $30-33 billion from $34-37 billion).

And what will the company do with the extra cash flow? Buyback more shares. Meta announced it had increased approval for share buyback by $40 billion.

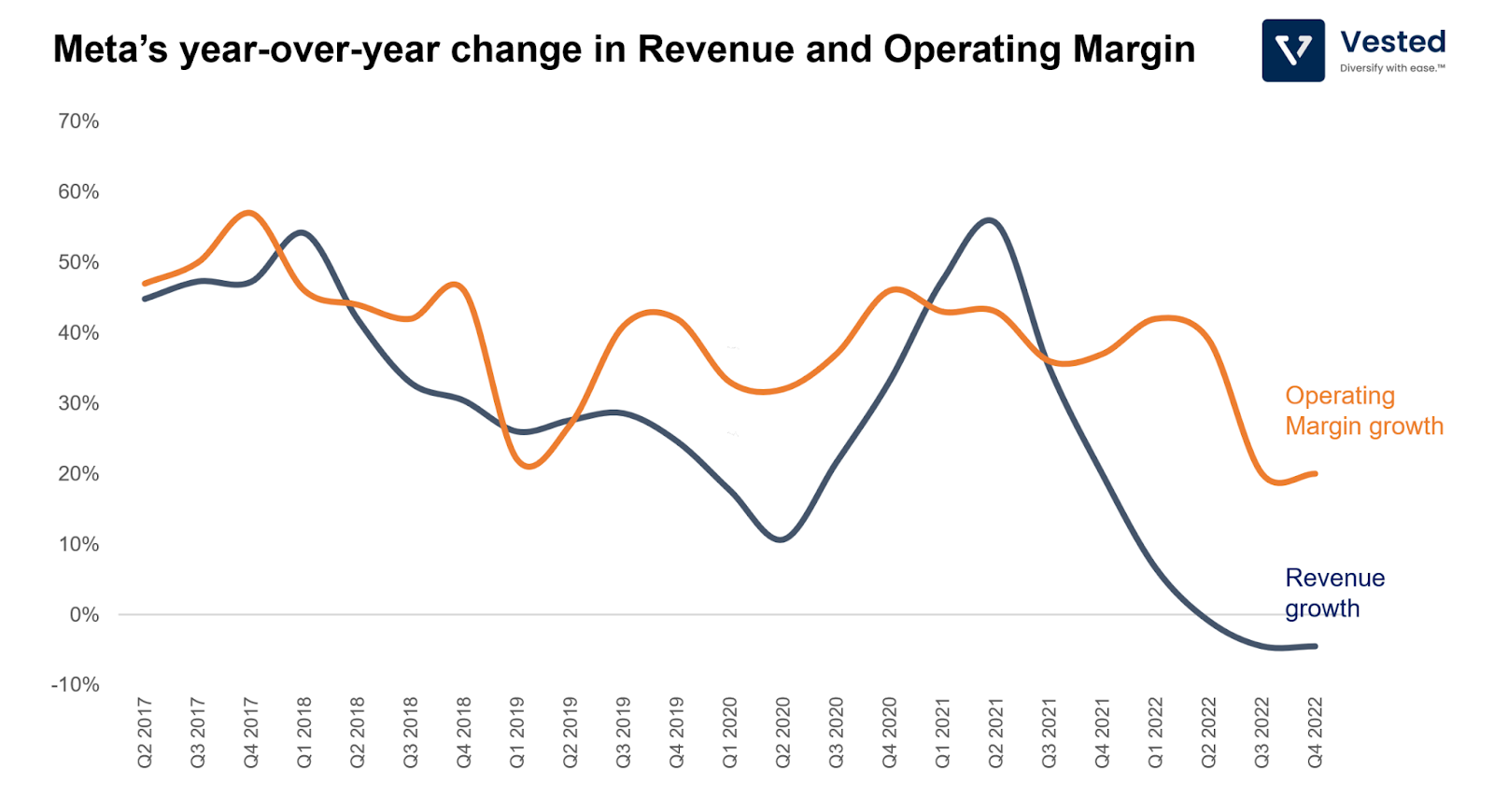

Overall, it seems that Meta has reached a turning point in growth for operating margin and revenue (see Figure 1 below).

If the re-acceleration of operating margin growth is driven by a newfound discipline on hiring and capex, then the re-acceleration of revenue growth can be attributed to Meta’s product progress.

Meta’s product updates

There are three key updates on this front.

The first is that Facebook and Instagram are transforming from organizing content based on social graphs (people you know and businesses you follow) to ones that show you content regardless of affiliation, powered by an AI recommendation engine (more akin to TikTok). This new content reorganization comes in all formats, but more recently, it has been focused on short videos (Reels). Zuckerberg reported that Reels consumption has doubled in the past year.

So far, Meta has been focused on getting people engaged with Reels, a feature that has historically been under-monetized the feature compared to its current flagship feature, Newsfeed. Facebook always under-monetizes new features to maximize engagement before turning on increased ad loads on its products. This is why engagement always precedes revenue growth. But in the earnings call, Zuckerberg indicated that Reels seems to have achieved sufficient scale, allowing the company to have more aggressive monetization in 2023. Until Reels achieves monetization parity with Newsfeed, earnings growth will decline since users’ attention is mainly zero-sum: if they are consuming Reels, they are not consuming Newsfeed.

The second is AI. The company continues to spend on AI to improve its content recommendation engine (for Reels). It is also heavily leveraging AI to improve monetization efficiency, specifically to improve conversions. The company reports that, on average, advertisers see 20% more conversion in the previous year, which translates to a higher return on ad spend.

The third is that Meta is finally able to monetize messaging. The company has a long and rich history of experimenting with messaging. In 2014, it spun out Facebook messenger from just being a tab inside the Facebook app into its own standalone app. That same year, the company bought WhatsApp for $19 billion, a price tag considered insanely high at the time.

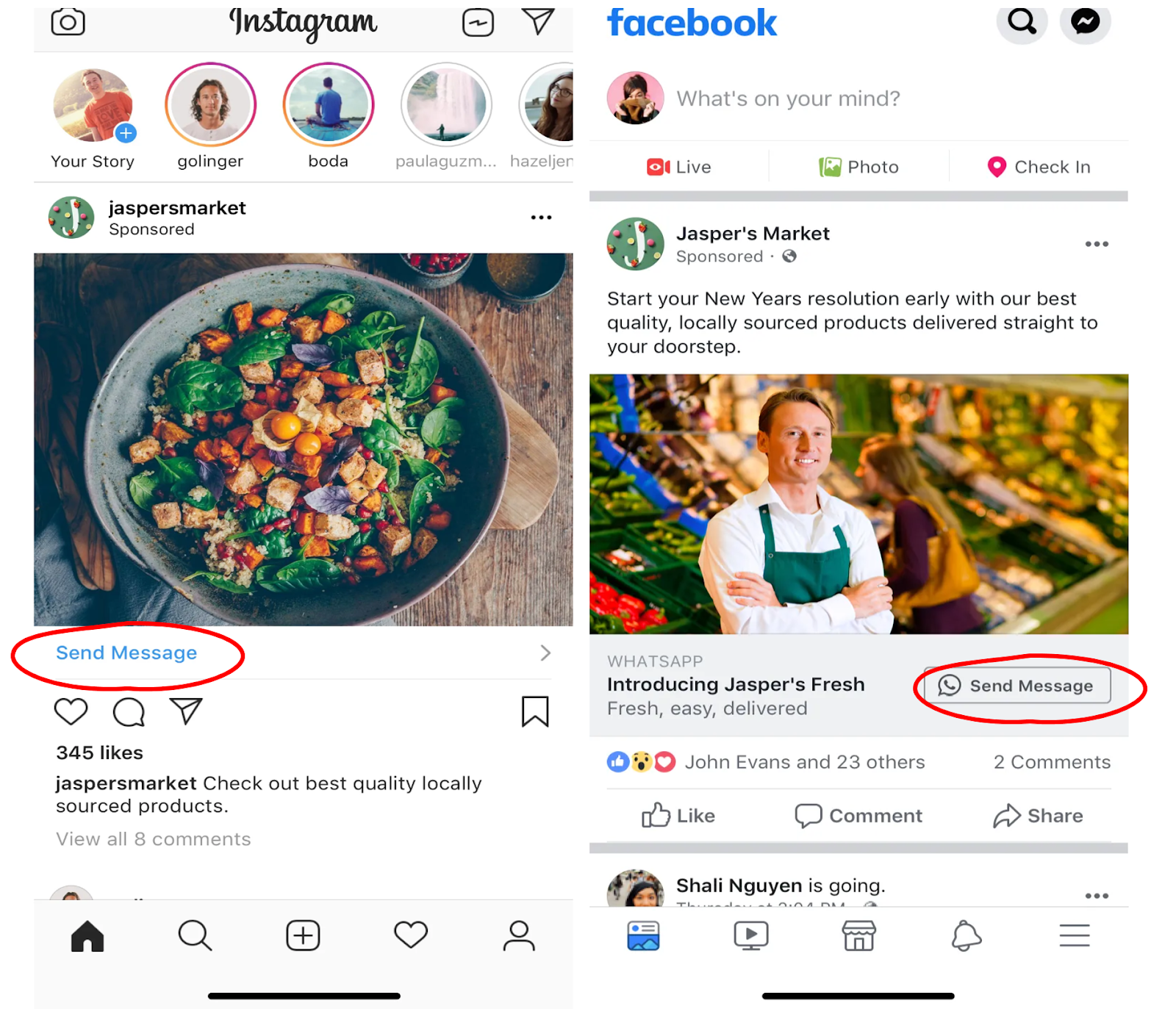

But for years, Meta experimented with ads on messaging services. One particularly bad implementation is these annoying ads within Messenger (Figure 2 below).

Finally, it had a breakthrough. Although it was first introduced in 2015, click-to-message ad format finally gained significant traction in recent years. Zuckerberg reported that this format had reached a $10 billion revenue run rate (roughly 10% of 2022’s total revenue). For an example of how this ad format looks, see Figure 3 below.

When users click on these, they will be directed to chat with the business. The business can then capture the user’s contact information and would be able to interact with the potential customer (via Messenger or WhatsApp). The contact information can also be used to increase the targeting efficiency of other ads. As a result, this ad format translates to higher conversions. Meta reports that more than half of click-to-message advertisers are new to the platform, driving incremental demand as they exclusively use this new ad format.

Meta is bullish on this new format. Over time, management believes that messaging will form the third pillar of its business (with the other two being Facebook and Instagram).

Overall Digital Ad Business is slowing down

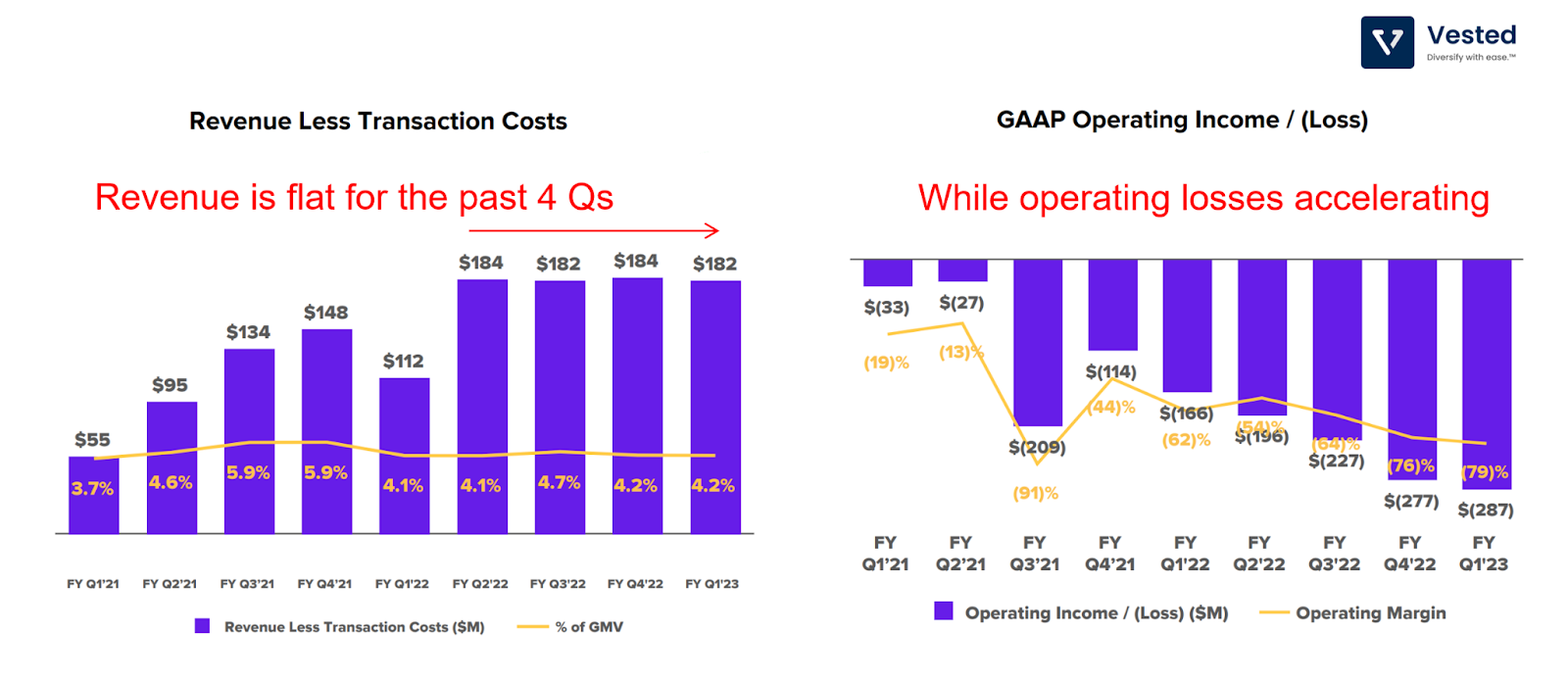

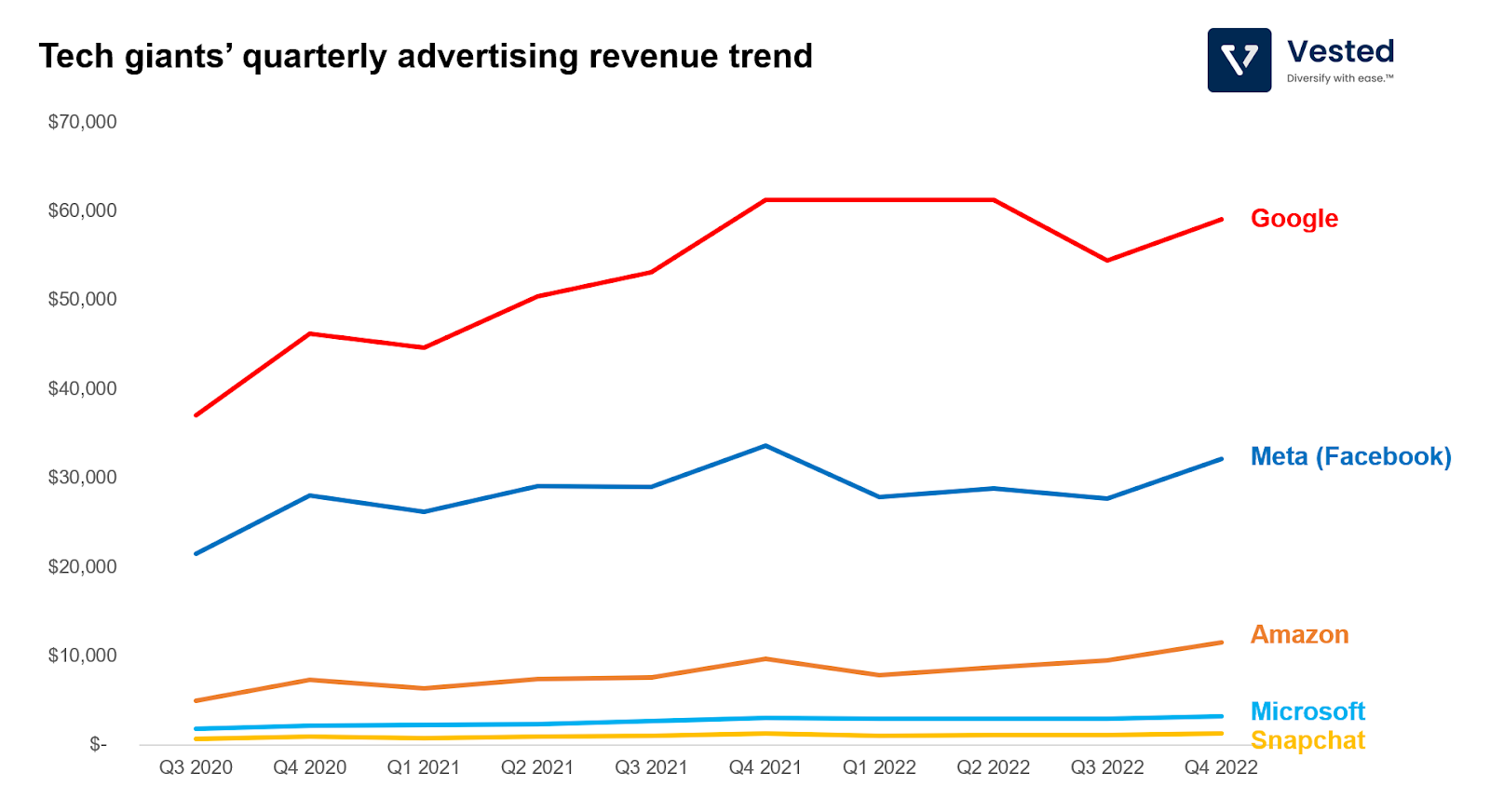

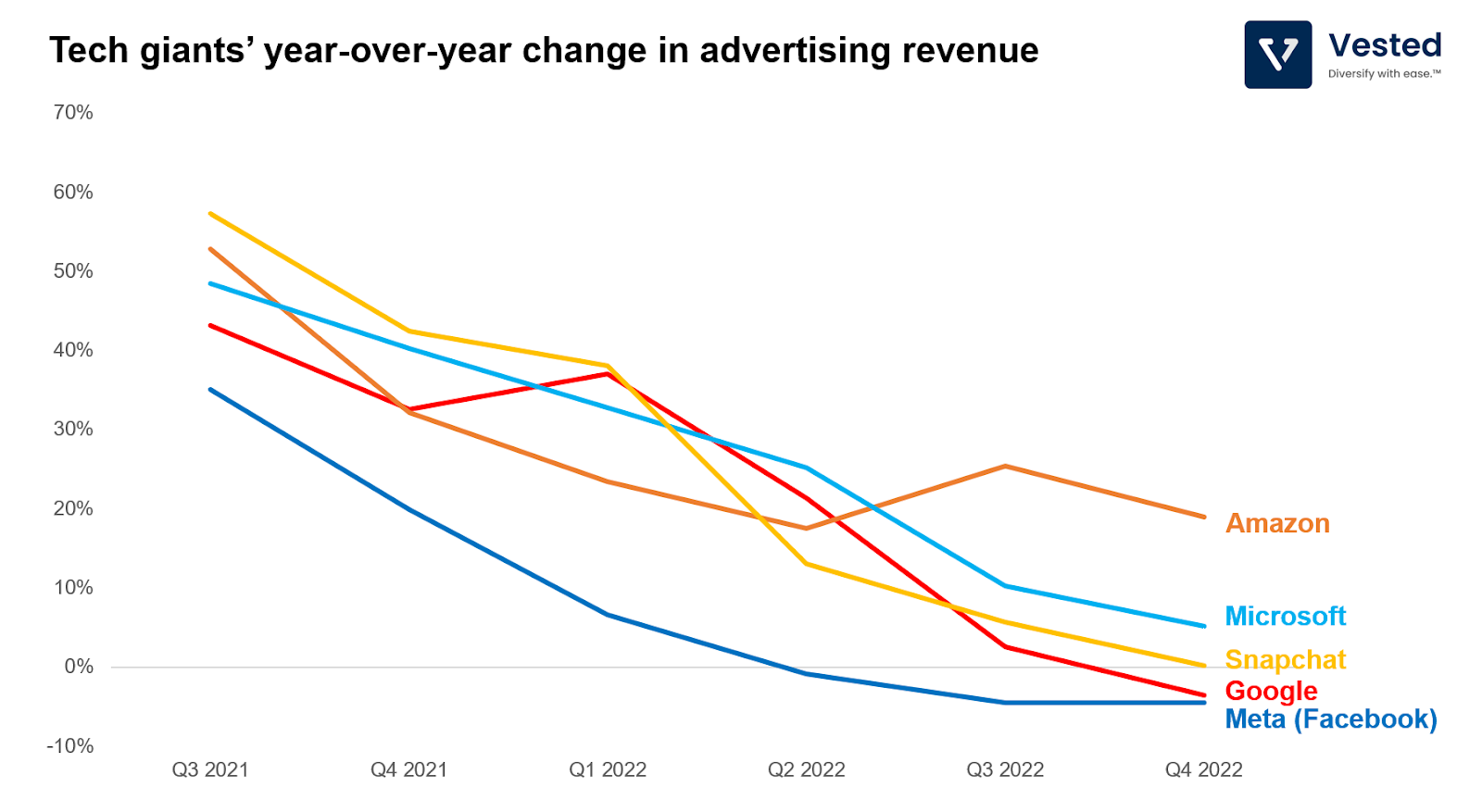

Zooming out of Meta and comparing it with the other tech giants’ ad business, you see a broad deceleration in top-line growth. Figure 4 below shows the quarterly ad segment revenues of these companies. Since Q4 2020, Google’s ad revenue has increased by 28%, but the growth rate has largely tapered down in the past two quarters.

This fact is more apparent in the quarterly revenue year-over-year change trend (Figure 5 below).

Some key takeaways:

- Meta experienced the most slowdown since it is most impacted by Apple’s privacy changes – something Meta believes it can overcome by the end of this year/early next year. And as we mentioned above, the worst might be behind them.

- Google’s ads business experienced a negative growth rate. Overall, the company missed earnings expectations, reflecting the overall weakness of the ad industry as businesses reduce marketing spending.

- Interestingly, Amazon’s ad business seems to defy the trend. Despite being the 3rd largest player, it is still posting a healthy 19% year-over-year growth. The resilience is likely because Amazon’s ad business is almost exclusively a direct advertising business, which captures higher-intent consumers. As such, this type of advertising is more closely related to sales and, therefore, is more robust (businesses would turn off brand advertising before they turn off direct ads). In addition, Amazon ads and their conversions occur within Amazon’s websites and apps. Therefore, it is not impacted by Apple’s privacy changes.

- Snap is in trouble.

Beyond digital advertising slowness, the common chorus that the tech giants are repeating is, on aggregate, when you consider the other segments, their businesses actually grew on a year-over-year basis – if you ignore currency headwind:

- Meta Platforms’ sales would have increased by 2% rather than dropping by 4%.

- Alphabet’s revenue would have increased by 7% rather than 1%.

- Amazon’s revenue would have increased by 12% instead of 9%.

- Microsoft’s revenue would have increased by 7% rather than 2%.

The slowing growth of cloud at Intel’s expense

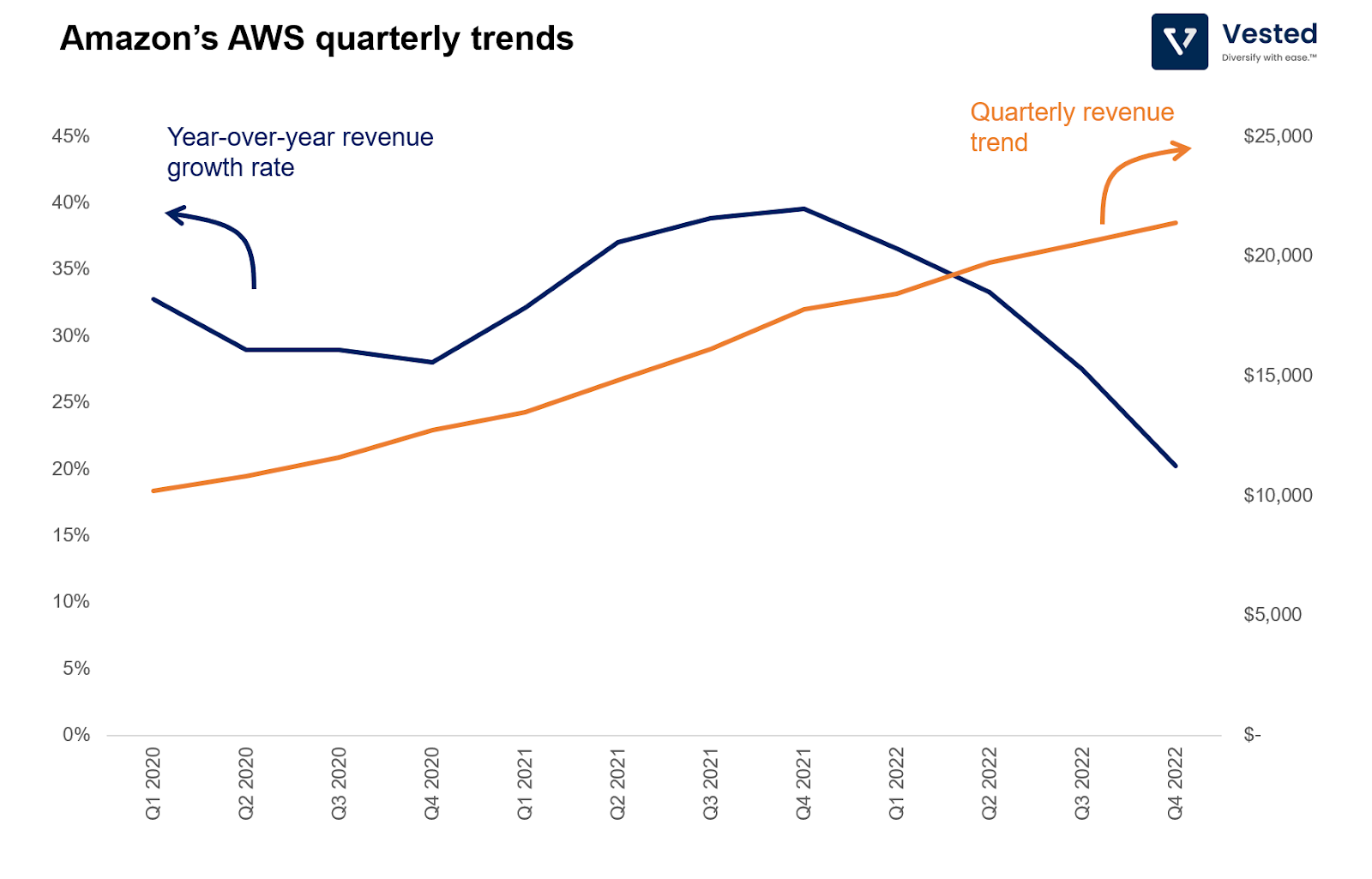

As businesses are reigning in spending, they’re not only cutting back on advertising; businesses are also reigning in spending on cloud computing. Amazon, the cloud segment leader, reported a growth of only 20%, the slowest growth rate posted in almost three years (Figure 6 below). AWS had the highest impact since this segment drives the company’s profitability and is also the largest driver of Amazon’s valuation.

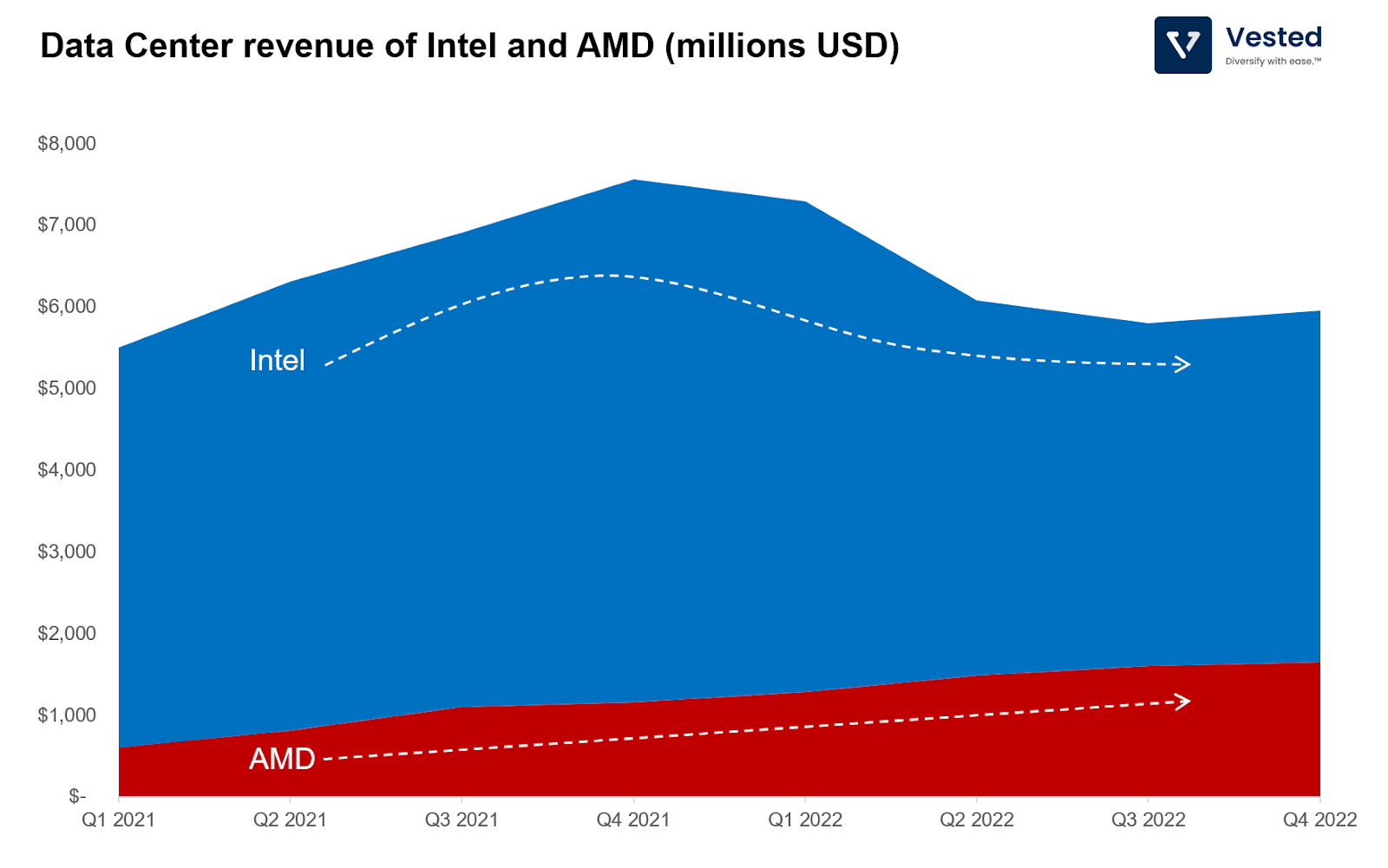

The slowness in cloud spending results in slower sales for chip makers. Data centers consume many resources, from energy, real estate, and chips (memory, microprocessors, and GPUs). From the perspective of computing chips, the X86 CPUs, made by both Intel and AMD, are the two primary chips used in Data Centers.

Here is the quarterly revenue trend for Data Centers for both Intel and AMD (Figure 7 below).

Similar to the acceleration of cloud demand that you see in AWS’ revenue trend that occurred in 2021 (see Figure 6 above), you see an acceleration of Intel’s Data Center revenue. But that bump in sales has declined to the pre-covid era. In contrast, AMD Data Center revenue keeps increasing.

While the market is likely slowing down, the decline is mostly at the expense of Intel. In contrast, AMD continues to grow unabated, taking market share from the once-dominant Intel. AMD’s Data Center product line (EPYC) outperforms Intel on performance and power consumption. This is because the company is riding on TSMC’s process advantage, something that we discussed in more detail in a previous post (The empires that TSMC built).

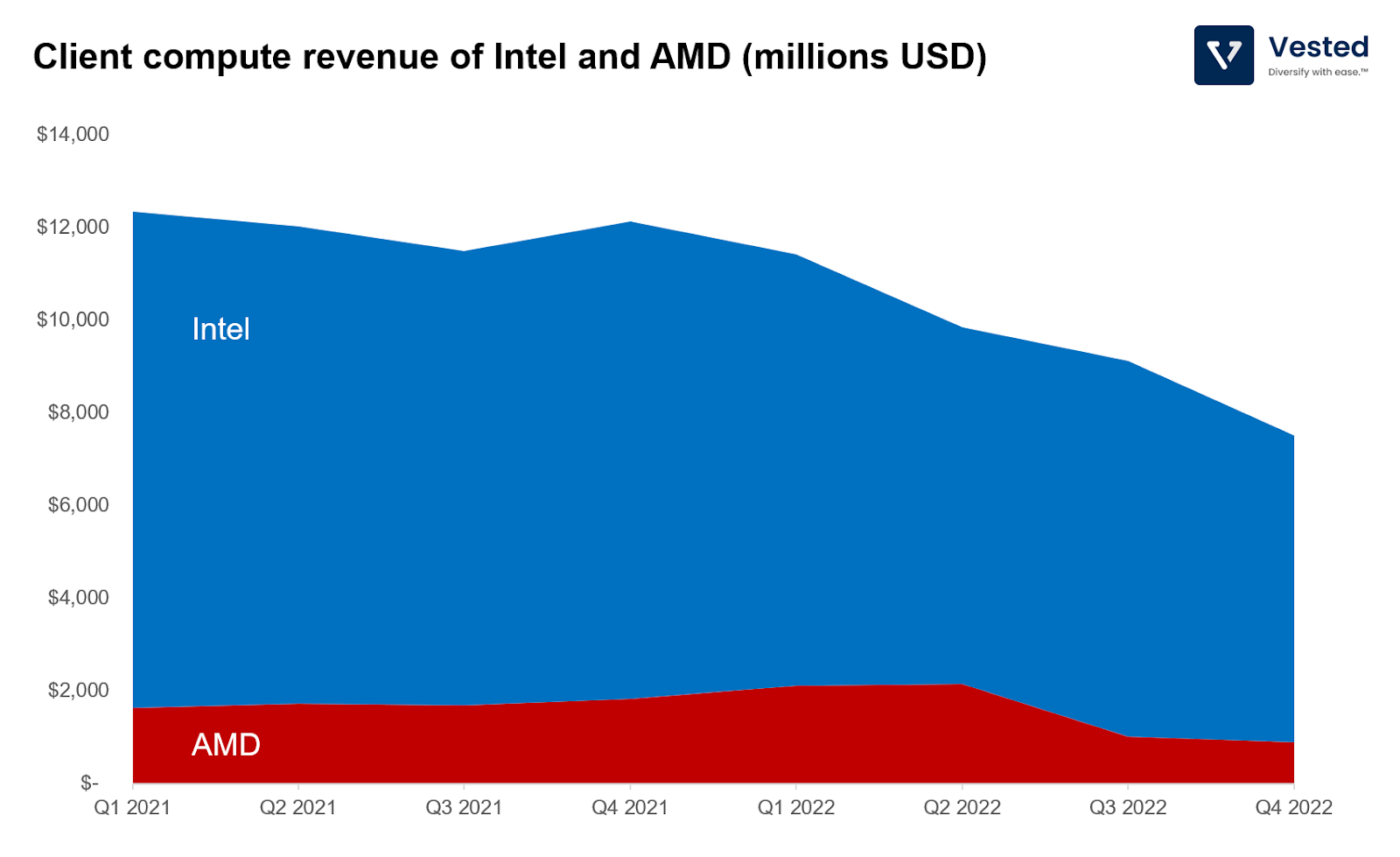

The PC market is in a slump

The story for the PC market is a lot simpler. After the pandemic boom, pulling forward purchases, and with the softness in the economy prompting customers and businesses to delay upgrades, the PC market fell by 16.5% in 2022. As a result, both AMD and Intel saw revenues decline on this front.

This paints a dire picture for Intel. For years, it had been lagging in process advantage to TSMC, so much so Intel relies on TSMC to produce its most advanced node. Intel’s CPUs are no longer competitive: it is losing market share, and its margins are being compressed. In terms of numbers, its gross margins used to be above 60%, but now it’s 39%, while operating margin is -8.1%. Also, its free cash flow was -$9.6 billion in 2022, a -200% decline from 2021.

The only way for Intel to regain process advantage is to invest heavily in R&D and build out fabs (a multi-year effort). This requires a lot of capital expenditures, which is difficult to do while demand is in decline and cash flow is negative. Despite all these headwinds, the company chose to cut employees’ pay and prioritize paying out dividends (it spent $6 billion on dividends in 2022). Considering Intel’s employees are the ones who will turn the ship around, not its investors, this move seems short-sighted.