What is SIP Investment?

SIP (Systematic Investment Plan) allows you to invest a fixed amount regularly in mutual funds, ETFs, or other financial instruments. It helps build wealth gradually through rupee cost averaging and compounding while minimizing market timing risks. With as little as Rs. 500 per month, SIPs offer flexibility and long-term growth. Tools like the US SIP calculator or stock market SIP calculator help track these returns across various markets.

Key Benefits of SIP Investment:

- Affordable and Accessible: SIPs allow you to start investing with as little as Rs. 500 or Rs. 1,000 per month, making it accessible to a wide range of investors.

- Long-Term Wealth: SIP investments benefit from compounding, where your returns start generating additional returns over time, especially when you invest over a long time.

- Disciplined Investing: SIPs automate the investment process, ensuring consistent contributions towards your financial goals without the temptation to stop or withdraw in the face of market volatility.

- Diversification: By choosing different types of funds or asset classes, such as equity, ETFs, or debt funds, you can easily diversify your investments.

- No Market Timing Required: Unlike lump sum investments, SIPs allow you to invest regardless of market conditions, reducing the risk associated with trying to time the market.

Whether you are investing in India or exploring international options, tools like SIP calculator USA or stocks SIP calculator can help you track your investment progress and returns. Similarly, the ETF calculator can assist you in understanding the potential growth of your investments in stock markets or ETFs.

Introduction to SIP Calculator

The Systematic Investment Plan (SIP) Calculator is designed for investors aiming to systematically invest in stocks and exchange-traded funds (ETFs). This calculator allows investors to project the future value of their investments by considering the monthly investment amount, expected rate of return, and investment duration. The SIP approach is especially effective in volatile markets, as it employs the principle of rupee-cost averaging, potentially reducing the average cost per share over time.

Moreover, the SIP Calculator aids in fostering financial discipline and long-term wealth creation. It provides a clear and strategic pathway for investors to build their portfolios, encouraging a consistent investment habit crucial for achieving financial goals in the stock market.

How does the SIP Calculator work?

The SIP calculator operates on a formula that factors in the monthly investment amount, the expected rate of return, and the investment duration.

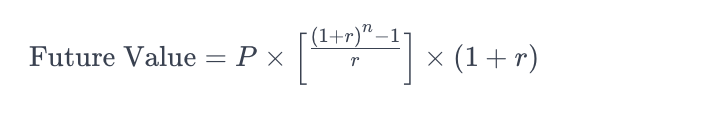

Using the formula below, the future value of your investment would be calculated:

Where:

- P = Regular investment amount ( monthly SIP amount)

- r = Periodic rate of return (monthly, if monthly investments are made)

- n = Total number of investments (number of months in case of monthly investments)

The term (1+r)^n represents the compound interest factor, and the overall formula calculates the future value of a series of cash flows at a given rate of return.

Let’s break down the calculation step by step to understand how a SIP Calculator would estimate the future value of an INR 100,000 monthly investment over 10 years, with an expected annual return of 12%.

Initial Data:

- Monthly investment (P): INR 100,000

- Annual rate of return (R): 12% (or 0.12 in decimal)

- Investment duration: 10 years

Converting annual return to monthly:

First, we need to convert the annual rate of return to a monthly rate. The monthly rate is calculated by dividing the annual rate by 12 (months in a year).

Monthly rate (r) = 12%/12 (or 1% per month)

Calculating the total number of payments:

Since the investment is monthly and spans 10 years, the total number of payments (n) would be 10 years×12 months/year=120 months

Now, we apply the formula for the future value of a SIP:

Future value = 100,000 × [(1+0.01)^120−1]/0.01×(1+0.01) = INR 2,32,33,908

Understanding the outcome:

The result of this calculation will give you the future value of your SIP investment. This value represents the total amount you will accumulate at the end of 10 years, considering a consistent investment of INR 100,000 per month and an average annual return of 12%.

How to use the SIP Calculator?

Using the Vested SIP Calculator involves a straightforward process. Here’s a step-by-step guide on how to use Vested’s SIP Calculator:

Inputs you need to provide:

- Monthly investment amount (in INR): This is the amount you plan to invest every month. Enter the amount you intend to regularly invest in your SIP. For instance, if you want to invest INR 100,000 monthly, enter this amount.

- Expected return rate (in %): This is the annual rate of return you anticipate from your investments. This rate should be an estimate based on historical performance or your personal expectation of how the stocks or ETFs will perform. Enter this as a percentage. For example, if you expect an annual return of 10%, just enter ‘10’.

- Investment period (in years): Here, specify for how long you intend to keep investing this amount. This is the duration of your SIP, and it should be entered in years. For example, if you plan to invest for 15 years, just enter ‘15’.

What the calculator will provide you:

After entering all the details, click on the calculate button. The calculator will use the provided data to compute the future value of your SIP investments.

The calculator will display the total amount you have invested over the period, the total returns generated, and the final value of your investment. This will give you a clear idea of how your investment is expected to grow over the specified period.

Key factors to consider when using a SIP Calculator

When using a SIP Calculator, there are several key factors you should consider to ensure that the estimates it provides are aligned with your investment goals and realistic in terms of market conditions. These factors help in fine-tuning your investment strategy and setting appropriate expectations:

Expected rate of return:

- Estimate a realistic rate of return based on the historical performance of the asset class you’re investing in. Overestimating the return can lead to unrealistic expectations.

Investment duration:

- Longer investment periods typically yield better returns due to the power of compounding. Consider your investment horizon carefully in relation to your financial goals.

Monthly investment amount:

- Determine an investment amount that is sustainable for you over the long term without impacting your regular expenses. Consider gradually increasing your investment amount over time to account for inflation and increased earning capacity.

Inflation:

- Consider the impact of inflation on your returns. The real value of your returns should be evaluated in terms of future purchasing power. Incorporate an average inflation rate in your calculations to get a more realistic view of your investment’s growth.

Goal alignment:

- Ensure that the SIP aligns with your financial goals, whether it’s saving for retirement, buying a house, or funding education. Regularly review and adjust your SIP in line with your changing financial goals and life circumstances.

What is the Importance of the Expected Rate of Return in an SIP Calculator?

The expected rate of return plays a crucial role in any mutual fund or share market SIP calculator. It allows investors to forecast the potential growth of their investments. For example, a higher expected return can result in a larger corpus over time.

However, it is essential to set a realistic return expectation based on historical performance and market conditions. For example, when using a SIP calculator stocks, investors may want to compare potential returns across different asset types such as equity funds or ETFs. Whether you are looking at an ETF return calculator or a US stock SIP calculator, understanding this rate can help you plan for long-term financial goals.

Advantages & Disadvantages of SIP Calculator

Advantages:

The use of a SIP Calculator comes with several advantages, particularly for investors who are looking to plan their investments in stocks, mutual funds, or ETFs systematically. Here are some key benefits, along with examples to illustrate them:

Easy to use and accessible

- User-friendly: SIP calculators are generally straightforward and user-friendly, requiring only basic inputs like monthly investment amount, expected rate of return, and investment duration.

- Example: An investor can easily calculate the future value of their monthly INR 10,000 investment over 20 years without needing complex financial knowledge.

Aids in financial planning

- Goal-oriented investing: Helps investors plan for long-term financial goals, such as retirement or education funding, by providing a clear picture of what their regular investments can amount to over time.

- Example: A couple planning for their child’s college fund can use the calculator to determine how much they need to invest monthly to reach the desired corpus by the time their child turns 18

Illustrates the benefit of rupee cost averaging

- Mitigating market risks: Regular investing through SIP helps in averaging the cost of investment over time, thus reducing the risk of market timing.

- Example: An investor who invests INR 100,000 monthly will purchase more units when the price is low and fewer units when the price is high, averaging out the cost over time.

Demonstrates the power of compounding

- Long-Term Growth: SIP calculators highlight the effect of compounding, especially over longer periods, showing how small, regular investments can grow significantly.

- Example: An investment of INR 100,000 per month at a 12% annual return can grow to over INR 2.32 crore in 10 years, illustrating the power of compounding.

Disadvantages:

- Long-Term Growth: SIP calculators highlight the effect of compounding, especially over longer periods, showing how small, regular investments can grow significantly.

- Example: An investment of INR 100,000 per month at a 12% annual return can grow to over INR 2.32 crore in 10 years, illustrating the power of compounding.

While the SIP Calculator is valuable for financial planning, they have certain limitations and drawbacks. Understanding these is crucial for investors to have realistic expectations and make informed decisions.

Works on certain assumptions

- The calculator operates on assumptions regarding the rate of return, which may not be accurate or consistent in the future.

- Example: If an investor assumes an annual return of 10% based on past market performance, actual returns could be lower due to unforeseen market downturns, impacting the final investment value.

Undermines the impact of market volatility

- SIP calculators do not factor in market volatility and the impact it can have on investment returns.

- Example: During periods of high market volatility, the actual value of investments can significantly deviate from the calculated estimates, leading to potential disappointments or financial strain.

Ignoring liquidity needs

- Systematic investments may not consider the liquidity needs of the investor, especially in emergencies or unexpected financial requirements.

- Example: An individual might commit too much into a SIP, leaving insufficient liquid assets for emergencies.

Conclusion

The SIP calculator is a valuable tool for investors to estimate the future value of their SIP investments. It aids in financial planning and illustrates the power of compounding and rupee cost averaging. However, it’s important to use it with an understanding of its limitations, such as reliance on assumptions and market volatility. In summary, while the SIP calculator is a helpful guide, investors should also consider other factors and seek professional advice when planning their investments.