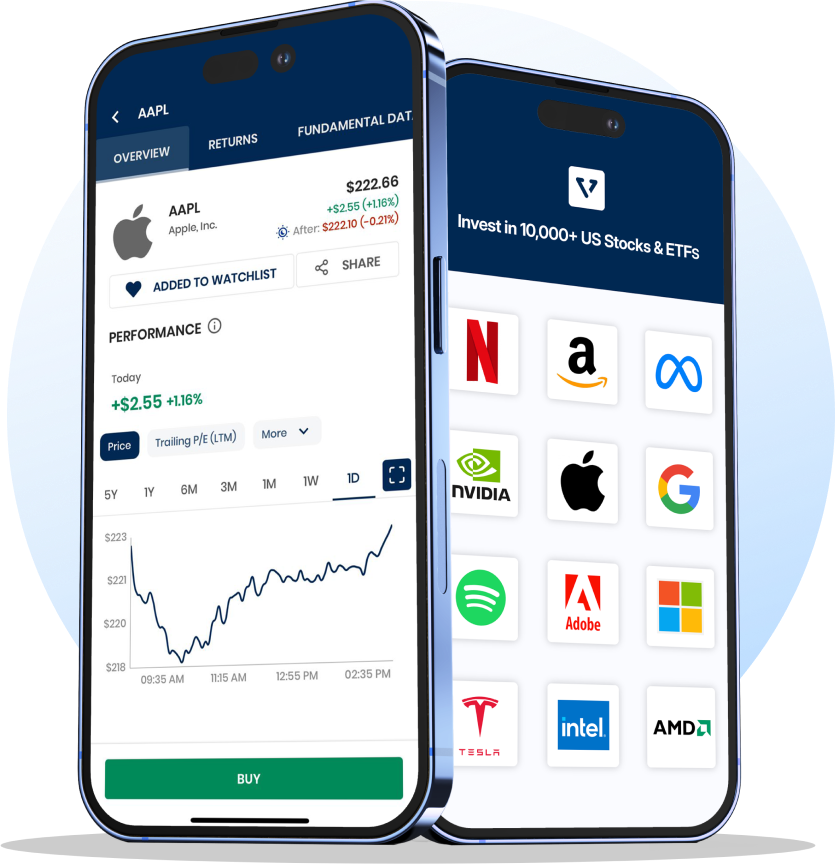

Invest in 10,000+ US Stocks and ETFs

* Offering through VF Securities, Inc. (member FINRA/SIPC)

$US Stocks

Securities offered through VF Securities Inc. Learn more

Vests are expert-built investment baskets built with a specific purpose. Each basket contains curated US Stocks and ETFs, built to target specific goals.

If you want to invest but don't have the time to research individual stocks, Vests offer a solution. They come in various categories, each focusing on a different investment objective. For instance, a Vest might aim for growth potential while another prioritizes stability. Vests can also cater to specific interests. Let's say you're passionate about renewable energy. You could choose a Vest that concentrates on companies in that sector. Explore Vests here.

Investing in US Stock Markets can give your portfolio the global exposure it needs. US Securities Market lists the largest companies globally such as Tesla, Apple, NVIDIA, Amazon, Meta and more. Easily diversify your portfolio by doing SIP in US Stocks or investing in lump-sum and get exposure to global economies and industries.

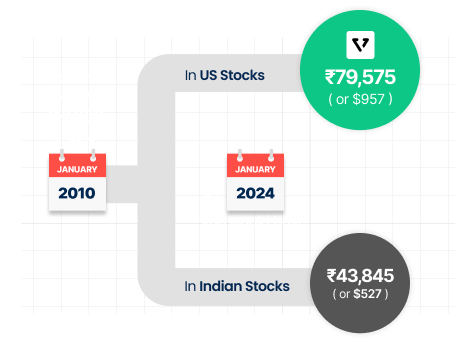

Source: Bloomberg and CNBC

The strength of the dollar can be an investor’s ally. In the period 2010 to 2024, the US Stock Markets have given 83% higher returns compared to the Indian Stock markets.

Aside from the stock market gains, there’s potential for better returns from currency(USD) appreciation against INR.

Read more:

Why Investing in the US has given superior returns

Investing directly in USD acts as a natural hedge against the INR (Indian Rupee). This can help eliminate single-currency risk from your portfolio and make it more diversified.

Source: Bloomberg and CNBC

Disclosure: Returns shown are based on historical performance. Past Performance does not guarantee future results.

Calculate your potential returns using historical performance data

Total Value

Invested Amount

Est. Returns

Total Value

CAGR

If you had invested $ 0 in January 2021, it would be worth $ 0 by August 2023 with 0% CAGR

This calculator utilizes dividend and split adjusted close price of third business day of start and end months to calculate returns. The total return, annualized return, and the hypothetical portfolio value of the investment amount are computed based on the first and last prices within the selected range.

Read about experiences of those who have taken their portfolio global with Vested

Disclosure: These customers were not paid for their testimonials and may not be representative of the experience of other customers. These testimonials are no guarantee of future performance or success.

We empower partners including fintechs, brokers and distributors with access to US stocks and other alternative assets

US Stocks and ETFs are instruments listed in the US stock exchanges – the NASDAQ (National Association of Securities Dealers Automated Quotations) and the NYSE (New York Stock Exchange), which are similar to the BSE and NSE in India. To gauge how well the stock market is doing, there are three major indices, the Dow Jones Industrial Average, the NASDAQ Composite and the S&P 500. These are akin to India’s SENSEX and NIFTY. The Dow Jones tracks 30 significant, established companies, giving a snapshot of industry leaders. The S&P 500 covers a broader spectrum, with 500 of the largest companies by market cap across different sectors, offering a wide view of the US economy. Meanwhile, the NASDAQ Composite index provides insight into the performance of stocks, especially tech, on the NASDAQ exchange, reflecting the sector’s growth and innovation. Here is a detailed comparison between Dow vs. Nasdaq vs. S&P 500

Yes, Indian investors can invest in the US stock market. Through Vested, investors can directly buy stocks and ETFs in the US market per the RBI’s Liberalized Remittance Scheme (LRS). The LRS is a policy established by the Reserve Bank of India that permits residents of India to freely remit up to $250,000 per financial year for investment and expenditure overseas.

While you can’t directly purchase individual US stocks on the National Stock Exchange (NSE) of India, there is an option through the NSE’s International Financial Services Centre (IFSC) that allows you to invest in select US stocks. However, it’s important to note that this offering is limited to around 50 stocks, and there might be liquidity concerns.

For broader access, Indian investors can look into mutual funds or ETFs that invest in US equities or track major indices like the S&P 500, available through investment platforms such as Vested.

You can buy and sell US stocks in India by opening a brokerage account with a platform like Vested, which allows you to invest in over 5,000 US stocks and ETFs.

In the US stock market, there are several categories of stocks that cater to different types of investors, each with unique characteristics and potential benefits. Here’s a breakdown of the various types:

Platforms like Vested enable investors to tap into the expansive US market by offering access to more than 10,000 US stocks and ETFs across these categories, providing Indian investors with a gateway to participate in global economic growth.

When you invest in US stocks from India, you’ll encounter two main tax considerations:

Capital Gains Tax: Any profits you make from selling your US stocks are taxable in India. The US does not tax these gains. The duration for which you’ve held the stocks determines how much tax you’ll pay. If you’ve held the stocks for more than 24 months, they qualify for long-term capital gains tax, which is 20% with the benefit of indexation. For holdings under 24 months, the gains are short-term and taxed according to your applicable income tax bracket in India.

Dividend Tax: Dividends from US stocks are taxed differently. They incur a 25% tax in the US. Thanks to the Double Taxation Avoidance Agreement (DTAA) between the US and India, you can claim a credit for this tax against your Indian income tax liability. This means the tax you’ve paid in the US can offset the amount you owe in India, preventing double taxation.

For Indian investors, the standard trading hours for the US stock market are from 7 PM to 1:30 AM India time. This timing aligns with the regular trading session in the US, which runs from 9:30 AM to 4:00 PM Eastern Time.

Additionally, Vested Finance offers Extended Hours Trading, adding an extra 9.5 hours of market access on each trading day. This feature allows investors to execute trades during the pre-market and after-market sessions, thereby capitalizing on new information and global events that occur outside the standard trading hours.

Understanding US Stock Market Timing is crucial for Indian investors as it helps in planning and executing trading activities effectively according to the market’s operational hours.

Popular US stock market indexes include the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite

The minimum amount to invest in US stocks can be as little as $1, especially when buying fractional shares through Vested.

No, you do not need a foreign bank account to invest in US stocks from India. You can fund your investments through Indian bank accounts under the LRS.