Today we discuss India’s latest export: Freshworks’ upcoming US IPO.

Investing in a software-as-a-service (SaaS) company is, in some ways, less challenging than investing in other types of companies. SaaS companies have common characteristics that make it easier for investors to gauge the health of said company, even without having domain expertise. If you do not know biotech well, it’s probably not wise for you to invest in biotech companies (especially if they are pre-product / pre-revenue). In contrast, in the SaaS world, even if the investor does not understand how CRM software works, by judging various SaaS metrics, the investor can gauge the health of the business. This is because SaaS businesses have the following characteristics:

- predictable recurring revenue

- high gross margins

- expanding revenue with more usage

These common characteristics mean that in most cases, it does not matter what type of software the company makes. Therefore, one can just look at growth rates and efficiency in sales to determine if the company is winning in its vertical. In this piece, we look at Freshworks using this common SaaS evaluation framework.

Interestingly, Freshworks’ origin story is anything but common.

The Origin

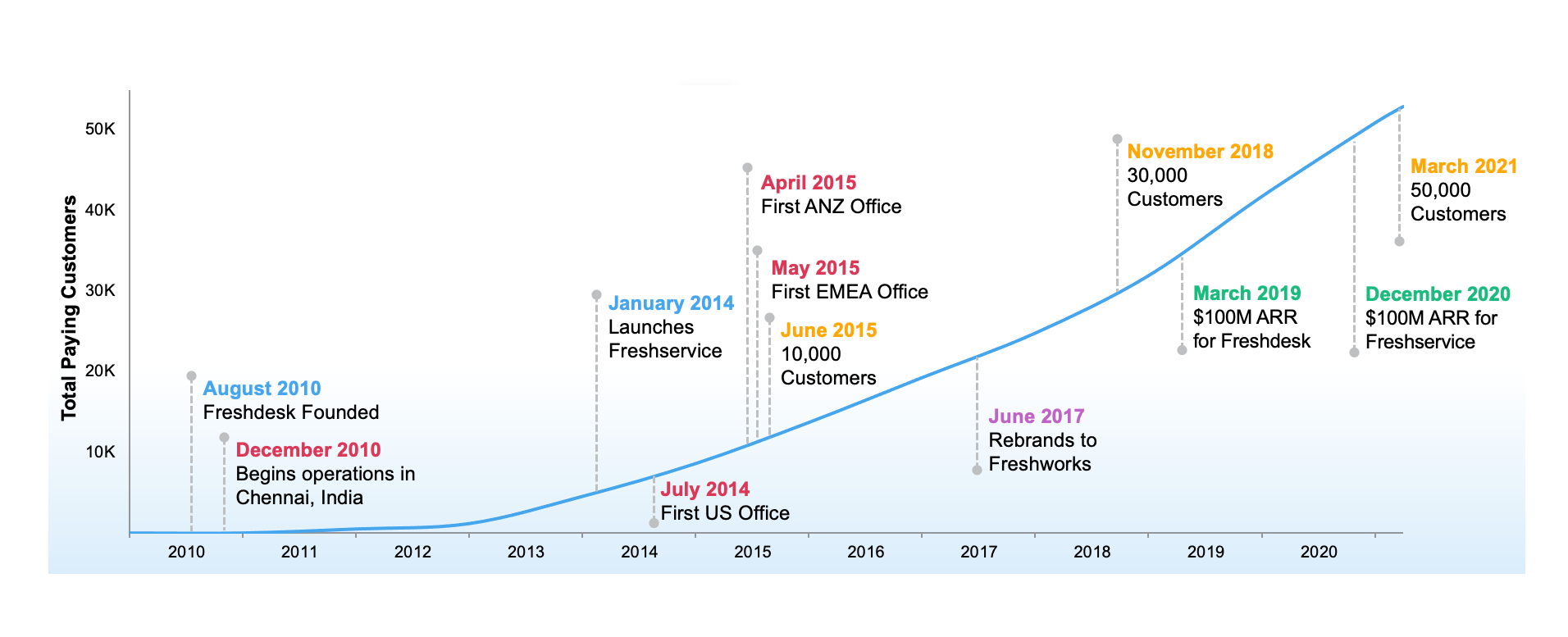

Freshworks (known as Freshdesk at the time) started in 2010 at a 700 square foot warehouse in Chennai, India. In the early days, the company only sold help desk software. As commerce became omnichannel, so did customer service; inbound inquiries came through email, chat, phone calls, and even text messages. Keeping track of those queries became difficult. To solve this problem, businesses of all sizes required a unified help desk software solution.

The idea for Freshdesk came to Girish Mathrubutham due to a poor experience he had with customer service (according to the S-1, but if you read this post, the idea came from seeing a post in Hacker News about the high cost of Zendesk). At first, Freshdesk mostly catered to small/medium-sized businesses (SMBs). SMBs that are overwhelmed with customer inquiries often search for a solution that can be adopted quickly. Targeting SMBs meant that Freshworks’ go-to-market motion had to be a light touch one (customers must be able to self-service) and that integration had to be fast and easy (solving customer help requests is a hair-on-fire type problem – I speak from experience).

Against all odds, the company grew – from the Founder Letter:

You Can’t Win

Freshworks is the company that wasn’t supposed to win. Whether we could differentiate ourselves in crowded markets, or compete with larger players, or build a global SaaS company from India, the doubts were always there. And people were not shy about telling me! Over the years, I’ve heard it all, including:

- There are 600 help desks in the market. How do you expect to win?

- You can’t find talent in Chennai; you can’t win unless you move to Bangalore.

- Microsoft just acquired Parature. They will put you out of business.

- Don’t enter the CRM market. You just can’t win.

- You really can’t build a global SaaS company from India.

Well, they did it. Freshworks is now a global company with offices in 6 countries, has more than 52,000 customers, and is going public on NASDAQ soon.

The Product

Freshworks offers three core software products that help businesses of any size carry out more efficient internal communication and task management. The products solve sales and back office functions, and have significant lock-in:

- Customer Experience: to provide better customer service.

- IT Service Management: to manage IT better.

- Sales and Marketing: to carry out outbound sales better.

The company competes directly with Zendesk, Salesforce, HubSpot, Monday.com, Atlassian and ServiceNow.

The Metrics

Most of the metrics used in evaluating SaaS companies revolve around measuring growth rate and efficiency. Here are a few examples.

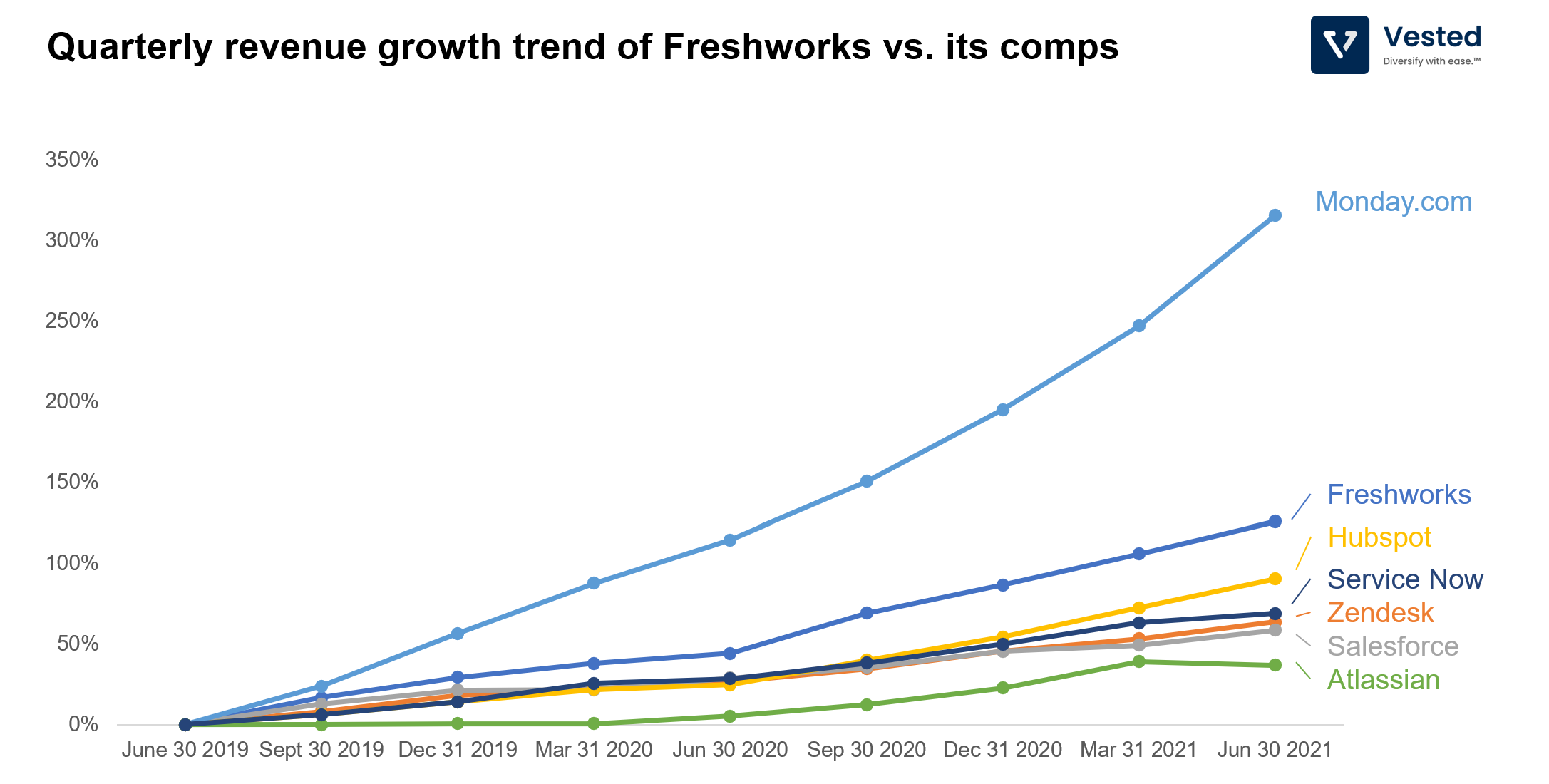

Revenue growth: Still small and fast growing

Figure 3 above shows the quarterly revenue trend for Freshworks and other companies in its market. Since Q2 2019, the company has grown its quarterly revenue by 126%, the second fastest growing company in the list above. Part of it is because it is smaller (so it’s still growing faster). HubSpot grew its quarterly revenue by 90% over the same period, but its quarterly revenue (June 2021) is ~3.5x higher. In contrast, Zendesk (Freshworks’ closest competitor) grew 64% over the same period, but has 3.6x higher revenue.

Of the companies listed above, Monday.com has the highest revenue growth (315% over the past 8 quarters), even though it has about the same quarterly revenue as Freshworks (Freshworks’ Q2 2021 revenue was $88.3 million, while Monday.com’s was $70.6 million).

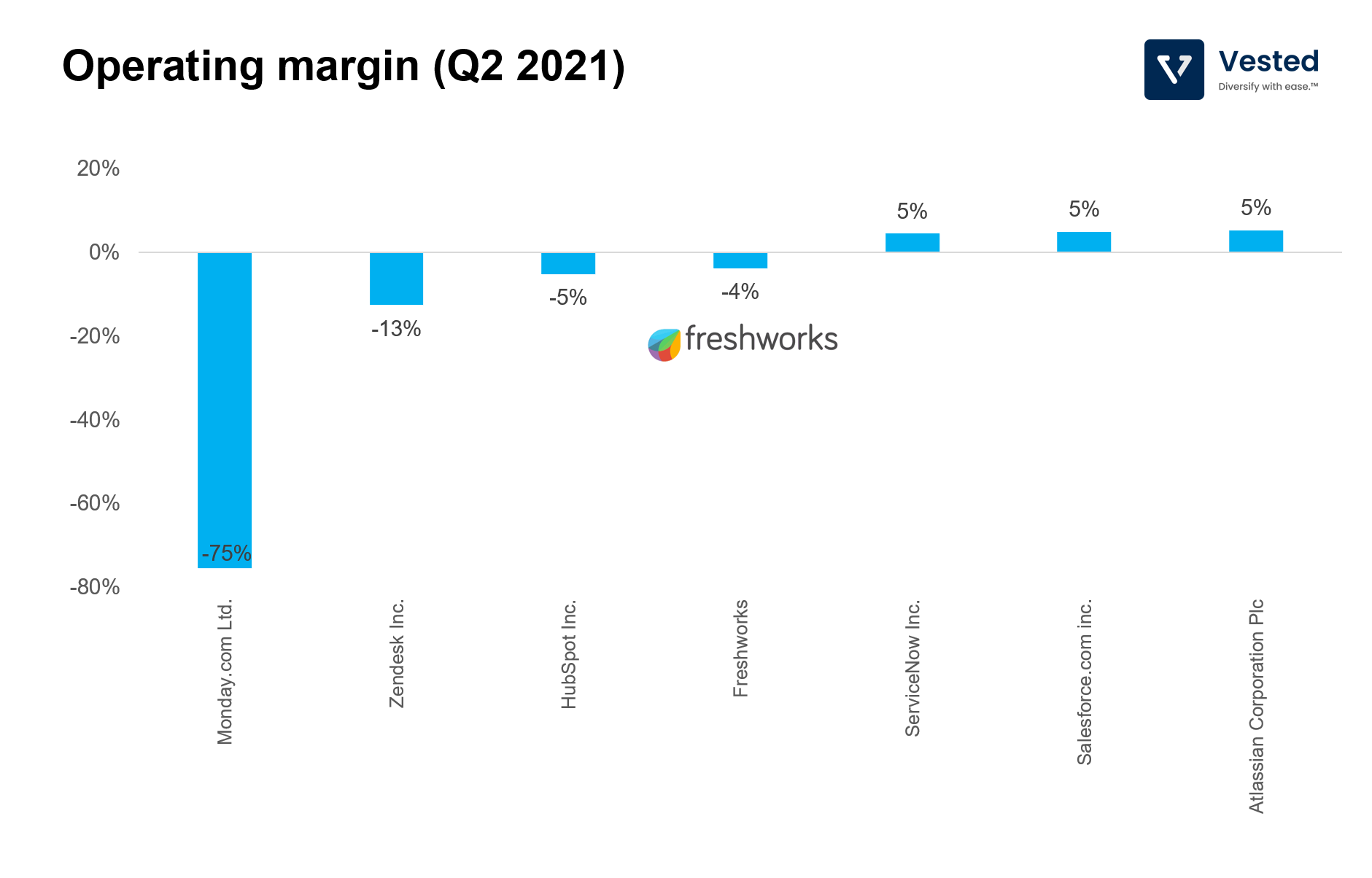

Profitability: Operating margin is good for its size

Typically, small to medium size SaaS companies do not have positive operating margins, as the upfront cost of software development and customer acquisition is larger than revenue generated (it takes time for revenue growth to snowball). At -4% operating margin, Freshworks is in the middle of the pack compared to its comps (Figure 4). It is, however, achieving a pretty good margin considering its size. In contrast, Zendesk with a much larger revenue has an operating margin of -13%, and Monday.com with comparable revenue has a margin of -75%.

One of the strengths of Freshworks is it’s an India company that became a global company. This means that much if its cost basis is India based, while the bulk of its revenue is generated in North America. As of June 2021, 88% of its employee base (or 3,634 employees) resided in India, while 42% of its revenue was generated from customers in North America. That is the best of both worlds.

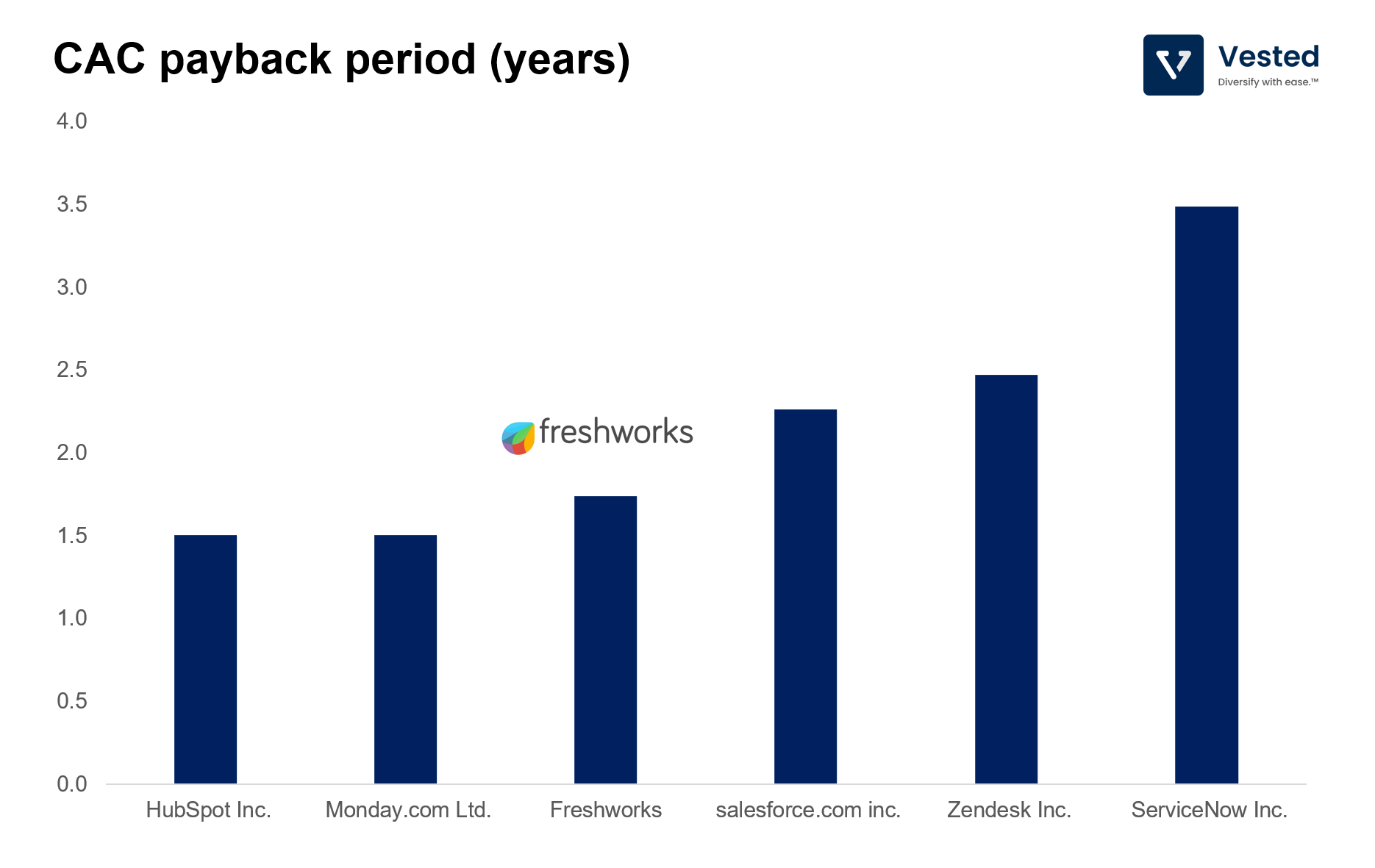

CAC payback period: Middle of the pack

The CAC payback period is the amount of time it takes for the marketing spend of acquiring new revenue to be recouped. This is a measure of sales efficiency. The shorter the time period, the more efficient the business is, and the less likely the company will experience a cash crunch. We estimate the CAC payback period using the following formula:

CAC payback period is estimated by dividing previous quarter’s sales and marketing spend by the new gross profit generated in the subsequent quarter, annualized. In Figure 5 below, we show the CAC payback period for Freshworks and its comps. All the companies discussed here have more than a year CAC payback period, and again, Freshworks is in the middle of the pack. Attlassian was excluded from the analysis because net new revenue from Q1 to Q2 2021 declined, making their CAC payback period numbers not meaningful.

Diverse customer base

Freshworks’ customer base is quite diverse. As of June 30, 2021, the company has about 52,500 paying customers, up by 8% compared to December 2021, and no customers individually contribute more than 10% of the company’s revenue, which means there’s low customer concentration risk.

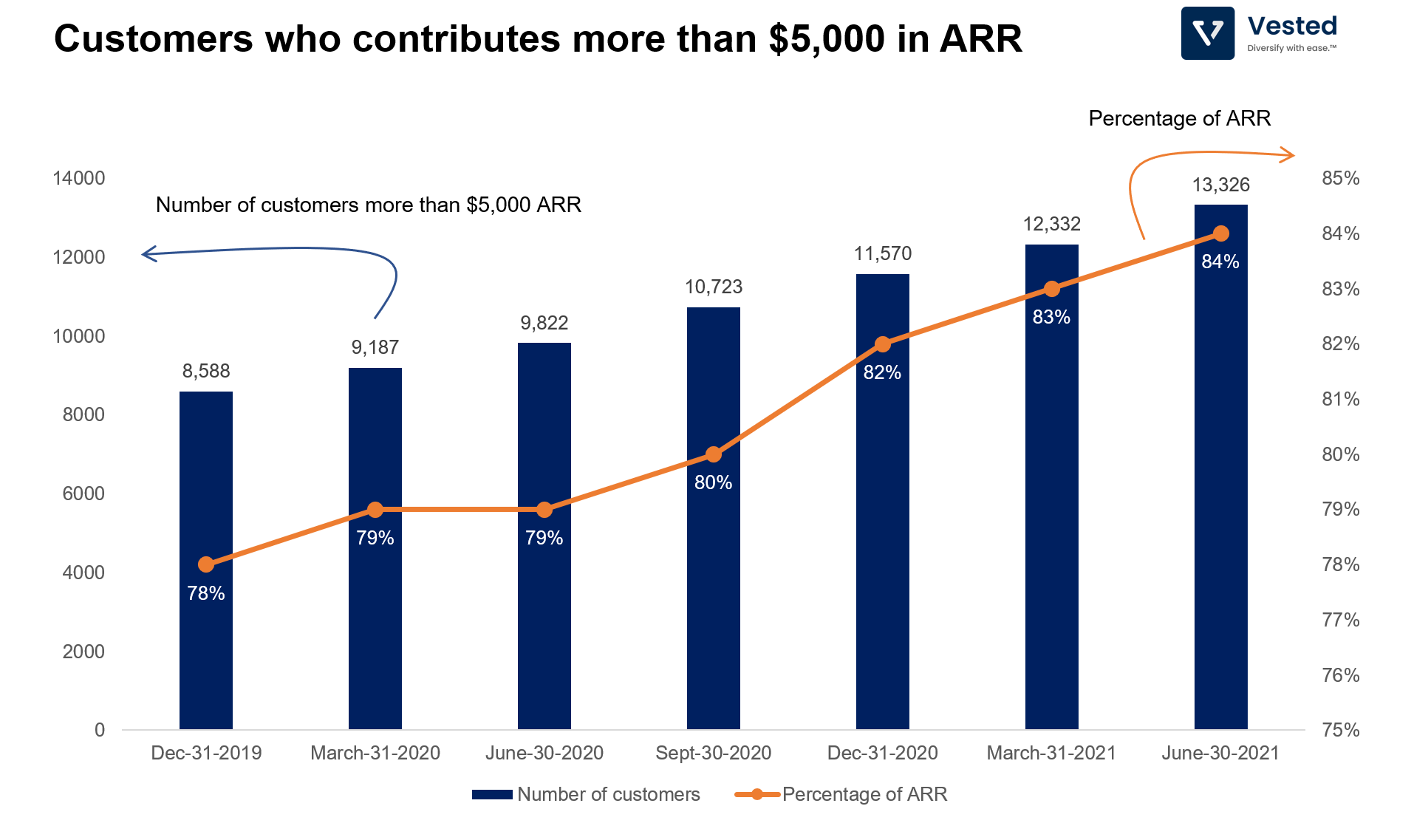

While it is true that the company started with and continues to focus on SMBs, over time the consumer mix has shifted towards larger organizations (Figure 6). As of June 2021, the company has 13,325 customers contributing more than $5,000 in ARR (84% of total ARR), 36% higher than the same period last year.

Valuation comp

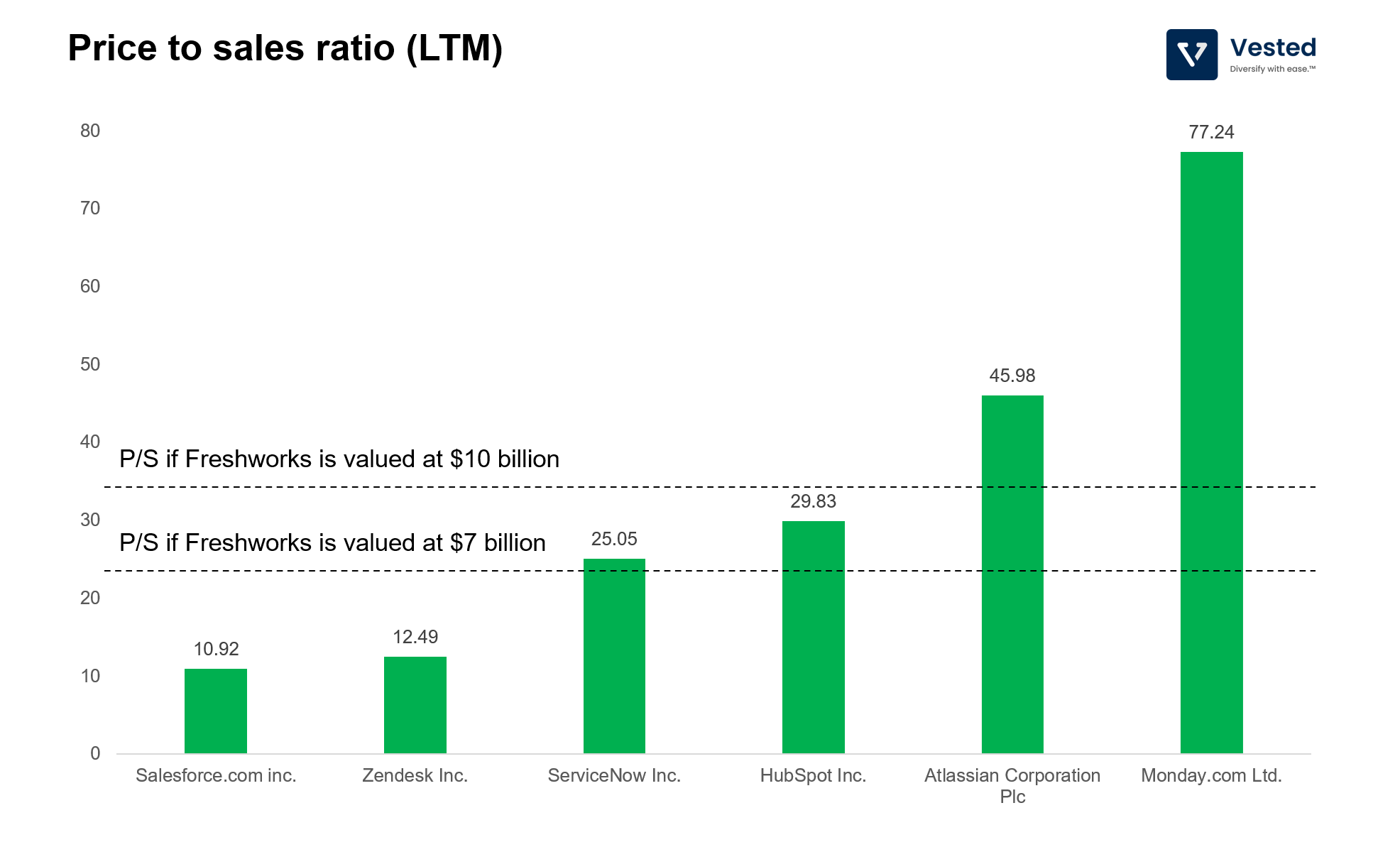

It’s unclear what valuation Freshworks will be able to achieve upon going public. The share price is yet to be determined. Its last private valuation was in 2019, and the company was valued at $3.5 billion then. If the Freshworks IPO is valued at $7 billion (2x higher than the last private valuation), then the P/S (LTM) ratio is about 28x. And if it’s valued at $10 billion, then the P/S ratio would be 33x. This range will put it squarely in the valuation range of ServiceNow and HubSpot, even though Freshworks is still growing faster.

Notice Monday.com’s valuation though – investors recognize the growth and are paying handsomely for it.

Closing thoughts

Freshworks has a tremendous story. The company started in India, but successfully created a global product. Recognizing the cost advantage that it has, it entered the market by underpricing its competitors. The combination of lower prices and easy setup allowed the company to acquire SMBs as its primary segment. As the product expanded, Freshworks started to move up market to larger companies, and compared to its peers, its growth rate is still rapid. And, thanks to its labor cost advantage, it is achieving this growth with an operating margin that is better than its peers of similar size.