In this week’s article, we cover various topics: US banks’ health, their earnings, declining trading volume, the return of US consumer spending, and Netflix’s foray into gaming.

The banks are OK

Why this matters: In the early months of the pandemic, banks braced for significantly higher losses and set aside large sums of funds (the highest in a decade) in preparation for loan defaults that they expected to occur due to the global lockdown. The losses never occurred. So the big banks are now saddled with very high levels of reserves.

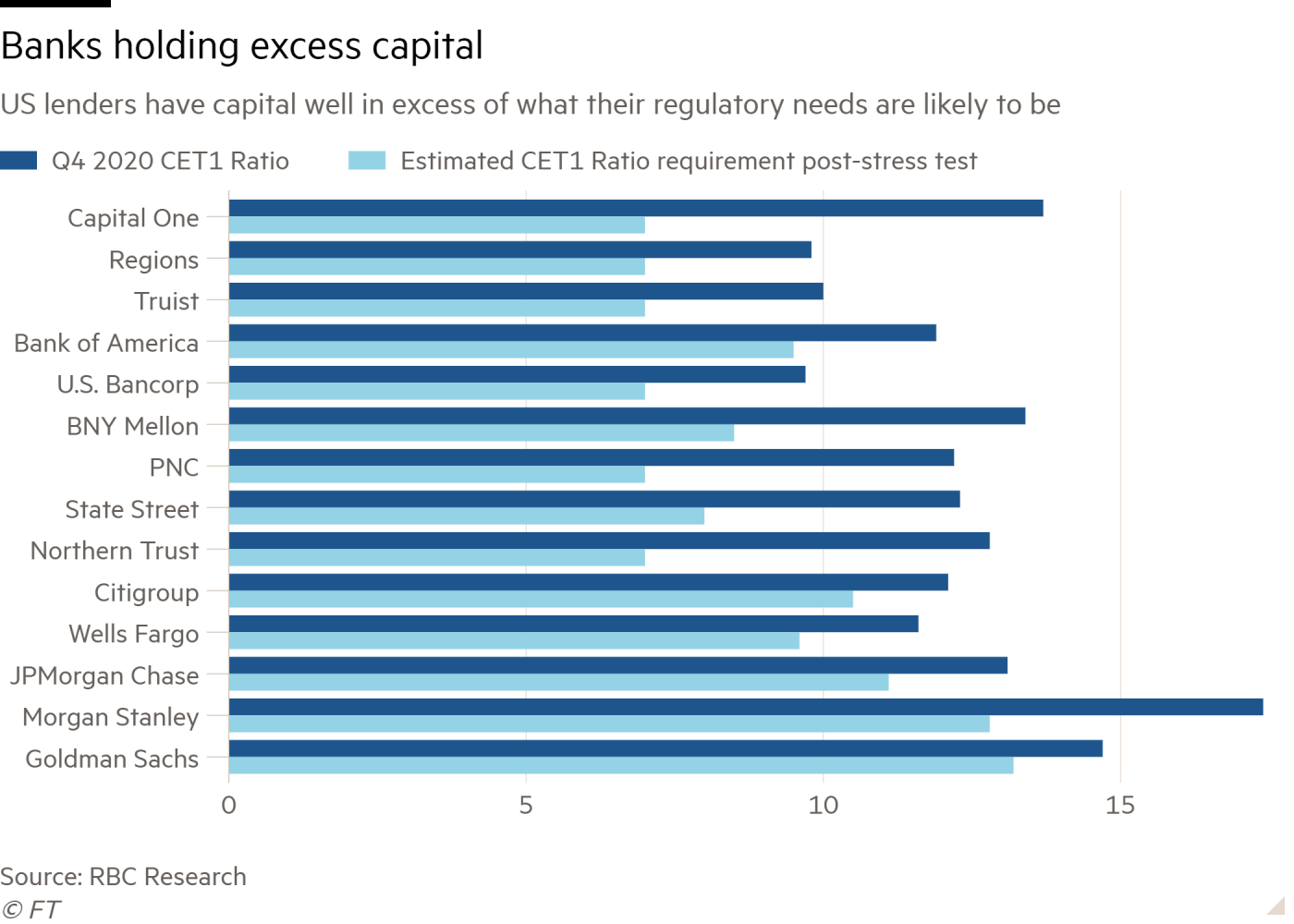

About a month ago, banks passed the stress test imposed on them by the Fed. The stress test is done to evaluate the resilience of large banks by estimating their losses, revenue, and capital levels under hypothetical recession scenarios.

All 23 large banks passed the test. Figure 1 below shows the capital required ratio, the CET1 ratio (ratio of common tier 1 equity to risk-weighted assets), of major banks. As you can see, US banks have capital ratios (dark blue bars) that exceed the minimum required (light blue bar). This means that 1.5 years after the recession started, the US banking sectors are healthy and have sufficient capital reserves.

Because of the healthy stress test outcomes, the Fed has since lifted restrictions on dividends and share buybacks that it imposed early on during the pandemic last year.

Banks’ earnings

Why this matters: In addition to passing the stress tests, banks also recently announced their Q2 earnings. The earnings reports of these banks can be used as a barometer for US macroeconomic conditions.

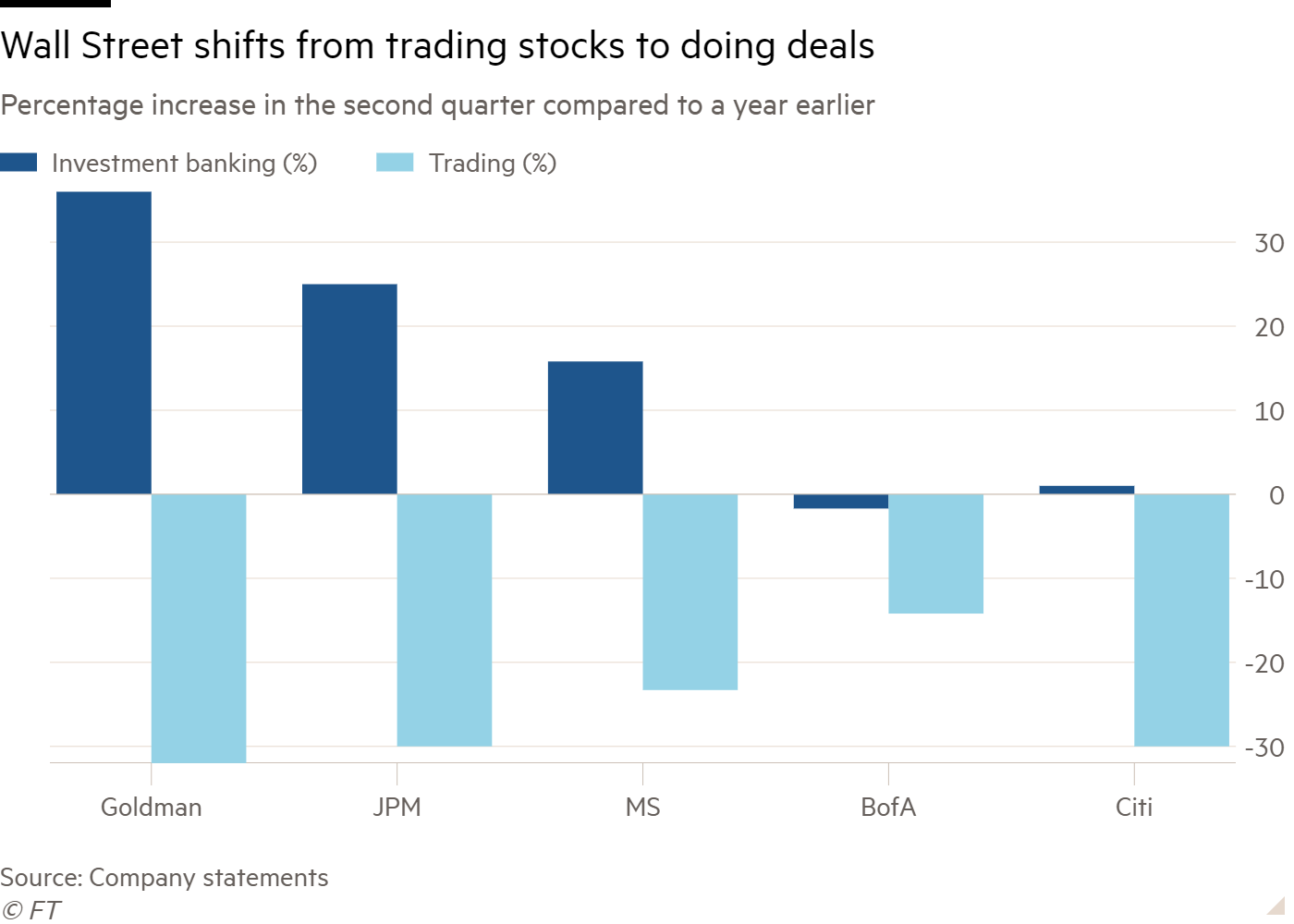

Last year, when the market was extremely volatile, the banks made record sales from trading. This means the banks with larger trading operations benefited the most. In Q2 this year, trading slowed down. The largest banks made up the loss in revenues from trading with increased dealmaking from corporate fundraising (bond issuance, IPOs) and mergers and acquisitions (and SPACs).

Figure 2 summarizes the percentage change from a year earlier for the top five banks. These banks all saw a decrease in trading revenue. Goldman Sachs, JPMorgan, and Morgan Stanley saw the largest growth in dealmaking revenue as they captured more of the global market share in investment banking.

Declining trading volume

Why this matters: Two weeks ago, we did a deep dive on Robinhood’s prospectus, and our take is that the company is going public at the absolute peak of retail investing. In its prospectus, Robinhood shared data up to the end of Q1 2021. If the banks’ earnings above is any indication, it is likely that retail investing volume has gone down as well in Q2 2021, which should translate to lower revenues for Robinhood.

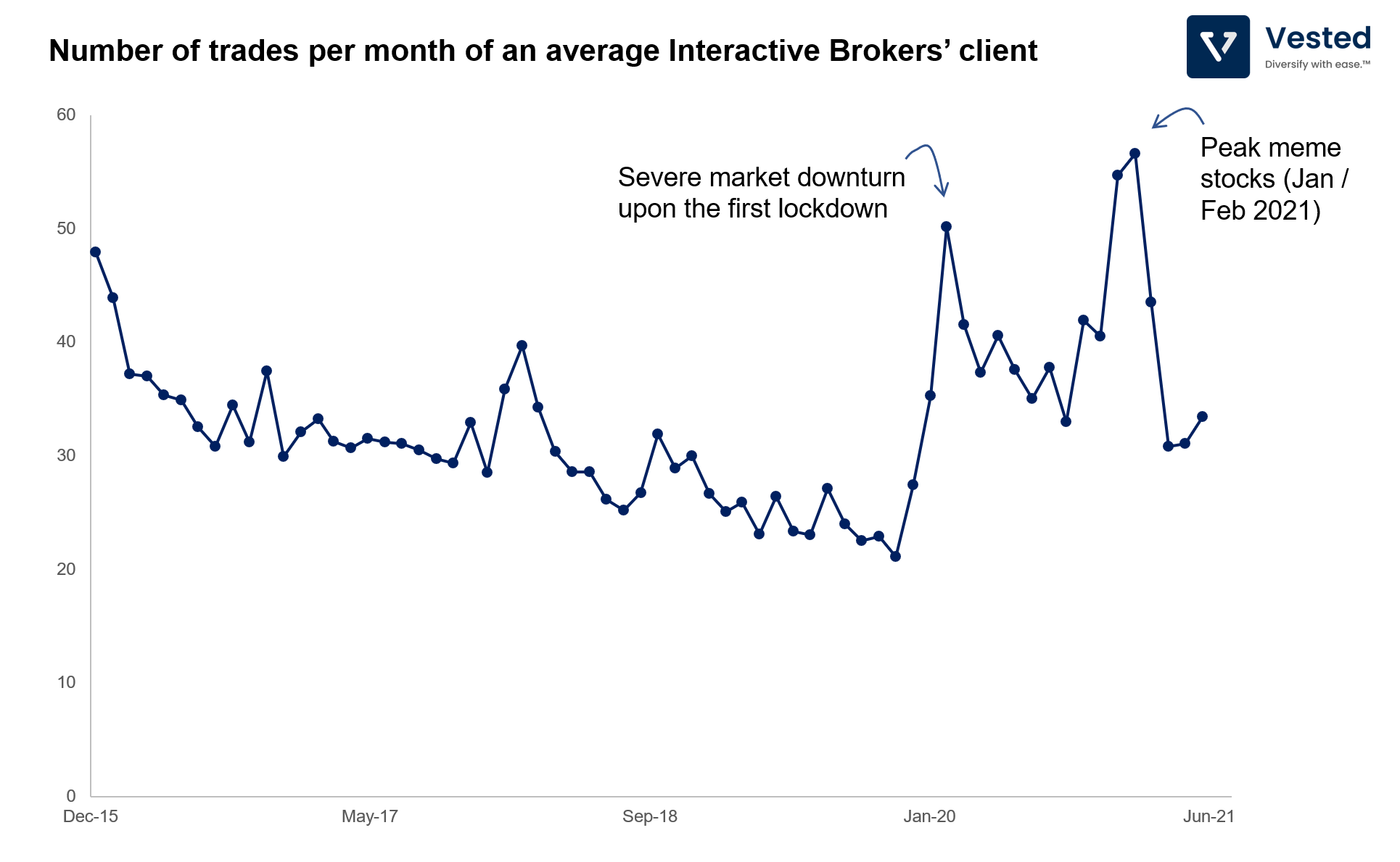

So let’s try and find a higher frequency alternative data source to see if this trend is true for retail investors. Interactive Brokers’ provides such data. The company reports the average trades per month of users on its platforms. Here’s the five year trend:

Figure 3 above shows the five year trend of average monthly trades. As you can see, the year 2020 and Q1 2021 are outliers. For the better part of 2016 to 2019, the average number of trades declined. Then, due to the heightened volatility and global lockdown, followed by the meme stock movements, trade volumes were highly elevated, so much so that January and February 2021 represent five year highs. However, trade volumes has since trended down in Q2 2021.

It is with this backdrop of macro tailwinds that Robinhood is IPO-ing. Lower trading volume will translate to lower revenue for Robinhood, which relies primarily on transactional revenues from payment for order flow. Even though the company has not published Q2 earnings – it is likely that Q2 2021 earnings will be lower than Q1 2021, and will also be lower than the same period of last year.

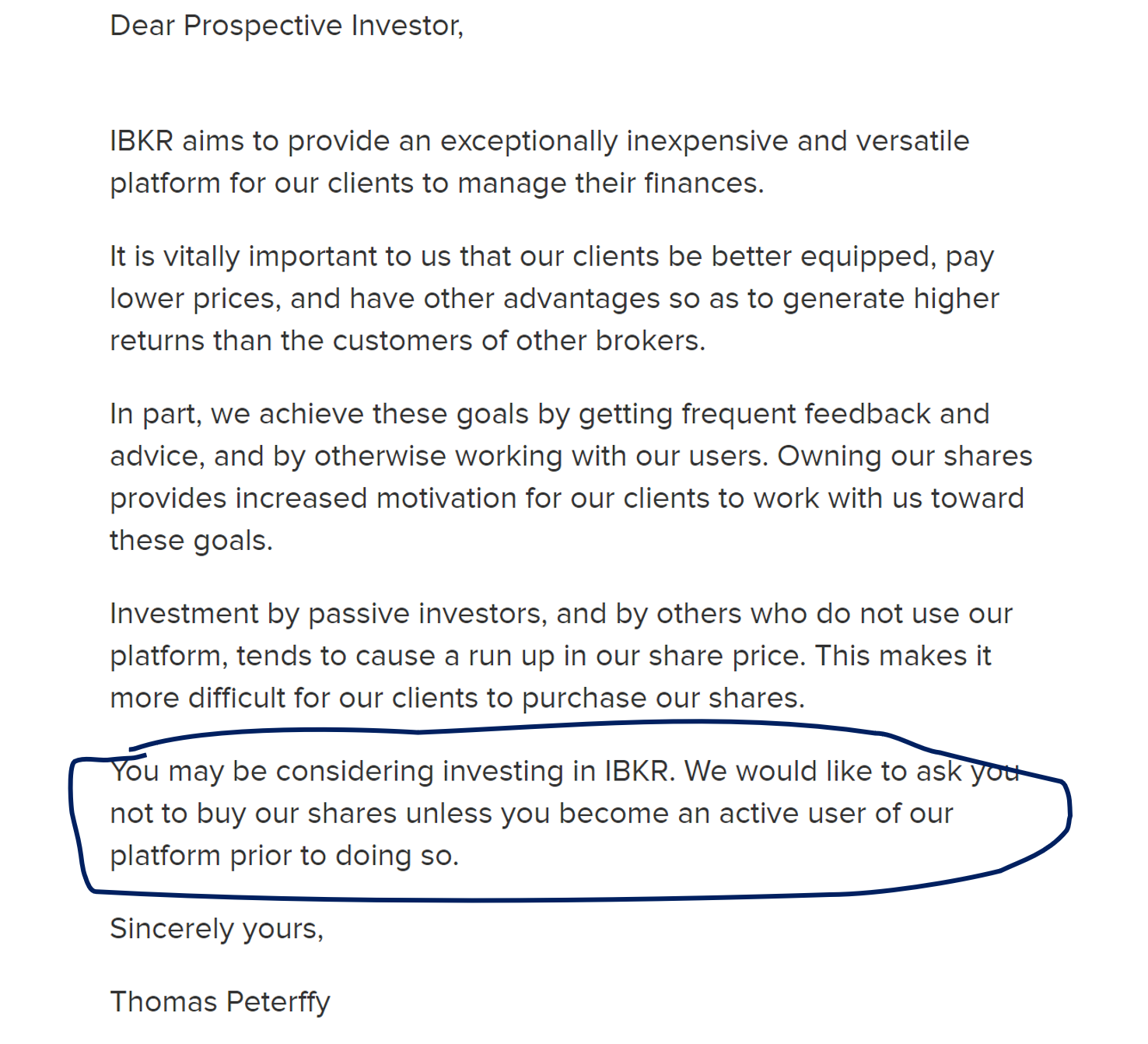

By the way, Thomas Peterffy, the CEO of Interactive Brokers, might just be a baller. You might be a baller if you have the temerity to ask investors to not buy the stock of your company. Here’s his open letter to prospective investors, posted on their website.

Consumer spend has returned to pre-COVID levels

Why this matters: Consumer spend is the largest driver of the US GDP (contributes to about 70% of the US GDP).

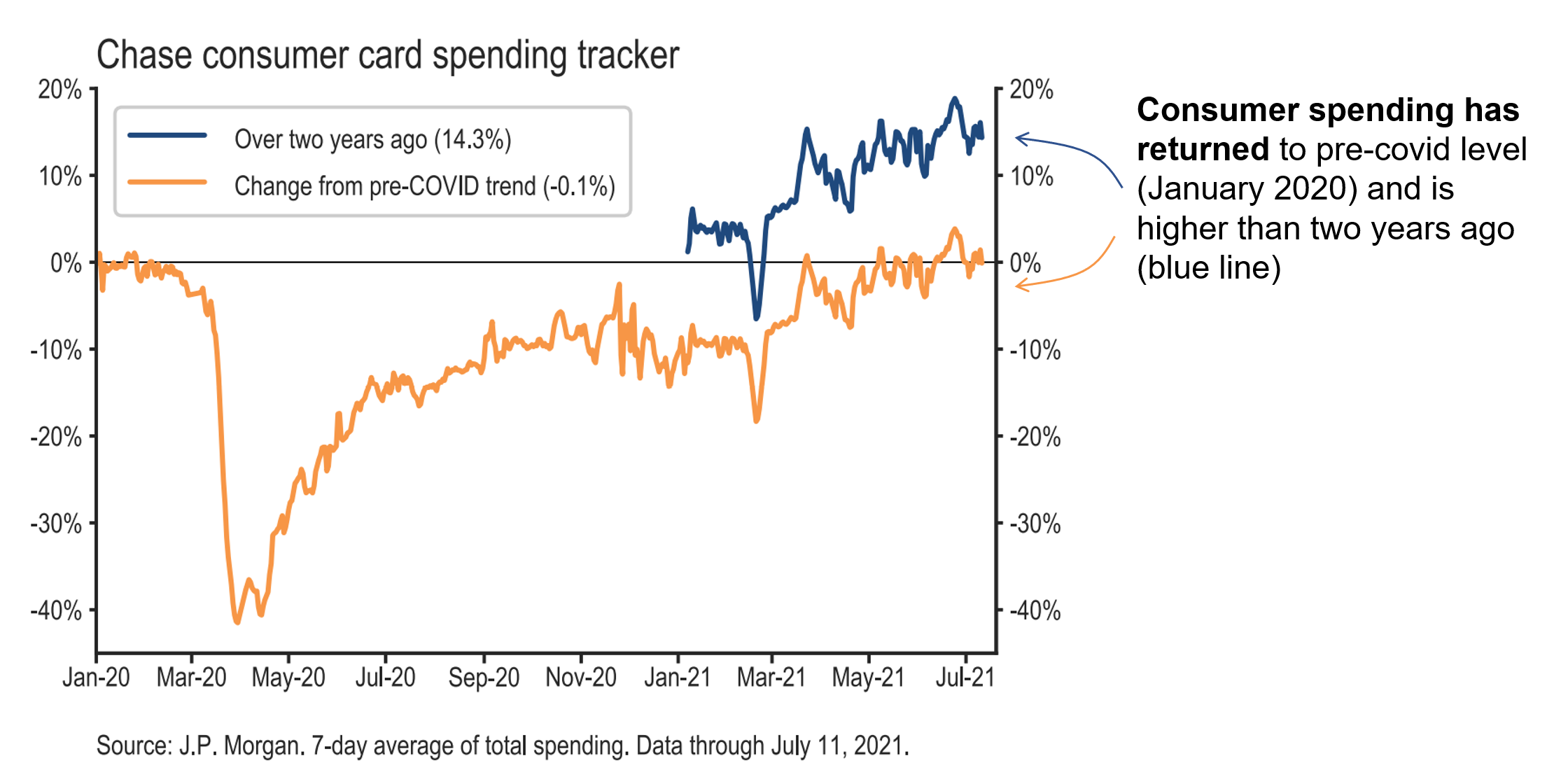

As JPMorgan is one of the largest credit card issuers in the US, we can use their data as a proxy to gauge consumer spending in the US. JPMorgan’s credit card spend data indicates that consumer spend in the US has returned to pre-covid level, back to the same level of January 2020 (yellow line), and is even higher than in 2019 (blue line) – see Figure 4.

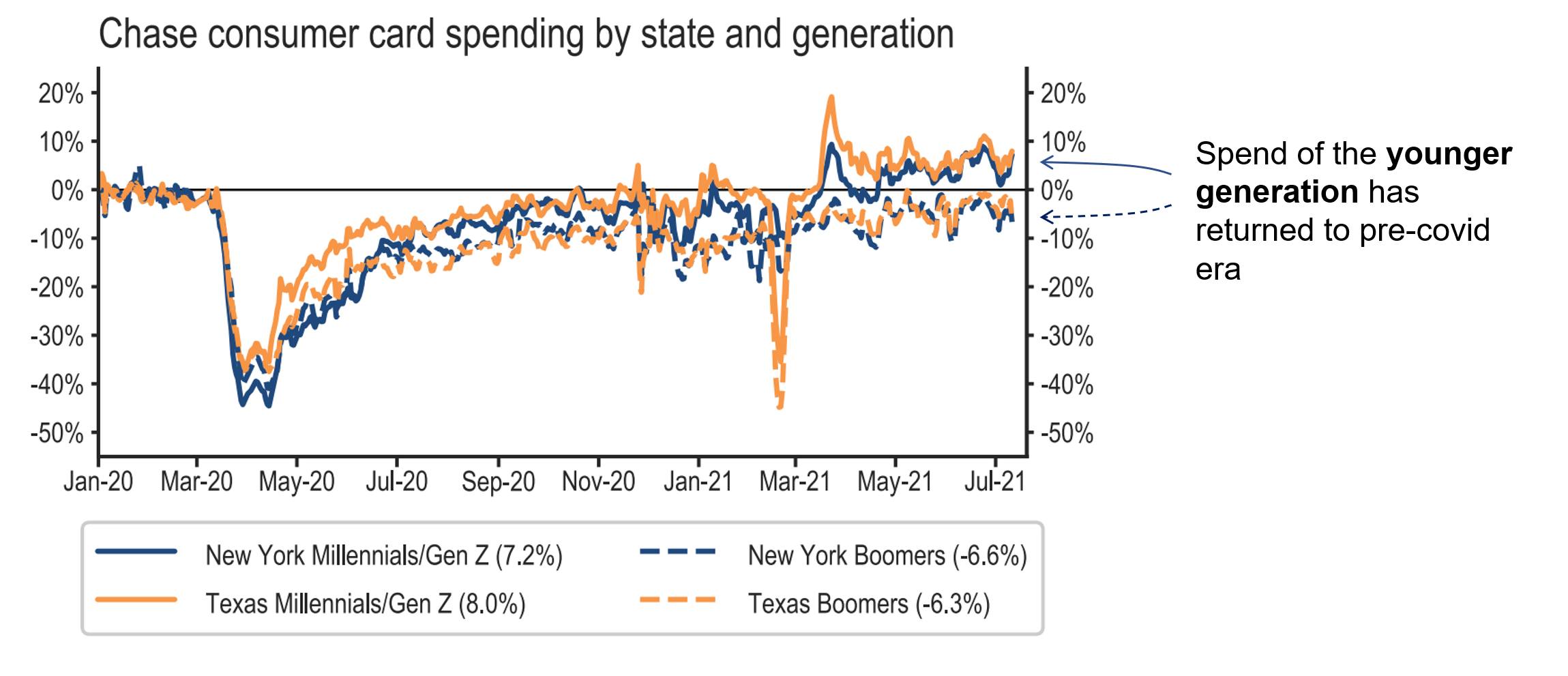

Who’s driving the increased spending? The younger demographic (Figure 5).

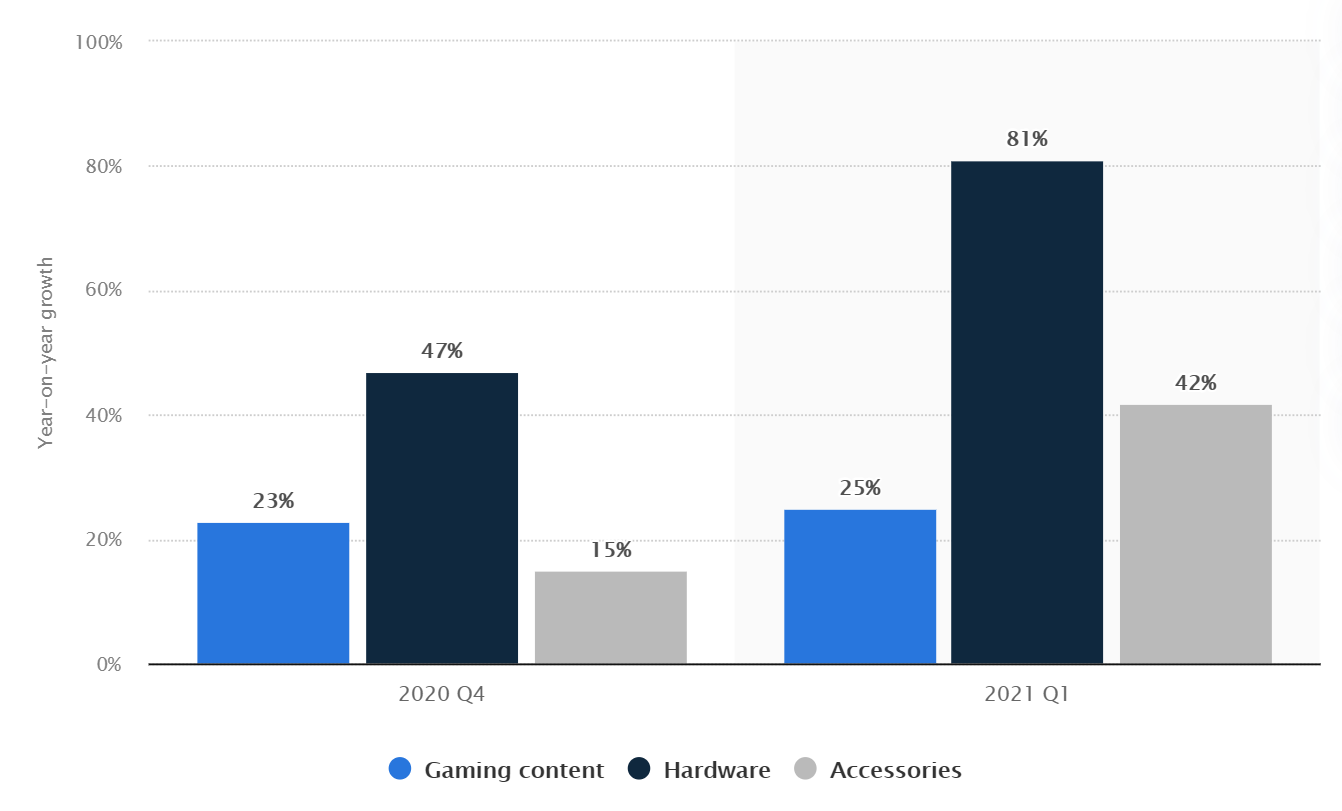

What are they spending it on? Some of the disposable income is spent on gaming. In the US, growth in consumer spend on video games increased significantly in 2020, and entered another level of growth in Q1 2021. See Figure 6. The growth in 2021 is largely driven by hardware sales, and likely could’ve been higher had it not for hardware supply issues.

Which brings us to Netflix.

Netflix will be launching a gaming service

Bloomberg reported that Netflix is entering the gaming space. Reed Hastings, co-CEO of Netflix has said, “We compete with (and lose to) Fortnite more than HBOâ€. As we have written before, Netflix sees itself as an entertainment company. The company wins if you spend more time on its platform, whether it is watching shows or, in the future, playing games.

Anytime a new business is launched, it is prudent for investors to ask, “Why now?â€:

- For Netflix specifically, the company has saturated the North American market, and as younger consumers are shifting their preference towards consuming short videos (TikTok, YouTube) and gaming (Fortnite, Roblox, Twitch), Netflix must compete for that attention as well.

- The game streaming technology is almost ready for prime time. Advancement in game streaming technology means that the average household broadband speed is sufficient in delivering a good gaming experience. As a result, all of the major tech companies are launching their own game streaming services (Microsoft, Amazon, and Google).

Game streaming will be a new core competency that Netflix must master, but if any company can reinvent itself, it’s probably Netflix. The company has reinvented itself many times before: from selling DVDs by mail, to DVD rentals, to becoming the largest video streaming service in the world.

Nevertheless, in all of the previous iterations of Netflix, the company had first-mover advantage. In the gaming space, this will not be true. There are two key challenges:

The first is that the company is entering a very competitive market. It must compete not only with game streaming services provided by Microsoft, Google and Amazon, but also with other non-streaming game subscription services.

Non-streaming game subscription services allow you to download an unlimited number of games to play. Since these services are non-streaming, you must own hardware to subscribe. Examples are: Apple Arcade (Apple is spending more than US$500 million on Indie games for its Arcade service), Sony’s PS Now, and also Microsoft’s XBOX Game Pass.

The second is that the gaming consumption pattern is different from that of video. In video streaming, the shelf-life of the back catalog can be very long. Shows from several decades ago can still be popular even today (for example: Seinfeld is more than 30 years old today, but is still very popular), but not so much for gaming. Most games have a short shelf-life.

As a result, to get the most out of a gaming investment, you either have to (i) recoup your investment by selling the game for a high upfront price (these are typically AAA console games) or (ii) make the game long-lived. This typically means that the game must be a multiplayer experience and be free-to-play to garner a large user base. Examples of these free-to-play games are Fortnite, Counter Strike, and League of Legends (which is 12 years old!). The longer shelf-life comes with different monetization strategies, however – these games rely on sales of in-game digital items, not subscription.