In this week’s article, we will be discussing Tesla’s US $1.5 billion Bitcoin purchase, and Uber’s 2020 earnings.

Last week Tesla made news after an SEC disclosure disclosed that the company had purchased US $1.5 billion worth of Bitcoin (BTC).

Why did Tesla do this?

Diversification and returns maximization

Tesla claimed that the goal was to “diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity.â€

As of the end of 2020, the company has more than US $19.4 billion on hand. So this investment represents close to 8% of its cash and is one of the largest investments into Bitcoin made by a public company. Regardless of how you look at it – this is a lot of cash to invest.

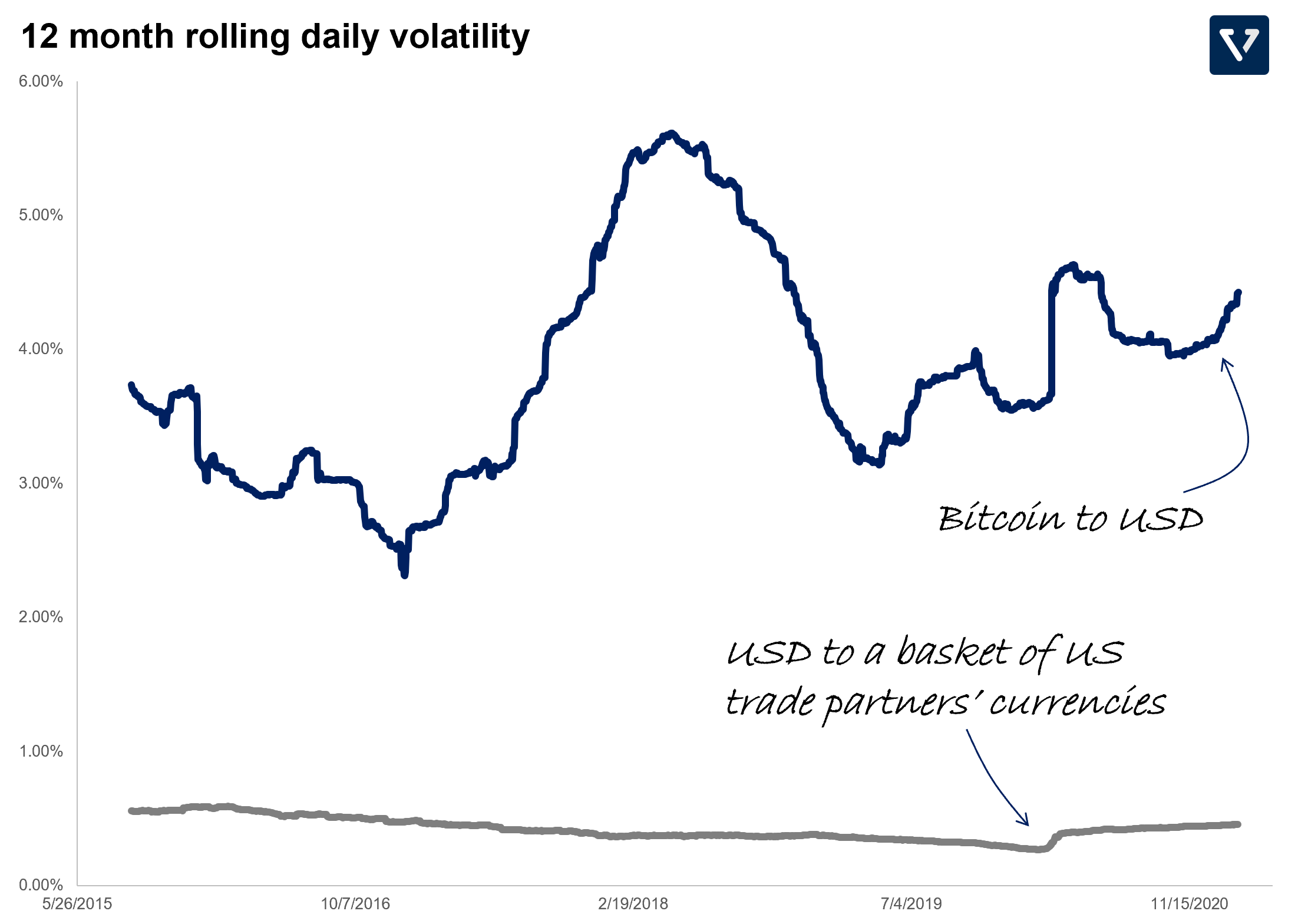

Most companies avoid investing in an asset this volatile. As of the writing of this article, the rolling-12-month daily volatility is 4.4%. This means, based on the last 12 months data, Bitcoin fluctuates about ~4% on a daily basis. Annualized, this volatility is about 84%!

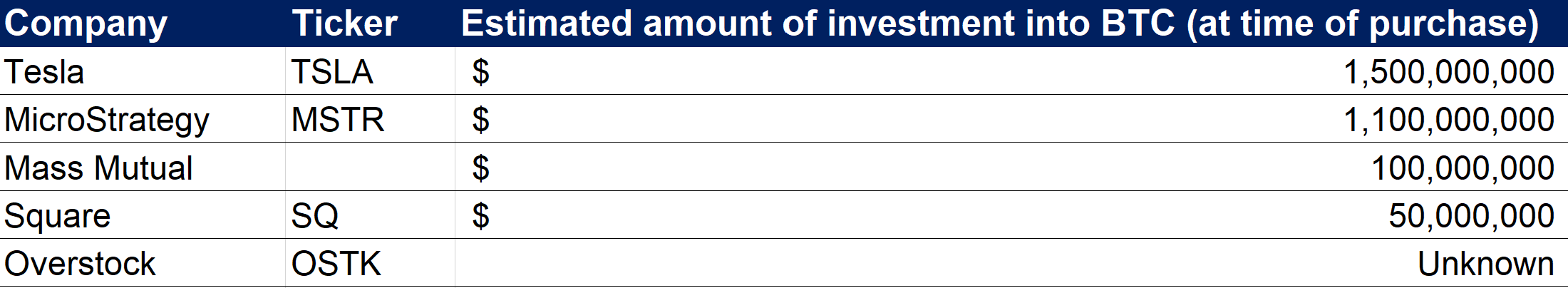

This extreme volatility is why most companies will not hold Bitcoin as part of their holdings, with the exception of a few (see Figure 1 for the list).

Accepting Bitcoin as a payment method

As part of the announcement, Tesla also said that it may accept customers payments in Bitcoin. The feasibility of Bitcoin as a method of payment has long been argued and thus far has been shown to be not feasible. Several companies have tried, but failed. Dell Technologies and Expedia tried to accept Bitcoin as a payment method but dropped the project due to lack of use. So far, Overstock.com is one of the rare companies that still accepts Bitcoin as a payment method.

For any instrument to be an effective payment method (e.g. money), it has to have four characteristics:

- Characteristic 1 – Store of Value: if you earn US $100 from the work you did on Monday, come Saturday, when you’re ready to spend that money, the value should be the same. In other words, the purchasing power needs to be relatively stable.

- Characteristic 2 – Unit of Account: money is also a measurement unit of how much something is worth. For example, if you earn an hourly wage of US $20/hour, and your rent is US$400/month, you know you can exchange 20 hours of your labor to pay for your monthly rent.

- Characteristic 3 – Medium of Exchange: money has to be accepted widely. The consumer must be able to use the money anywhere he/she chooses.

- Characteristic 4 – Accepted by the government: under normal circumstances, this definition is implicit because since ancient times, the ruling organization (the king, government, etc) issues the money. But with the rise of decentralized cryptocurrencies, we have observed that this requirement is needed, as we have multiple instances where the government banned crypto (China banned crypto in 2017. India banned crypto in 2018, which was reverted by the Supreme Court last year, but might be banned again).

Let’s focus our discussion on characteristics 1 – 3. Cryptocurrencies generally, and Bitcoin specifically, do not meet characteristics 1 and 3. It is not widely accepted as money because it is not a good store of value. The price is too volatile.

Figure 2 shows the past 12-month-rolling-daily-volatility of Bitcoin from the past 6 years. For Bitcoin, the price varies anywhere between 2% – 6% on a daily basis (blue line). The volatility tends to increase with increasing hype. As of this writing, the daily volatility is 4.4%, which translates to a whopping volatility of 84% annualized. In contrast, the volatility of USD (against a basket of currencies of US trading partners) is 10X lower than that of Bitcoin.

The key takeaway from Figure 2 is not just the magnitude of volatility, but also the trend. Despite higher awareness and media coverage over the past 6 years, the volatility is not trending down. As such, it’s unlikely that Bitcoin will be adopted as money anytime soon.

Currently, barely anyone uses Bitcoin to buy anything. Only about 1.3% of economic transactions came from merchants in the first four months of 2019.

Bitcoin as a speculative investment vehicle for Tesla

Just because it cannot function as money effectively, does not mean that Bitcoin cannot be a speculative investment vehicle (at least for Tesla).

Here are three things that are true:

- After Tesla’s share price ran up more than 420% the past year alone, the company has been issuing more stocks (and therefore diluting the investors) to raise more cash. As a result, as we mentioned above, it has more than US $19 billion in cash, and therefore, this Bitcoin investment won’t affect Tesla’s liquidity in the short/medium term.

- In the past 6 years, the largest drawdown in Bitcoin price was between Dec 2017 to Dec 2018, where Bitcoin price went down almost by half.

- Elon can influence Bitcoin prices. There have been multiple instances where a tweet from Elon boosted the price of Bitcoin.

Therefore, at the risk of losing potentially half of its investment in Bitcoin, combined with the fact the Elon’s tweets can move the price upwards, Tesla is making an asymmetric bet, where the potential upside is larger than the potential downside.

The risks involved for Tesla (or other public companies that invest in Bitcoin)

If the Bitcoin price goes below your purchase price, it can negatively affect your earnings

In the US, Bitcoin (and other cryptocurrencies) are not considered currencies. Rather, they are considered “intangible assetsâ€. As a result, if the price of the assets go down below the purchase price, even temporarily, then the company is forced to write down the value (impairment charge). In other words, for Tesla, if Bitcoin price declines below its purchase price, then the company must take the charge, which in turn will reduce profits.

What will the regulators make of this?

There appears to be conflict of interest. On one hand Tesla owned Bitcoin. On the other hand, its famous CEO has the ability to influence its price. How will regulators react to this?

There has been precedent of celebrities getting in trouble for pumping ICOs (initial coin offerings – which is similar to IPOs but for crypto). But those celebrities were pursued by the SEC for failing to disclose that they got paid for pumping the ICOs (which are considered securities – hence the SEC’s involvement). This is not the case with Elon or Tesla.

It is likely that Elon’s actions hyping Bitcoin won’t put him in regulatory hot water. Regulators are very wary of pump-and-dump schemes (buying an asset, hyping the asset to entice new buyers to increase the price, and unloading the asset). Right now, at most, Elon’s actions constitute the pumping (hyping), but since there’s no dumping (selling) yet, it is unlikely that it will draw regulators scrutiny.

Nevertheless, some prominent lawyers have advised caution.

Uber’s 2020 Earnings

Unlike many of the tech companies that we often discuss, 2020 has been very bad for Uber. Here are three key takeaways from the earnings release:

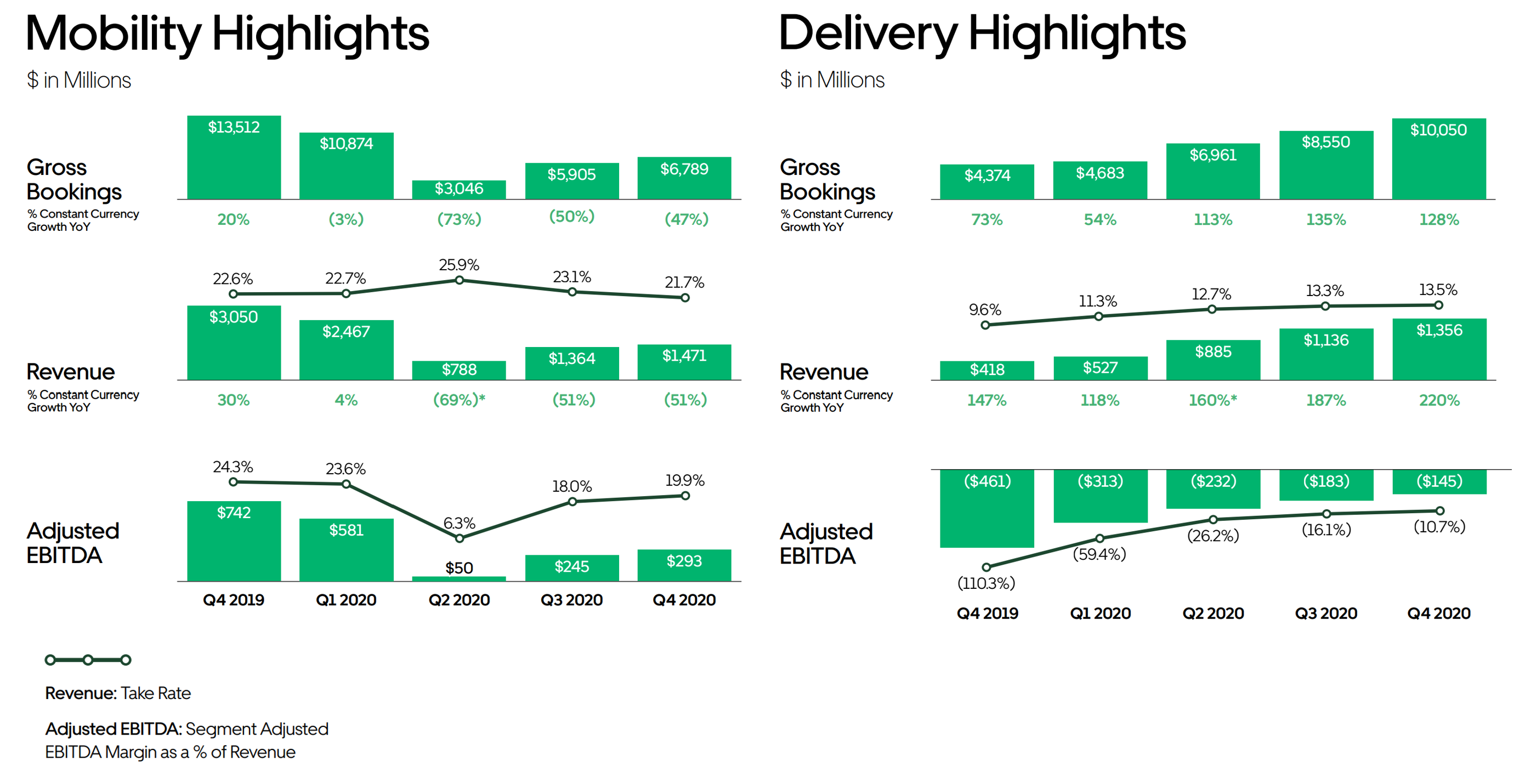

The first takeaway: Mobility (rideshare) segment has not recovered (see Figure 3 left). In both Q3 and Q4 2020, Gross Bookings and Revenue are still down ~50% when compared to 2019. Fortunately, as people were stuck at home, the delivery business accelerated. It acted as a hedge against the global lockdown (see Figure 3 right). In Q4 2020, Gross Booking for Delivery was up 128% year-over-year, while Revenue went up 220% year-over-year.

The second takeaway: With deployment of vaccines and the decline of new COVID-19 cases globally, Uber’s mobility business might be poised to return. The company has observed demand recovery in Taiwan, Brazil, New Zealand, Hong Kong and Australia. Demand has mostly recovered for Social and Commute purposes (perhaps proclamations about the death of work from office might be premature?), but has not recovered for Airport rides.

The third takeaway: The year 2020 has pushed Uber to re-focus. The company has sold its deeply unprofitable self-driving and vertical taxi businesses, refocusing its efforts to core mobility and delivery businesses. It bought Postmates to expand its food delivery service. And recently announced the acquisition of Drizly, a liquor delivery service for US $1.1 billion (a mostly stock deal).