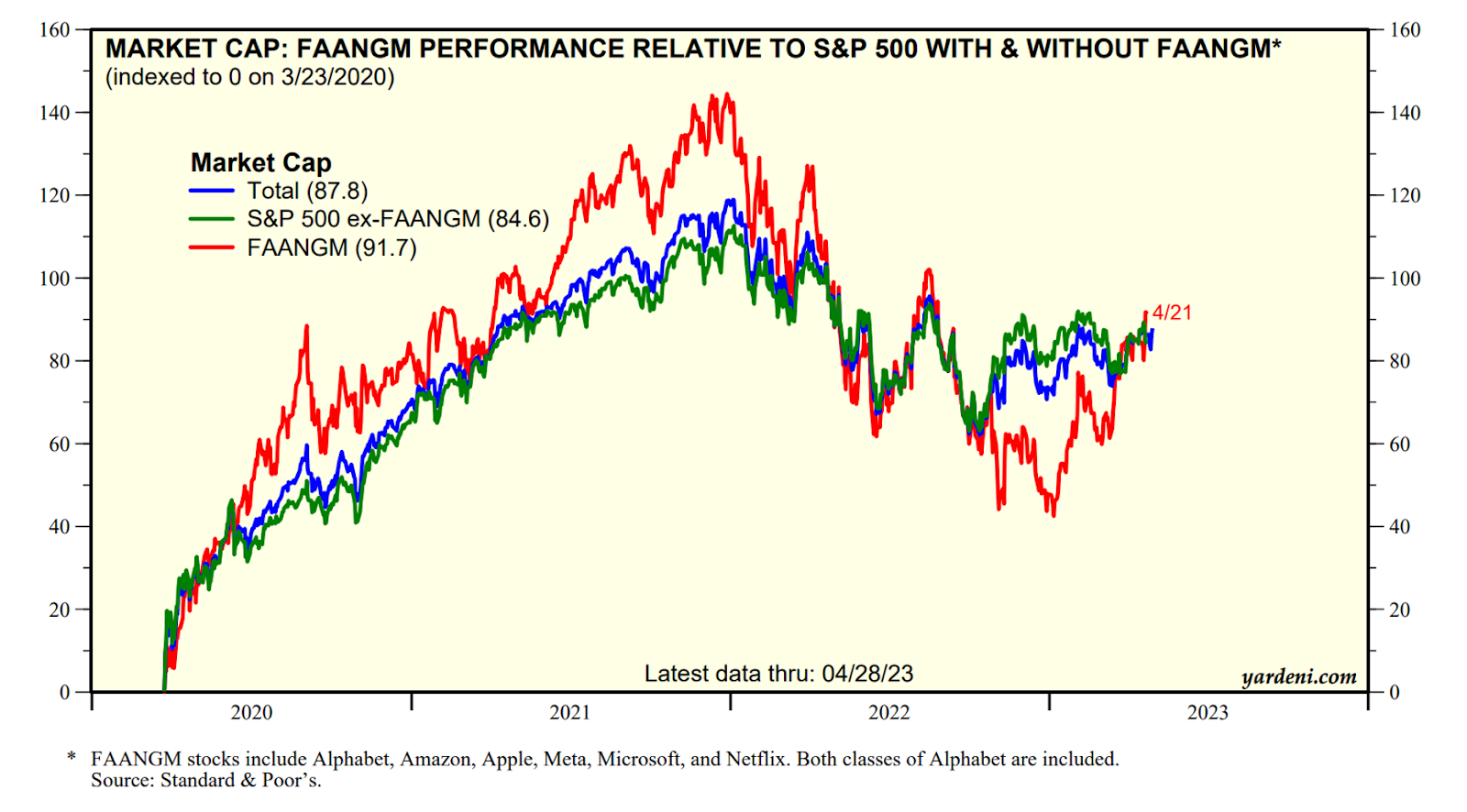

Q1 2023 earnings season is in full swing. Last week, we discussed Tesla and Netflix. This week, Meta, Alphabet, Amazon, and Microsoft reported theirs. It’s not a secret that the US stock market has rallied this past quarter. The rally has predominantly been driven by mega-cap tech stocks, often colloquially abbreviated as FAANGM (see the red line in Figure 1 below). Without the contribution of these companies, the S&P 500 has largely been flat this past quarter.

Figure 1: Meta (formerly Facebook), Apple, Amazon, Microsoft, and Alphabet (formerly Google) drive the US stock market rebound. Source

Has the FAANGM stock rally been justified? Last week, we saw how Netflix’s pivot to ads has been more effective than originally thought. This week, we will discuss Amazon, Meta, Microsoft, and Alphabet. You will find that all of them beat top-line and bottom-line expectations.

The structure of this article will be as follows: First, we will review specific updates for each company. Then, we compare their common businesses, specifically ads and cloud revenue growth.

Amazon has turned the corner on operating margins

| Expected | Actual | Observation | |

| Revenue | $124.5 billion | $127.4 billion | Beat |

| EPS | $0.21 | $0.31 | Beat |

Data is from Refinitiv

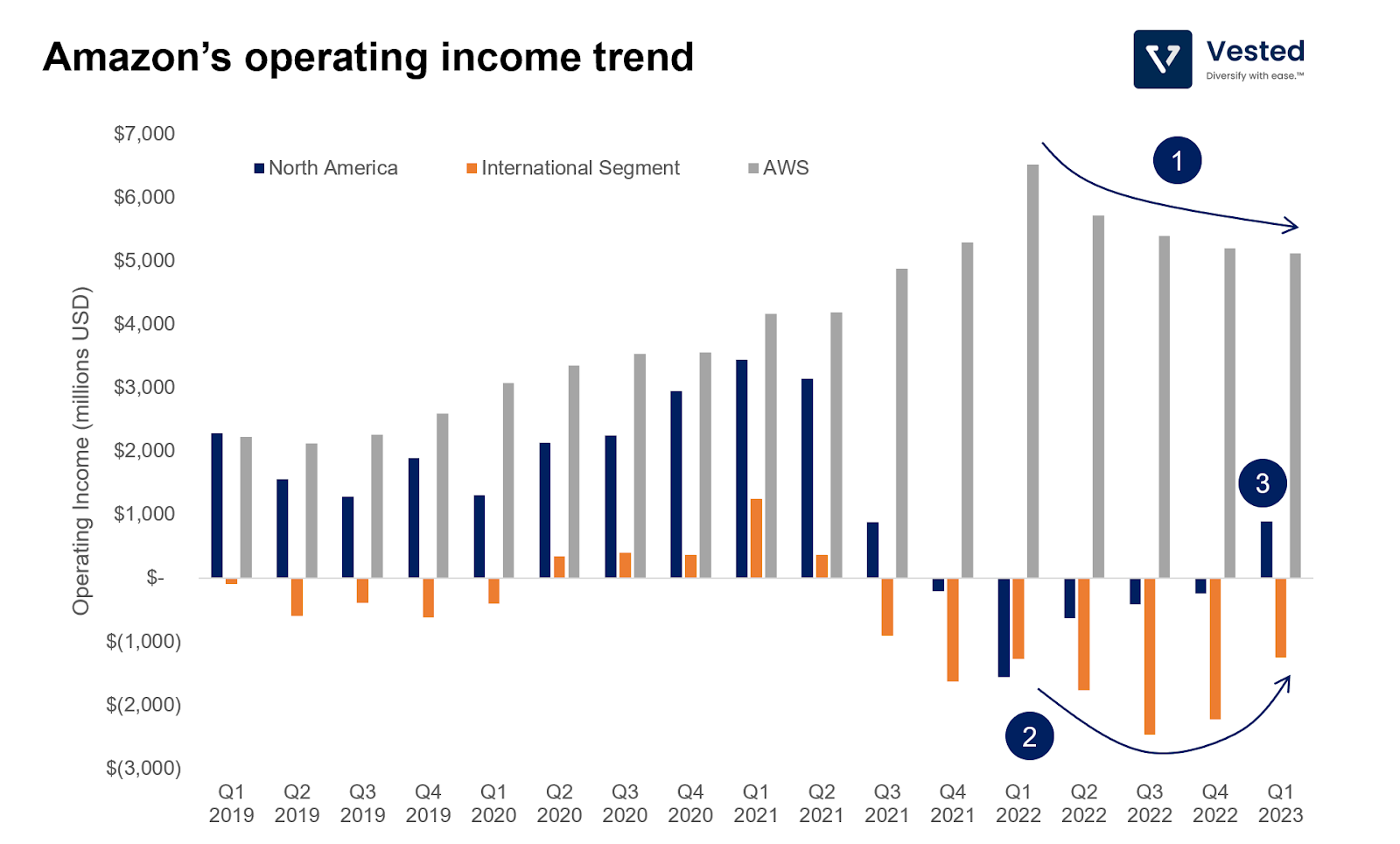

Amazon reported first-quarter revenue of $127.4 billion, up 9.4% year-over-year, and a strong operating income margin. After a period of over-expansion, Amazon has been streamlining its businesses amid slowing revenue growth in retail and AWS. It has turned the corner regarding returning to profitability (see Figure 2).

Here are key takeaways:

(1) AWS, the most profitable aspect of Amazon’s business, remained a cash cow (gray bar in the chart above), albeit with a slowing growth rate. The company expects AWS growth to continue to slow in Q2 2023 as its customers are optimizing their cloud spending.

(2) The international segment has turned the corner, propelled by the easing of Europe’s macroeconomic pressures.

(3) After five quarters of negative operating margins, the North American segment has returned to profitability. Amazon achieved this by reorganizing its fulfillment network in the US. The company initially expanded the fulfillment center footprint aggressively without optimization, and now it’s doing the hard work of optimization to lower costs. It is also reducing costs through aggressive workforce reduction. The company has reduced its headcount by 27,000 these past few quarters.

As the earnings call unfolded, Amazon’s share price increased during extended trading hours (read more about extended trading hours here) as it revealed profits that exceeded expectations. But, as management provided a lower cloud growth outlook, shares went down even before the market opened.

Regarding AWS’ growth vs. other cloud giants, and a comparison between Amazon’s ads, Google’s, and Meta’s, we will discuss those in a later section of this article.

Meta’s good quarter

| Expected | Actual | Observation | |

| Revenue | $27.65 billion | $28.65 billion | Beat |

| EPS | $2.03 | $2.20 | Beat |

Data is from Refinitiv

In the past few years, Meta’s (Facebook) share price has been prone to massive drops and rallies. Meta’s share has the honor of setting the record for the largest share drop by any US public company while also recording – a few months ago – its best one-day gain over the past decade. The company’s share price jumped again last week after releasing its Q1 2023 earnings. These large movements are atypical for a company of its size that has a relatively stable business. These fluctuations are driven by constant narrative change (something about Meta AI that we discussed previously), driving rapid valuation compression and expansion. Here is a quick summary of the shifts from the past year.

- Meta was losing ground against TikTok

- Apple’s privacy changes are causing long-term monetization challenges for Meta, Snap, and other ad-driven businesses.

- The spending on Metaverse has not been favored by Wall Street. Zuckerberg has been very aggressive with his investments to jump-start the ecosystem at a very steep cost. Over the past nine quarters, Meta incurred $27.9 billion in operating losses from Reality Labs.

Some of these narratives are changing, however.

Meta for half the world

As the second half of 2022 rolled, Meta’s user growth across all apps (Facebook, Instagram, Whatsapp, and Messenger) seems to have re-accelerated. In its latest earnings, Meta announced that it had crossed 3 billion daily active users across all its apps. That’s 47% of the world’s population (excluding China, as these services are banned there)!

Meta, the AI company

From a business model perspective, Meta is an advertisement company. From a user’s perspective, it is a social media company. But from a core competency perspective, it is a hardcore engineering company.

- It created React Native, the most popular Javascript framework for mobile application development.

- It created PyTorch, the most popular Python-based AI framework.

- Although it is not a cloud provider, it has similar compute infrastructure capabilities as Google and AWS.

- And, as we discussed in depth before, Meta is increasingly becoming an AI company. It has published several open-sourced Large Language Models (LLMs), including the foundational model, Llama, and the zero-shot AI model for image and video segmentation.

There are several business impacts driven by Meta’s AI capabilities.

First, Meta has been able to increasingly leverage AI to increase engagement and user growth, not a trivial task considering the maturity of the product suite. From the earnings call:

“Our investment in recommendations and ranking systems has driven a lot of the results that we’re seeing today across our discovery engine, Reels, and ads. Along with surfacing content from friends and family, now more than 20% of content in your Facebook and Instagram feeds are recommended by AI from people, groups, or accounts that you don’t follow. Across all of Instagram, that’s about 40% of the content that you see. Since we launched Reels, AI recommendations have driven a more than 24% increase in time spent on Instagram.” — Mark Zuckerberg, CEO or Meta.

AI has also been key to the company’s revenue recovery. After Apple’s privacy changes (called ATT) slowed Meta’s revenue growth, the company invested heavily in AI to overcome ATT. The company has increasingly been successful in this effort. From the same earnings call:

“Our AI work is also improving monetization. Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook quarter-over-quarter. Daily revenue from Advantage+ Shopping Campaigns is up 7x in the last six months.” — Mark Zuckerberg, CEO or Meta.

PS: Apple’s ATT forces apps to require positive opt-in before being tracked. This has lowered advertisement efficiency across mobile ads and caused Meta $10 billion in lost revenue in 2022.

Meta, still focused on Metaverse

Of late, analysts, us included, have surmised that the company has been quietly retreating from the Metaverse investments, a narrative shift that has helped Meta’s share price rebound. But Zuckerberg flat-out denied it.

“Beyond AI, the other major technology wave we’re focused on is the metaverse. A narrative has developed that we’re somehow moving away from focusing on the metaverse vision, so I just want to say upfront that that’s not accurate. We’ve been focusing on both AI and the metaverse for years now, and we will continue to focus on both.” — Mark Zuckerberg, CEO or Meta.

Despite this denial, investors reacted positively to Meta’s earnings, as it turned the corner on revenue growth and operating margin growth rates. Figure 4 below shows the quarterly year-over-year revenue and operating margin change of Meta.

Microsoft’s resiliency

Microsoft also reported earnings that beat analysts’ expectations. The company reported revenue of $52.9 billion and net income of $18.3 billion.

| Expected | Actual | Observation | |

| Revenue | $51.02 billion | $52.9 billion | Beat |

| EPS | $2.23 | $2.45 | Beat |

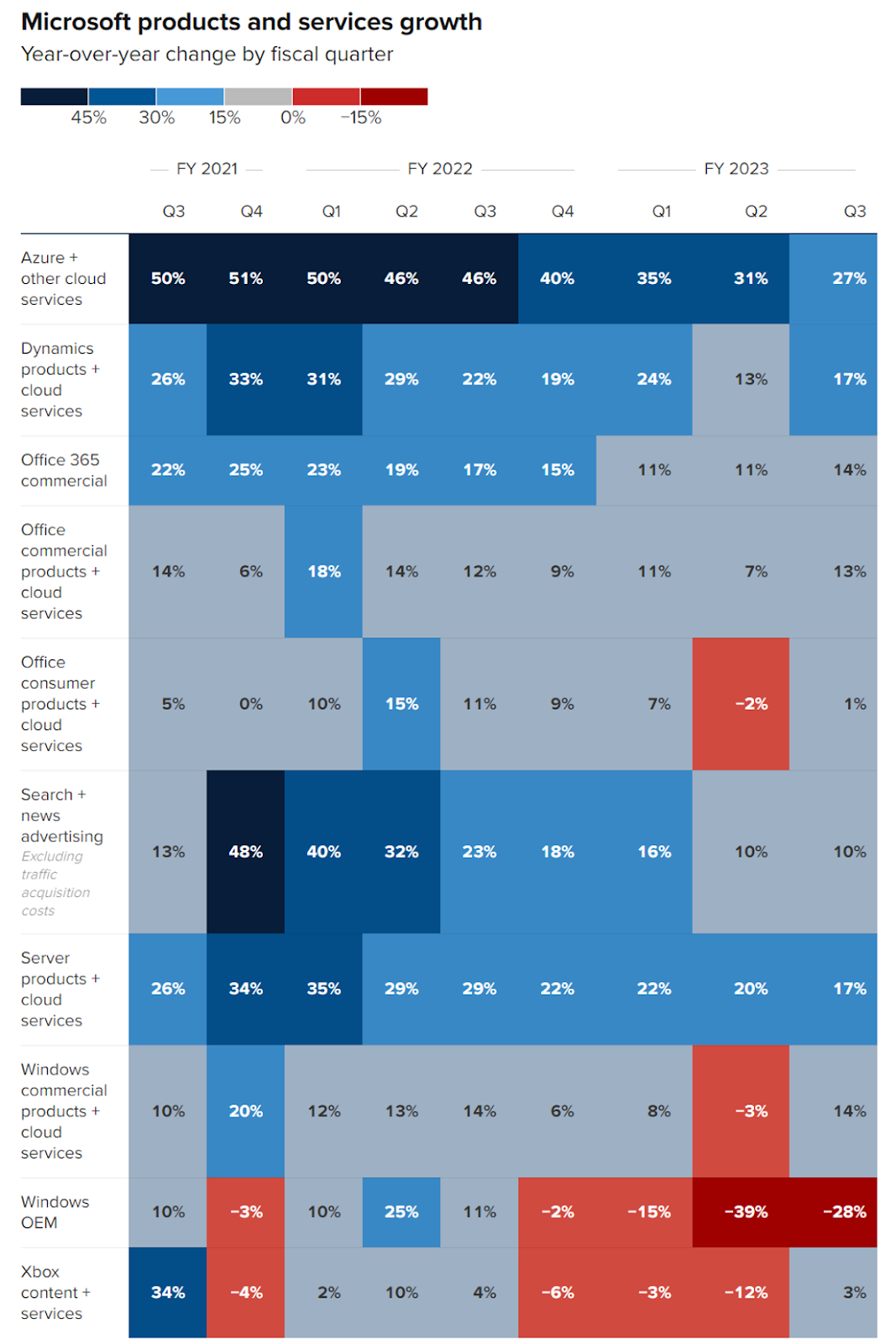

Overall, Microsoft’s business is strong and weak in areas that you would’ve expected. We thought that this graphic from CNBC really captured the essence.

Figure 5: Microsoft’s products and services growth, year-over-year change by fiscal quarter. Source

Here are key takeaways:

- Worldwide PC sales are down by almost 30% in Q1 2023. As expected, this hurts the Windows business, with shares down by 28% year-over-year.

- After several quarters of slowing growth (largely due to tough comparisons from the pandemic year of 2021), gaming revenue has returned to positive growth. Microsoft achieved a milestone of $1 billion in subscription revenue from its cloud gaming service.

- Microsoft shows resiliency in its core SaaS business (one of the largest in the world). Despite layoffs in the tech sectors, the company projected a 16% expected growth next quarter.

Regarding Microsoft’s search and cloud computing business, we will discuss those in a later section of this article.

Alphabet’s Q1 2023 earnings

| Expected | Actual | Observation | |

| Revenue | $68.9 billion | $69.79 billion | Beat |

| EPS | $1.07 | $1.17 | Beat |

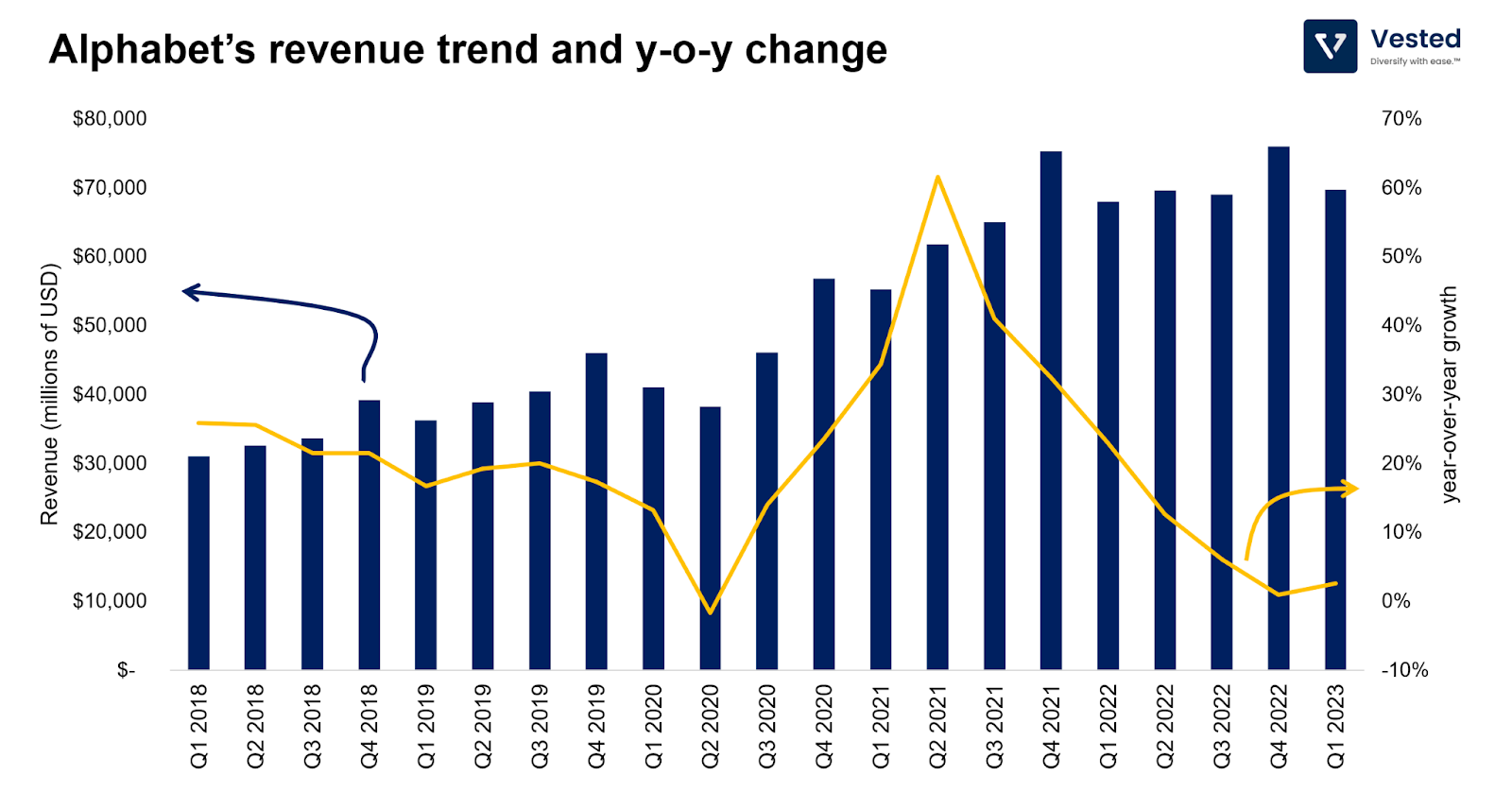

Overall, Alphabet reported a 3% increase in revenue and beat analysts’ expectations on top-line revenue and profits. That said, similar to Meta’s revenue trend, Alphabet’s revenue growth rate has decreased since the COVID boom and appears to be turning a corner in Q1 2023 (see yellow line in Figure 6 below).

Alphabet observed modest revenue growth due to retail and travel verticals, while finance, media, and entertainment saw reduced ad spend.

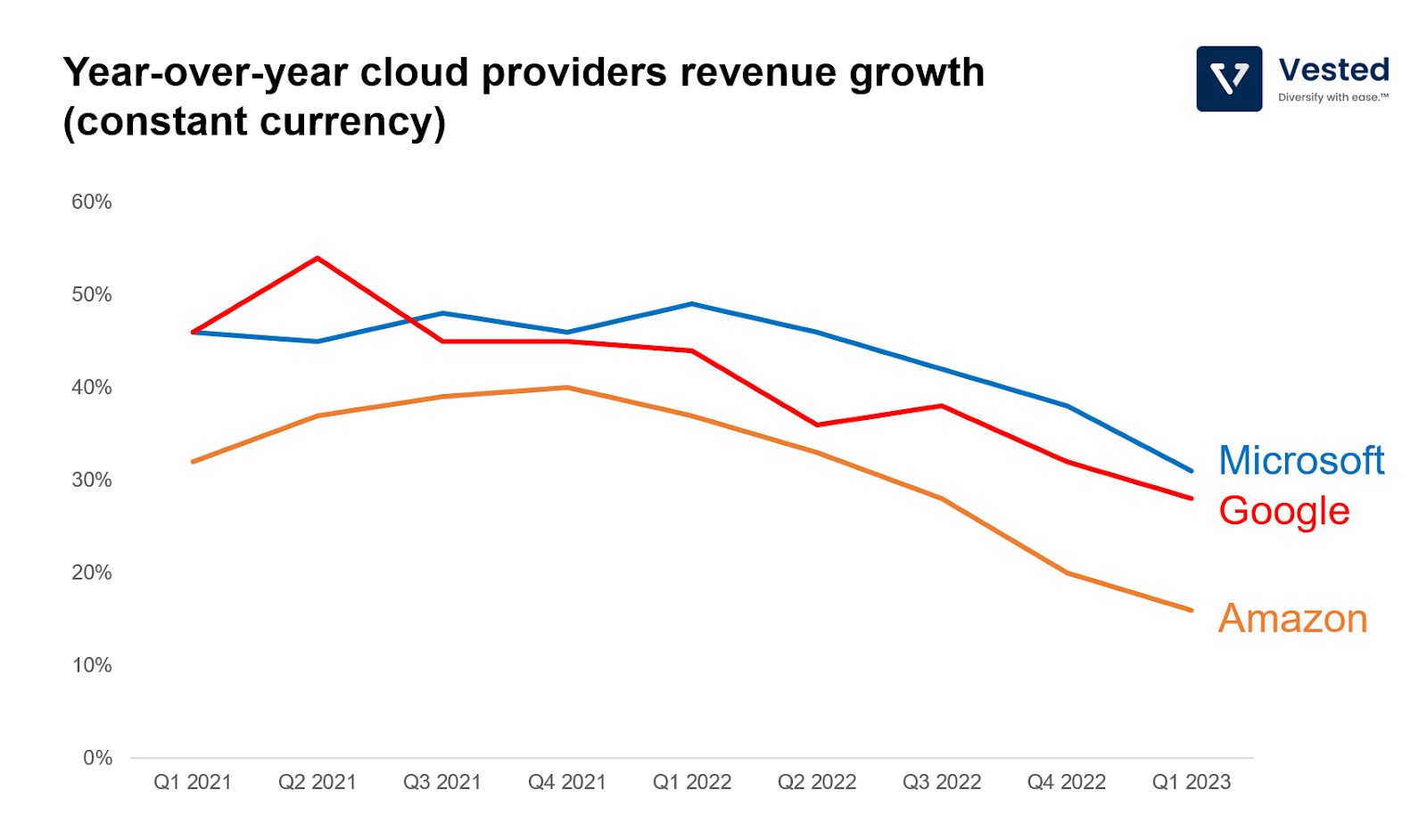

Comparing Cloud growth: Amazon, Microsoft, and Alphabet

Here are the key takeaways:

- All three major cloud providers are observing slower growth (albeit still a very impressive growth rate considering the sizes of these businesses)

- Amazon is growing the slowest but is still the largest. AWS generated $21.4 billion in Q1 2023, while Google Cloud made $7.5 billion. We do not know how much revenue Azure generates as Microsoft does not break that out separately.

- To be fair, the above is not an apples-to-apples comparison. Amazon’s cloud service is more infrastructure oriented, while Microsoft and Google’s include additional software subscription services. Nevertheless, the slowdown is being observed by all three players.

- As the macroeconomic environment shifts and more firms prioritize cost cuts, many cloud consumers reduce their cloud consumption and delay projects.

- It appears that Azure is taking market share from others. Microsoft’s OpenAI’s partnerships has allowed it to increase Azure revenue through OpenAI API usage. Currently, Azure has 2,500 OpenAI service customers, up 10x quarter-over-quarter.

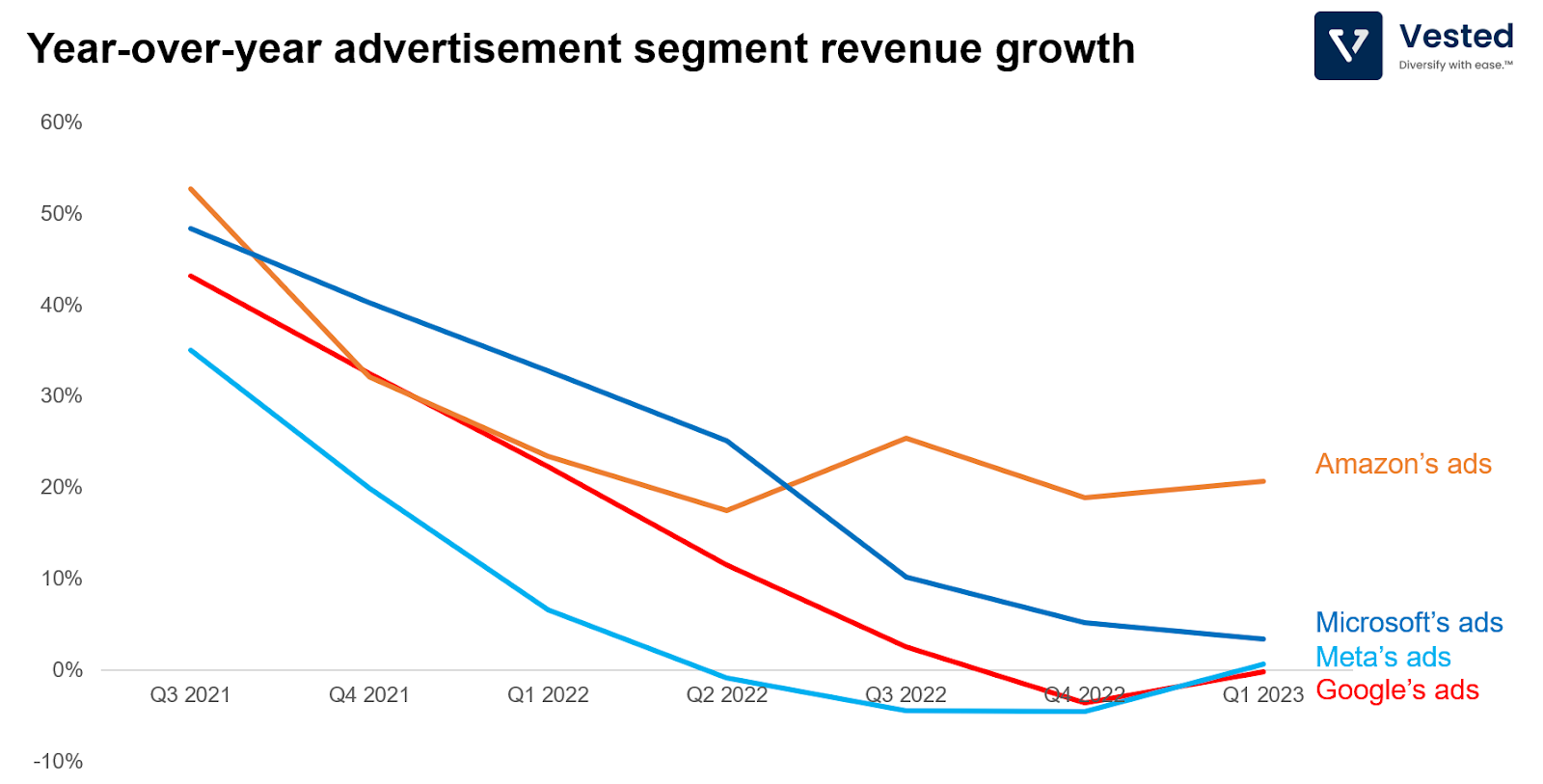

Comparing ads growth: Amazon, Microsoft, and Meta

Here are the key takeaways:

- Amazon’s advertising business generated $9.5 billion in the first quarter of this year. Compare that to $54.5 billion for Google Ads and $28.1 billion for Meta. It is the 3rd largest digital ad provider, more than 3x the size of Microsoft’s ads business.

- While all major ad providers saw significant growth slowness compared to 2021, Amazon saw the smallest decline in ads growth rate.

- This is partially because all of Amazon’s advertisements happen within its platform (its website and App) and therefore is not impeded by Apple’s privacy tracking changes.

- And partially because Amazon operates mostly on direct conversion advertising, driven by search keywords within its platform. In contrast to brand awareness ads, demand for direct conversion ads is more resilient as the macroeconomic environment shifts.

- That said, the development of the ads business for Amazon is still in its early days. The company owns free streaming ad-supported services, live sports, and grocery properties that can be leveraged for ad placements.