We often say that the stock market is not about the economy, but rather about the expectations of the economy. That expectation, when widely disseminated, is generally already baked into equity prices, and any deviation from said expectations can cause the market to swing wildly. Here are some examples of this phenomenon from the past week:

- Early last week, the US job openings statistic was released. The number of job openings fell by the most in nearly 2.5 years (from 11.17 million to 10.05 million). This news generally means that the US economy is weakening, but as a result of the news, the US stock market rallied.

- At the end of the week, another bit of macro data was released: The BLS reported that the US unemployment rate fell to 3.5% (from 3.7% in August 2022) – the lowest in 50 years. This news generally means that the US economy is still strong. However, the stock market subsequently fell and gave up some of its gains from earlier in the week.

To understand what happened, it is important to understand expectations. The market is expecting Fed officials to lift their benchmark rate by 0.75% in November and by 0.5% at their meeting in December 2022.

- If there is bad news which suggests the US economy is weakening (which would ease inflationary pressures), then the market expects the Fed to ease from this expected interest rate schedule. This would trigger a market rally.

- But if macroeconomic data continues to suggest a strong US economy (which would add more inflationary pressure), then the market expects that the Fed will stay its course, or worse, increase interest rates even more. It is very likely that the stock market will decline further if this happens.

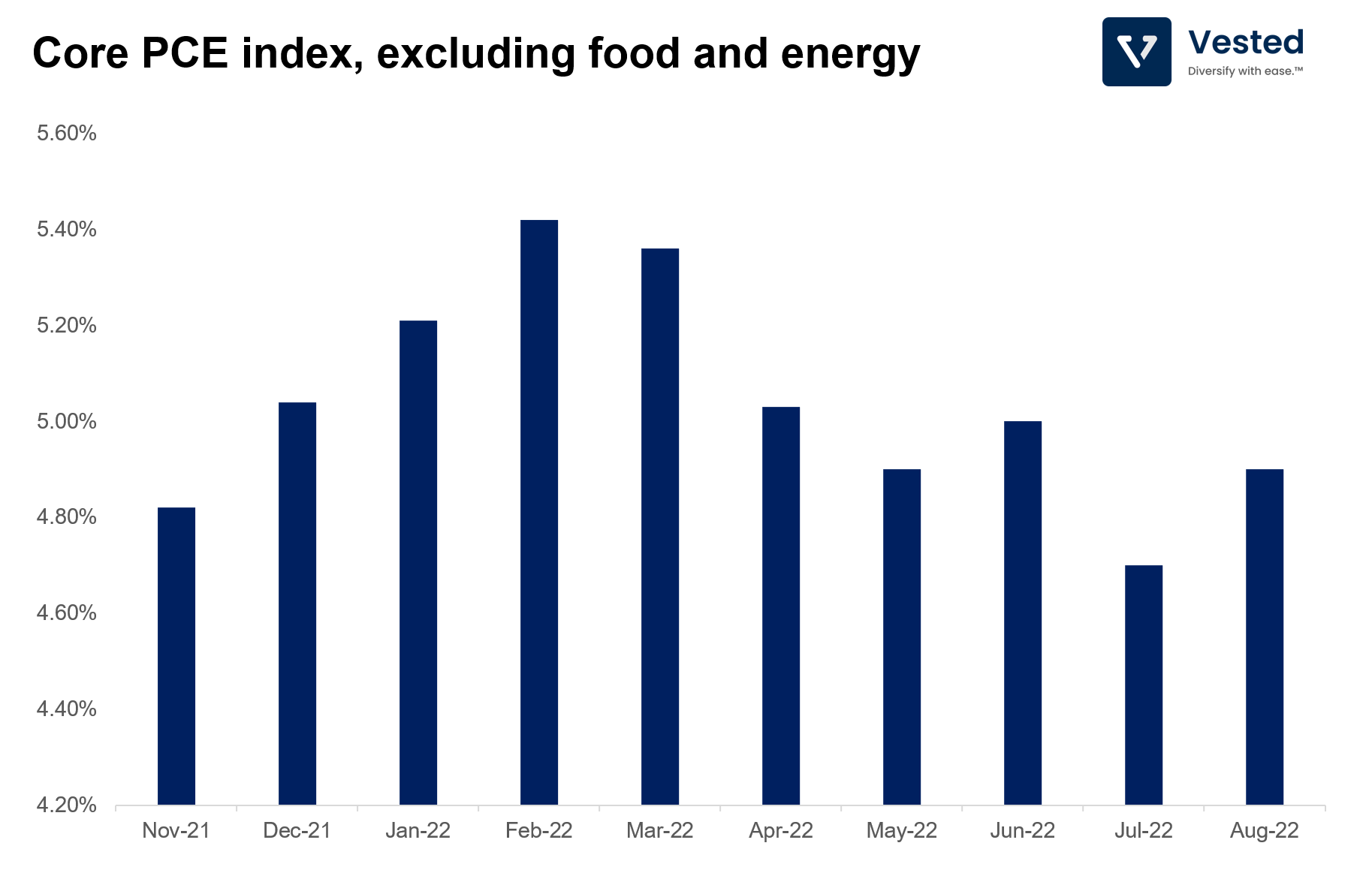

Understanding the above concept is useful as it can be used as an indicator for the market bottom. The bottom is hit (unfortunately, oftentimes obvious only in hindsight) when the Fed starts to ease off the interest rate schedule. And to make this determination, the Fed’s favorite inflation indicator is the core personal consumption expenditure (PCE), which is the tracker of consumer spending that excludes spending on food and energy.

The Fed’s target for this measurement is 2%. The latest available measurement, from August 2022, was still elevated at 4.90%. When this indicator trends down approaching the target value, the Fed will begin to ease interest rates.