Netflix’s Turbulent 2019

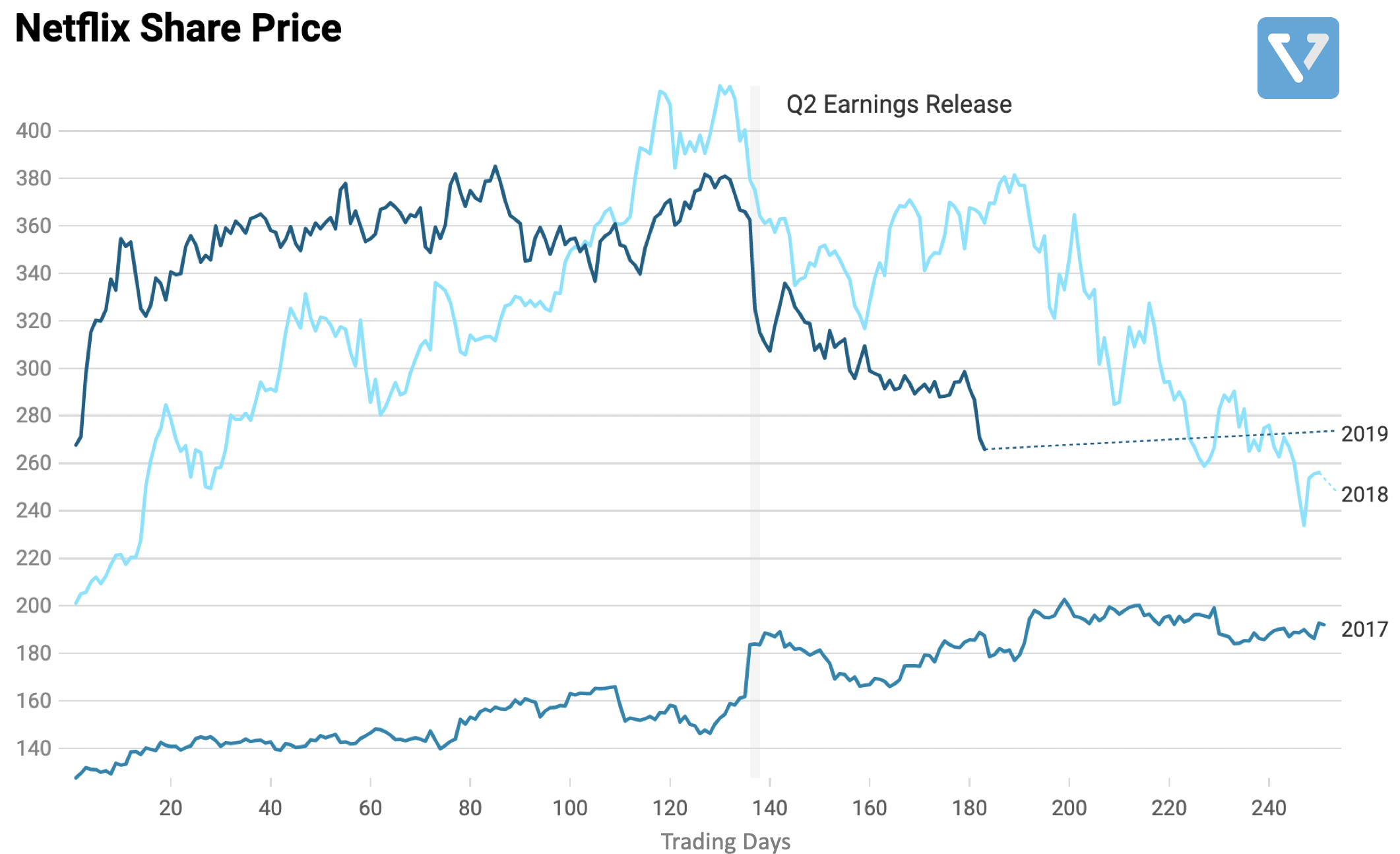

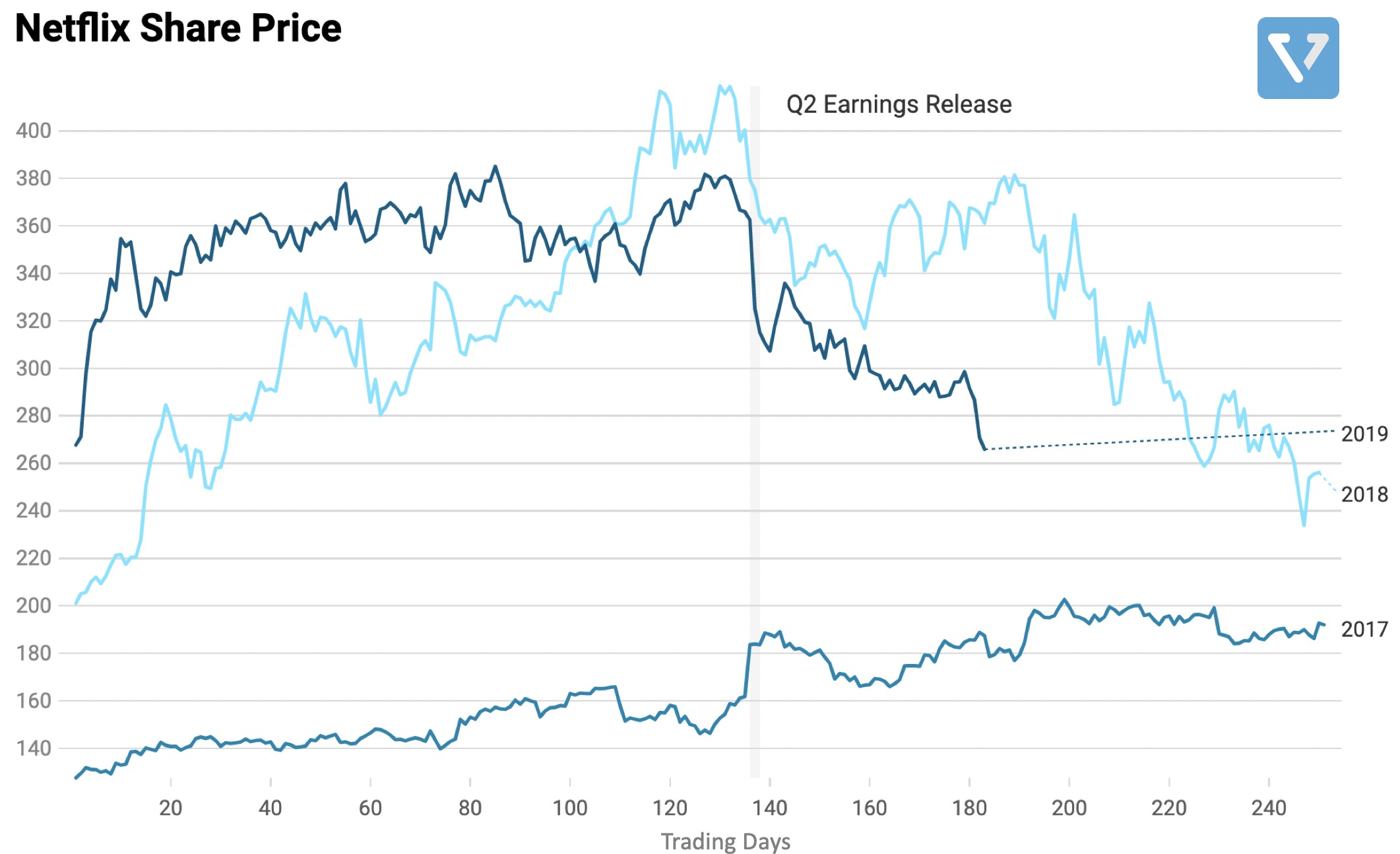

Figure 1: Netflix share price in 2019

Netflix’s share price has been volatile this year (Figure 1). After a sharp increase earlier in the year, the company’s share price has declined significantly and has lagged behind its tech brethren.

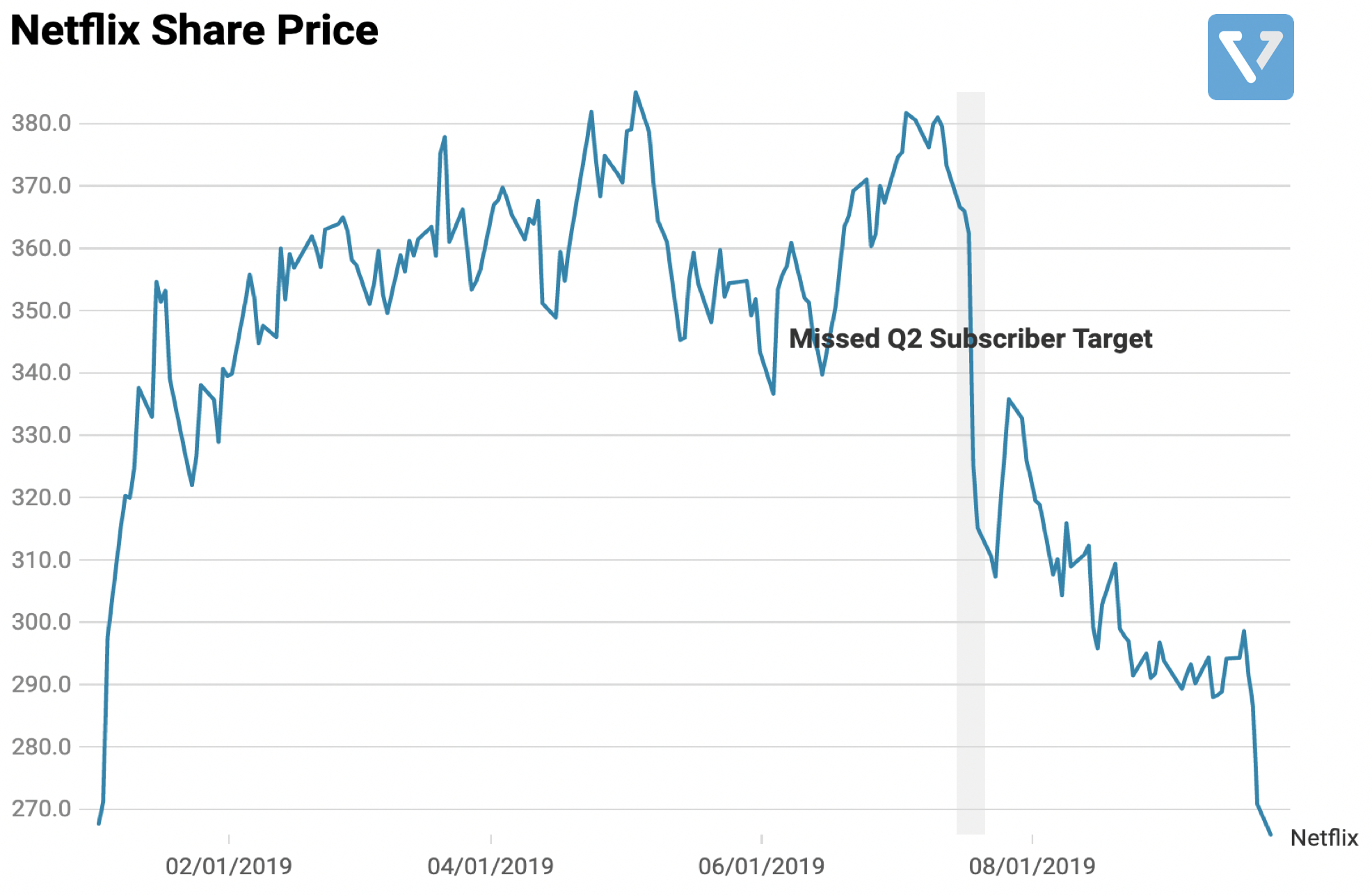

Why is this happening? The chief reason is that the company missed its subscriber growth target in Q2 of this year. Netflix is considered a growth company, and as such the company’s share price is largely driven by its subscriber growth:

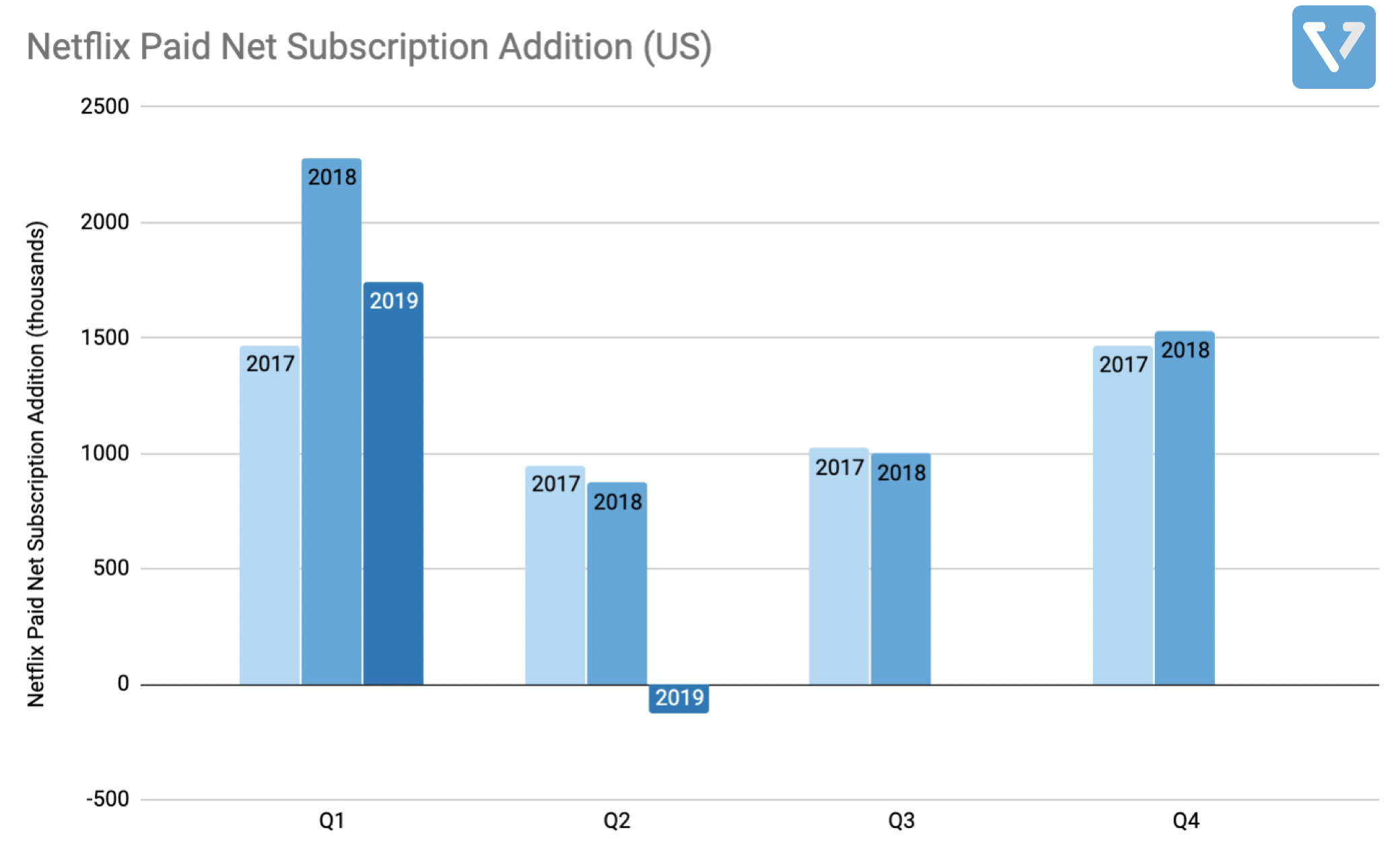

Figure 2 shows the company’s quarterly US subscriber growth, from 2017 – 2019. There are two key takeaways here: first, Netflix’s growth is seasonal. In the past 3 years, Q2 has typically been the slowest growing quarter. But Q2 this year has been especially bad. The company actually lost customers – due to its price increase. But despite the churn (customer loss), the average revenue Netflix extracted on a per user basis actually went up due to the price hike (from $31.4 per user per quarter in Q2 2018, to $32.5 per user per quarter in Q2 2019).

Figure 2: Netflix’s US paid net subscription addition is seasonal. Q2 is typically the lowest, but in Q2 2019, the company actually lost customers. Data from the company

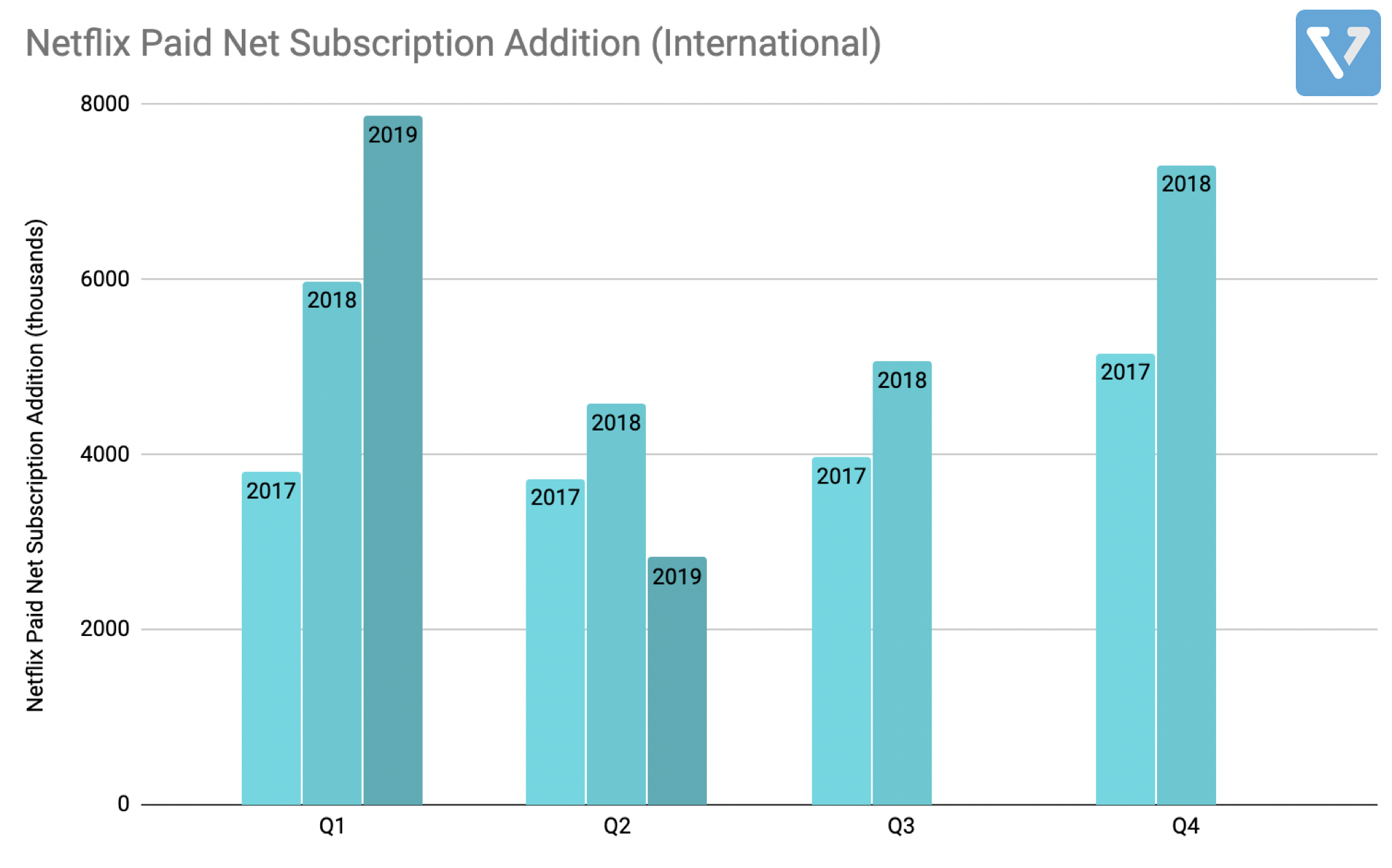

Figure 3 shows the company’s quarterly international subscriber growth. Similar to the US numbers, Q2 is typically the weakest quarter. Notice, however, that these international growth numbers are higher than the US growth. Netflix has dominance in the US, with more than 75% market share. Therefore, its growth in the US has slowed down considerably, and it’s entering revenue extraction phase (hence the price hikes). And because of the saturation of the US market, moving forward, Netflix’s growth hinges on its ability to grow internationally.

Figure 3: Netflix’s International Paid net subscription addition is seasonal. Similar to the US numbers, Q2 is typically the lowest for international growth as well. Data from the company.

Note that Q2 2019 is not the first time the company has missed its growth target. The same thing happened in the same period last year, and similarly the share price subsequently fell (Figure 4).

Figure 4: Netflix share price from 2017 – YTD. In both Q2 2018 and 2019, the company missed its subscriber growth target, resulting in share price drop

Rockier road ahead? It seems the streaming war in the US is set tol enter a more competitive era. Starting in November 2019, both Disney and Apple will be launching their streaming solutions, Disney+ and Apple TV+ respectively, at a price point that is lower than Netflix’s. Reed Hastings’ (CEO of Netflix) acknowledgement of this increased competitive landscape has caused the share price to drop more than 5% in recent weeks.

What does this mean for Netflix? With more competitors, Netflix’s cost of producing and acquiring shows will go up. And with consumers having many more options, Netflix’s growth may slow down in the face of more intense competition.

Can these offerings affect Netflix’s international growth? Likely, but the threat may not be immediate. Yes, these new streaming services are launching internationally as well, but their initial offerings will have limited appeal in the international market. At launch, Apple TV+ ‘s offering is very US centric. In contrast, Disney+ has a library of global brands (Star Wars, Marvel, Pixar) that is appealing to the international market, but the roll out of these shows might take a few years, as some of the more popular brands are not launching until 2020/2021. Meanwhile, to counter these threats in the international market, Netflix has been spending heavily on local/regional content (as it has done in Italy and India) and lowered tier pricing (In India, Netflix will be introducing a cheaper mobile only plan).

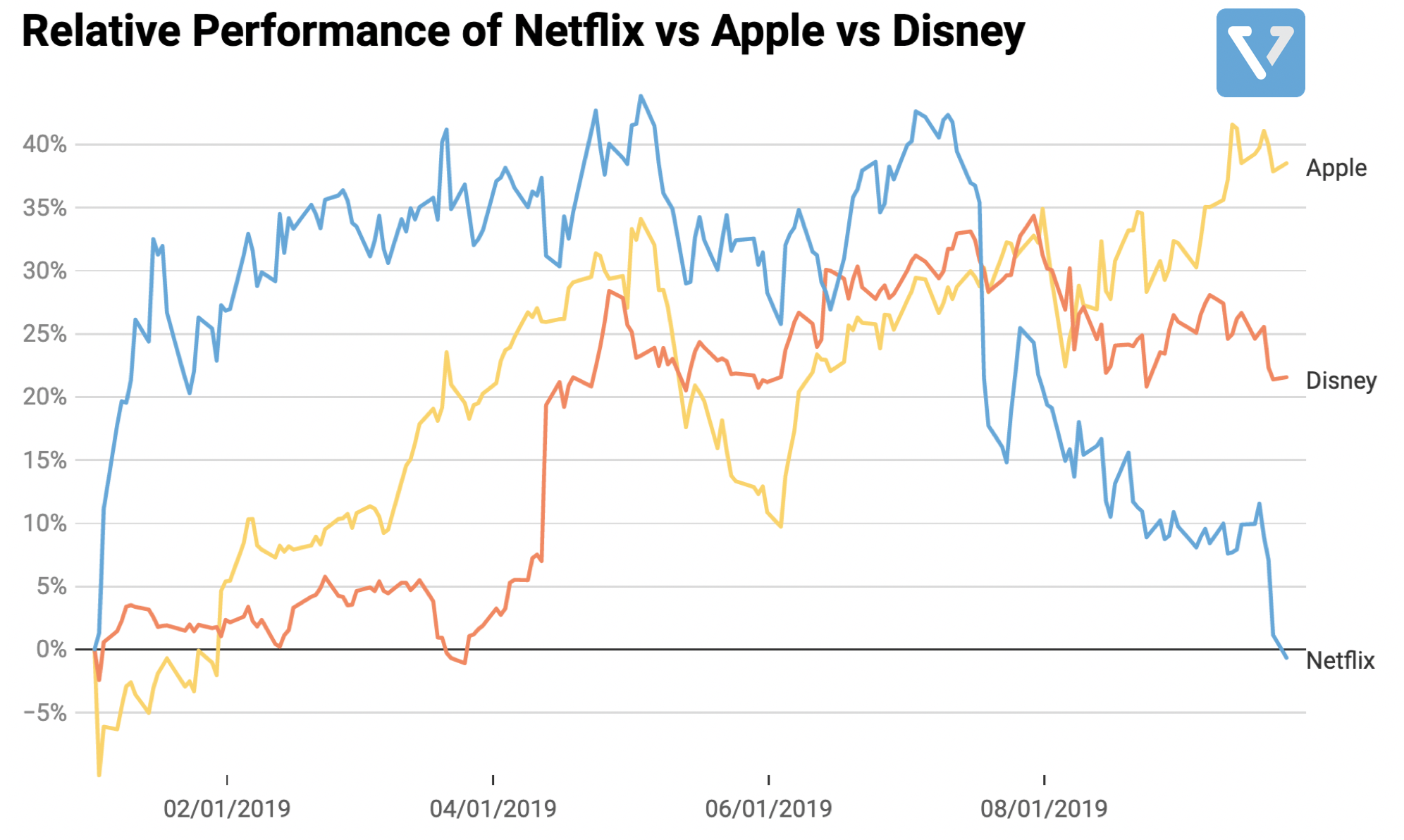

Which one would you invest in? Figure 5 shows the relative performance of Disney (who is also the owner of Hotstar), Apple and Netflix in 2019 – YTD. Please note that investing in Netflix is an investment in a streaming company, while investments in Disney and Apple represents an investment in a more diverse income stream, as both companies have multiple business units.

Figure 5: relative performance of Disney, Apple and Netflix in 2019 – YTD