In today’s article, we discuss the website building industry and compare Shopify, Wix, and Squarespace.

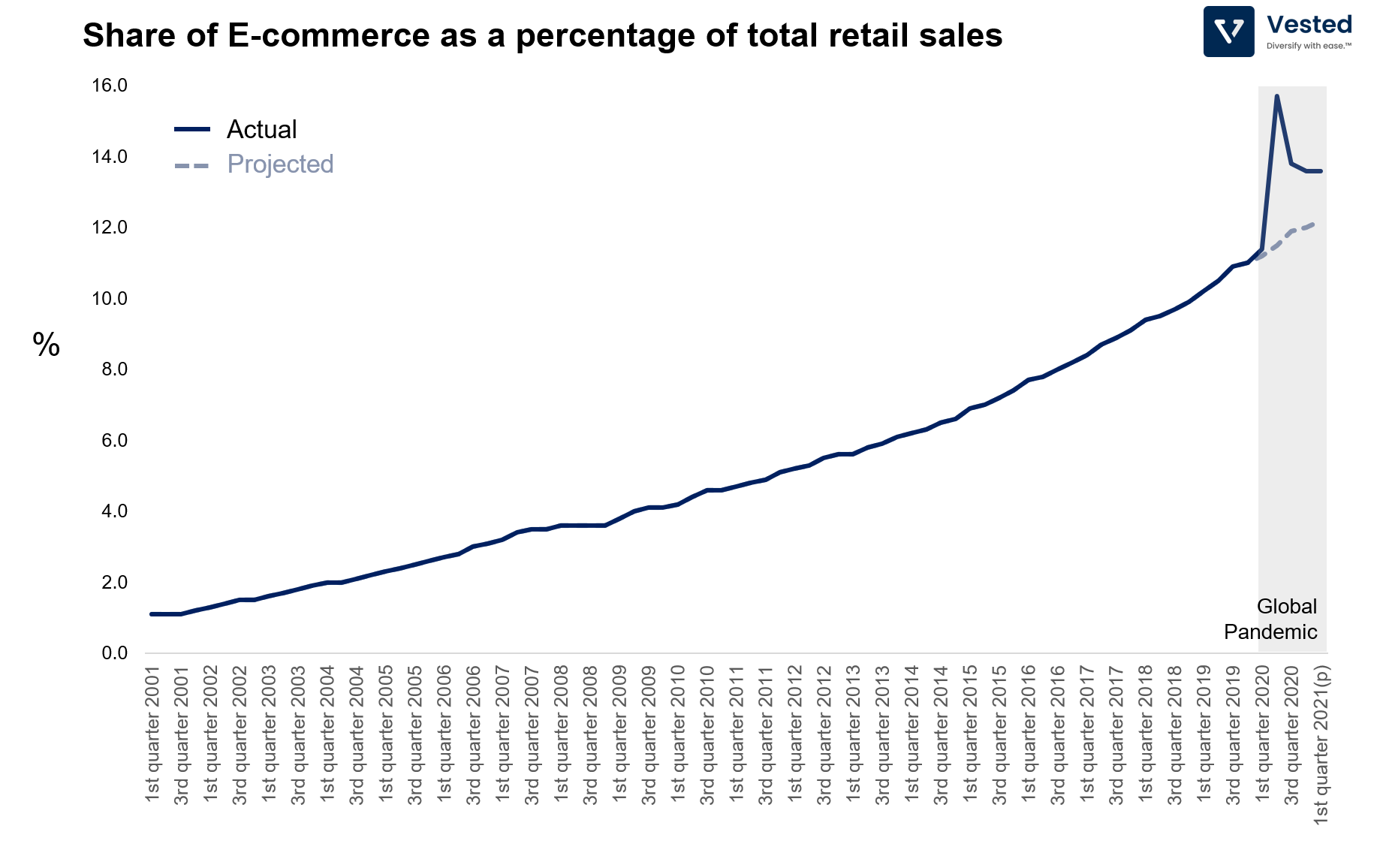

It’s no secret that the global lockdown this past year has accelerated adoption of e-commerce. Over the past year, e-commerce sales increased by 39%. As a result, the share of e-commerce as a percentage of total retail went up from 11.4% in Q1 2020 to 13.6% in Q1 2021, accelerating adoption by several years (see Figure 1).

You see the impact of this shift in the earnings of the digital advertising giants (Facebook and Google) and in the earnings of Amazon. You can also see the impact of this shift on several website building companies (Shopify, Wix, and Squarespace). These companies provide a suite of tools that enable anyone to start a website without any coding required.

In the past, we discussed Shopify’s business extensively. In this piece, we will look at Wix’s business and compare it with that of Shopify and the recently IPO‘d Squarespace.

Note: One notable addition to this list would be WordPress.com, but it’s a private company, so we do not have their data.

The front door to your internet identity

In the mid 2000s, both Squarespace and Wix were providers of software that enabled individuals (particularly bloggers) to build their own website without coding. But with the increased importance of e-commerce, more and more offline entities are driven to have a digital presence. Whether you’re a blogger, a designer, a yoga studio, or an operator of a small hotel, you need a website. More importantly, your website needs vary depending on the specific vertical you are in.

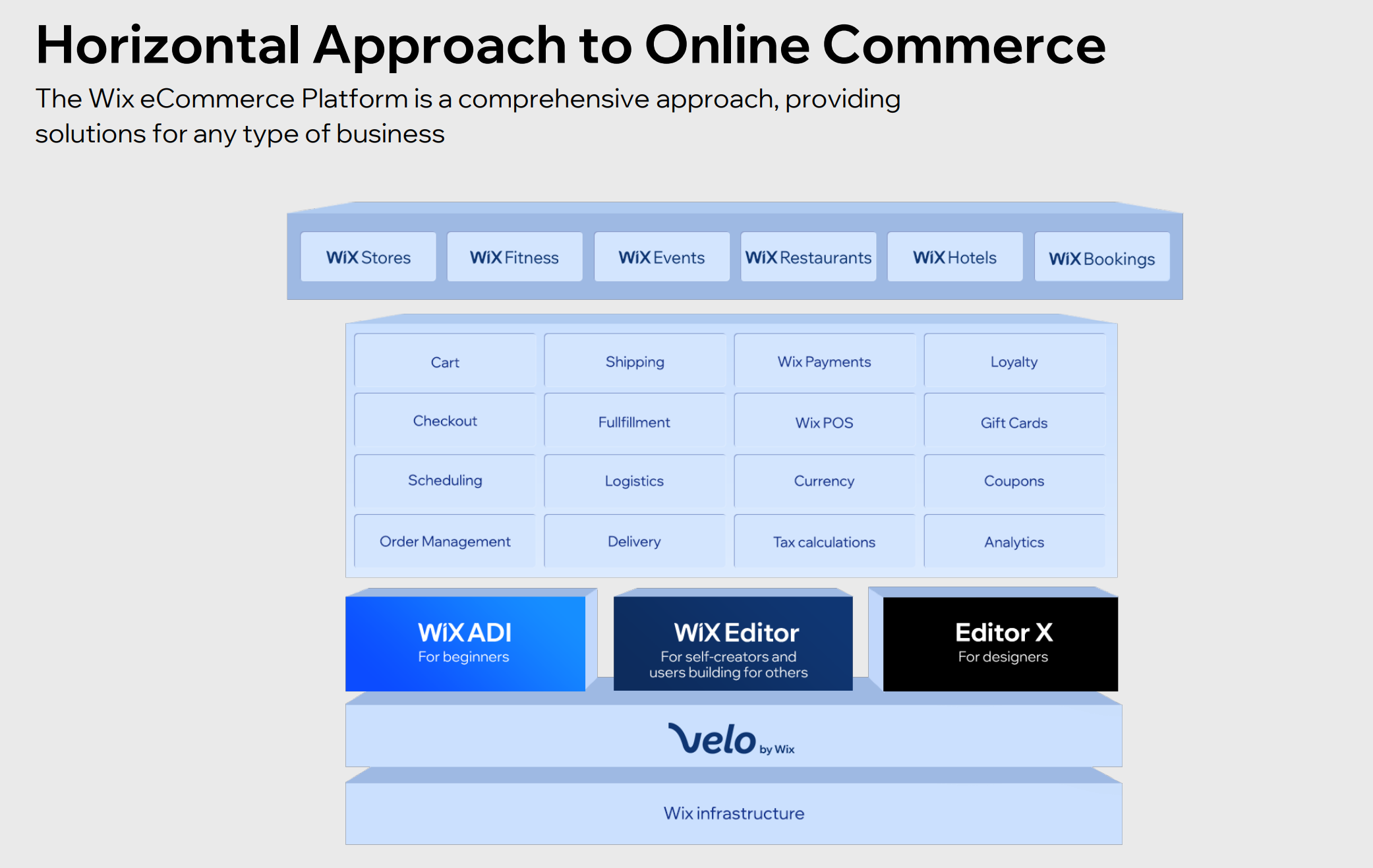

- If you run an e-commerce shop, you will not only need a website, you need an inventory management system, a billing and payment system, a coupon management system, and more.

- If you run a small hotel, your needs may be different: You need an online booking system that is coupled with a pricing tool that can dynamically adjust based on demands.

Seeing this trend, both Wix and Squarespace started to expand their offerings beyond a simple website builder. They diversified their products into different verticals of commerce (restaurants, hotels, fitness, etc). This is in contrast to Shopify’s strategy that mostly focuses on pure e-commerce (selling stuff over the internet).

An illustration of Wix’s horizontal strategy is shown in Figure 2.

Despite different approaches in pursuing different verticals, the three companies have similar revenue sources. At the highest levels, they all have two business segments:

- The first is recurring revenue from selling software that empowers websites (SaaS revenue).

- The second is providing payment solutions for merchants. This is the fintech play – where the companies provide payment service for small businesses and take a cut on the total gross merchandise value (GMV).

Revenue comparison

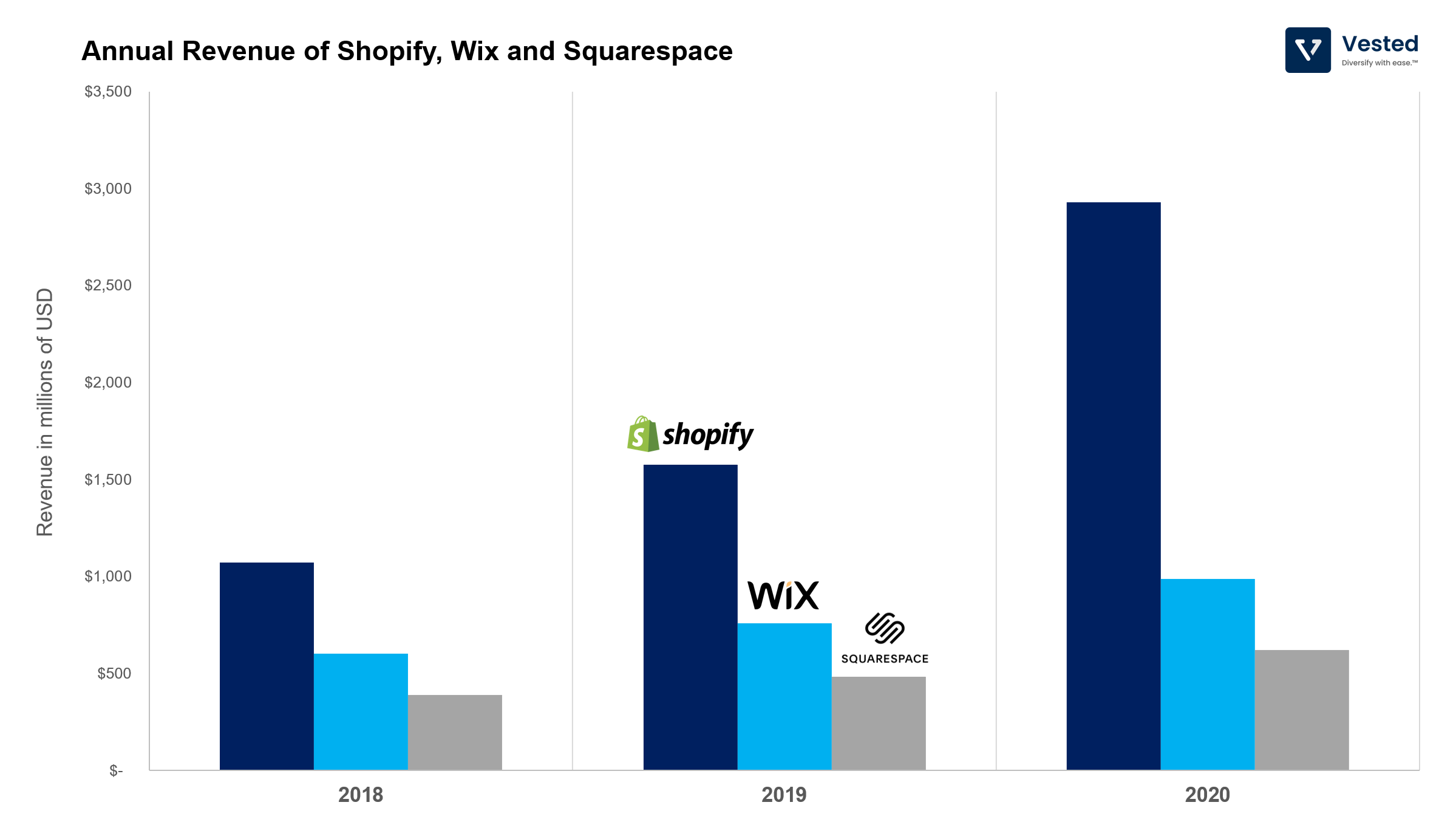

When you look at the top line revenues of these three companies (Figure 3), Shopify is by far the largest. Shopfiy’s annual revenue is almost 3x larger than that of Wix’s (and 4.7x larger than that of Squarespace’s).

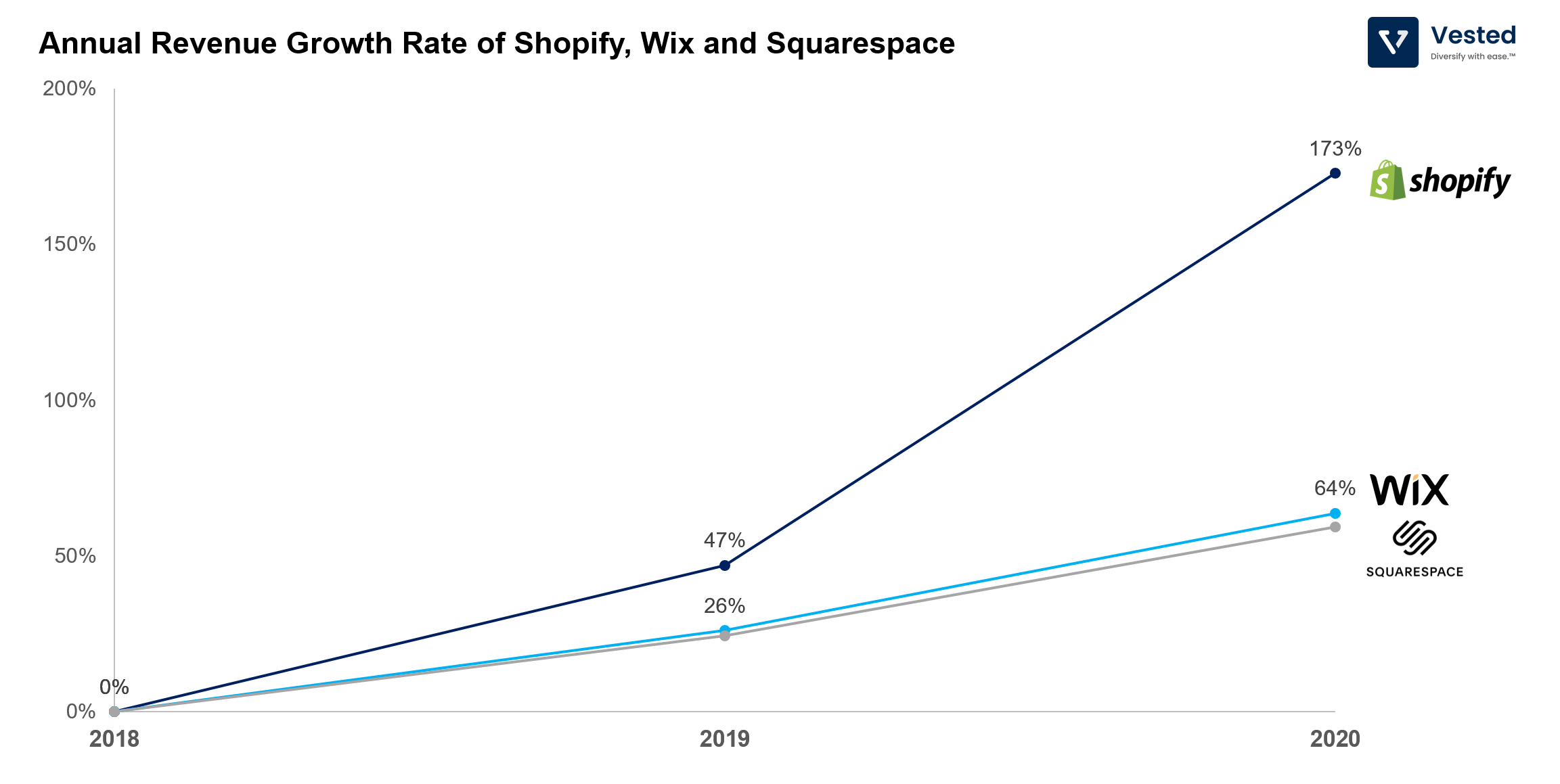

It’s not just the size of the revenue where Shopify has the other two beat, but also the growth rate of the revenue. In the past 2 years, Shopify has grown its revenue by 173%, while Wix and Squarespace grew 64% and 59% respectively (see Figure 4).

Shopify’s rapid revenue growth largely comes not from its recurring software business, but rather from its payment solutions (the fintech play), which contributed towards 70% of revenue in the past year.

It’s clear that Shopify is outperforming Wix and Squarespace. Shopify is not only larger, but also growing faster. It’s growing almost 3x faster in top line revenue than Wix. Despite being younger than the two other companies, Shopify’s early focus on e-commerce has allowed it to have the lead in powering e-commerce sites of various sites. After Amazon, Shopify is the 2nd largest e-commerce player.

Shopify’s outperformance is not missed by the market. As of this writing, the company enjoys three times higher valuation than Wix. Shopify’s price-to-sales ratio for the next twelve months (P/S NTM) is 32x, while Wix’s is 11x.

The SaaS comparison

Comparing Wix to Shopify might not be an apples-to-apples comparison for two reasons:

- Wix’s fintech play is much less mature when compared to Shopify’s. The majority of the company’s revenue still comes from recurring software services, which has an implication on revenue recognition – more on this later.

- Wix’s customer base is more concentrated towards individuals and small businesses, and is less focused on e-commerce (unlike Shopify’s customer base).

So, let’s look at Wix from the perspective of a SaaS business.

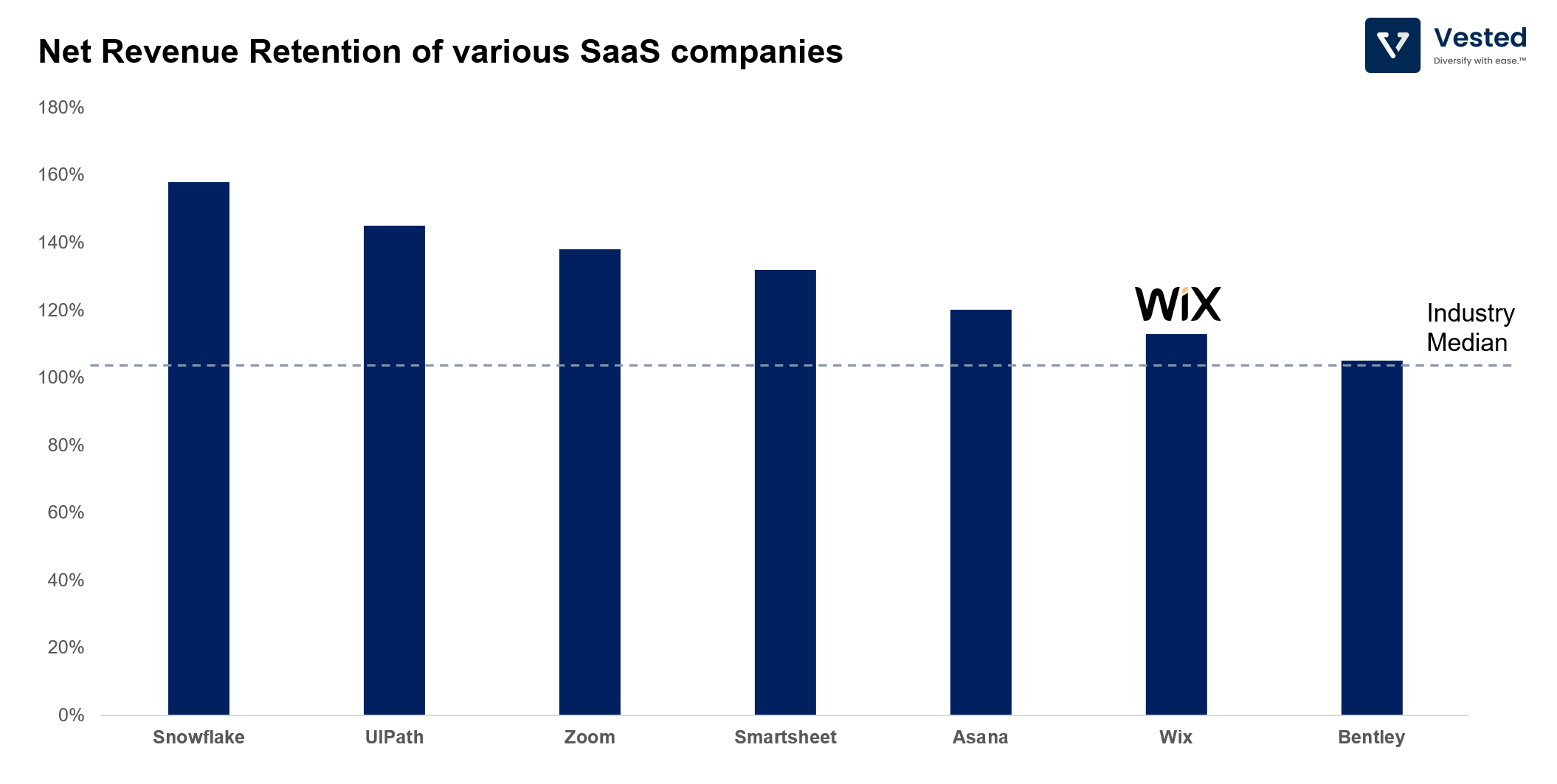

Wix’s product is sticky. It’s very difficult for users to move their website and their data once they’ve used Wix. The primary source of churn is likely SMBs going out of business (30% of small businesses fail within the first 2 years). Nevertheless, because surviving businesses spend more on Wix’s services, its net revenue retention is positive. Wix’s net revenue retention is 113%, slightly above industry median (this means that if a user spends US$100 in the first year, the same user would spend US$113 the following year). The higher the net revenue retention, the more efficient revenue growth will be.

Here’s Wix’s net revenue retention vs. other companies:

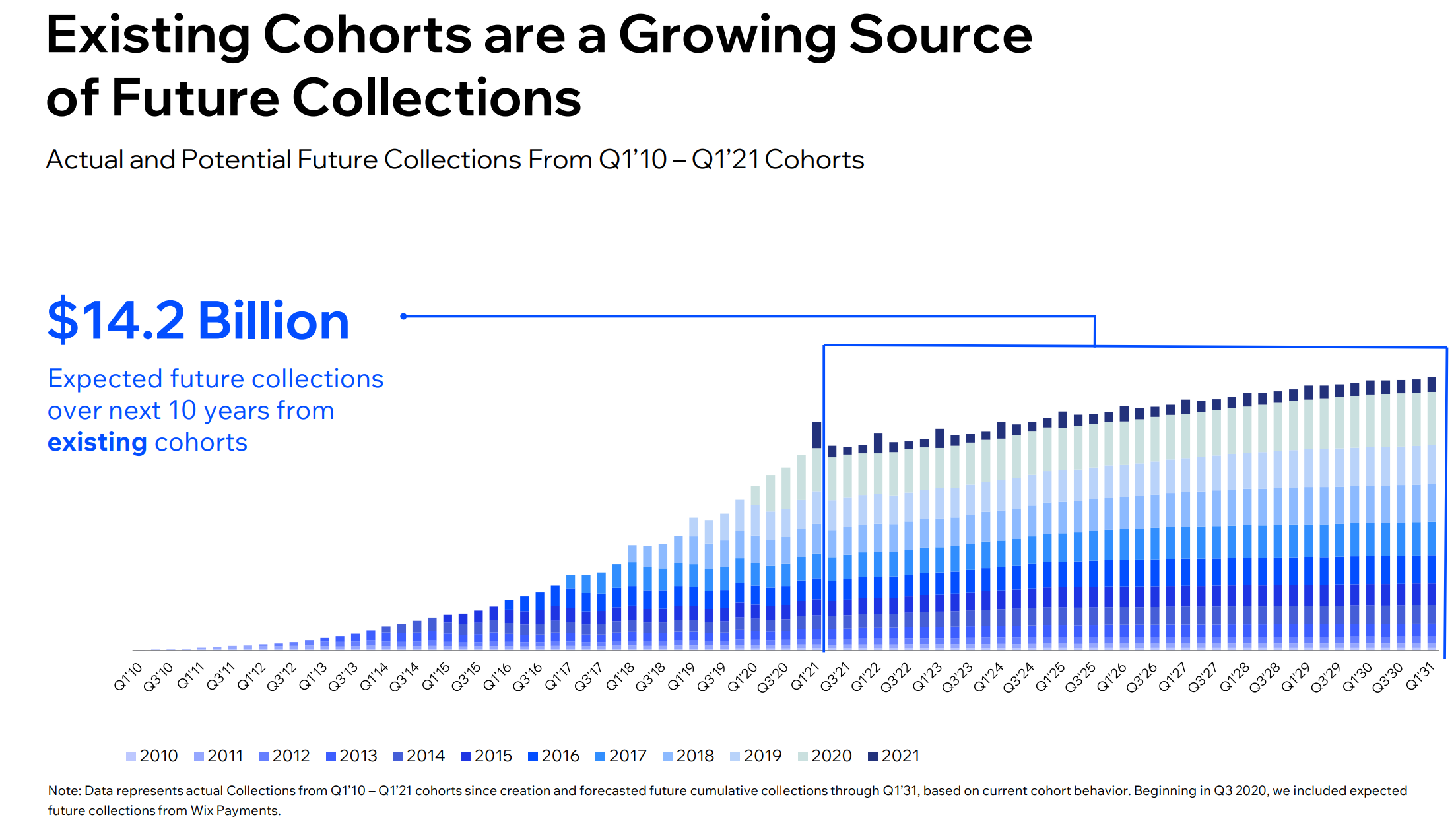

A sticky product and increasing usage means that even without acquiring new customers, the company can continue to grow its revenue. In fact, just from existing customers, without taking into account future customers, Wix believes that it can collect US$14.2 billion in subscription revenue over the next decade (see Figure 6).

We mentioned above that Wix’s revenue is still mostly SaaS revenue (the fintech play is very small compared to Shopify). Because of GAAP accounting (GAAP is an accounting standard), Wix can only recognize revenue when the revenue is earned, not when the cash is received. In other words, if a user pays for a full year of service ahead of time, Wix can only recognize the revenue when the software service is used by the user on an ongoing basis. But because more than 80% of Wix’s customers opt for the annual subscription, evaluating Wix’s growth based on recognized revenue understates its true growth rate. Because of this, the company introduced a non-GAAP metric called Collections.

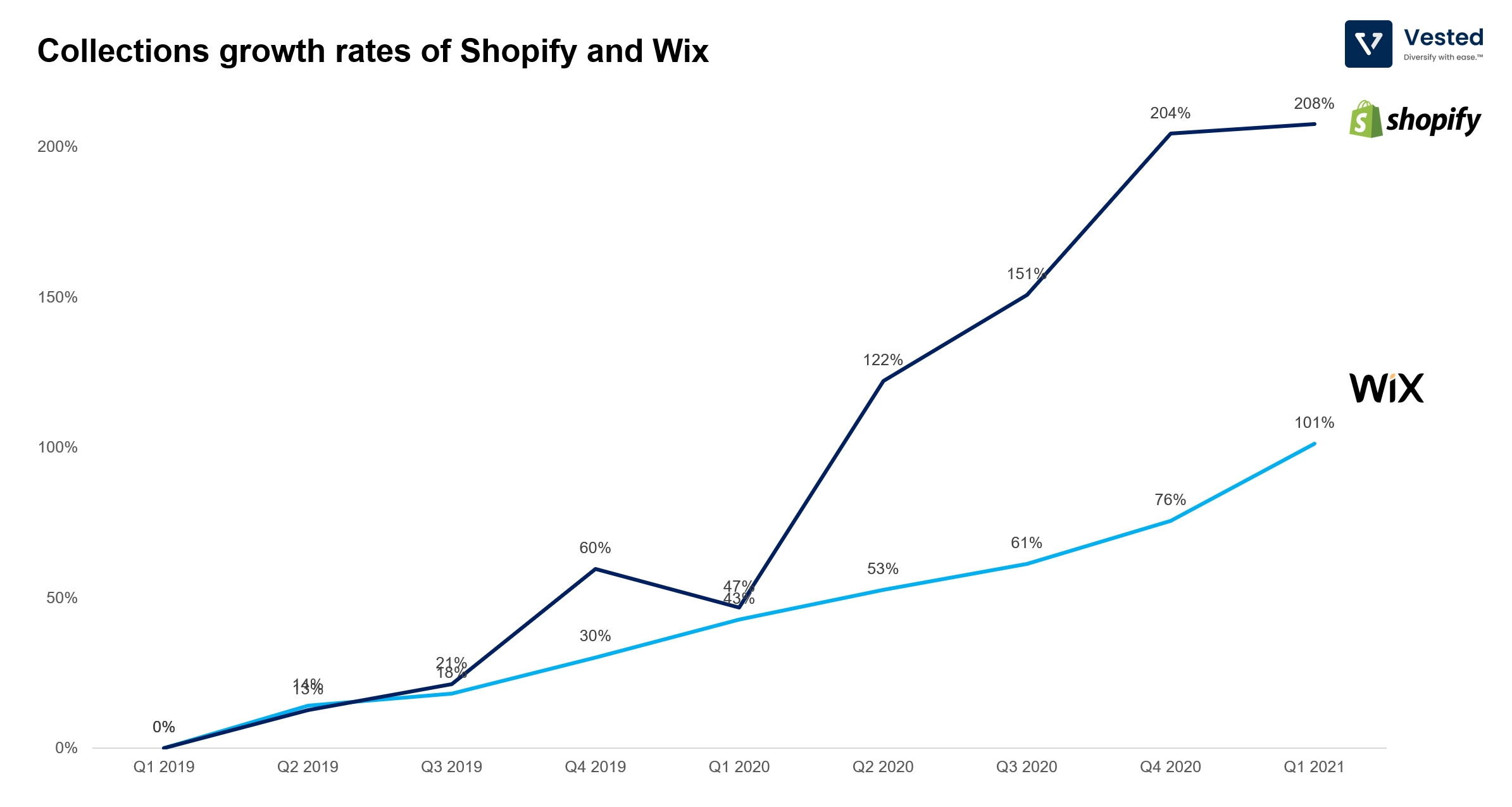

Collections are calculated as revenue plus change in deferred revenue. Wix reports this in its quarterly earnings. Shopify does not, but you can calculate it from its earnings reports. Figure 7 summarizes the Collections growth rates of both companies normalized to 2 years ago.

When you take into account change in deferred revenue, then a different picture emerges. If you look at pure revenue growth over the last two years, Shopify’s revenue growth rate is 3x faster than Wix’s (see Figure 4 above). But if you compensate for deferred revenue, Wix is actually growing slightly faster than what its revenue is suggesting. Instead of 3x faster, Shopify is actually only growing 2x faster than Wix over the past 2 years on a Collections growth rate basis. And, if you strip out Shopify’s payments revenue, its subscription solutions growth rate is actually less than that of Wix’s.

Considering that Wix is valued 3x cheaper on a P/S basis than Shopify, and its fintech play is still very nascent – Wix might be a good alternative for investors looking for better value in the website/e-commerce building space.

The market for website building is large, and despite the rapid shift to e-commerce these past years, there’s still a lot of growth to be had. On average, more than 500,000 new businesses are created each month in the US, and almost half of small and medium-sized businesses are still not online today. Companies such as Shopify, Wix, and Squarespace provide services that make it easy for entities to have an online identity.