In today’s edition:

- Apple is now the richest company in the world

- The US has become the main source of new liquefied natural gas (LNG)

- Meta launches Threads

- China has imposed over $1 billion in fines

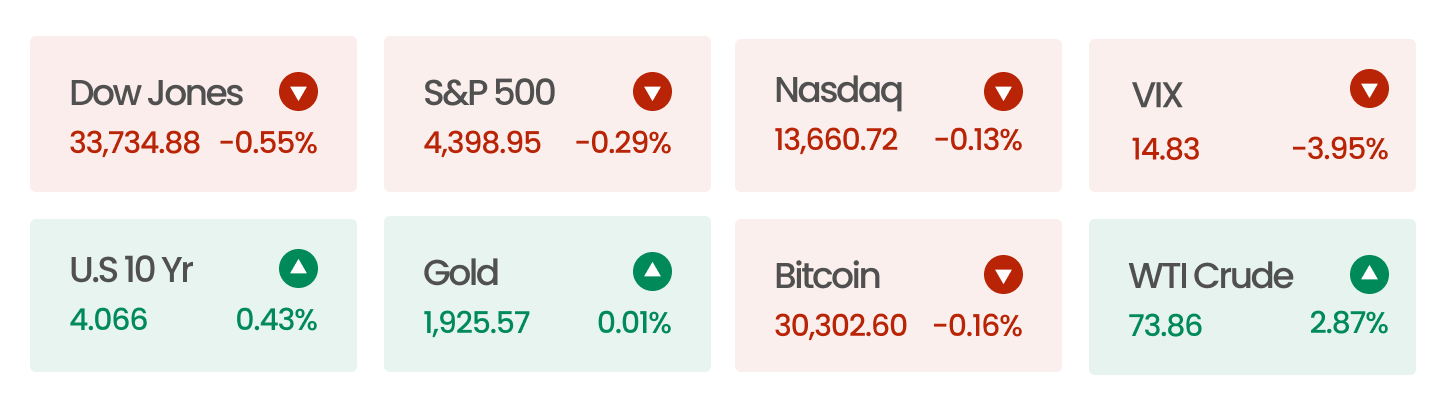

Market Snapshot

US stock indices declined amid investor expectations of more rate hikes from the Federal Reserve in response to inflation concerns. The Labor Department’s report of a lower-than-expected increase of 209,000 nonfarm payrolls in June, coupled with downward revisions for April and May, heightened these concerns.

Data as of market close 07 Jul 2023

Source: AlphaScreener

News Summaries

Apple has become the first company in the world to reach a market cap of $3 trillion! The company’s worth has grown by nearly $1 trillion this year alone, which is like gaining the value of more than two Walmarts (market cap of Walmart is $ 440 billion). It seems investors believe in the iPhone’s lasting appeal, which, 16 years after its launch, still leads people to buy other Apple products. While iPhones are changing slowly, the higher-priced Pro lineup introduced in 2019 has helped sales go up.

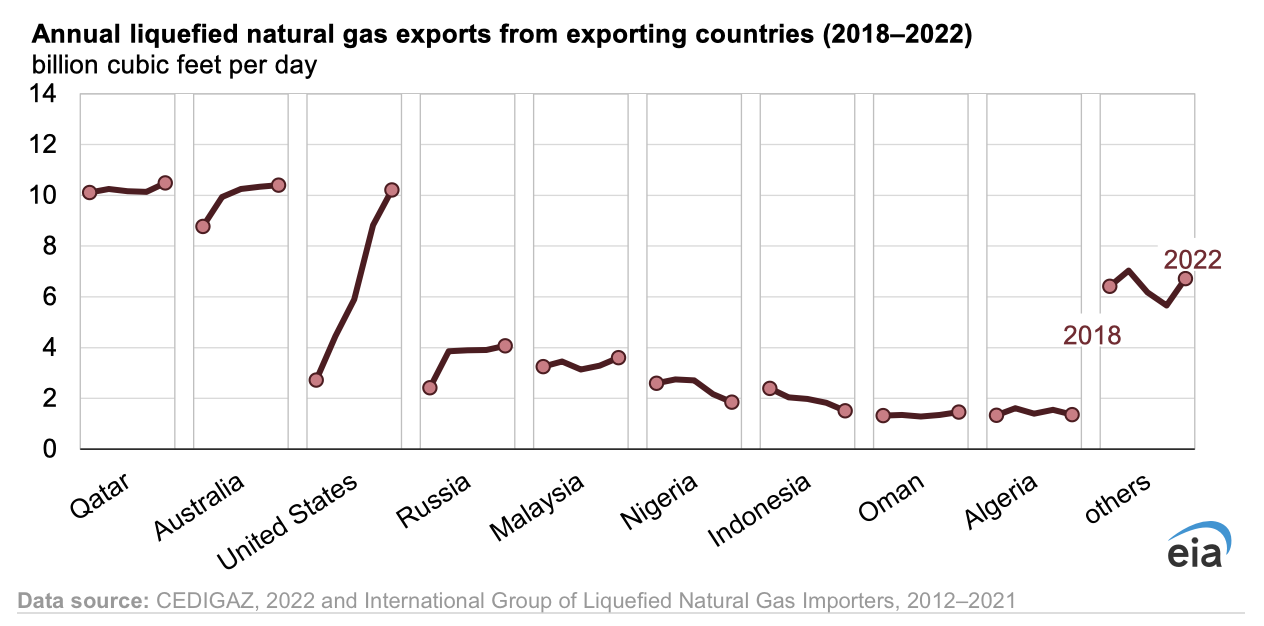

Figure 1: Annual liquified natural gas exports (2018-2022)

The US has become one of the main sources of new liquefied natural gas (LNG) in the world (see Figure 1). The availability of US natural gas has helped prevent a sharp increase in domestic energy prices, as seen in Europe. The recent rise in US LNG production is a result of planned projects coming online, although there was a setback last year due to a fire at a Texas plant. Moving forward, there is expected to be further growth as US companies develop new projects and sign contracts with major markets like Germany and China.

Twitter’s frequent changes are providing a golden opportunity for Meta’s latest launched app, Threads. While Meta has a spotty history of successfully emulating other platforms’ features, its vast user base has the potential to drive deep engagement, as seen with Instagram’s TikTok-inspired feature, Reels. Musk’s recent controversial tweaks to Twitter, such as the “rate limit” changes and making TweetDeck a paid service, could push users towards alternatives like Threads. With social media trends leaning towards individual and group messaging, it will be interesting to watch how Threads shape in the coming years. Threads has already shown potential, reaching 95 million posts and 50 million profiles and crossing 1 million users within just 1.5 hours of its launch.China has imposed over $1 billion in fines on tech giants Ant Group and Tencent Holdings, indicating a potential end to the sector crackdown that had adversely affected their market value and disrupted Ant’s IPO. The People’s Bank of China fined Ant 7.12 billion yuan ($984 million) and Tencent 2.99 billion yuan ($410 million), which was well-received by investors, leading to a surge in Alibaba’s stock price. The fines address concerns over fintech and the overall internet sector, easing pressure on Alibaba. The central bank stated that most of the issues in Ant and Tencent have been rectified, signaling a potential relaxation of restrictions and demonstrating support for the industry. Despite the fines, the market sees this as a positive development that could pave the way for Ant’s growth and eventual IPO revival.