If you want to invest in real estate but can’t bear the hassle of purchasing and maintaining a property, this article is for you. Today, we discuss how to invest in real estate the same way you would in the stock market. Let’s talk about REITs.

What are REITs?

A real estate investment trust (REIT) is a company that owns, operates, or finances income-producing real estate. REITs invest in a broad scope of real estate properties by leasing out spaces and collecting rent. From these activities, REITs generate cash flow, which is then paid out to shareholders via dividends. REITs are required by law to pay out 90% of their income as dividends, on which investors have to pay the ordinary income tax rate (rather than the dividend tax rate).

REITs can be divided into two broad categories:

- Mortgage REITs (mREITs) invest in mortgages or mortgage securities tied to commercial and residential properties.

- Equity REITs (eREITs) generate income by collecting rent on and from sales of the properties they own.

Due to the underlying nature of their asset classes, eREITs and mREITS have different characteristics:

- Credit risks and cyclicality: eREITs tend to be cyclical and sensitive to recessions and periods of economic decline. In contrast, mREITs typically comprise mortgage securities backed by the federal government, limiting their credit risk.

- Income and growth: eREITs typically provide returns through revenue and growth. While mREITs are more like bonds: they provide yields without changes to the value of the underlying asset (no growth).

Investing in REITs can be beneficial in high-inflation environments. But because of the two core differences mentioned above, the total returns from mREITs have generally lagged those of eREITs, especially over long periods (after all, there’s no free lunch; the lower risks associated with mREITs translate to lower returns). In the following sections, we talk about eREITs in particular and how to invest in them.

How to invest in REITs

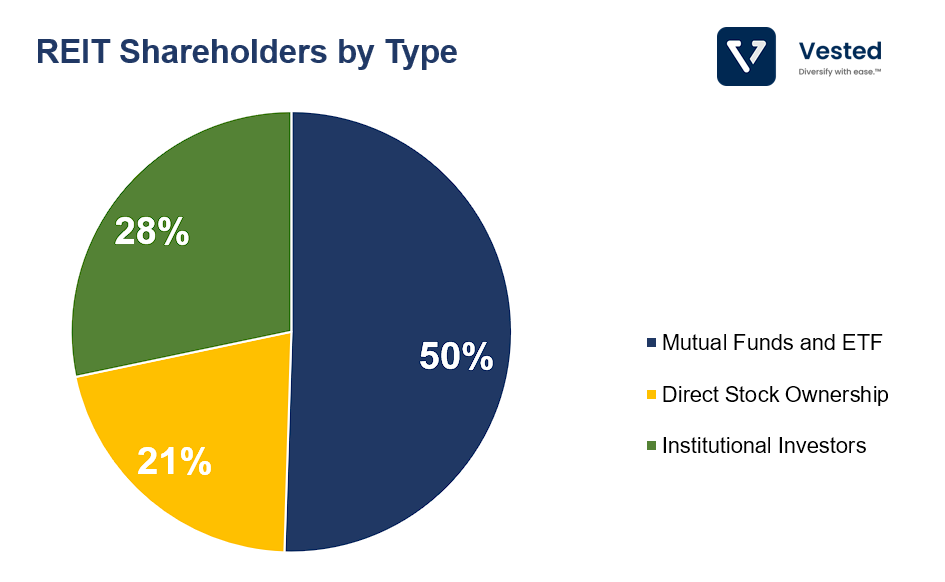

Roughly 44% of American Households are invested in REITs through their 401(k), IRAs, pension plans, and other investment funds. But you also can invest in REITs in one of two ways:

- Invest in individual REITs by buying their stocks. These individual REITs tend to hold property assets within the same vertical.

- Purchase ETFs that hold a multitude of REITs. These ETFs combine multiple REITs and, therefore, can include many different segments.

Invest in individual REITs

As mentioned above, investing in one particular REIT company means investing in a specific real estate vertical. This means that the performance is primarily driven by (i) the growth of that vertical and (ii) the geographic location (owning a mall in Wisconsin is not the same as owning prime retail real estate in New York).

Let’s first look at the different verticals.

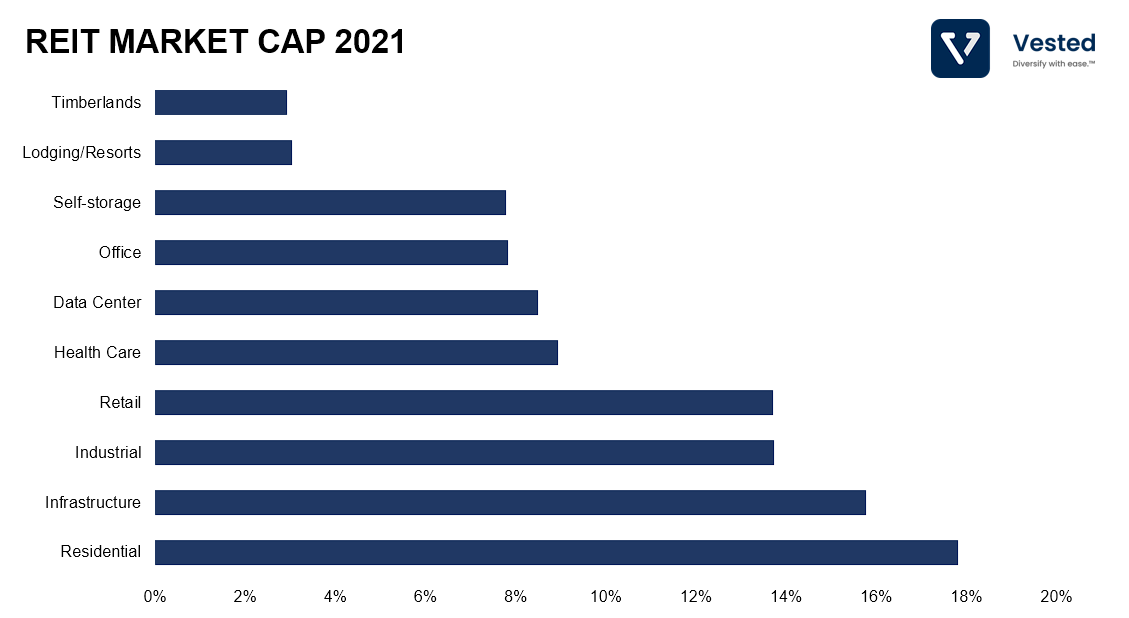

REITs can own offices, apartment buildings, warehouses, retail centers, medical facilities, data centers, cell towers, infrastructure, and hotels (Figure 3). Here are a few examples:

- Extra Space Storage (EXR) invests in self-storage units.

- Equity Residential (EQR) invests in high-end apartment buildings.

- American Tower (AMT) invests in wireless and broadcast communications infrastructure, and recently they’ve also invested in Data Centers.

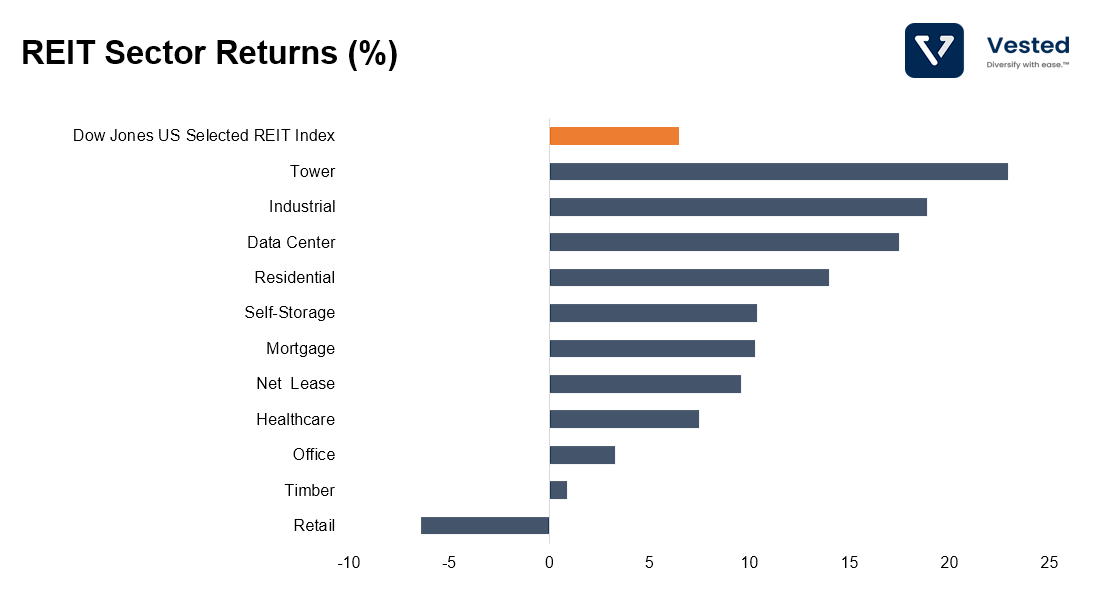

Retail REITs suffered the most during the pandemic as people shifted toward online shopping and went to retail stores less frequently. In contrast, Tower REITs were at the top of the sector list as the demand for wireless data usage continues to grow. (See Figure 4) Industrial and Data Center REITs are second-place competitors due to the growing need for high-quality space to store IT infrastructures such as servers and other computing equipment.

But if studying each industry seems too daunting of a task, you may opt for an easier alternative.

Invest in ETFs instead

REIT ETFs are a low-effort alternative for investors seeking exposure to real estate without studying each company separately. They own baskets of REIT stocks and are designed to mirror an underlying REIT index.

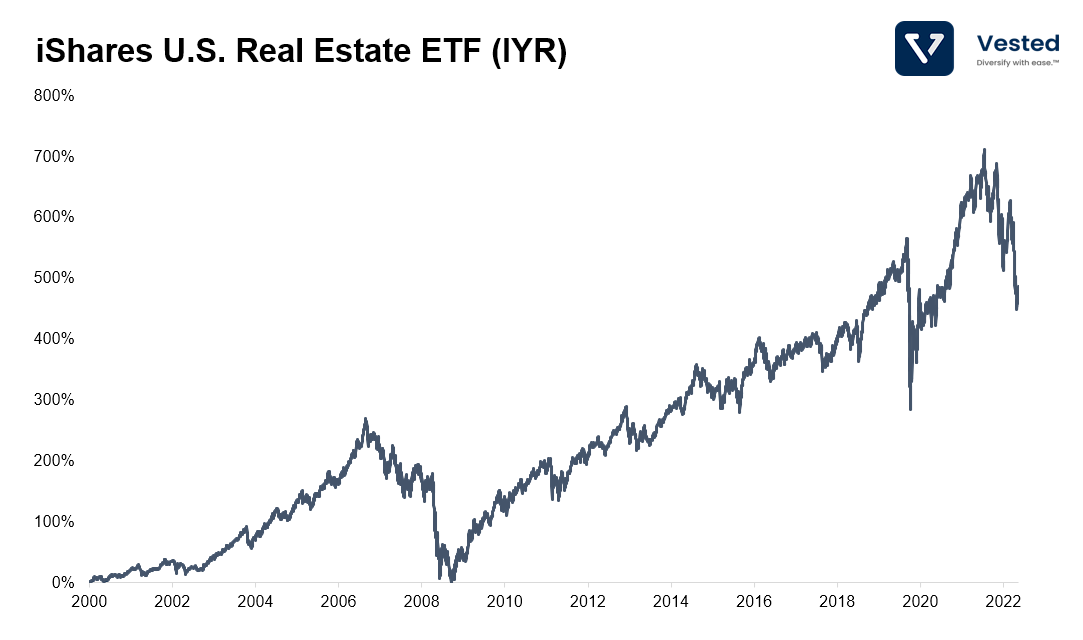

An example is the iShares Dow Jones Real Estate Index (IYR) Fund, which was launched in 2000, making it the first REIT ETF. (See Figure 5) More than 20 REIT ETFs are now available in the market. For example,

- Invesco KBW Premium Yield Equity REIT ETF (KBWY) is designed to track the KBW Nasdaq Premium Yield Equity REIT Index based on a modified dividend yield weighting methodology.

- Vanguard Real Estate ETF (VNQ) is a behemoth among REIT ETFs, with more than ten times the AUM of its nearest competitor.

- Nuveen Short-Term Real Estate ETF (NURE) seeks to concentrate its holdings in apartment buildings, hotels, self-storage facilities, and manufactured home properties that typically have shorter lease terms.