NVIDIA buying Arm

Background

For those of you who are not familiar with Arm or NVIDIA, here’s a little background on the two:

Both are mainstays in the semiconductor industry, powering millions of devices worldwide. But they have very different expertise and business models.

Arm

Arm makes basic design components for low powered chips (prevalent in computers, smartphones, microcontrollers, and other devices). Other companies (Huawei, Samsung, Apple, etc) take these basic designs (license Arm’s technology) and design the computer chips. TSMC (or other semiconductor fab) then makes the computer chips.

In other words, Arm creates intellectual properties that it then licenses to everyone. It makes money by being impartial. Note that Arm is a UK company, owned by Softbank.

NVIDIA

NVIDIA, on the other hand, designs and sells computer graphics chips (more specifically, discrete GPUs, which are then made by TSMC). Graphic cards are specialized computer chips that can do parallel computations quite well (because that is what is required for gaming – for example: parallel calculations to render each pixel in a 3D environment in a video game). For the better part of two decades, NVIDIA has the lion’s share of the GPU market – thanks to its CUDA software. CUDA is a free software that allows engineers to more easily optimize the performance on NVIDIA’s GPUs (CUDA only works on NVIDIA’s products). This in turn makes NVIDIA’s GPUs perform better than its competitors. Over the years, this has been NVIDIA’s strategy: Make customized software that works only with its own devices, give the software for free, and charge a premium for the hardware.

When the AI boom happened this past decade, researchers discovered that these graphic cards are quite good for AI applications, and the CUDA software made it easy to develop AI applications. Thus, NVIDIA expanded beyond gaming to AI chips. and are now trying to get into the data center applications (that is dominated by Intel with 90+% market share).

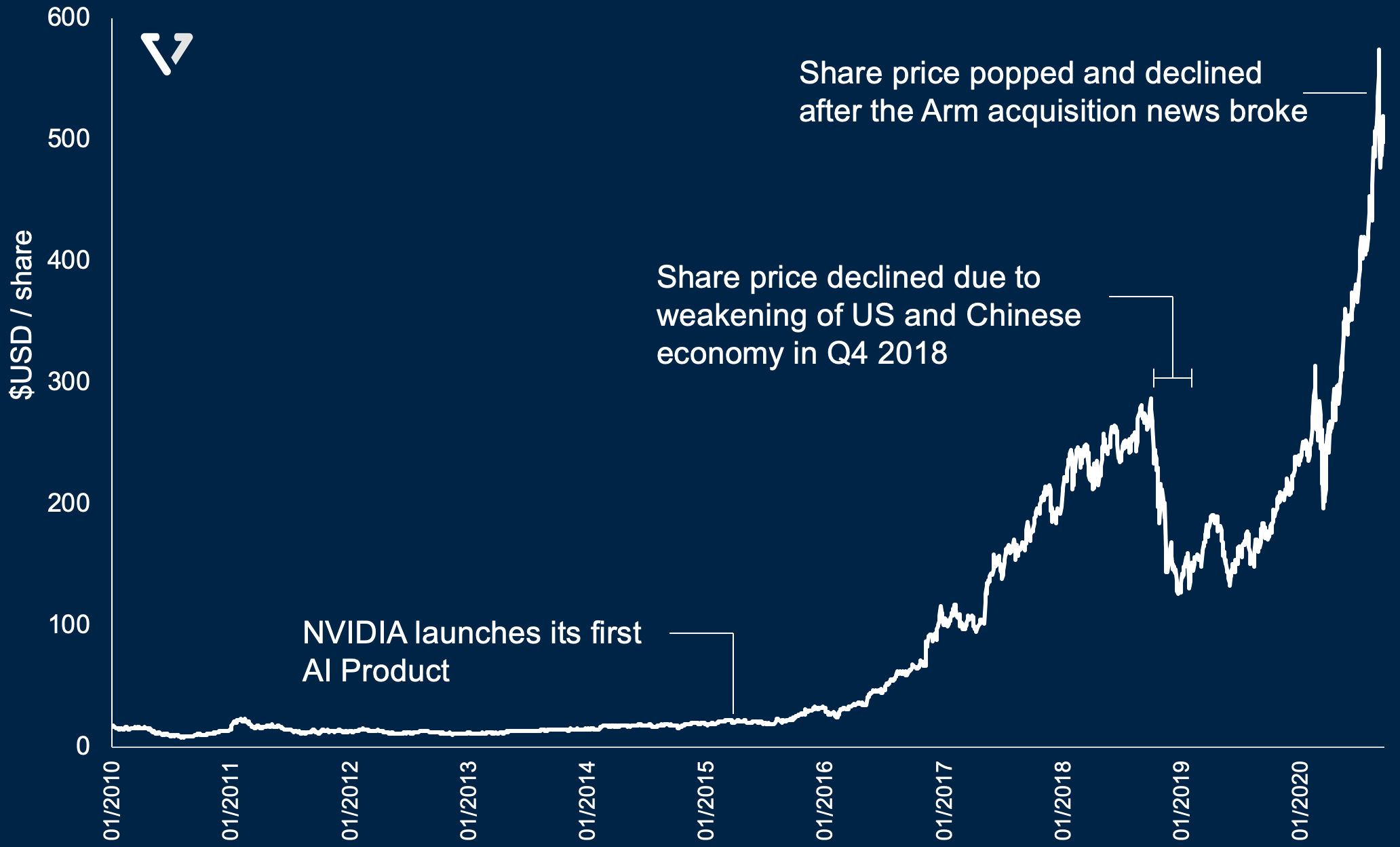

See Figure 1 for the share price history of NVIDIA from the past decade. NVIDIA’s share price started to grow again after the discovery of a new market for its core technology.

Why does NVIDIA want to buy Arm?

Arm and NVIDIA have two divergent business models. Arm wants to sell its designs to everyone. While NVIDIA creates its designs and software to be used on its own hardware, so that the company can sell premium hardware devices.

So, why does NVIDIA want to buy Arm? The short answer is to expand NVIDIA’s footprint in data centers.

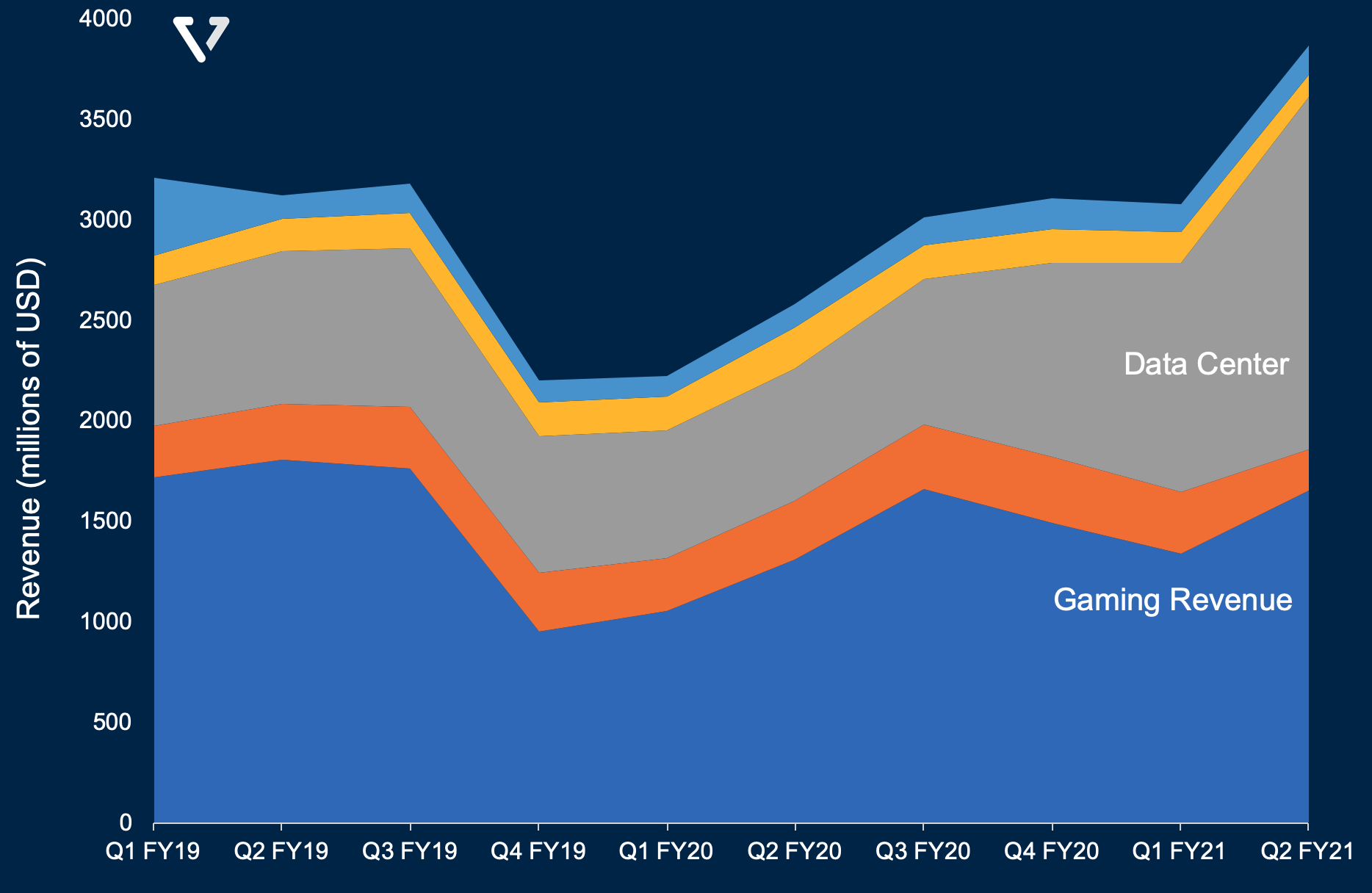

NVIDIA’s data center business has been powering the company’s growth (see Figure 2). Data Center revenue currently represents 45% of total revenue, growing 167% year-over-year (to be noted though that this is partly due to the result of a recent acquisition). In contrast, gaming represents 43% of revenue, but growing only 26% year-over-year.

NVIDIA’s growth into the data center business is still largely powered by GPUs for AI applications. Now, it wants to take a share of the CPU workload as well. Currently, the CPU workload in data centers are dominated by Intel and its X86 architecture. Here, the emerging alternative in data center CPUs is Arm architecture, for two reasons:

- Chips built with Arm design is cheaper and consume less power (but are also less powerful)

- Because it consumes less power, Arm chips likely won’t require active cooling in the data centers, and therefore data centers built on Arm architecture will be cheaper.

Despite some progress, adoption of Arm in data centers is still in the very early days. Not many software applications are written for Arm architecture, which may slow down adoption. This is where NVIDIA believes it can provide great value – by making great software for Arm architecture to accelerate its adoption. True to its DNA, when NVIDIA makes software, it is typically unique to its own product so that the company can sell premium hardware. This is likely why the company wants to buy Arm. NVIDIA wants to capture the upside of Arm adoption in data centers that may require NVIDIA’s software investments.

Purchase not guaranteed

For NVIDIA, the purchase might be a good deal. Of the US$ 40 billion price tag, NVIDIA will pay that amount partly in stocks (US$21.5 billion in stocks) and in cash (US$12 billion in cash), including US$2 billion payable at signing. Considering NVIDIA’s share has gone up 128% in the past 6 months, funding the acquisition largely in stock (that some may consider is overpriced) gives the company downside protection.

There’s no guarantee that the acquisition will go through, however. There are significant regulatory hurdles:

- US regulators may not approve. Customers of Arm that compete with NVIDIA may influence US regulators to block the deal.

- Chinese regulators will likely block the deal. If NVIDIA (a US-based company) buys Arm (a UK-based company owned by a Japanese conglomerate), the US government’s block to prevent US companies from doing business with Chinese tech companies will be enforced, especially Huawei (which uses Arm IP).

- UK regulators seem to be mainly concerned about maintaining jobs in the UK. NVIDIA can placate them by promising headcount expansion in the UK (Softbank did something similar when it purchased Arm in 2016).

Nikola’s fraud allegations

Nikola’s share price has gone through a wild ride recently. Nikola is a public company that makes hydrogen powered semi trucks (these are large 18-wheeled trucks) and hydrogen fueling infrastructure. The company is pre-product – it hasn’t launched a production vehicle yet.

Its share price jumped 40% after Nikola announced a partnership with a GM. The share price has since declined rapidly after a bombshell report published by Hindendberg research (a group of short sellers – they make money when Nikola’s share price falls), claiming that Nikola is a fraud.

Is the report true?

So far, some of the research has proven to be true. For example, the report proclaims (among many other things) that the video of Nikola’s Hydrogen powered truck was faked – the truck did not roll under its own power – let alone is hydrogen powered (Figure 3). This has since been corroborated by Financial Times.

Nonetheless, most of the claims made by Hindenburg have not been independently corroborated by any 3rd party. Here are some key excerpts from the report:

- We reveal how, in the face of growing skepticism over the functionality of its truck, Nikola staged a video called Nikola One in Motion which showed the semi-truck cruising on a road at a high rate of speed. Our investigation of the site and text messages from a former employee reveal that the video was an elaborate ruse Nikola had the truck towed to the top of a hill on a remote stretch of road and simply filmed it rolling down the hill.

- “Inexpensive hydrogen is fundamental to the success of Nikola’s business model. Trevor has claimed in a presentation to hundreds of people and in multiple interviews to have succeeded at cutting the cost of hydrogen by ~81% compared to peers and to already be producing hydrogen. Nikola has not produced hydrogen at this price or at any price as he later admitted when pressed by media.

- The company’s Nikola One reveal was a total farce. We corroborate Bloomberg’s earlier work debunking Trevor’s claims regarding its semi-truck that this thing fully functions and worksthis is a real truck and provide new evidence.

- Nikola’s key partners and backers have been cashing out aggressively. Worthington, Bosch and ValueAct have all sold shares. Worthington sold $237 million shares over a 2-day span in July and another $250 million in August. We think they know exactly what type of company Nikola is, and we expect that as Nikola’s GM partnership boosts the stock price, key holders will continue to exit.To be clear, both parties have much to be gained. When the stock of Nikola crashes, Hindendburg gains. Meanwhile, Nikola will fight to protect its reputation. It recently published its rebuttal.

Did GM not vet the technology before partnering with Nikola?

They claimed that they did extensive vetting of Nikola before signing the partnership and are standing by their decision. Nonetheless, there’s minimal downside to the deal for GM. The way the deal is structured, GM brings most of the technology to the partnership (GM’s chassis, battery and fuel cell technology). GM will also retain the intellectual property from the partnership. In return, Nikola reimburses GM about $700 million to cover GM’s investments in modifying and expanding its manufacturing capacity. On top of that, Nikola will also pay GM more money to manufacture the vehicles on a cost-plus basis (GM makes money either way). Furthermore, GM also gets 11% of Nikola (worth ~US$ 2 billion, which must be held for 1 year).

In other words, GM is getting paid to do technology investments that the company has to make anyway, by finding a partner to pay for them, and a free call option for Nikola’s stocks. The biggest downside for GM (if the allegations are true) is likely reputational damage.

That said – the deal is not closed. Each party can cancel by December.

The Final Word

The case is still ongoing. It’s unclear which of Hindenburg’s allegations are true and which are not. In any case, the SEC and the Department of Justice have opened up investigations on the matter. Opening up investigations does not mean that there will be allegations of wrongdoing, however. Investors beware.