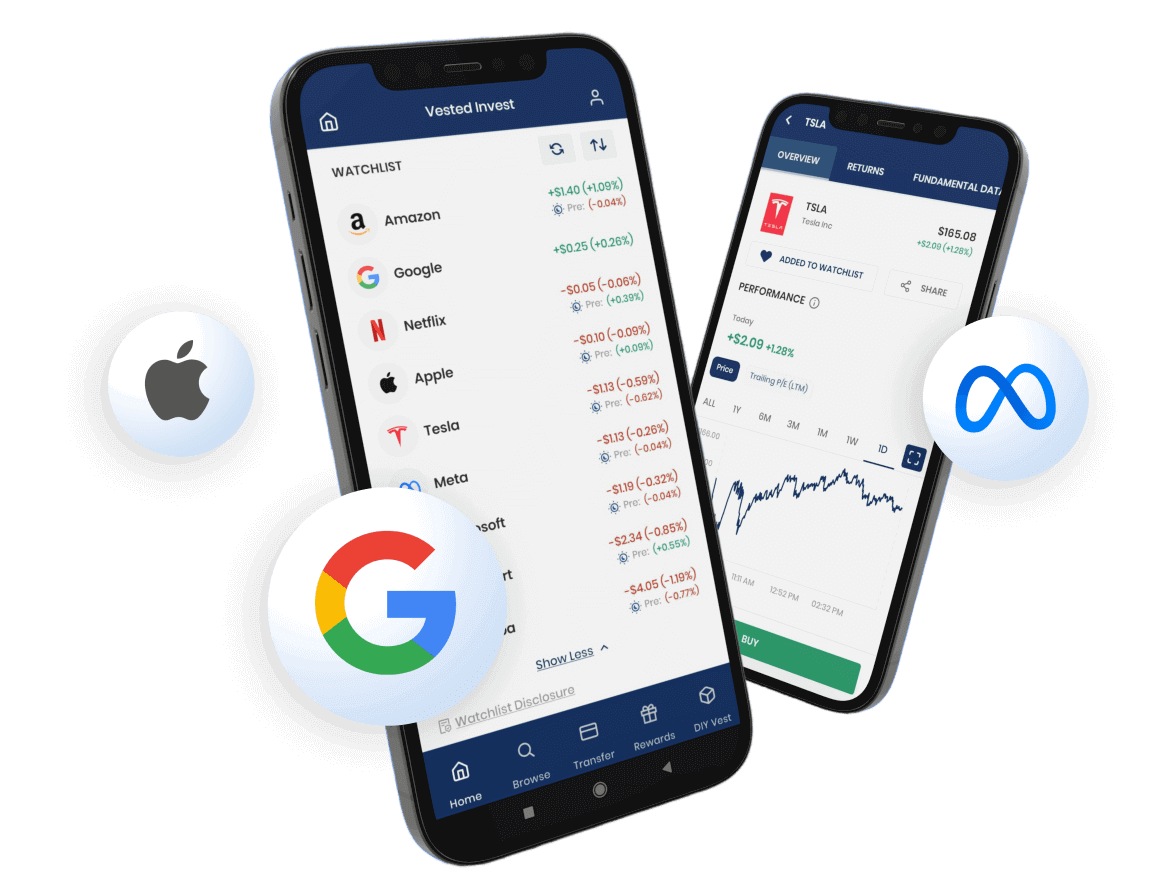

Invest in 10,000+ US Stocks and ETFs

* Offering through VF Securities, Inc. (member FINRA/SIPC)

$US Stocks

Securities offered through VF Securities Inc. (member FINRA/SIPC). Learn more

Source: Bloomberg and CNBC

Disclosure: Returns shown are based on historical performance during the period 2010 - 2023. Past Performance does not guarantee future results.

Disclosure: Vests are powered by Vested Finance, Inc. an SEC registered Investment Advisor.

Know your returns as if you had already invested in the US

Total Value

Invested Amount

Est. Returns

Total Value

CAGR

If you had invested $ 0 in January 2021, it would be worth $ 0 by August 2023 with 0% CAGR

This calculator utilizes dividend and split adjusted close price of third business day of start and end months to calculate returns. The total return, annualized return, and the hypothetical portfolio value of the investment amount are computed based on the first and last prices within the selected range.

Read about experiences of those who have taken their portfolio global with Vested

Disclosure: These customers were not paid for their testimonials and may not be representative of the experience of other customers. These testimonials are no guarantee of future performance or success.

Deep-dive articles on the long-term prospects of U.S. companies, with our in-depth research.

Bite-sized insights on market updates and trends to stay ahead of the curve.

Learn more with regular insights that dive into the US Stock Markets.

Yes, NRIs can invest in US Stocks from Vested. In order to onboard you, we will require your PAN card (or passport), address proof (Aadhaar or passport), and tax ID from the country in which you are currently a tax resident.

Currently, there are two ways in which you can add funds:

The beneficiary details are available under the Fund Transfer section on the platform.

If you are adding funds from your bank account outside India or from an NRE or FCNR account within India, the LRS limits do not apply. You are permitted to transfer up to USD 10,000 from an NRO account.

You will be taxed as per the laws in the country in which you are a tax resident. For example, if you are a tax resident of the UAE, you will pay taxes as per UAE tax laws.

Share ownership verification works slightly differently in the US than in India. Shares are held by a third-party custodian in the ‘street name‘ of the broker rather than the underlying investor. This is why you do not receive direct emails from the custodian regarding your holdings. As per SEC guidelines, if you want to confirm the share ownership for your Vested account, you can contact DriveWealth, our broker partner, directly at support@drivewealth.com.

On the Vested platform, you can invest in either full or fractional shares. When your investment is in full shares, our broker partner (DriveWealth) will route the orders to market centers on an Agency basis. When the investment is fractional shares, our broker partner will satisfy the order from its own account on a Principal basis at the National Best Bid or Offer (NBBO). NBBO means that DriveWealth cannot add margin to the price. So, if the market price of 1 share of Amazon is $1000, and you purchase 0.1 share of Amazon, you will pay $100 for the 0.1 share. Any orders for both full or fractional shares will be executed via both methods, part as Agent and part as Principal.