Explaining why the stock market dropped in December 2021

Here’s a detailed analysis explaining the stock market drop of December 2021.

Despite is the word of the week. Here are some investing news headlines from the past week:

- CNBC: Stitch Fix shares crater as retailer cuts forecast, despite topping earnings estimates

- Investors.com: Zoom Stock Tumbles Despite Earnings Beat As Billings Growth Moderates

- Seeking Alpha: UiPath dips despite third-quarter earnings beat, analyst upgrades

- SiliconAngle: Despite earnings beat, weak guidance sends DocuSign stock into freefall

We can go on, but you get the point. A lot of stocks went down despite beating earnings expectations, especially in the past three weeks.

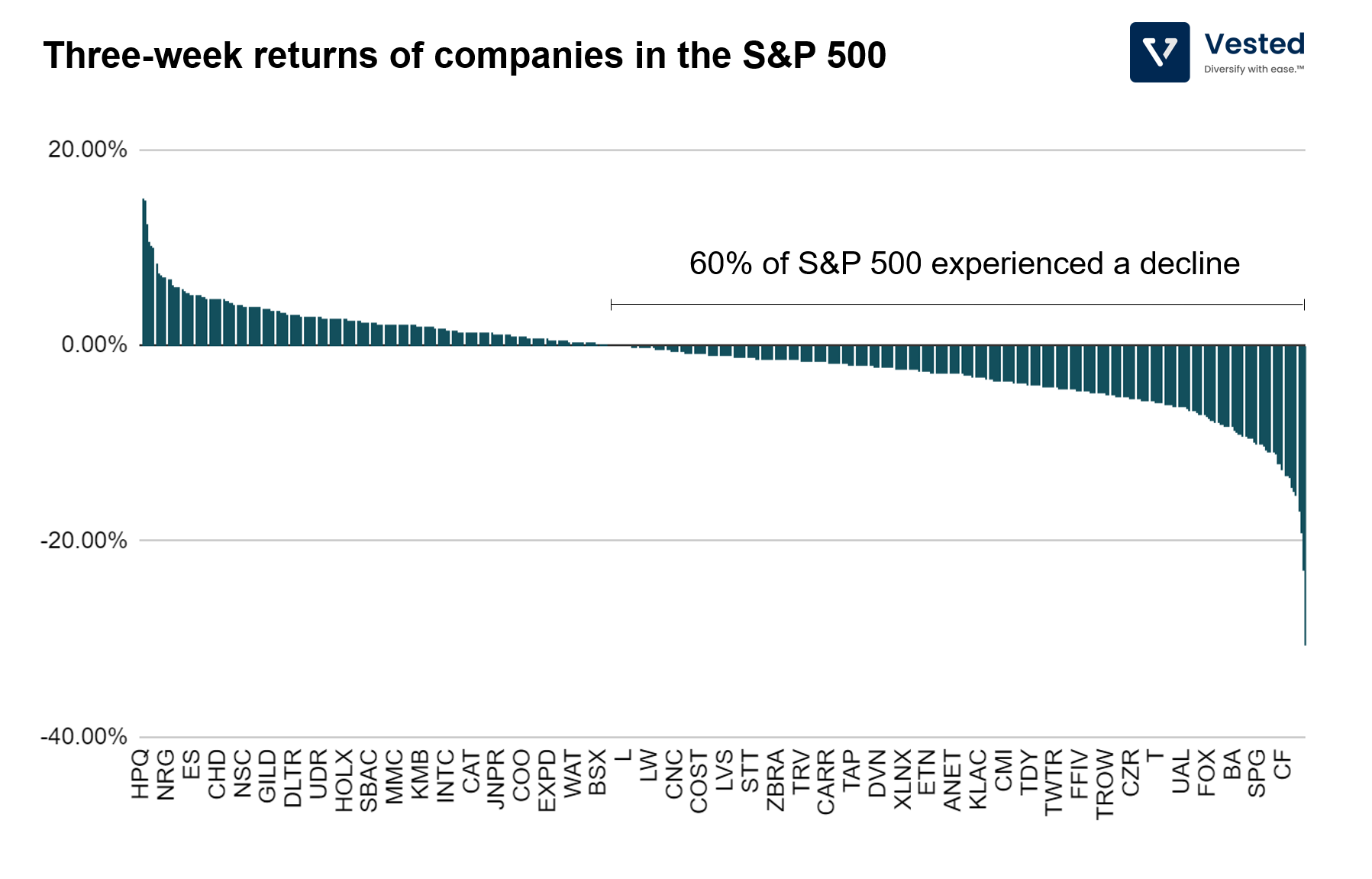

As of this writing, the S&P 500 is up 5.4% in that time span, but of the 505 tickers in the S&P 500, about 60% (or 302) are in the red. Here’s the breakdown (Figure 1):

Fortunately, the S&P 500 is an index that is market cap weighted (the larger market cap has higher allocation). As a result, despite 60% of companies in the index giving negative returns in the past three weeks, the S&P 500 is still positive (thanks to the mega cap tech stocks).

As to the reason for the broad decline? Here are several possible reasons:

- Omicron: The new more transmissible Omicron variant from South Africa was first announced about three weeks ago. The announcement sparked fear and concern worldwide, which triggered a market sell-off. Unlike before, however, the sell-off appears to be broad based. Pandemic stocks that surged upon the beginning of the lockdown in 2020 suffered this time around (e.g. Netflix – down 15% and Zoom – down 26% during this three weeks period). Having said that, early data around Omicron seems to suggest that the new variant causes less severe illness than expected, reducing market concerns.

- Inflation concerns: Around the same time, the Fed (US Central Bank) announced that it would consider accelerating the reduction of its asset-purchase stimulus program at its meeting on December 14-15, as the supply-induced inflation is lasting longer than the Fed initially expected. This means the market has to start planning for the end of quantitative easing and the increase in interest rates in the not too distant future. Higher interest rates translate to adjustments towards lower valuation, which hurts high-flying stocks.

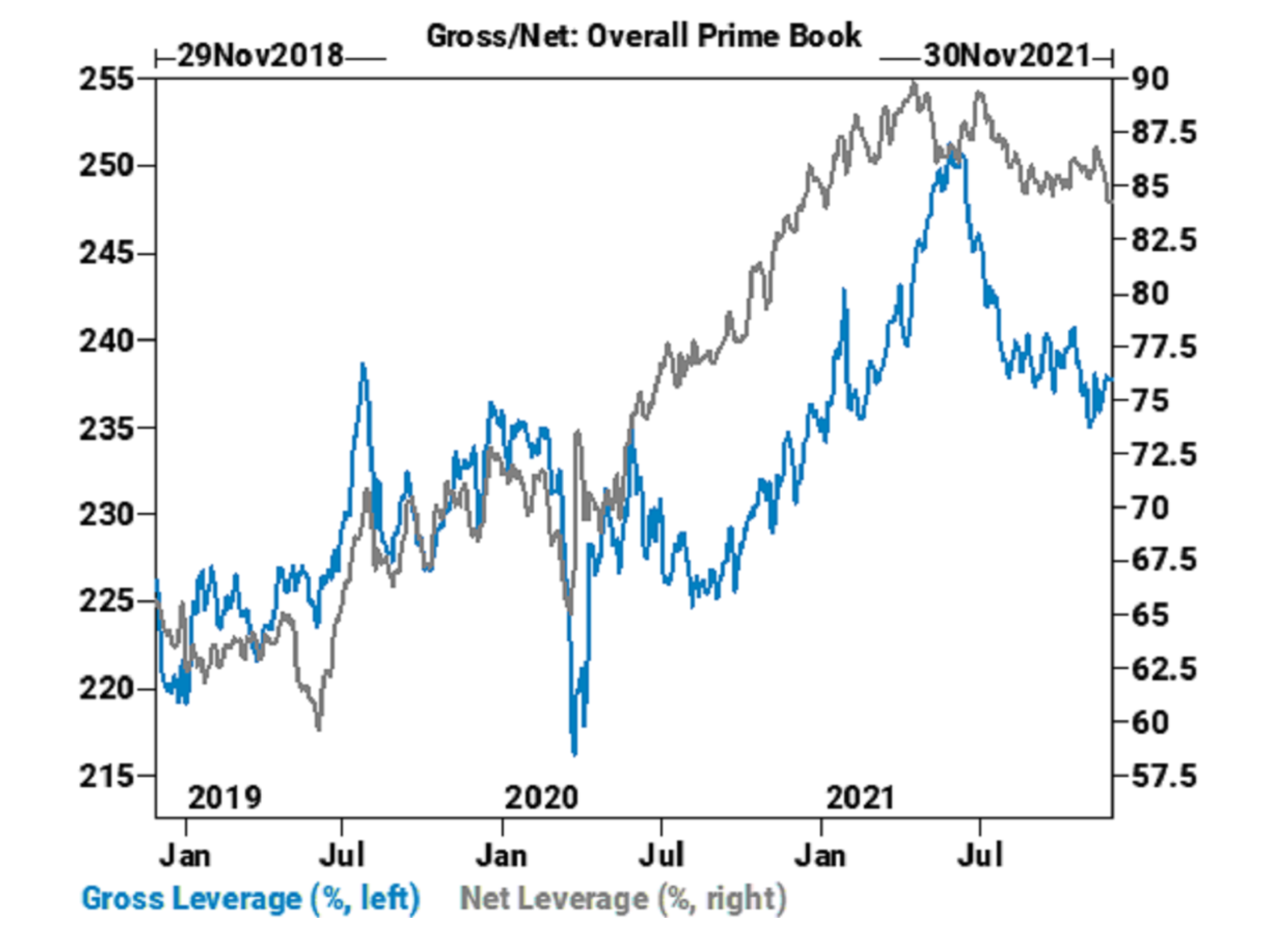

- Deleveraging: All these uncertainties led hedge funds to de-lever at a rapid clip. Figure 2 below shows data from Goldman Sachs’ prime book. Net leverage (grey line), which measures the risk appetite of hedge funds that takes into account long vs. short positions, fell to a one-year low in the last week of November 2021.

The confluence of these three factors likely led to the broad market dip the past three weeks. One interesting outcome of this, however, is that many pandemic stocks that experienced accelerated growth over the past two years are valued lower than their pre-pandemic valuation in 2019.

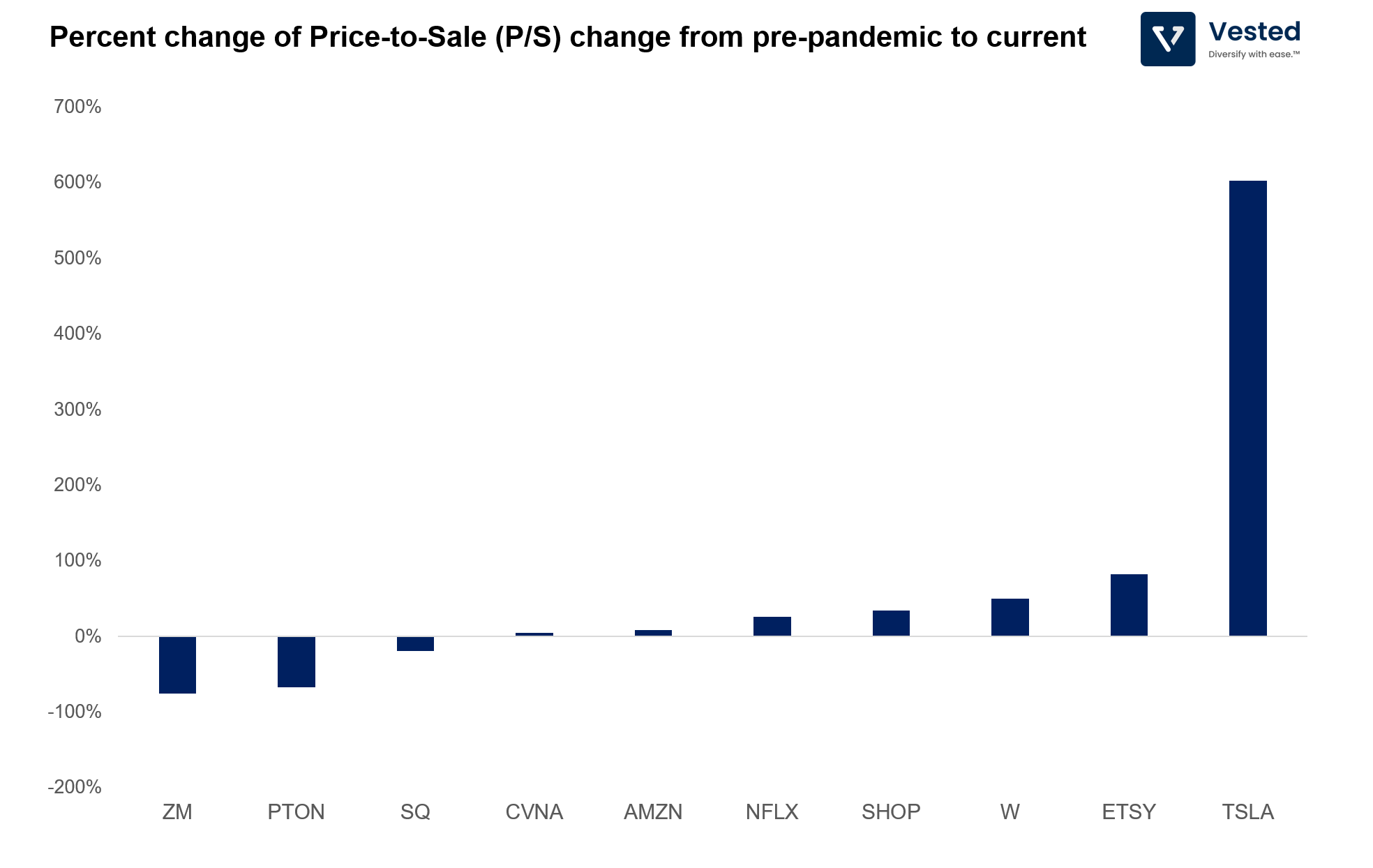

Figure 3 below shows the change in the Price-to-Sale (P/S) ratio (a valuation ratio that tells investors how much they are paying for every dollar of the company’s sales – the higher, the more expensive the share is) of some of the biggest beneficiaries of the global disruption the pandemic caused.

- In the early days of the pandemic, Zoom (ZM) was definitely the biggest winner. From a relatively business-centric communication software, the company became a verb synonymous with video calling. The stock soared, became overpriced, and now is valued much less when compared to before the pandemic started. The stock saw a 75% decline in P/S valuation (P/S at the end of December 2019 was 56.9x, now it’s 14.1x). This massive decline in valuation is despite the company growing its revenue almost 6x and operating margin by 2x during the past two years.

- Peloton (PTON) was also a big winner in the early days of the pandemic. As the US entered a prolonged lockdown, everyone wanted to work-out from home. Before the pandemic, the P/S was 8.7x. It is now valued at 2.9x P/S, a 67% decline. To be fair, it missed its last two quarterly earnings targets, and had product recall issues, among other issues.

- On the other hand, nothing fazes Tesla’s share price. It is even more expensive than before – ever defying expectations.🤷