In today’s edition

- Yahoo’s acquisition spree

- Europe’s gasoline demand peaks

- Apple makes record share buyback

- X to collect more data

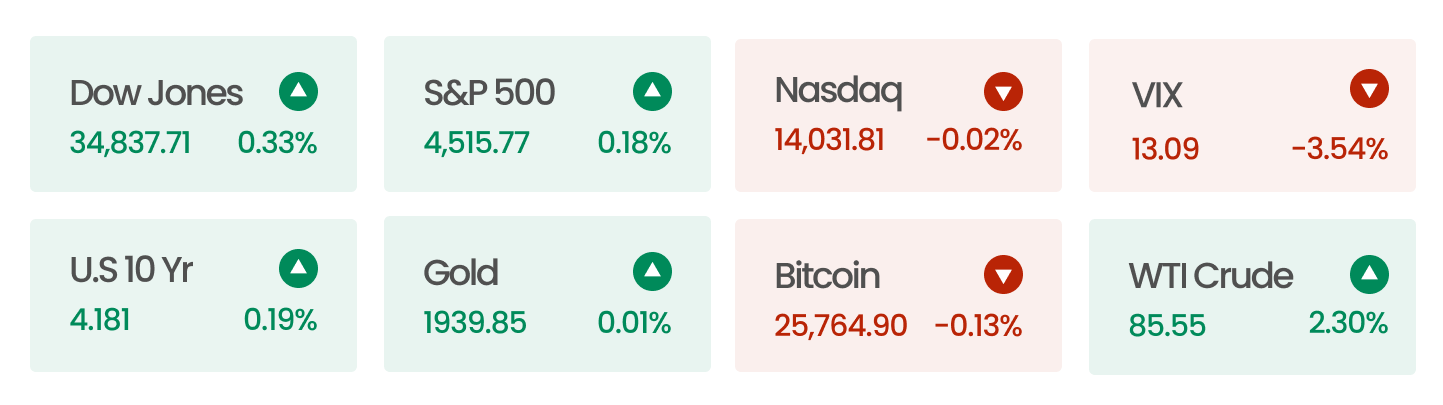

Market Snapshot

The major U.S. stock indexes, saw gains this week as signs of a loosening job market led investors to believe that the Federal Reserve might soon conclude its aggressive interest rate hikes.

Data as of market close 01 Sep 2023

News Summaries

Yahoo! is ambitiously buying up companies to refresh its brand and offerings. Now owned by private equity firm Apollo, Yahoo! recently acquired venture capital-focused media startup StrictlyVC to enhance its tech news site, TechCrunch. This move aligns with their recent acquisitions like the social investing platform CommonStock, sports betting app Wagr, and the “unbiased news platform” TheFactual. With a notable web footprint of 4 billion monthly visits, Yahoo! is strategizing not only to reclaim its footing in the search engine race but also to tap into the lucrative potential of its established businesses.

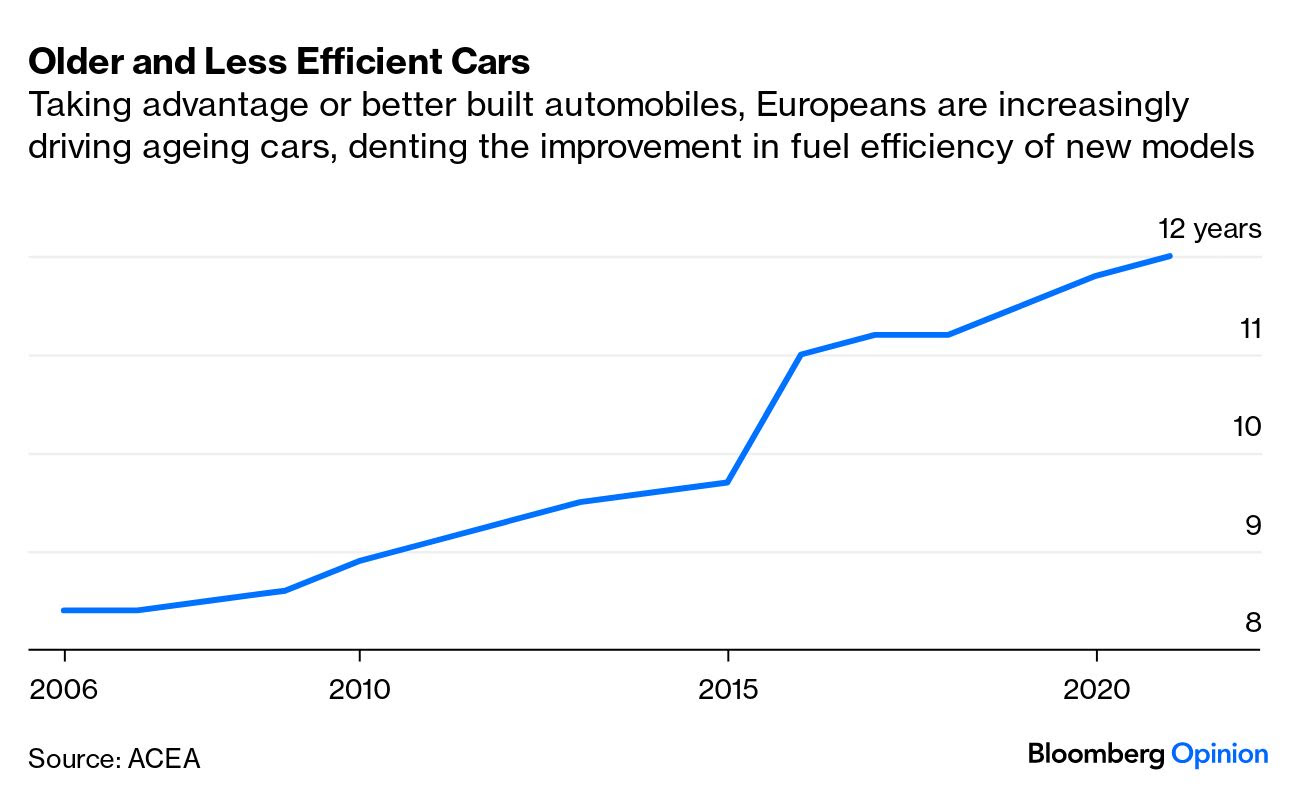

Figure: Source

Europe’s Gasoline demand is hovering near a 10-year high. Despite the proliferation of EVs, European’s are continuing to use old automobiles. Due to their superior quality, many of these older models are lasting upto 12 years (see Figure above). Over the past decade, the number of automobiles has increased by almost 20%. Although increasingly more of these vehicles are electric, many of them are hybrids and partially rely on gasoline. Meanwhile, Russian gas exports to OECD Europe fell by an estimated 65% significantly reducing the overall supply. This means, the current surge may be short-lived as the Inernational Energy Agency expects a 7% decline this year.

Apple has made the biggest share buybacks in the past 10 years. Despite 3 consecutive quarters of declining revenues, the company recently spent $18 billion on share buybacks. According to new data published by Reuters, the top 5 are respectively: Apple, Alphabet, Microsoft, Microsoft, Meta, and Wells Fargo. Apple is by far the biggest spender in this regard. The company has spent more on share buybacks ($621 billion) than the other 4 combined. In comparison, its closest competitor Alphabet has only spent $193 billion. Apple’s aggressive buyback strategy suggests a long-term vision, undeterred by short-term market fluctuations.

X (formerly Twitter) updated its privacy policy to collect biometric data. This will most likely include data collected from a person’s face, eyes, and fingerprints. Users who sign up for its subscription service X premium, can take a selfie and provide photo ID for verification. This new policy may also give X access to its users education and employment history. In return, X will connect users with employment opportunities and share their employment history with recruiters (much like LinkedIn). This move is another step towards making X an “Everything App”.