In this week’s update, we discuss the gold/silver rally in recent months, and Q2 earnings results of Tesla, Netflix, and Microsoft.

Tesla’s Q2 2020 Earnings

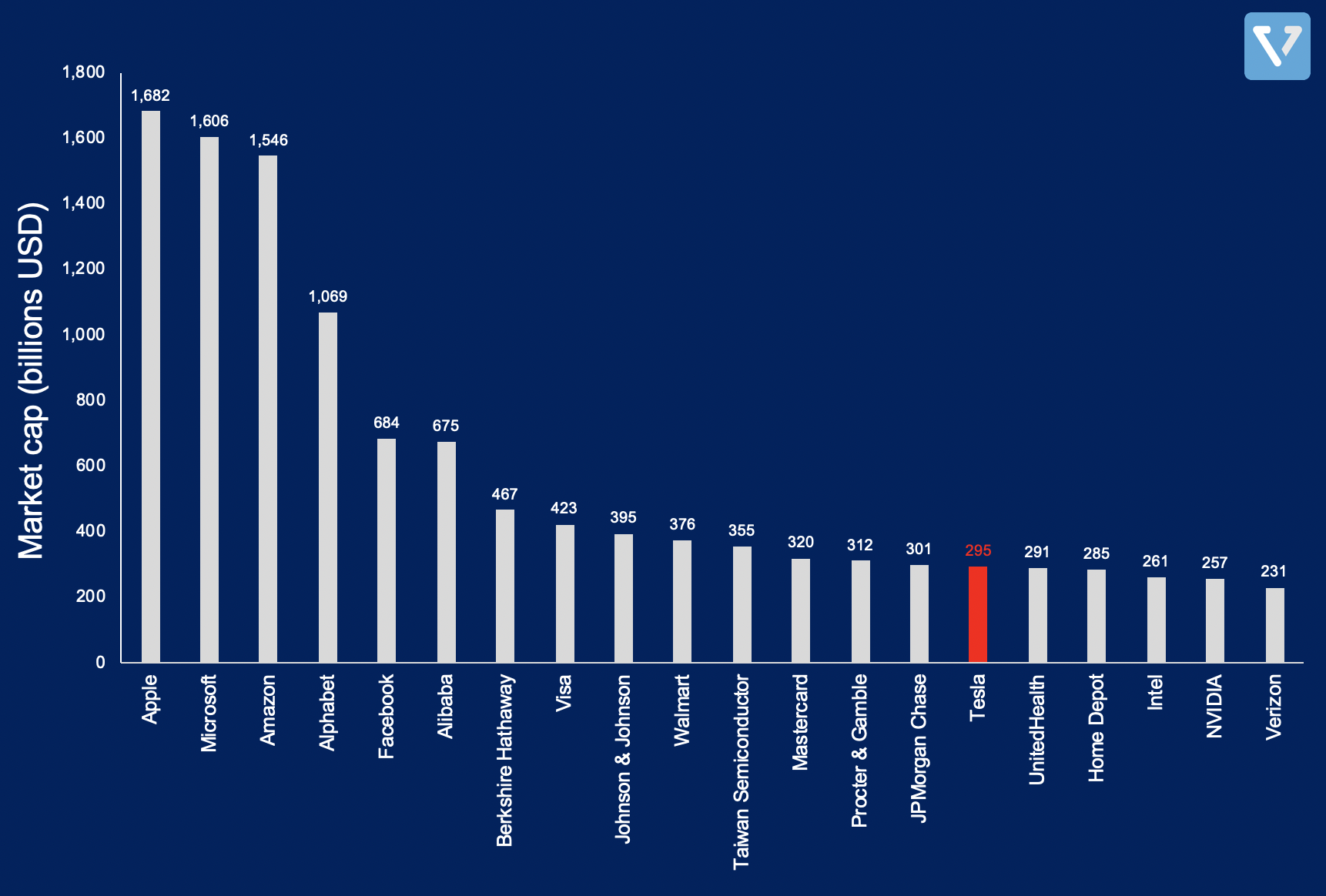

Tesla did it. The company posted four sequential profitable quarters for the first time in its history. This is a big deal, because, as we outlined previously, this was the remaining requirement that Tesla had to meet to be included in the S&P 500. Note that official inclusion into the index still has to be approved by the S&P 500 selection committee. It will likely be difficult for the committee to reject Tesla’s inclusion as (at time of writing) it is the 15th largest company in the US by market cap.

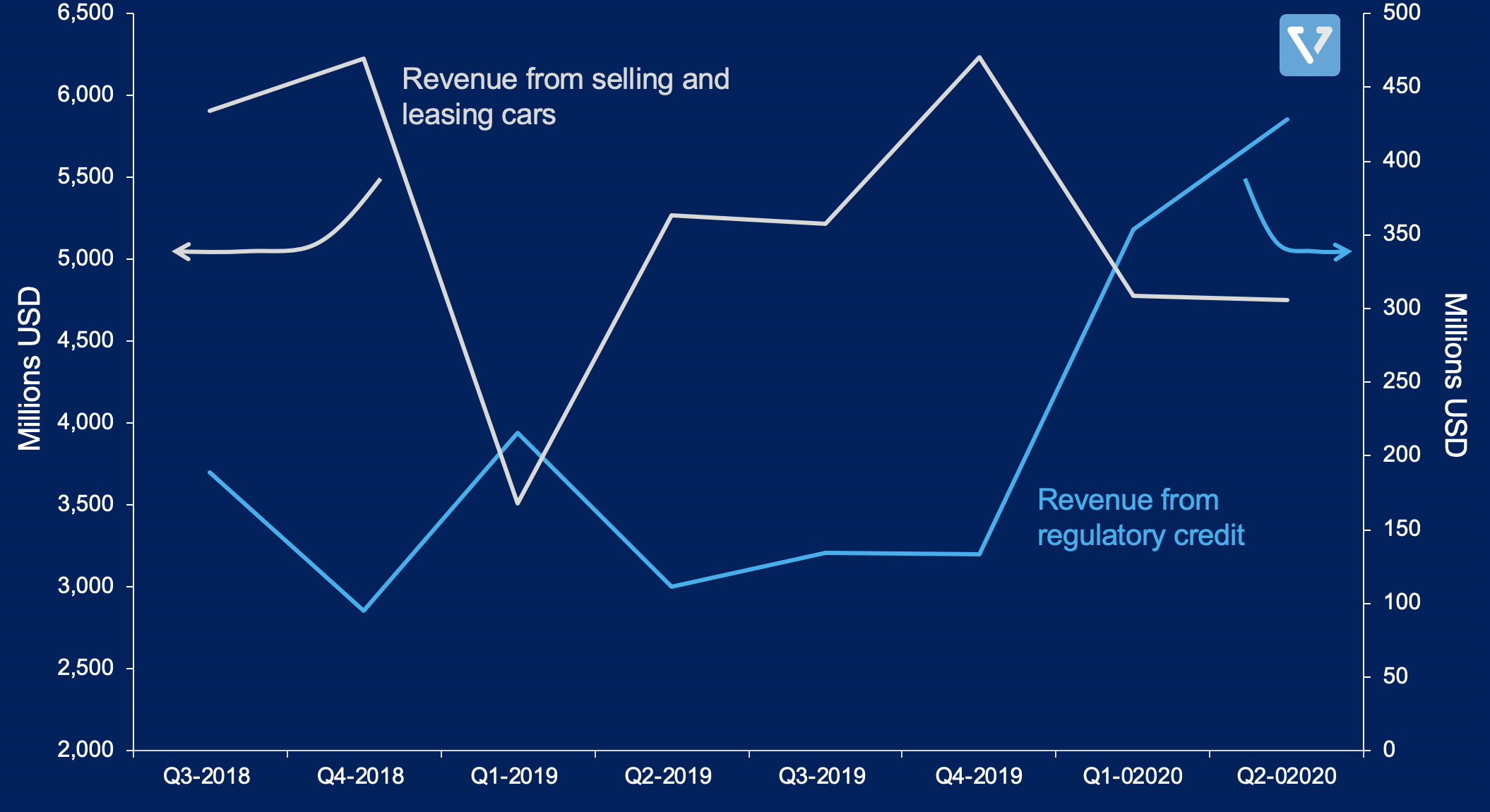

Tesla achieved profitability this quarter by relying on regulatory credits (US$428 million, or 8.3% of automotive revenue; A 286% increase year over year). Without this boost of revenue, the company would not have been able to to achieve profitability.

Regulatory credit revenue is revenue earned by Tesla from selling its carbon credit to other automakers. Car makers are required to meet certain emission standards. If they fail to do so, they have to either improve emission of their own vehicles (which takes time and money) or they can buy regulatory credits from companies with excess credit (i.e. Tesla) to bring their total emission level down within limit.Tesla is able to earn this income because other carmakers have not built enough electric vehicles and have to buy credits from the company to satisfy emissions regulators. This means that although highly profitable, this type of revenue might not be available in the future, as companies introduce more fuel efficient vehicles or if the government changes the emission standards.

Figure 2 shows Tesla’s revenue breakdown from selling/leasing cars vs. from regulatory credit. As you can see, the revenue from regulatory credit has grown rapidly in the past two quarters, while revenue from selling/leasing cars went down in Q1 and Q2 this year. It’s unclear if this slowdown in revenue growth is due to COVID-19 or due to market saturation at the current price point. If it’s the latter, then to continue to drive revenue growth, Tesla will need to lower the price of its cars, potentially foregoing some profitability.

Netflix Q2 2020 Earnings

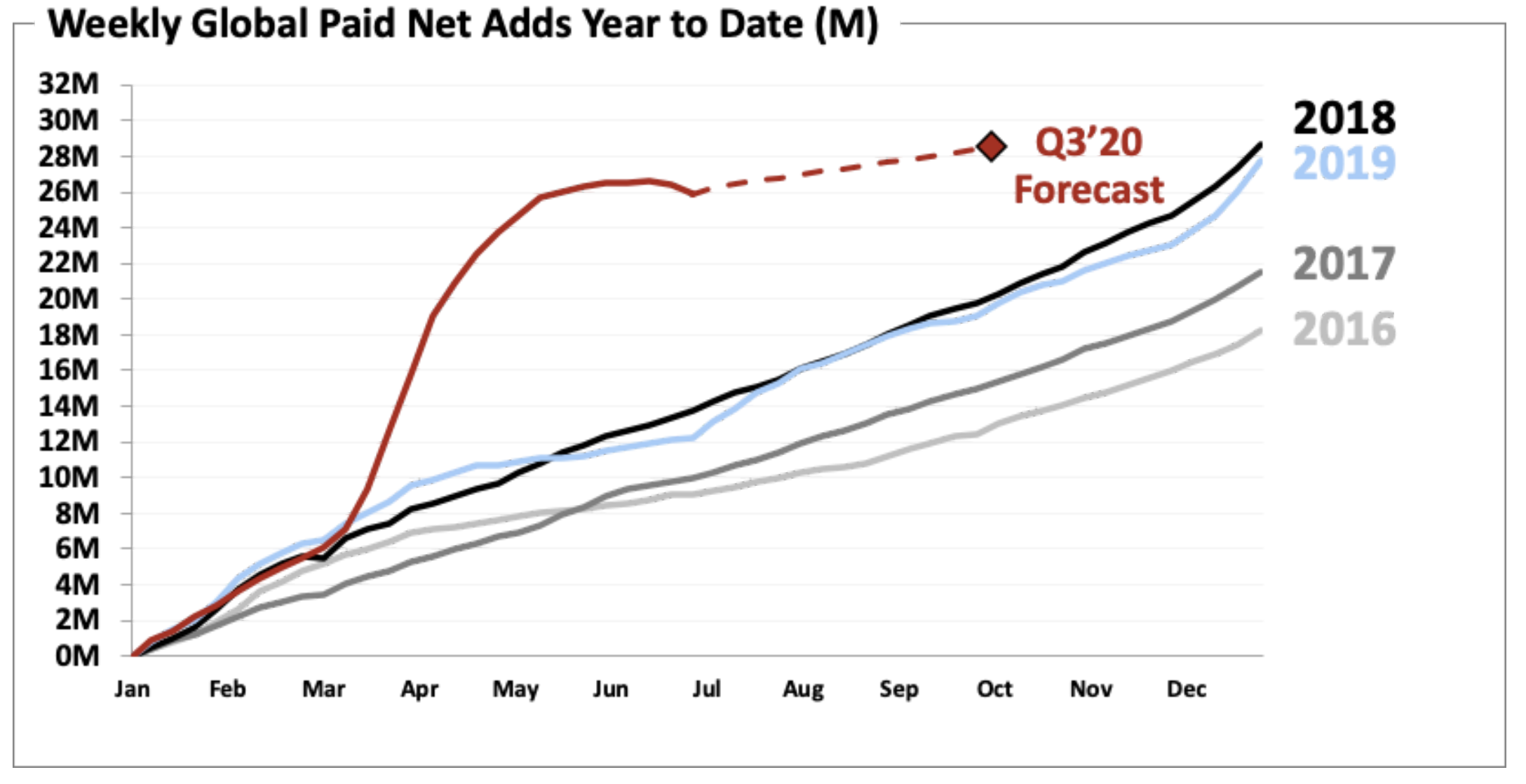

For Netflix, Q2 earnings are largely consistent with Q1 results. Subscriber growth continues to beat expectations as the global lockdown is prolonged. In the first half of this year, the company added 26 million new paying subscribers, almost as much as the 28 million added in the entire 2019 (Figure 3).

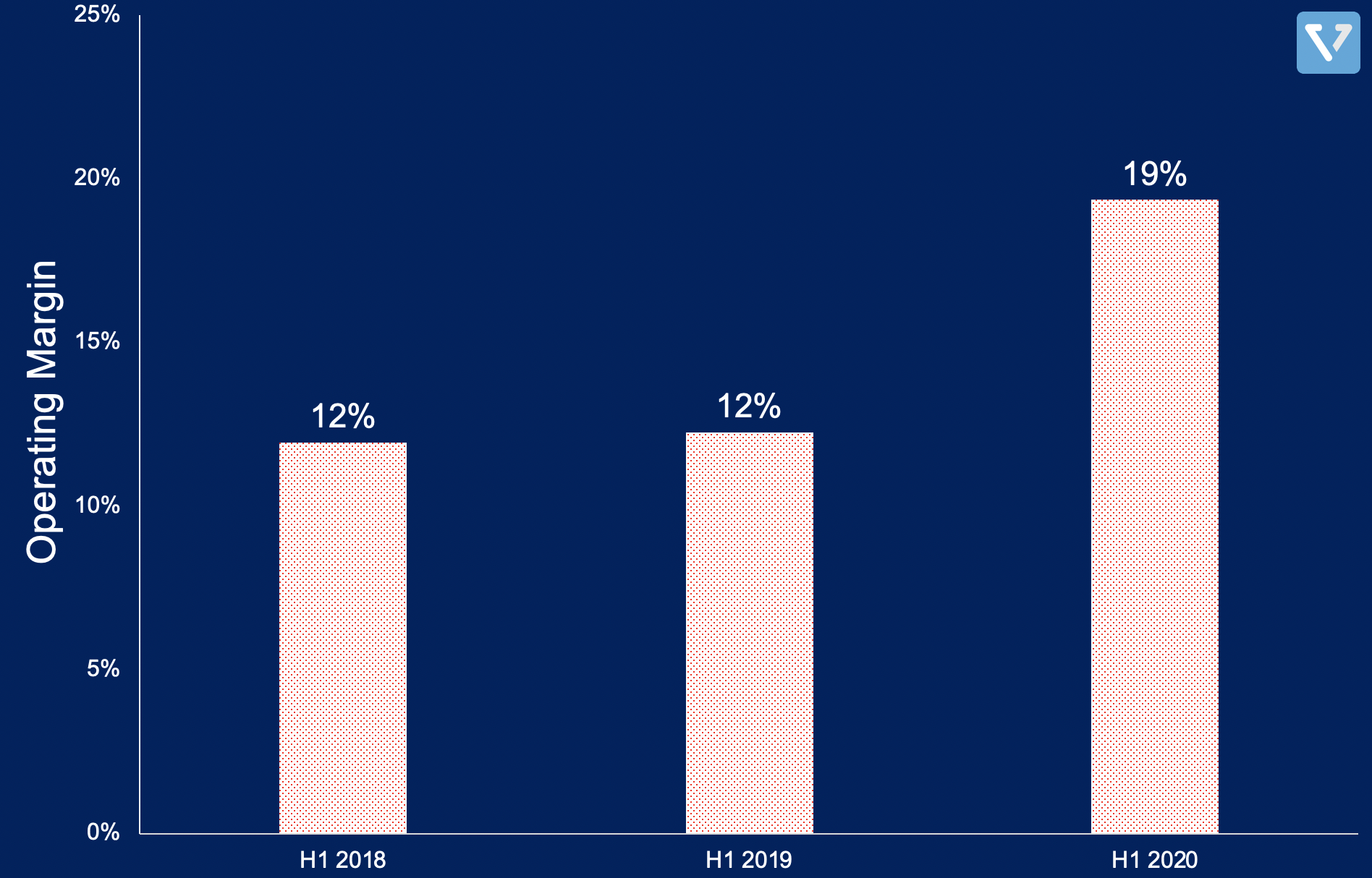

This means that Netflix is pulling forward subscribers that may have subscribed later, without spending on marketing, and that the recurring revenue starts earlier than expected. These factors, combined with delayed content production spend due to the global lockdown resulted in a jump in operating margin (Figure 4).

Microsoft continues to beat expectations

The company reported US$38 billion in revenue for the three months ending in June (beating analysts’ forecast of US$36.5 billion). The global lockdown and work-from-home trend has accelerated adoption of many of Microsoft’s products. Demand for its cloud computing solutions (up 17% year-over-year), productivity software (up 6% year-over-year), and personal computers (up 14% year-over-year – powered by a 65% increase in the Xbox division) have increased. Considering the size of the company, it is remarkable that it is still showing double digit revenue growth in many areas.

After the announcement, their share price decreased slightly, however. The prolonged lockdown is starting to take a toll on small businesses. Microsoft is seeing a slowdown in software license purchases for small and medium businesses. LinkedIn and Search ads (Bing) also saw a decline in revenue to the weak job market and reductions in ads spend.

Rush for the shiny stuff

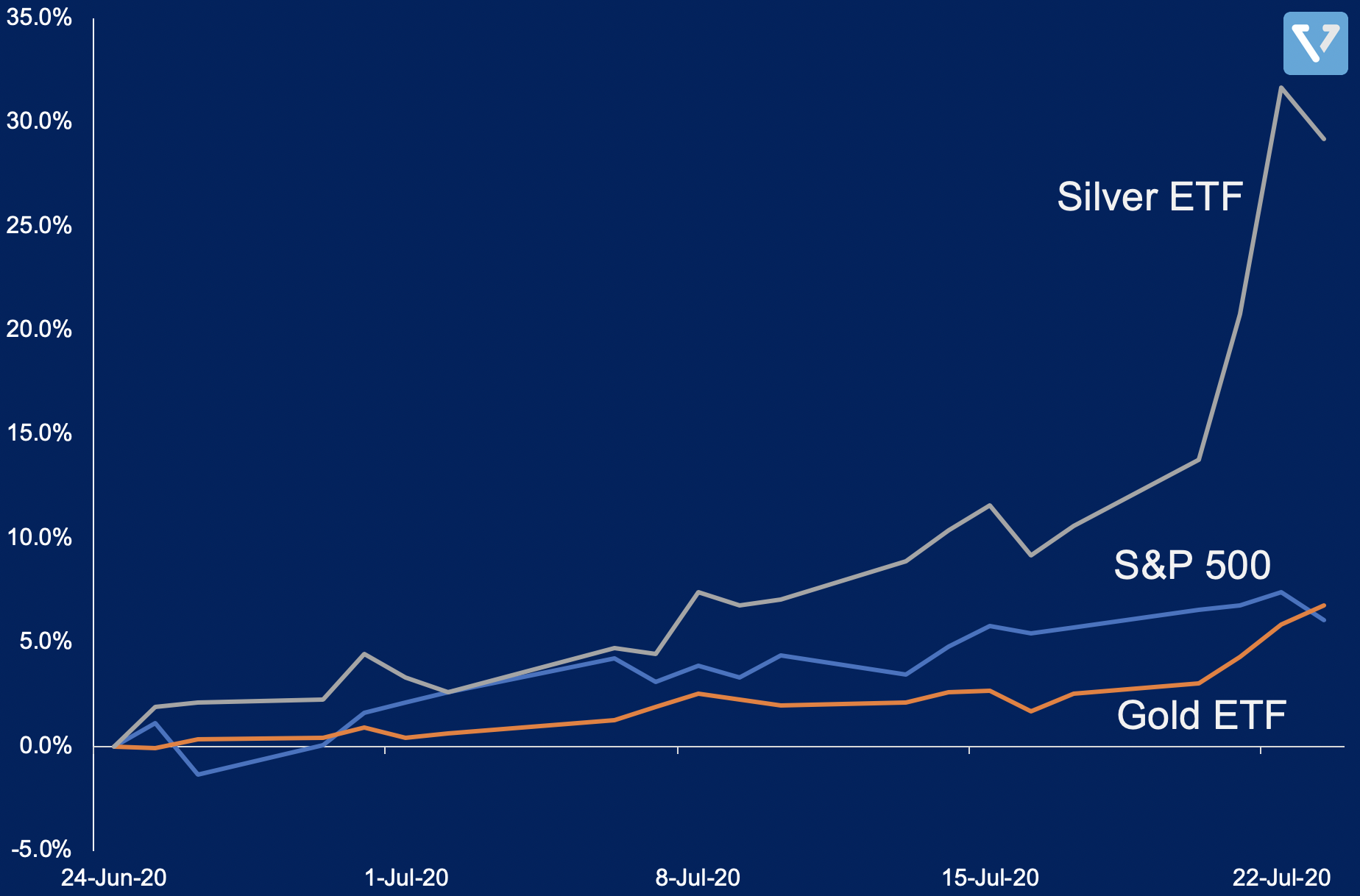

The prices of gold and silver have rallied in recent months.

This is due to several factors:

- Fear of inflation caused by the unprecedented stimulus package by both the US and the EU. It is debatable if this fear is warranted, however. Some argue that in the near term, inflation might not happen due to continued weakend demand for goods and services.

- About 50% of global silver demand is from the car and solar industry. With the global lockdown, demand from these sectors have weakened, leading to mines closing, and causing supply restrictions. However, the prospect of industrial reopening, combined with investors’ rush to buy silver, has contributed to the recent rally.