Tesla’s Q1 2020 earnings and COVID-19

Tesla just reported Q1 2020 earnings. The company surprised everyone when it announced a US $1.24 per share profit (analysts were expecting a US $0.28 per share loss). Revenue grew 32% year over year. The primary reason for this revenue growth is the sale of regulatory tax credit to its competitors (Tesla receives tax credits (for selling electric cars) that it then sells to its competitors). As you can imagine – sale of tax credit is almost pure profit. So this boosts profitability. But Tesla is a car manufacturer, not a seller of tax credit.

So how did it do on car sales?

The short answer is – better than expected. Two key numbers to pay attention here: (1) Car deliveries: this is important because it is a leading indicator for revenue, and (2) Cash flow: if the company runs out of cash, it cannot produce cars, build inventories and deliver cars.

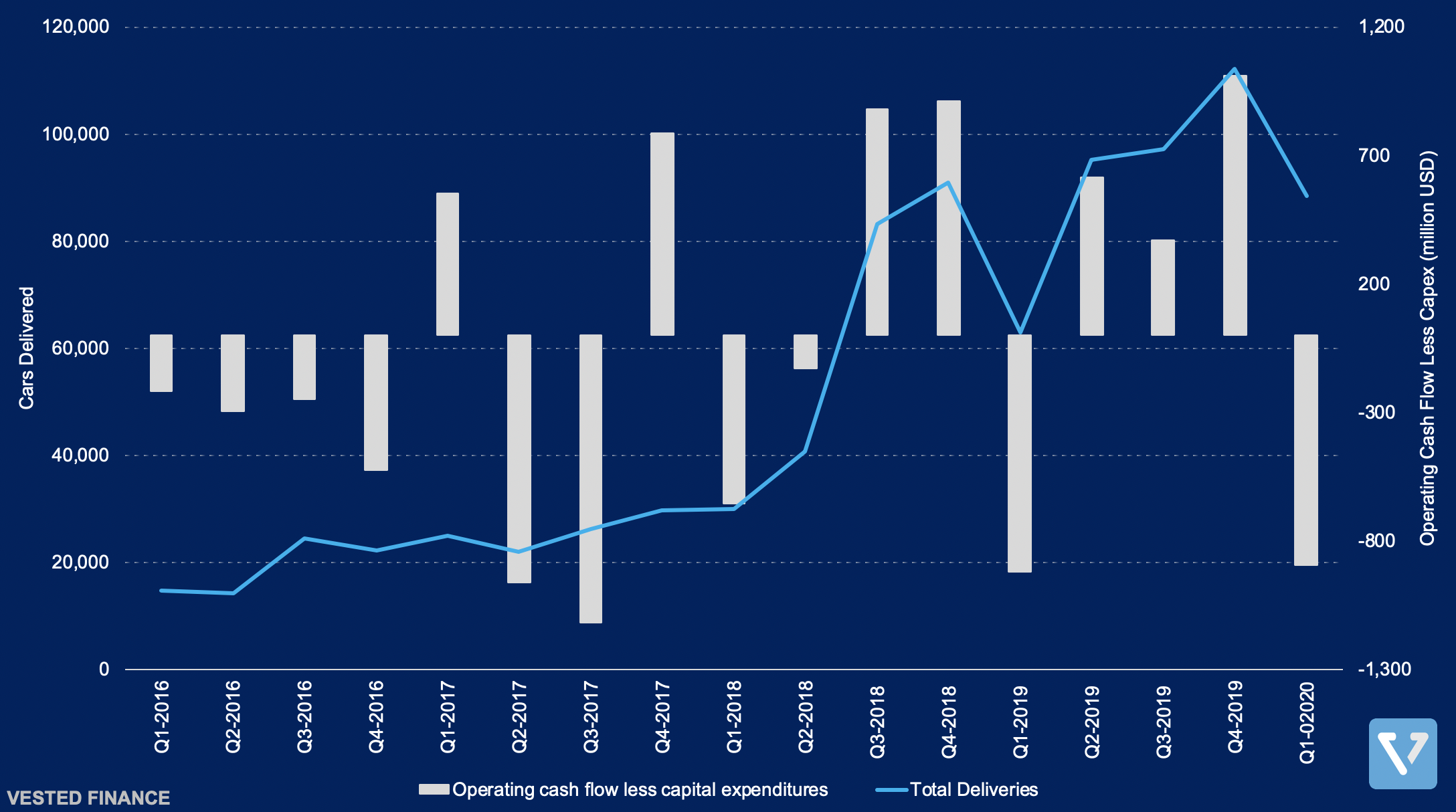

Figure 1 summarizes the results since 2016. In Q1 2020, car deliveries (blue line) and cash flow (grey bar) were significantly down compared to the previous year. Car deliveries are down 21% compared to the previous quarter, but still up 40% compared to Q1 of last year. Tesla claims that deliveries were strong in the first two months of the year, but decreased significantly in March due to the global lockdown. As a result, expect deliveries to continue to be suppressed in April and May (Q2 2020) due to continued lockdown in the US and Europe.

The lockdown also significantly impacted cash flow. Due to its inability to deliver cars, Tesla’s inventory grew, negatively impacting its cash flow by US $981 million. Furthermore, continued investments in Fremont (California) and Shanghai (China) required more capital expenditures. Nonetheless, the company expects to be able to weather the storm. It has US $8.1 billion in cash – thanks to its recent US $2.3 billion capital raise (good timing!).

Tesla – always controversial

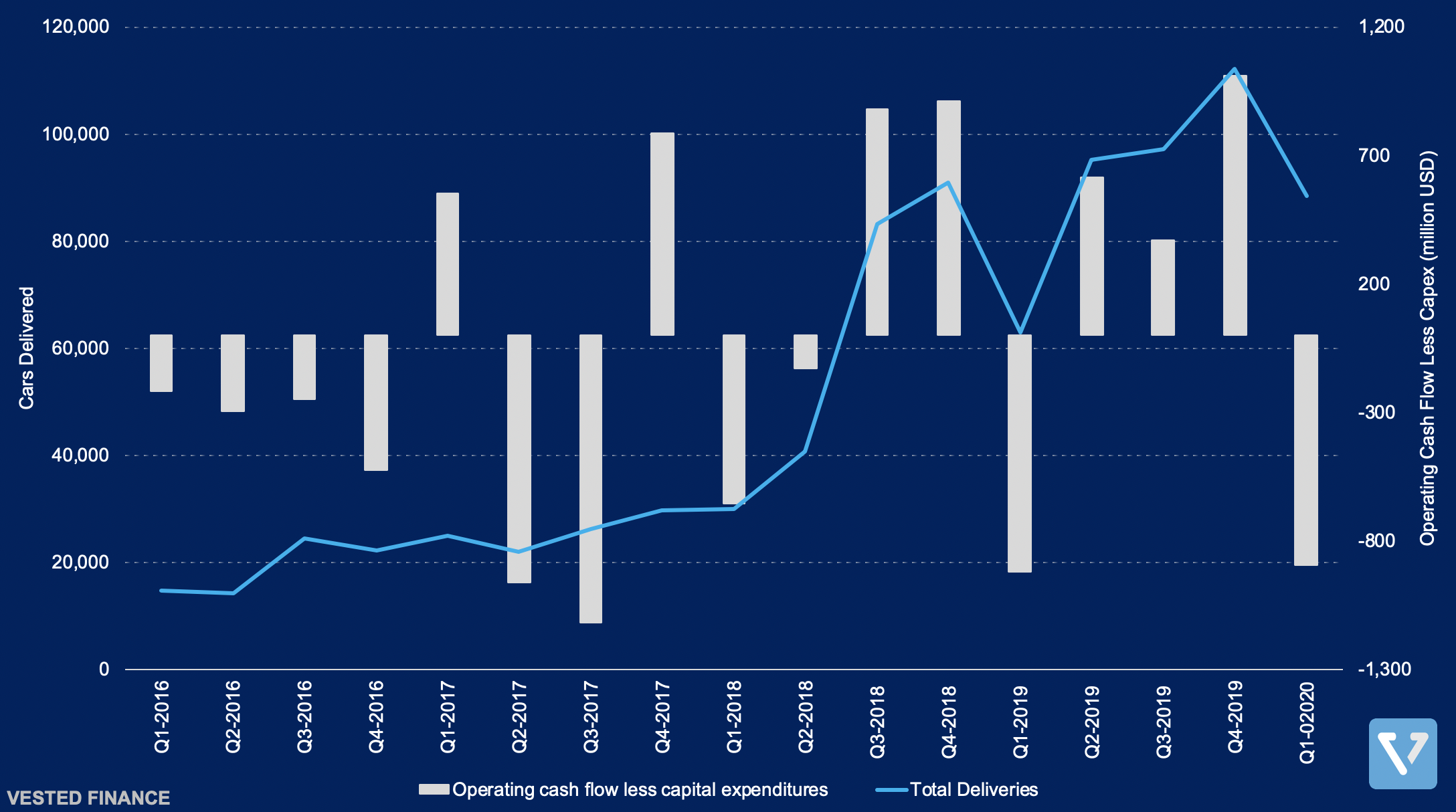

Overall, the result was not good – but much better than what investors had expected. But, if investors had expected the worst – why has the company’s share price gone up despite the pandemic? Tesla has always been a controversial company to invest in. This year alone, its share price grew more than 100% from January to mid-February, just to fall rapidly, bottoming in mid-March, and has been on an upward trajectory since. After today’s earnings announcement, the share price has increased another 11% in after market trading. Clearly, this large swing is not representative of the company’s fundamentals, but rather fueled by wild speculation.

When compared with other car companies, Tesla is very richly valued. In Figure 3, we compare the enterprise value (EV) to sales ratio vs. other car makers. We use EV to take into account the debt these companies have. Tesla’s EV/Sales ratio is about 5X that of BMW.

Clearly, investors are evaluating Tesla based on its future potential, not on current earnings or fundamental values. Since its founding, Tesla has been at the center of the transportation revolution: (1) transition from internal combustion engines to electric motors, and (2) self-driving revolution through its autopilot.

As a result, the bulls have always valued the company at high multiples, more akin to other tech companies. See Figure 4 for comparison of Tesla’s valuation vs. FAANGM (Facebook, Apple, Amazon, Netflix, Google, Microsoft – which collectively represents more than 20% of S&P 500)

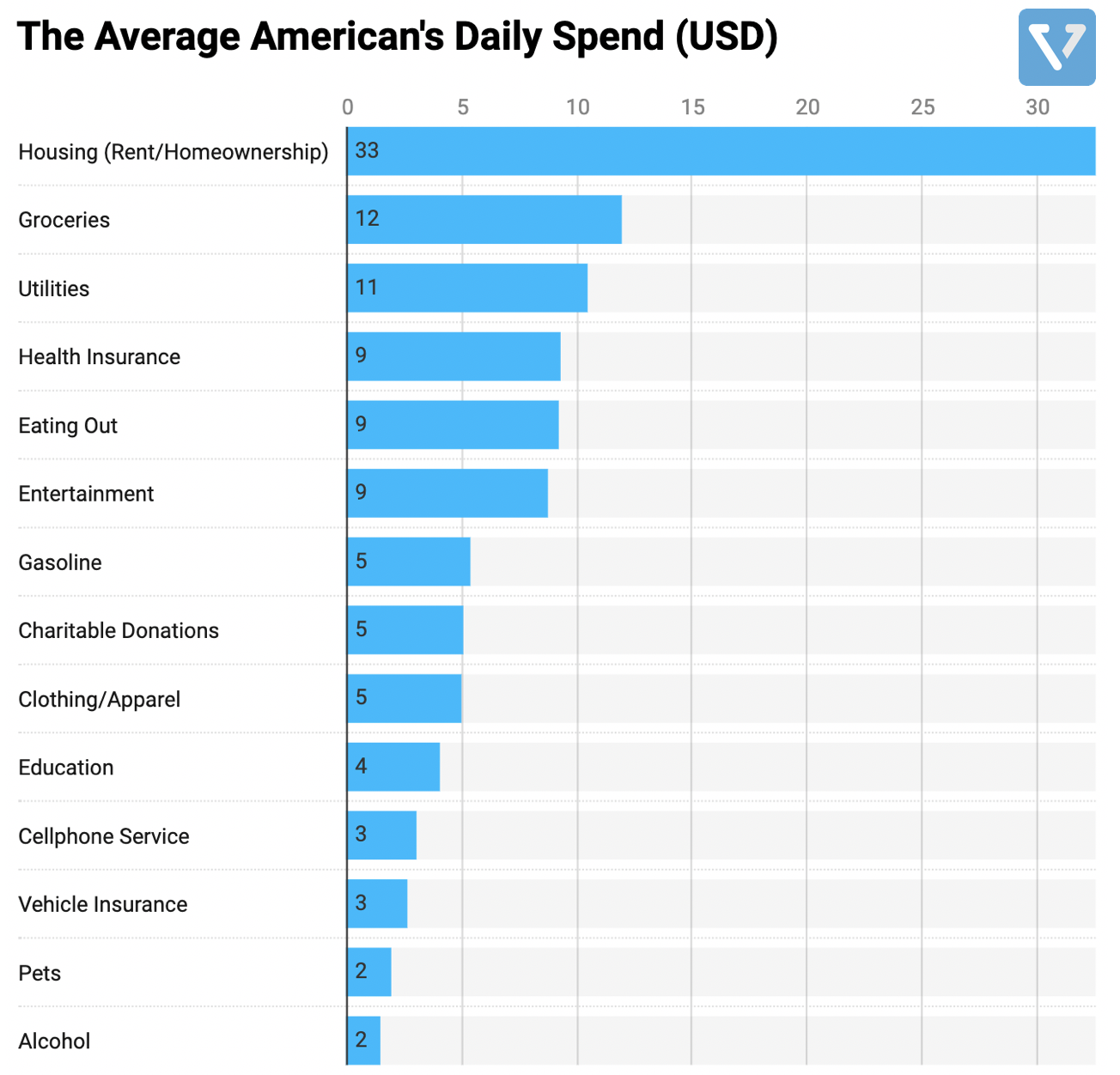

But clearly, Tesla is unlike tech companies listed here (with possibly Apple as the lone exception). It produces real world physical products and is constrained by manufacturing and supply chain limitations (as opposed to a zero marginal cost software services). Its operations are subject to global lockdowns, disruption of supply chains and change in consumer spending in times of recession (considering Tesla sells relatively high priced cars).

A lot is riding on Q2 2020. Will Tesla see continued production disruptions? Or will the company see reduced demand due to a global recession?

On the supply side

Tesla’s Fremont factory is closed until the end of May, as the government of California extended its lockdown. Fortunately, the company completed its Shanghai Gigafactory in record time last year which helped sustain production. During the lockdown in China, Tesla enjoyed a special relationship with the Chinese government that led to minimal disruptions to its operations. The company only closed the Shanghai factory for less than two weeks. The closure was then followed by a bolstered effort by the local government to help Tesla reopen its factory. The municipal government of Shanghai helped Tesla install infrared cameras to detect fevers, offered housing for workers, and even made arrangements to prevent supply chain disruptions. As a result, the company expects to be able to hit its target of producing 200,000 Model 3 cars per year this year.

On the demand side

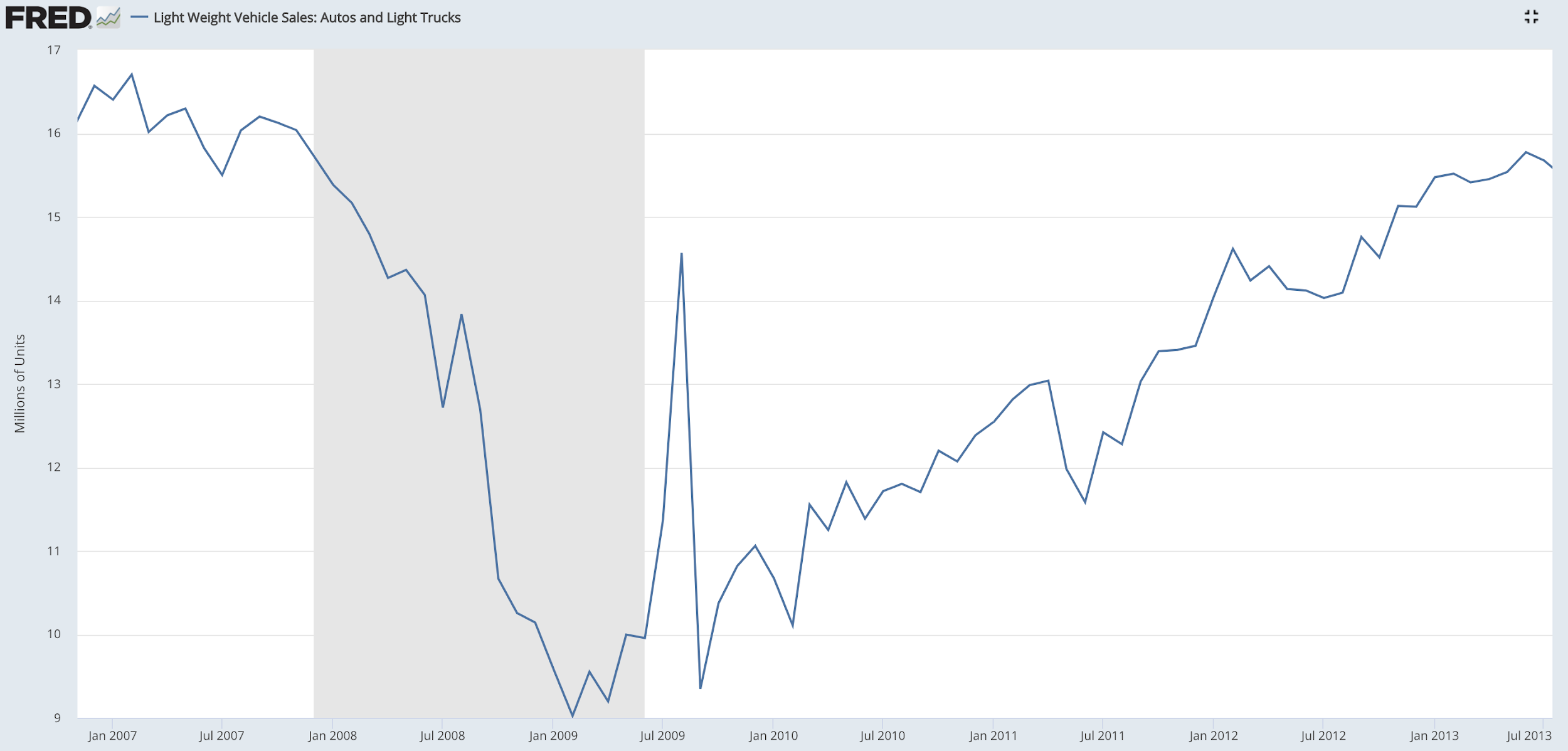

Just because Tesla can avoid disruptions in manufacturing, this does not mean it can sell all these cars. During recessions, consumers reduce large spending, which typically hits car manufacturers hard. Figure 5 shows car sales numbers during the last great recession. Number of cars sold in the US decreased by 40% and took 4 years to recover to the previous level.

What’s causing the wild swings in share price?

When share price swings +/- 100% within the span of three months, there can only be one answer: speculation.

The bear (pessimist) believes that the company is too highly valued and that any hiccup in Tesla’s ability to deliver on its promises will cause the share price to tumble. This is why the stock often tops the most-shorted US stock list. On the other hand, the bull (optimists) believes that the company has out-innovated its competitors and has superior technology (you can read more about this on our blog). And with the Shanghai gigafactory coming online, it can continue to improve margins and production output. The confluence of these factors have made Tesla extremely popular with retail traders in the US and India.

Whether you are a Tesla bull or bear, Tesla has proven its skeptics wrong time and time again – but with a once in 100 hundred year global pandemic induced recession upon us, Elon might have met his match.