Today we discuss why the new Bitcoin ETF might be bad for retail investors, and break down the Q3 2021 earnings of Netflix and Tesla.

Why the Bitcoin futures ETF might be bad for you

Let’s be clear here. The new ProShares Bitcoin ETF (ticker: BITO) is not really a Bitcoin ETF, but rather a short term Bitcoin futures ETF. The SEC has not approved any ETF that holds the underlying Bitcoin. In a way, this ETF is similar to oil ETFs that are based on futures contracts, which means it has all the same downsides as well.

What are futures contracts? They are legal agreements to trade Bitcoin at a predetermined price at a specified time in the future. These are financial derivatives that are used to speculate and hedge on price movements of Bitcoin prices. The way ProShares’ ETF works is that the fund buys short term futures (typically contracts that are one month out).When the contract is about to expire, the ETF cannot buy Bitcoin (the SEC does not allow this yet!) and let the contract expire. So instead, the fund sells the current futures contracts it owns and buys new ones.

Which leads us to the next question – what if the new futures contracts that the ETF has to buy are cheaper/more expensive than the ones it is selling?

- If the new futures contracts are priced higher than the ones the ETF is selling, then the fund has to use its cash reserve (which introduces cash drag) to buy the same number of futures. This is called contango.

- If the futures contracts are priced lower than the ones the ETF is selling, then the the ETF generates extra cash flow as it sells the more expensive contracts for the new, cheaper ones. This is called backwardation.

As a result, using futures contracts to track Bitcoin prices is not very efficient. The correlation is never a perfect 1:1.

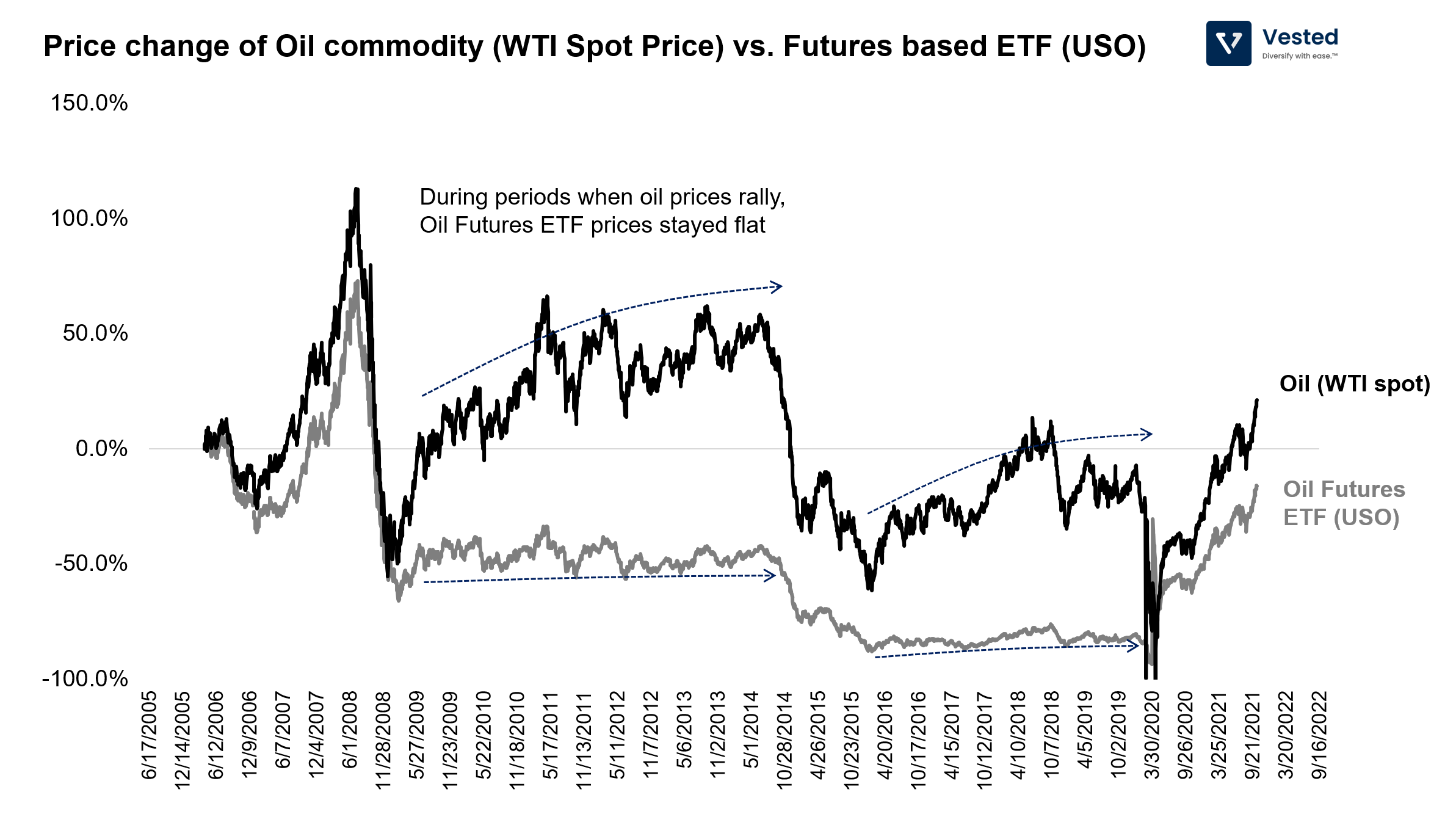

In oil futures ETFs, what you see is that, in the long run, the ETF does not track oil prices well. When oil prices go up, the ETF either does not go up as much or stays flat (see Figure 1).

Regardless of tracking efficiency, an ETF of oil futures may make sense, since the average retail investor cannot physically hold a barrel of oil. But this is not a problem with digital assets such as Bitcoin, as it is completely digital. If one wants to get exposure to Bitcoin, the better approach may be to just buy and hold Bitcoin via a crypto exchange.

Q3 2021 earnings of Netflix and Tesla

The common theme that you’ll see here is that when analyzing the business of companies with good management, it is often better to trust what management says.

Netflix’s Q3 2021 earnings

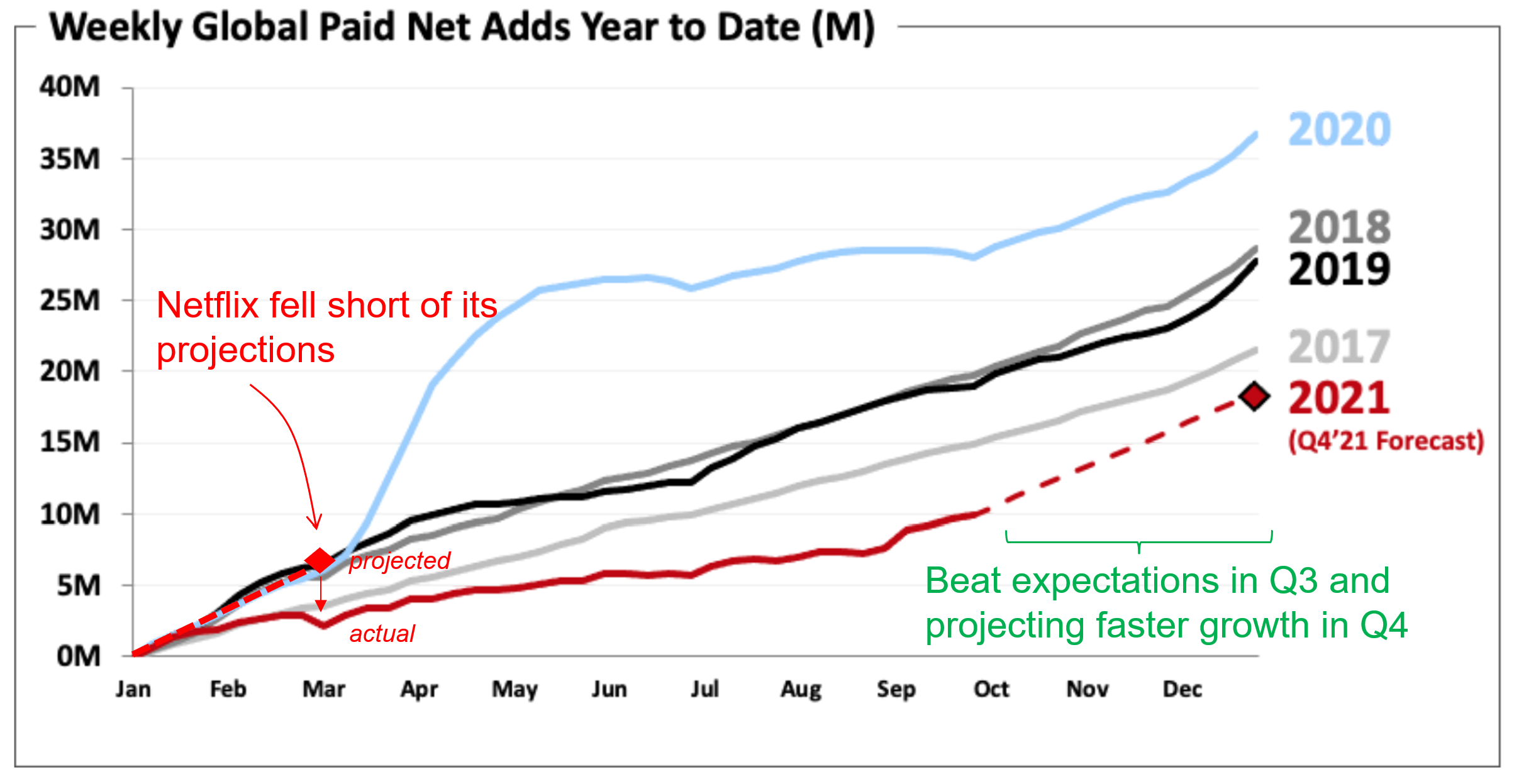

In the first half of 2021, Netflix’s share price took a hit when it missed its Q1 subscriber growth projections. Many media outlets were quick to pronounce that Netflix was being trounced by its competitors.

But management rejected the idea. Netflix saw Q1 growth weakness across the globe, not just in the more competitive US streaming market (where it competes with Disney+, HBO Max, Amazon Prime, Apple TV+, and others). Netflix believed that the slower than expected growth was due to a lack of new releases, as its management wrote in their Q1 shareholder letter (emphasis ours):

“We believe paid membership growth slowed due to the big Covid-19 pull forward in 2020 and a lighter content slate in the first half of this year, due to Covid-19 production delays. We continue to anticipate a strong second half with the return of new seasons of some of our biggest hits and an exciting film lineup.â€

If you have been following Netflix for a while, you should know that the company’s leadership is known to be more right than wrong. For example: In the past decade, Netflix has been telling investors that it was cheaper for the company to finance content creation with debt than by selling its own equity. Since 2011, the company has raised more than $15 billion in junk bonds. Investors doubted this strategy and often cited it as one of the main reasons that the company would fail. But in Q4 2020, the company had generated enough cash flow, so much so that it announced it would stop relying on debt to fund content production. As it turns out, management was correct – debt was not only cheaper, it also was not a risk for the company. Funding content creation using debt was cheaper for the shareholders by a factor of ~6x.

A similar pattern repeated itself In early 2021 – investors didn’t believe what Netflix’s leadership was saying, and the stock floundered in the first half of the year.

And then hit shows started to be released. With a strong slate of releases in Q3, which included Squid Game (now Netflix’s most watched show ever), Netflix regained its subscriber growth rate, outperforming its own projections. The company added 4.4 million new paying subscribers (vs. 3.5 million projected). Similar to last quarter, growth was driven by the Asia Pacific region (Figure 2).

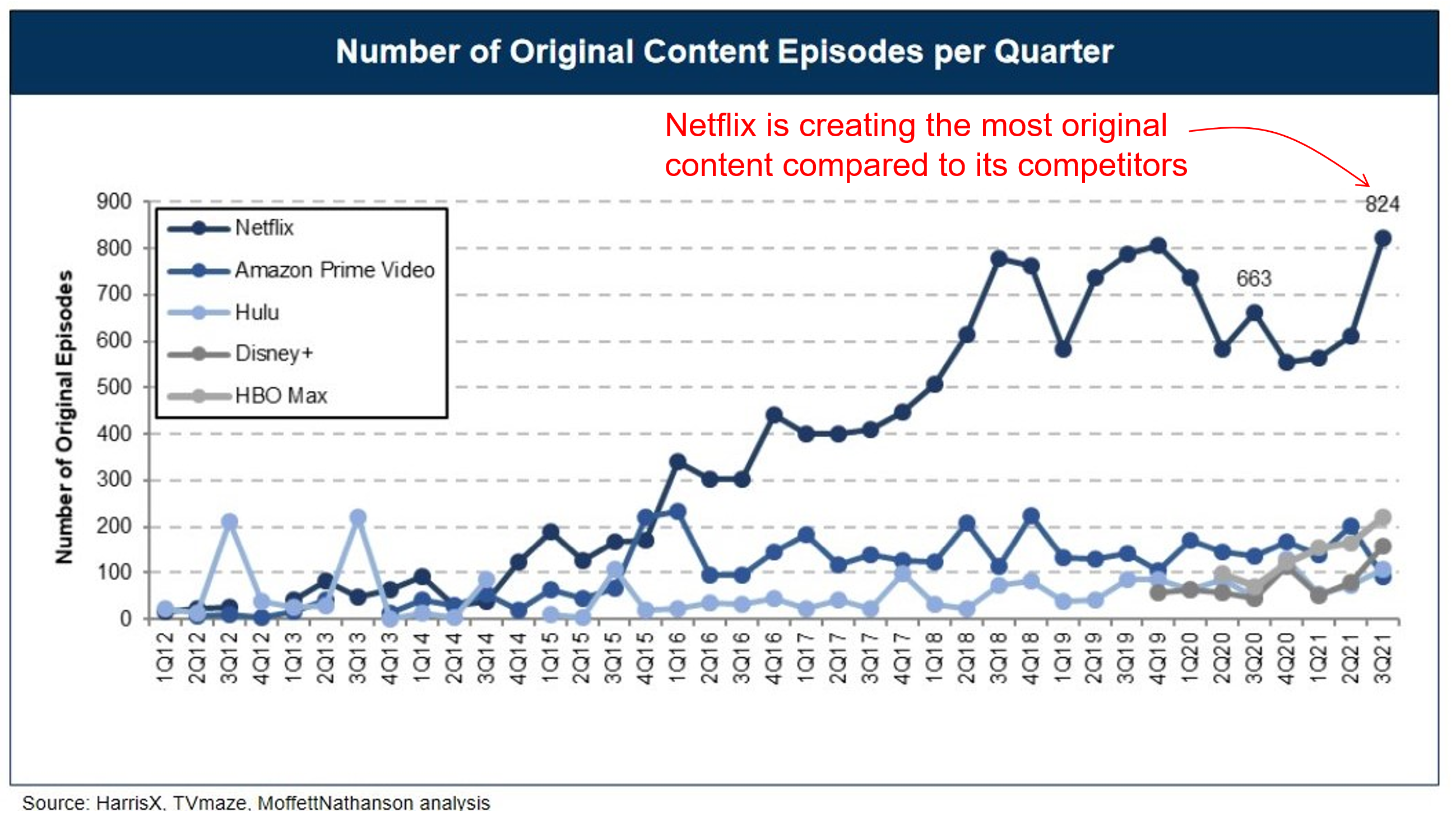

Turns out, management was right again. Having new releases is important to drive growth – the streaming war is increasingly driven by hit shows. Since you don’t typically know which show will be a hit (no one would have predicted that a Korean language TV show about adults playing children’s games to the death would be Netflix’s biggest hit ever), it’s extremely important to have many shots on goal.

And in an increasingly competitive streaming world, Netflix has the most shots on goal (Figure 3).

Tesla’s Q3 2021 earnings

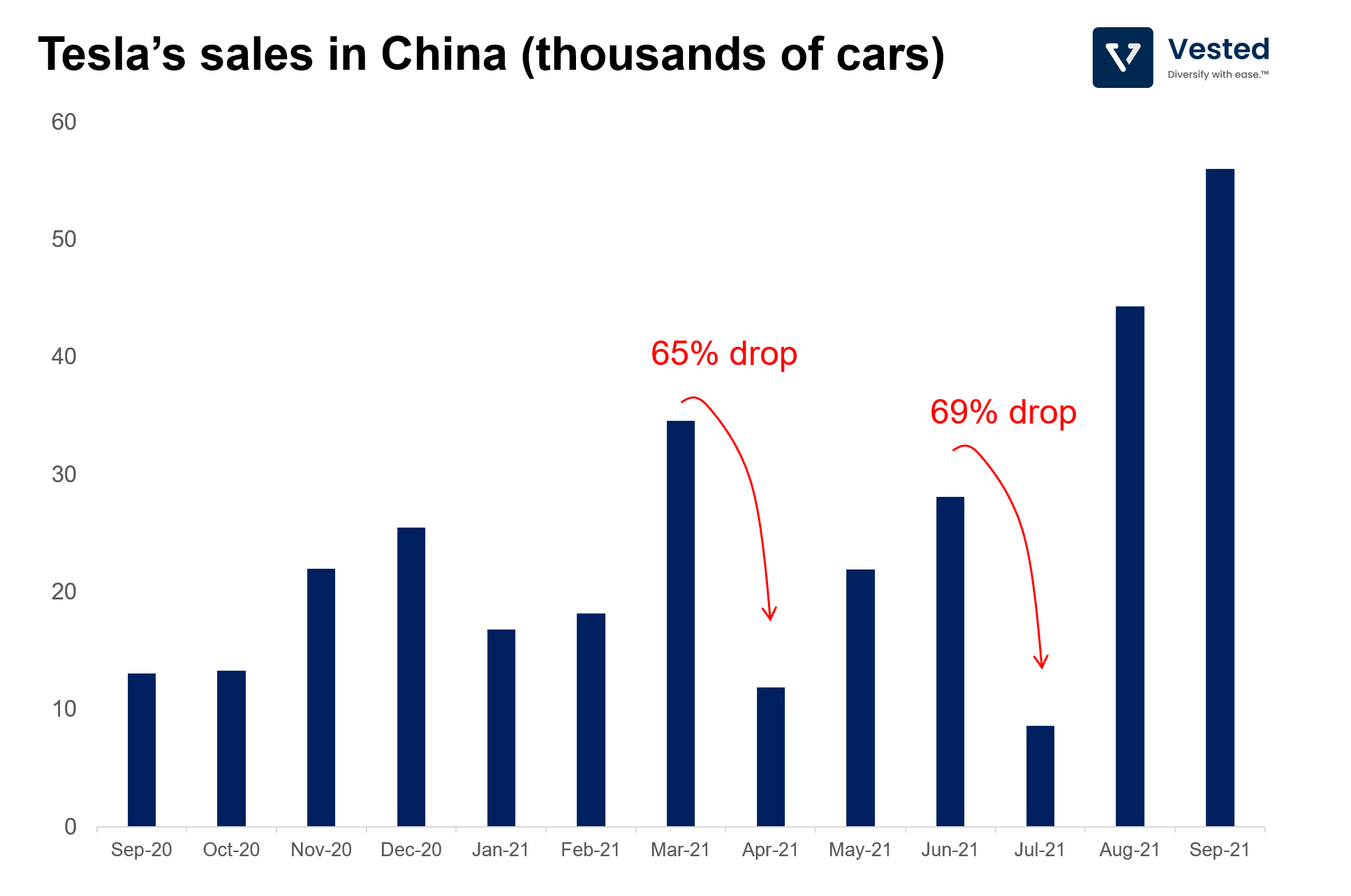

In the first half of 2021, investors were alarmed when they saw that Tesla’s sales in China were decelerating. After a spat of customer complaints and a rebuke from regulators, Tesla’s sales in China declined by more than 65% from March to April. As a result, the company’s share price underperformed the market for the better part of this year.

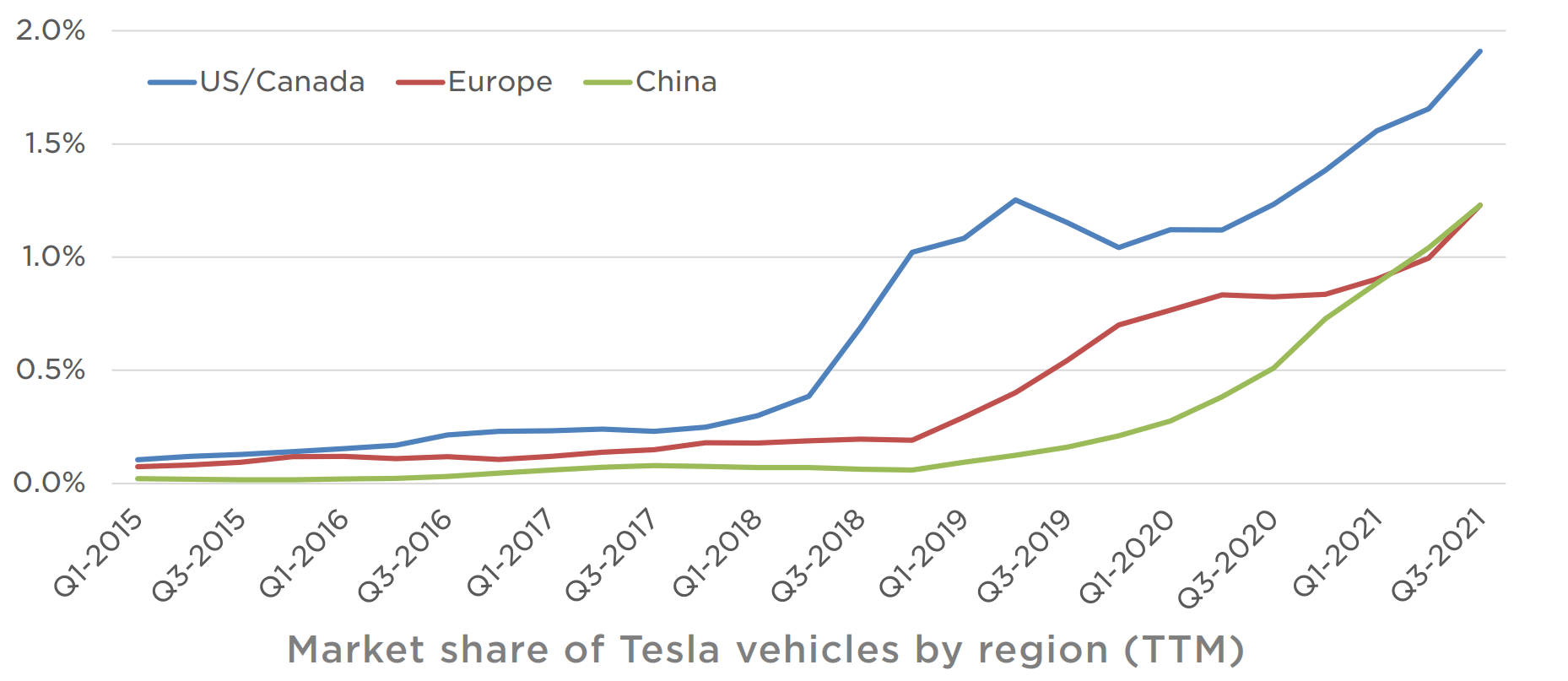

But Elon and Tesla’s management have been telling the public that the decline of sales in China was because the company was prioritizing exports to Europe to navigate chip constraints (Figure 4).

Again, this was another case where investors should have listened to management. Here’s the monthly trend of Tesla’s sales in the Chinese market (Figure 5).

If you look at the month-to-month comparisons of the last month of the quarter (e.g. March 2021 and June 2021) to the first month of the subsequent quarter (e.g. April 2021 and July 2021), you see a staggering drop in sales. Taken out of context, this gives the appearance of declining sales in China. But as Elon tweeted, In the first half of the quarter, cars made in China were mostly exported. And in the second half of the quarter, the company focused on local deliveries.

Some analysts mistakenly assumed that Tesla was losing market share in the global electric car race, especially in China. But the company announced in its Q3 earnings that this was not the case (Figure 6 below). In fact, Tesla’s market share reached its peak in Q3 2021.

Overall, Tesla announced a record breaking Q3. It announced its best ever net income, operating profit, gross profit, and vehicle deliveries. It generated $13.8 billion in total revenue (up 57% year-over-year) and delivered more than 241,000 cars (a 64% increase year-over-year).

Two more notable takeaways from Tesla’s Q3 earnings report:

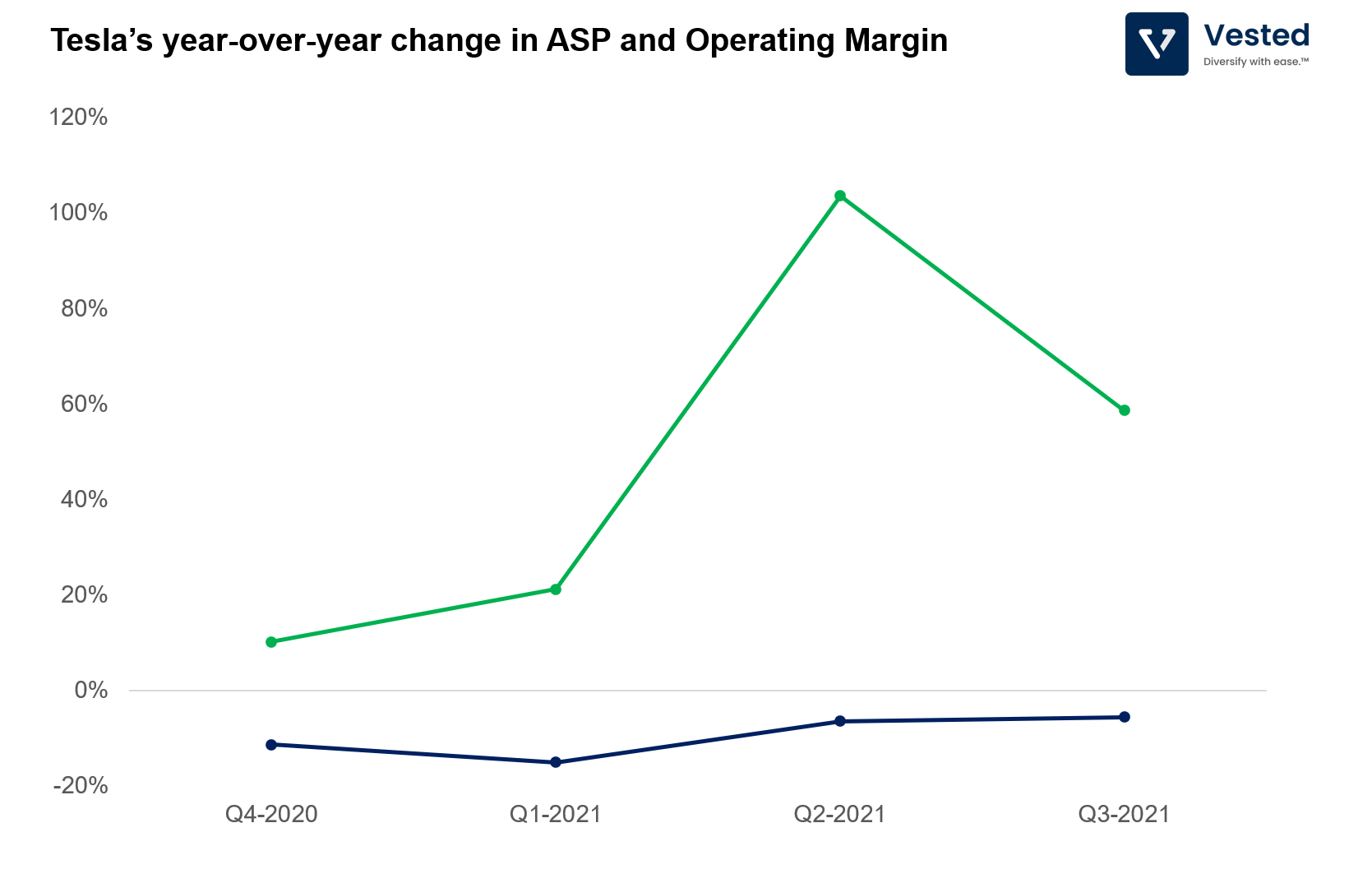

- Despite global supply chain constraints and increased raw materials costs, Tesla posted record profitability. It posted a 14.6% operating margin (a year ago, operating margin was 9.2%). This is due to increased production output of its Giga factory in Shanghai. In fact, the increase in operating margin (green line) is outpacing the decline in average selling price (blue line). As Tesla sells more mass market cars, the average selling price that the company sells at declines, and that declining average selling price, without increasing efficiency, will hurt profitability.

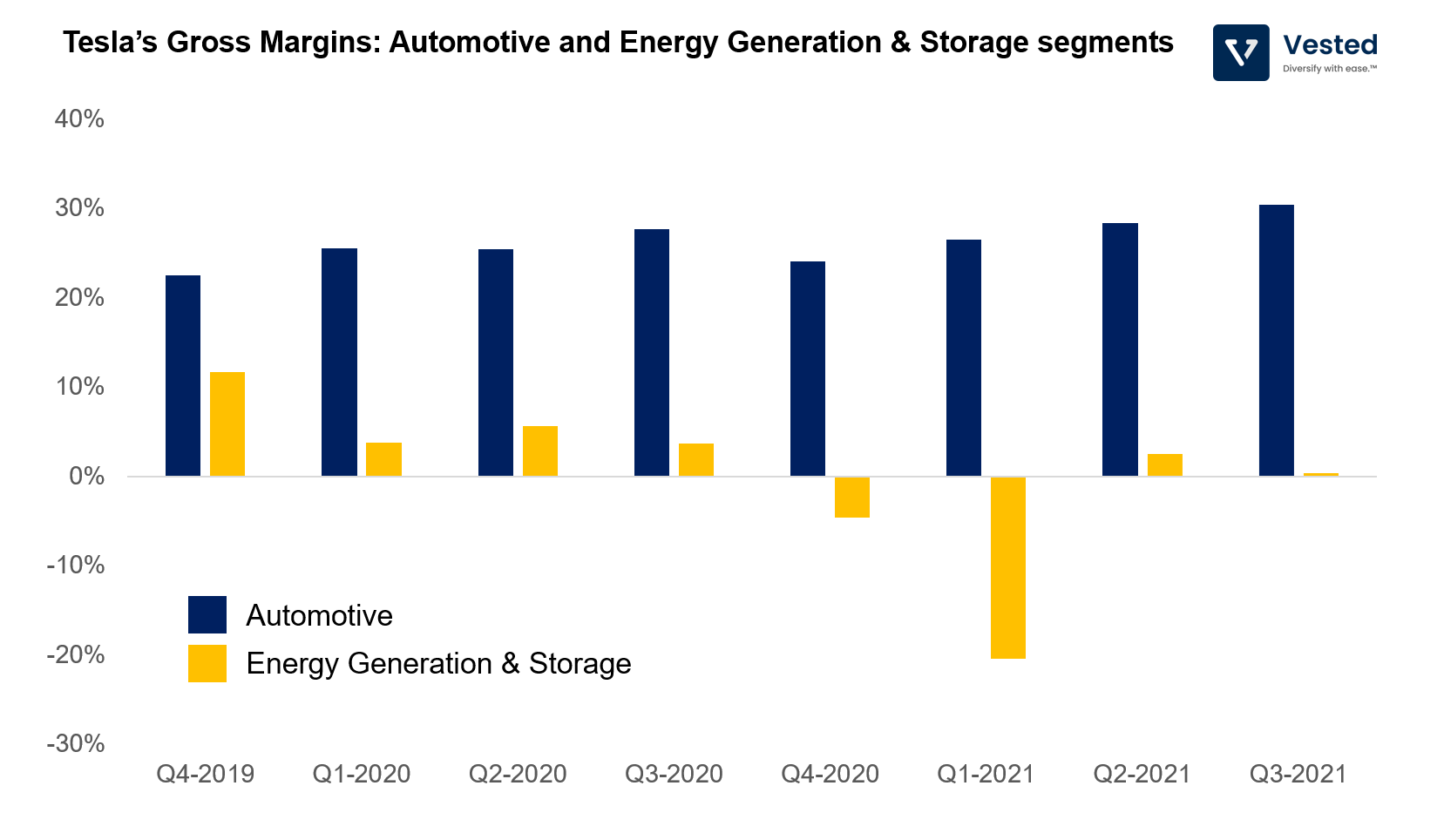

- Tesla’s gross margins for the energy generation and storage segment (yellow bar in Figure 8 above) has turned the corner. In Q1 2021, customers complained and the company received criticism for increasing the price of its solar panel (Tesla partially reversed the price increase after being sued). The company increased its price because installation was far more complex than it had initially predicted, leading to cost overruns and negative margins. It seems that the company has turned a corner, however. Margins for this segment have been positive in the past two quarters (yellow bar – Figure 8).

Thanks for reading. As you can see in the Q3 earnings results above – business outcomes often take quarters or even years to reveal themselves. This is why making short term bets or monthly rebalancing of one’s portfolio is typically a bad idea, as it can lead to chasing one’s own tail.