Today we discuss Neuralink’s latest show-and-tell, the Fed’s upcoming interest rate hike, and discuss unsustainable businesses that thrived when the capital was cheap and now struggle with the capital being expensive.

Neuralink’s show and tell

Since the advent of computers, humans are slowly evolving into an enhanced species capable of interfacing with external information processing machines. Over time, our I/O (input/output) has continued to evolve to be more natural:

- The first computers received input using punch cards and required users to undergo specialized training to use

- Then came the PC era, which initially used DOS-like command prompts. Soon after, the point-and-click mouse was invented. This was followed by the development of the GUI (graphical user interface – which is the point-and-click, drag-and-drop system we use today). The GUI became the de facto standard adopted by Apple and Microsoft

- Decades later, the iPhone introduced the touchscreen interface

- More recently, Amazon’s Alexa smart speaker popularized voice commands

Neuralink, a brain-interface company, is one of Elon’s companies. The folks at Neuralink believe that the next progression of the human-computer interface is the direct communication (I/O) between the brain and the computer. To achieve this vision, they are developing full-stack technology to make this happen at scale. This includes the development of a robot to perform surgeries, the creation of electrode implants, the making of digital neural nets to transform brain impulses into electrical commands, and many more.

The company recently showcased its progress (watch here). In short, Nerualink shared its progress in using animal models to capture brain electrical impulses.

Similarly, the converse is true. Once Neurallink understands the electrical impulses the brain creates when instructing muscles to move, it can simulate these impulses through the spinal cord to make the body move.

While we are still years away from the commercial human application, one cannot help but think how profound this technology can be.

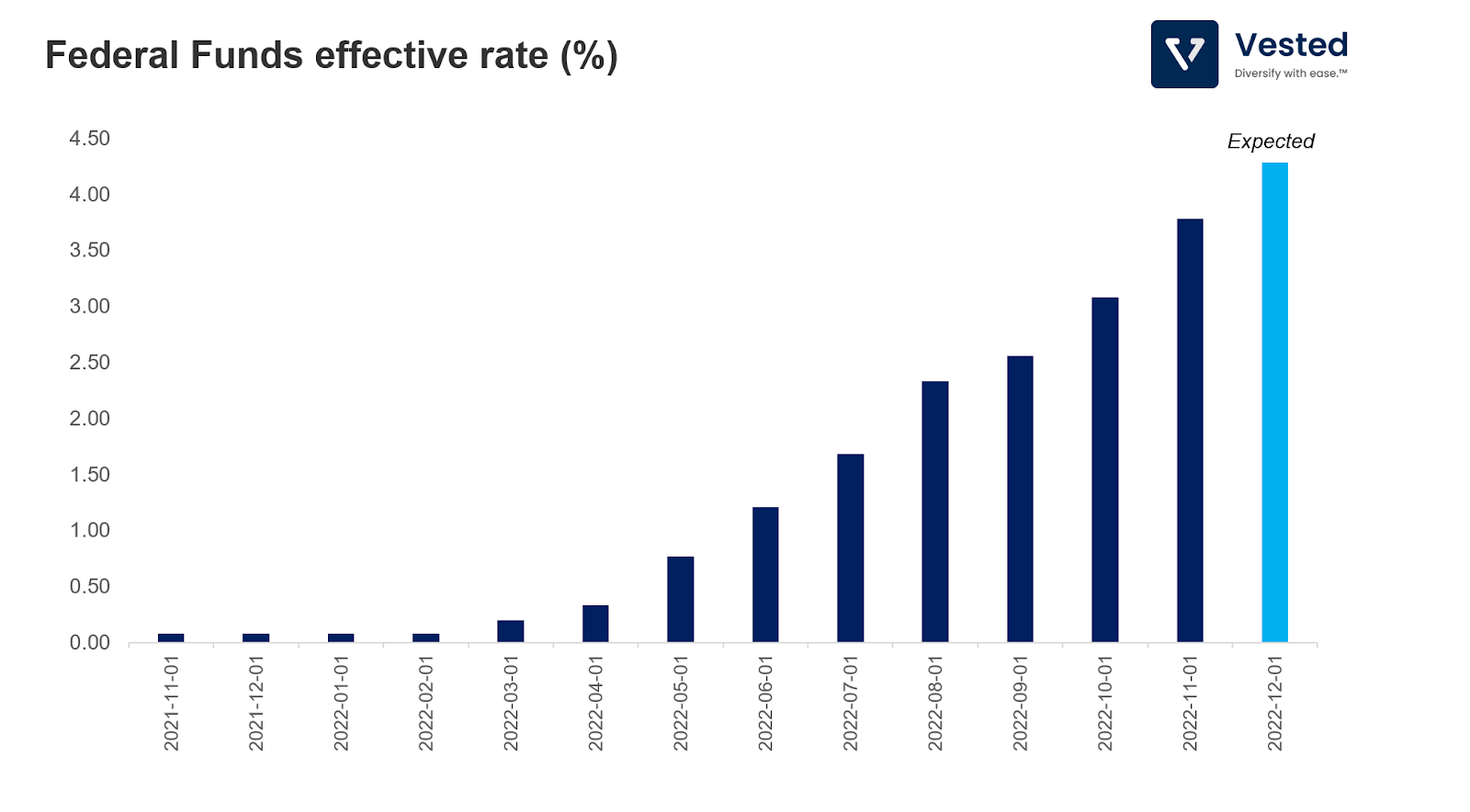

The Fed’s plan for December interest rate hike

This past week, Fed chairman Jerome Powell signaled that the Fed will start to slow down interest rate hikes and will only raise interest by 0.50% in December. Under normal circumstances, 0.50% would be considered a jumbo increase, but this number pales in comparison to the past two hikes, which have been 0.75% apiece.

Stocks rallied after this announcement, as this aligns with broader Wall Street projections and reduces risks of broader inflation in the US. That said, the Fed is still keeping an eye on employment numbers, which it believes are too strong. Currently, job openings are higher compared to the number of job seekers. Despite what you’ve read regarding Tech layoffs, the unemployment rate in the US is still near a record low at 3.7%.

To cope with the tight labor market, there are two possible approaches: (i) create more workers, something that the Fed cannot do (lower immigration rates and early Covid-induced retirements in the US seem to have contributed to labor tightness), or (ii) eliminate job openings. The Fed cannot do (i), so it is trying its best to do (ii). It will continue to increase interest rates until it sees softness in the job market, albeit slower to give itself more room to maneuver.

The receding capital tide

We’ve previously written about how the rapid increase in interest rates has significantly increased the cost of capital for many. This makes it difficult for certain unsustainable businesses to continue to operate. As Warren Buffett famously said:

“It’s only when the tide goes out that you learn who has been swimming naked”

Eight months into the rate hikes, the tide is out – let’s see who’s been swimming without their swimming trunks on.

Crypto

Sure, there are many aspects of crypto that are pure fraud. When we wrote about the collapse of FTX several weeks ago, no one realized the extent of the fraud and misappropriation of funds. And then there was the 3AC Ponzi scheme that led to the collapse of many other crypto firms.

Proponents of defi (decentralized finance) often say that defi is doing fine. Despite collapsed asset prices, decentralized crypto systems remained relatively unscathed. It was the centralized exchanges (FTX, BlockFi, Celcius) and hedge funds (3AC) that are in ruins – all thanks to the massive use of leverage. The use of leverage is a unique trait of the 2022 crypto winter. Yes – we’ve had many crypto winters before, but this is the first time that such a massive amount of leverage is employed within the system.

Will there be another crypto spring? Can that happen in a period of high-interest rates? (please do not send me angry emails to extol the upsides of crypto …I’m not trying to make a prediction here. I’m merely asking the question). Possibly, but one can argue that for crypto to have staying power, it has to have a real-world use case (other than trading) and be able to generate cash flow. So far, that has not been the case.

Appreciation of crypto asset prices seems to have been primarily driven by new money coming into the system, allowing large holders (who invested early) to cash out. A recent paper by the Bank of International Settlements (BIS) discussed this in detail. Here are some key takeaways.

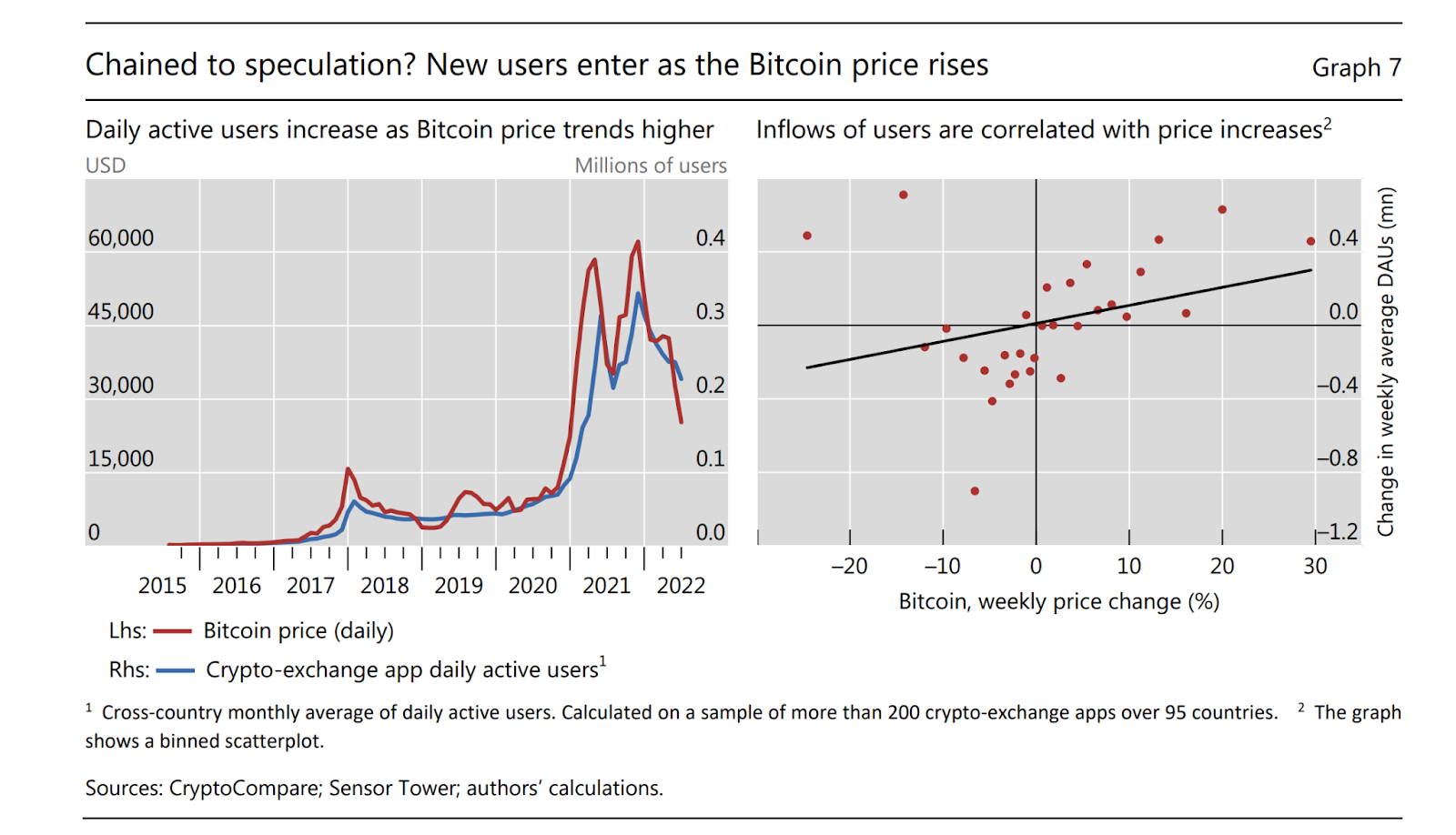

Most people join after a rally in price, pushing prices even higher.

“Between August 2015 and its peak in November 2021, the price of Bitcoin rose from $250 to $69,000. Meanwhile, the monthly average number of daily active users (DAUs) has increased from around 119,000 to more than 32.5 million. During the rapid price increases in late 2017 and early 2021, alone, around 105 and 511 million new monthly active app users joined. In mid-2022, there were around 700 million instances of monthly active use in our global sample, and a cumulative total of 565 million crypto exchange app downloads over the full sample period.”

Users mostly lost money.

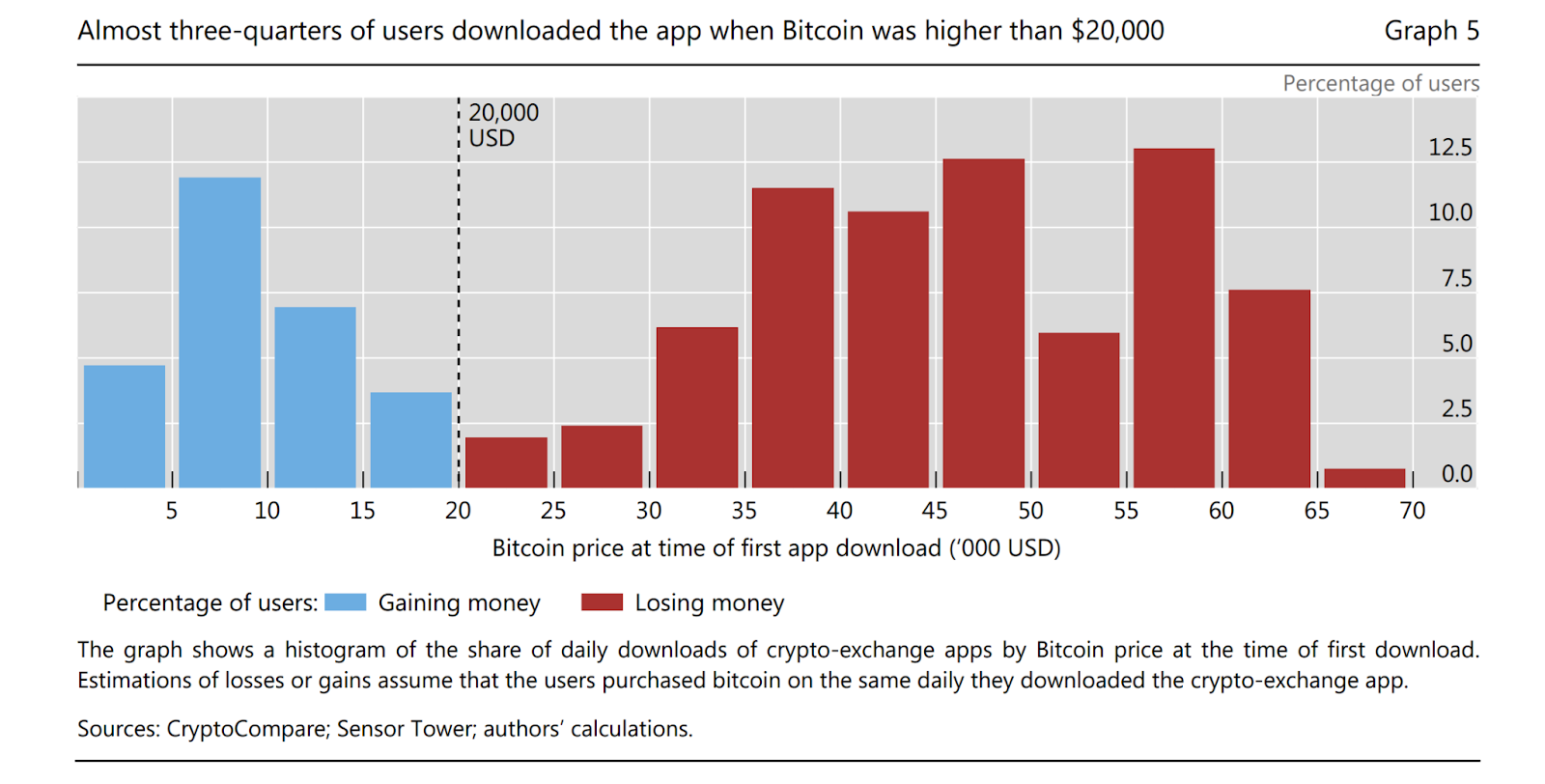

“We find that 73% of the users downloaded their app when the price of Bitcoin was above $20,000 – above the price of Bitcoin in October 2022.”

Users entered their BTC positions in lock-step after price rallies.

“Bitcoin prices and user numbers have moved in lockstep, with a correlation coefficient of more than 0.9.”

“Indeed, rises in user numbers have lagged rises in prices by an average of about two months.”

When small retail investors enter, the largest BTC holders sell.

“…in periods of price increases, small Bitcoin holdings tend to increase, while especially the largest Bitcoin holders – the humpbacks – tend to sell. This, again, is consistent with a market sustained by new entrants, allowing early investors and insiders to cash out at their expense.”

Science experiments by large tech companies

The increased cost of capital have also exerted pressure on cash-rich companies, forcing them to be more judicious with their spending.

An example of this is Amazon’s Alexa division. Earlier this month, the company laid off 10,000 employees. The layoffs include personnel from the hardware division that makes Echo, Alexa, Fire, and Kindle devices.

The devices and Alexa division were once high-priority initiatives within Amazon. In a race to ‘own the home,’ Amazon doubled its headcount in those divisions to more than 10,000 engineers between 2017 and 2018. The division’s desire for more engineers was so large that, at one point, any engineer getting an offer from another department would get an offer from Alexa as well. As a result, costs ballooned. In 2018, Echo and Alexa lost the company about $5 billion.

But after years of selling Alexa devices at a loss, Amazon has little to show for it. Despite high penetration (approximately 25% of all US households have at least one Alexa device), other than basic commands (such as setting the timer, playing music, and controlling lights), people do not use these devices. The vision for voice-enabled shopping has not come to fruition. In an effort to show more capital discipline, Amazon is reducing investments in hardware.

Amazon is not the only company in investors’ crosshairs to show fiscal discipline. Activist hedge funds are pressuring Google (Alphabet) to reduce spending on its Other Bets. According to a letter from Google CEO Sundar Pichai, in the past 5 years, Alphabet’s Other Bets has only generated $3 billion in cumulative revenue but incurred $20 billion in operating losses! One particular expensive endeavor is Waymo, the self-driving car effort. Perhaps, Alphabet should follow the lead of Ford and VW and reduce their self-driving investments.

EV SPACs

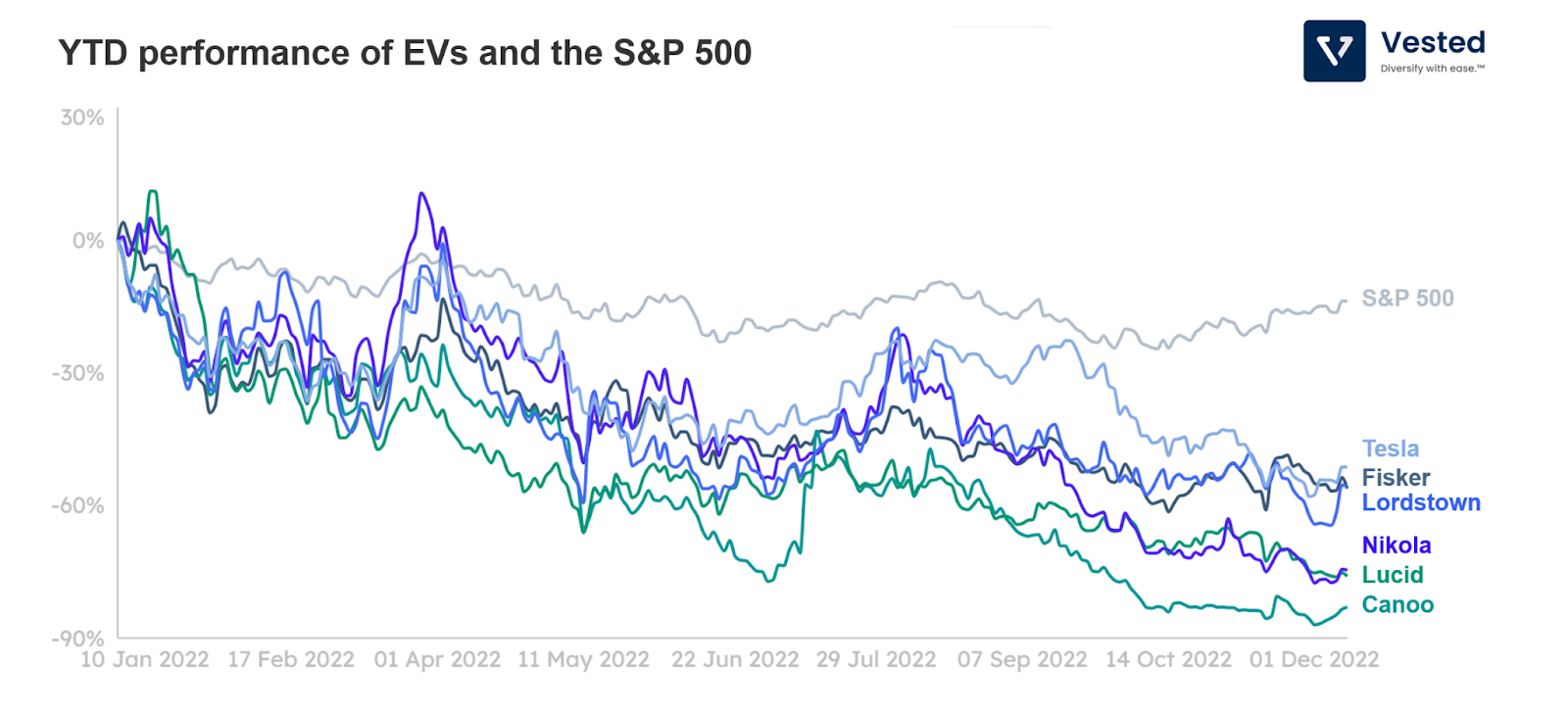

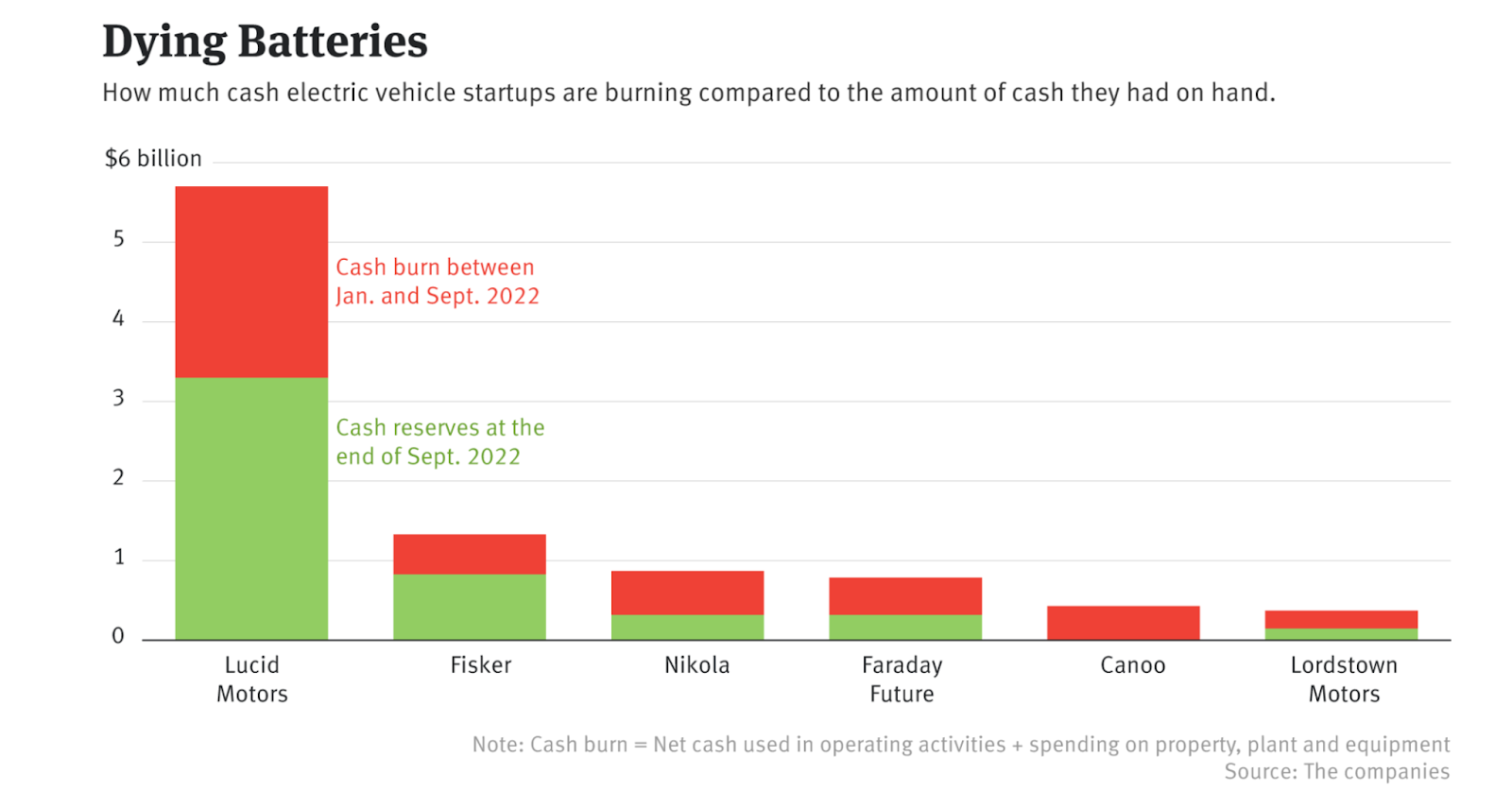

This one is a combination of two things. SPACs have severely underperformed in the past year, worsened by the fact that EV companies are cash-hungry. The underperformance is staggering.

Of the EV companies above, only Tesla is profitable. The rest are not, and many are teetering on the brink of bankruptcy.

- Canoo burned $419 million in the first nine months of 2022. It ended September with $7 million in cash.

- Lordstown Motors burned $222 million in the first nine months of 2022. It ended September with $154 million in cash.

- Faraday Future fared much worse. It burned $467 million in the first nine months of 2022. It ended September with $32 million in cash.

Buy now, pay later

When the cost of capital increases, the lending sector tends to struggle, especially one that tends to cater to Gen Z and the younger demographic. The pressure from higher interest rates appears on two fronts:

- Sourcing capital to lend out becomes more expensive, putting pressure on revenue

- As the economy deteriorates, loan delinquency goes up

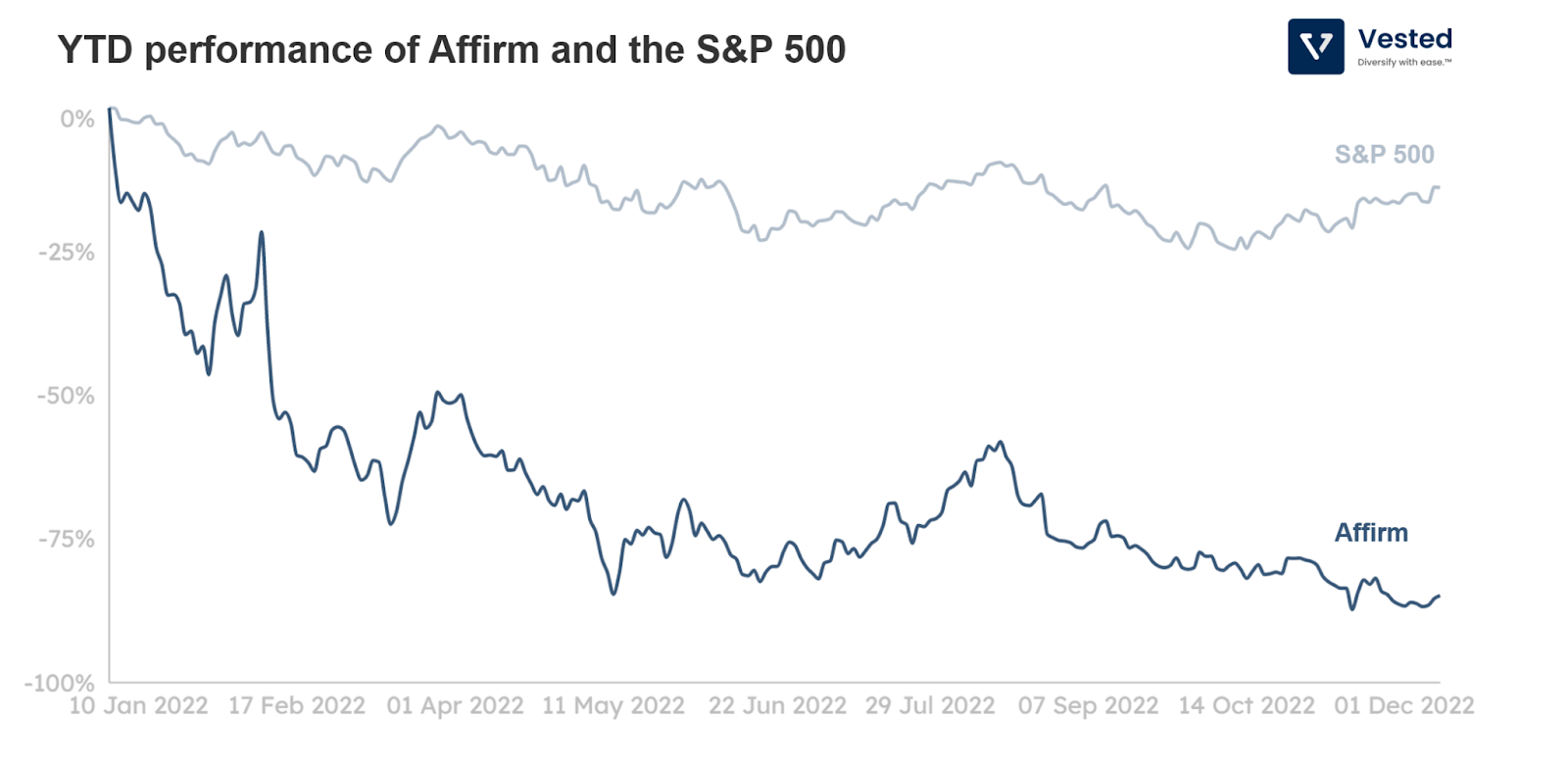

Take Affirm, for example, the Buy-Now-Pay-Later (BNPL) Covid darling. Its stock cratered this year (down 85%). The combination of investors’ appetite for purchasing Affirm’s securitized loans drying up (earlier this year), and as interest rates continue to rise and the economy is getting shakier (at present), have started to present cracks in Affirm’s business.

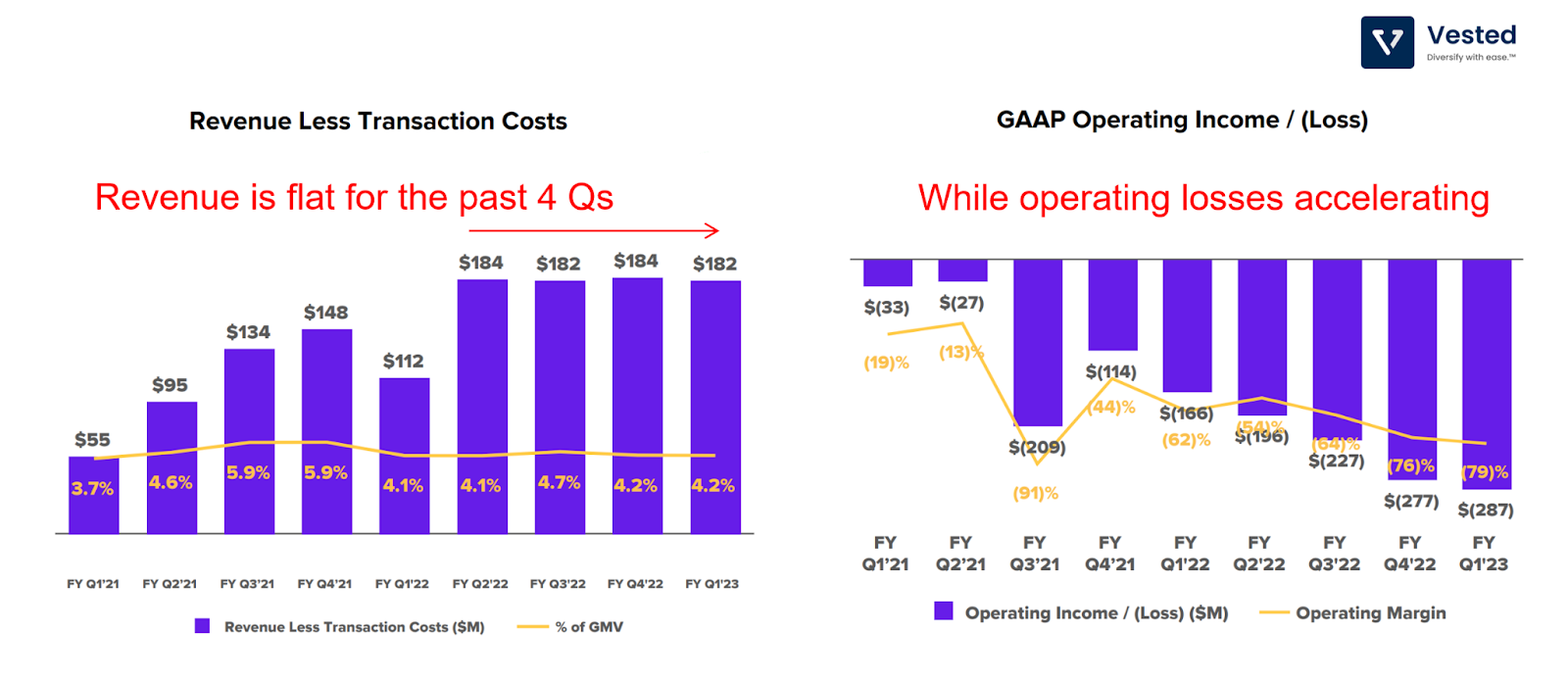

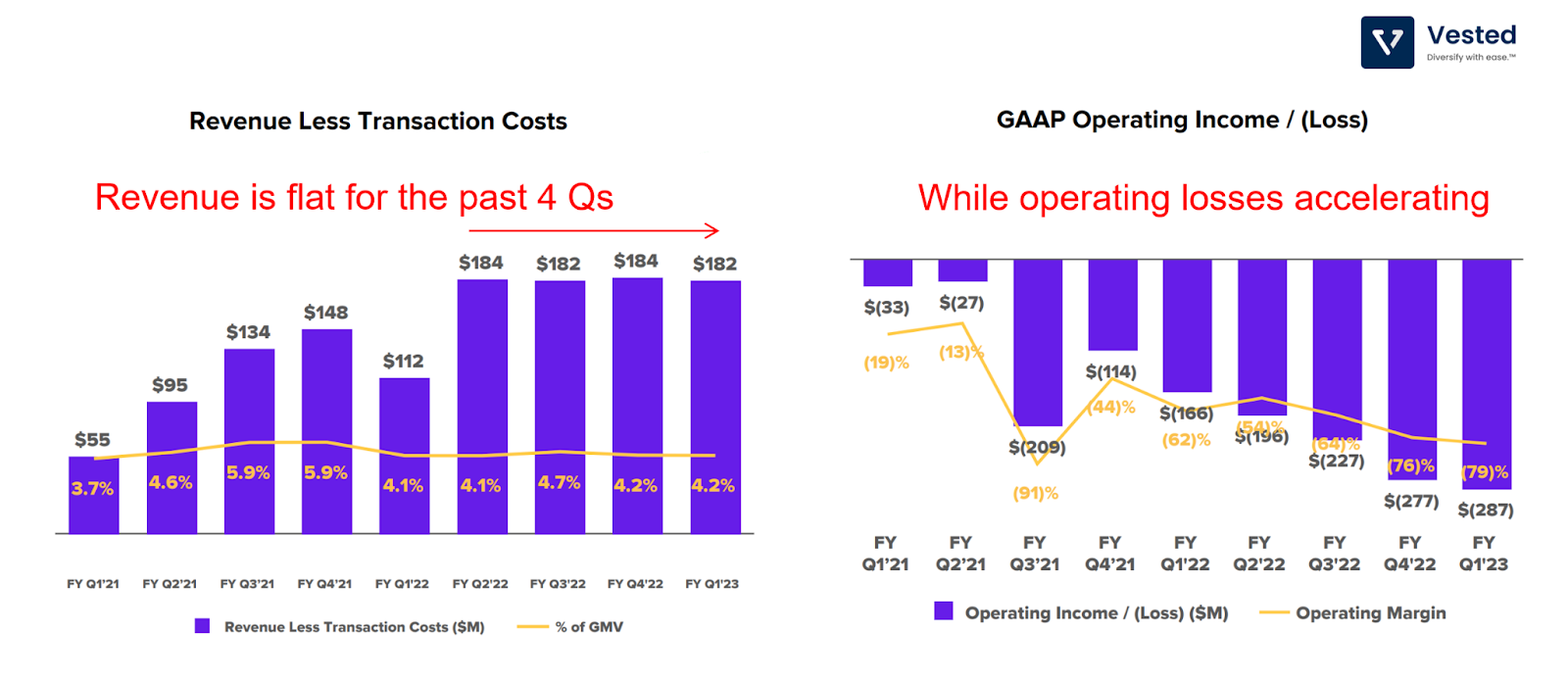

Revenue is flat, while operating losses are accelerating.

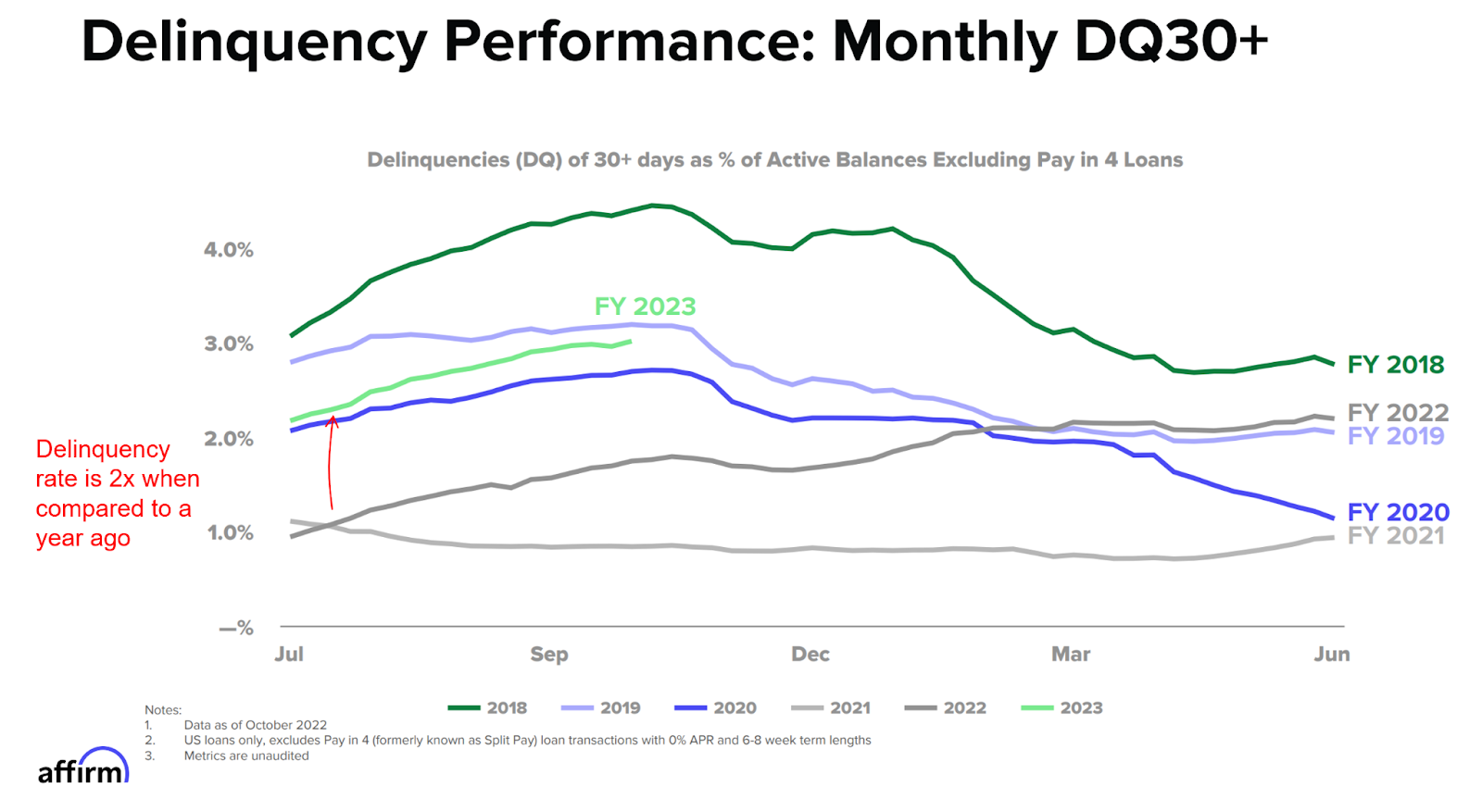

Meanwhile, delinquency of loans is increasing. The FY2023 cohort’s delinquency rate is double that compared to 2021 and is worse than the peak Covid lockdown of Spring 2020.

Car vending machine

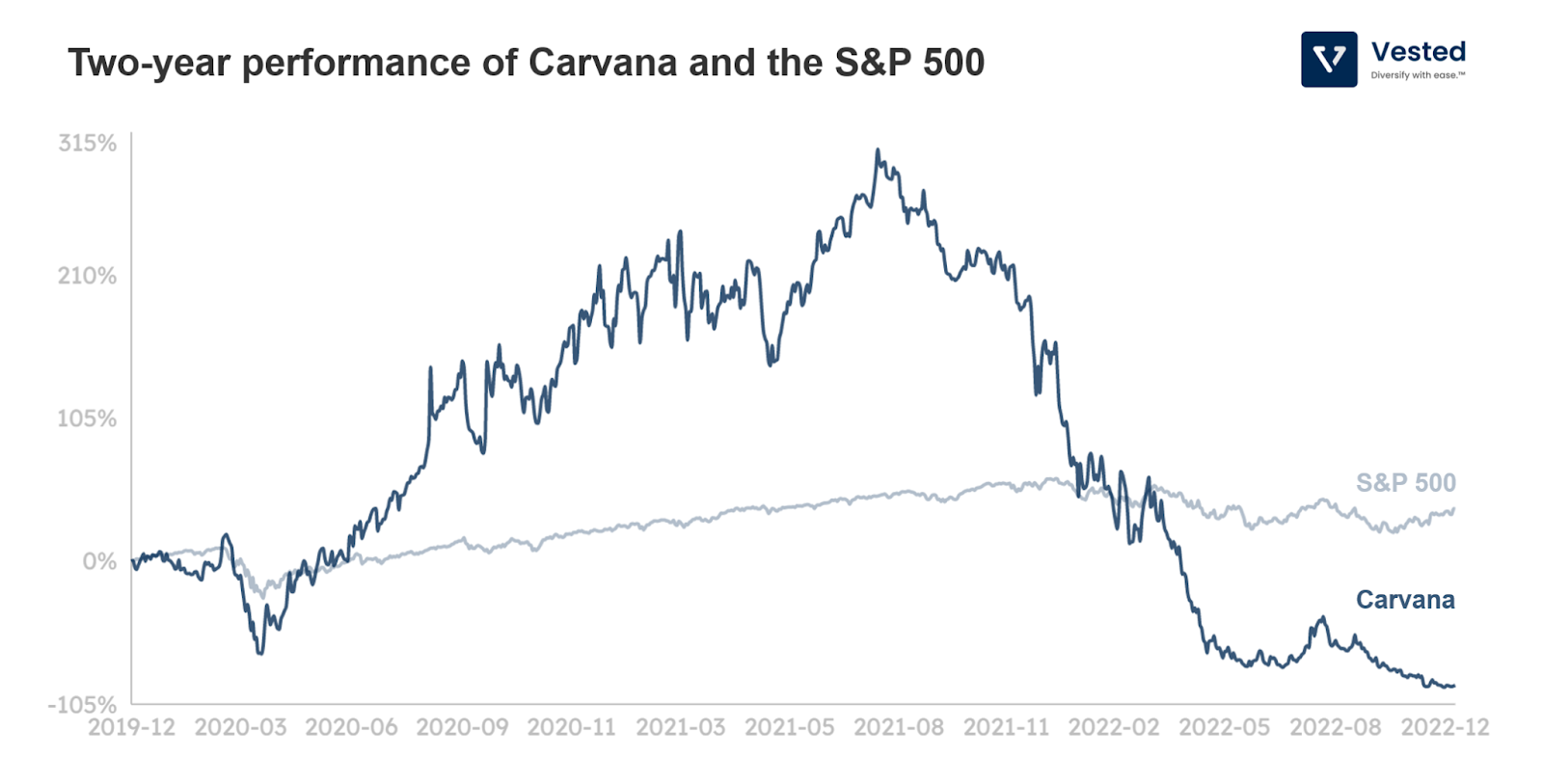

Carvana, the purveyor of the car vending machine, might be going bankrupt soon. For those of you who are not familiar with the company. Carvana is an online-only used car retailer. It buys, sells, and finances used cars. Its primary value proposition is its frictionless experience: consumers can transact through an app. The company then arranges pickup or delivery to the consumer’s home, or via the vending machine shown above.

At the beginning of Covid, supply chain issues caused the prices of used cars to skyrocket, and the global lockdown made in-person shopping for cars difficult. These two conditions made Carvana another Covid bubble stock.

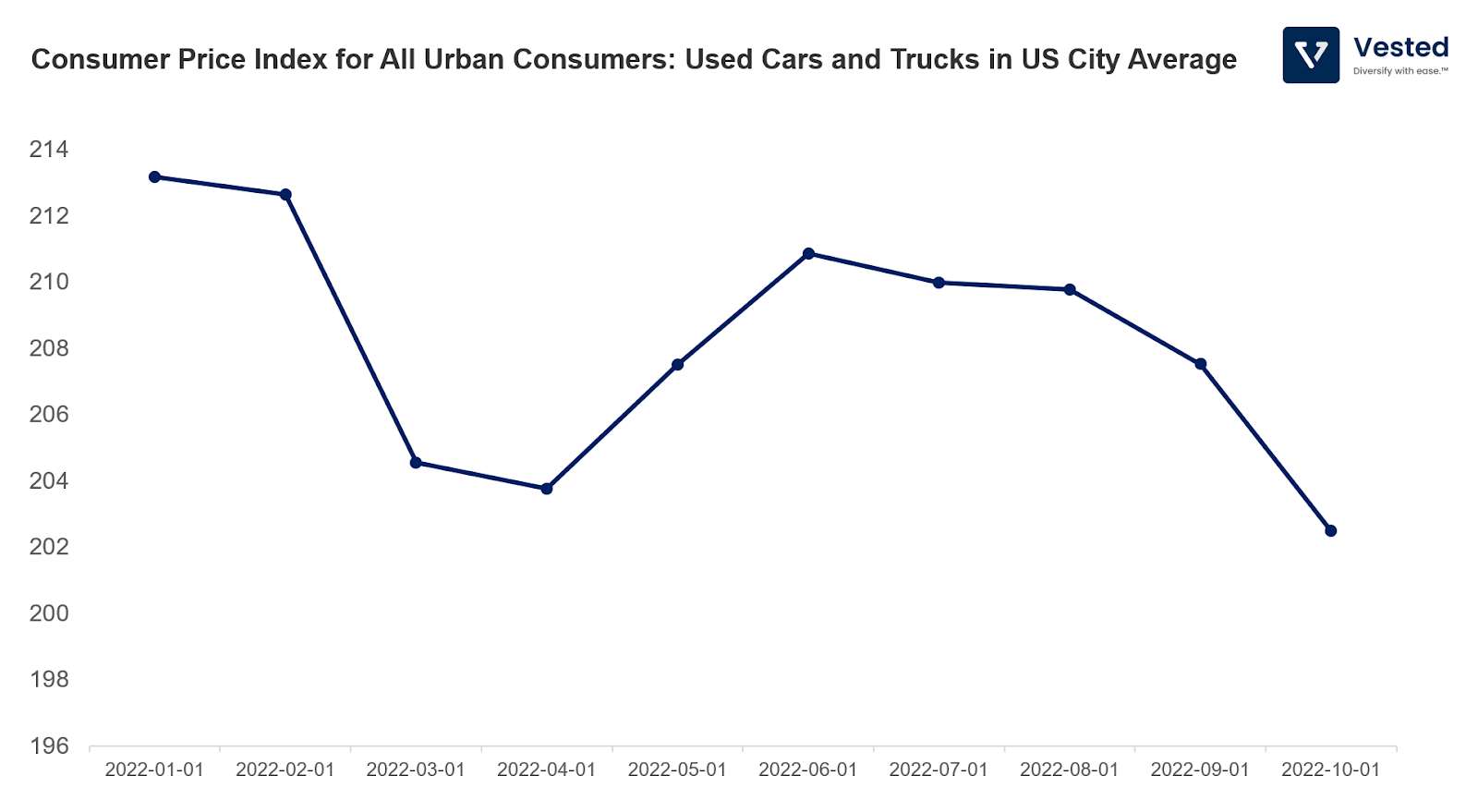

Currently, the company is struggling. The higher interest rate to combat inflation has helped reduce used car price inflation.

This means that Carvana’s value of inventory is depreciating, hurting per-unit profitability. This is made worse by the inventory over-expansion that the company conducted in the past year.

But the bigger problem may lie in its business model. Extended periods of low-interest rates and the Covid hype might’ve delayed the discovery of the unsustainable nature of its business. By not having physical dealerships, Carvana does not have other business lines that help sustain other car sellers. Take AutoNation as a more traditional example. It is one of the largest car dealership networks in the US. It is profitable (7.8% operating income margin), and one of its most profitable segments is reselling parts and servicing cars (46% gross margins). To be in this line of business, you need a physical footprint.

As of this writing, Carvana is facing a significant liquidity crisis. In Q3 2022, the company burned $188 million, leaving the company with only $316 million in cash, and $2.9 billion in depreciating inventory.