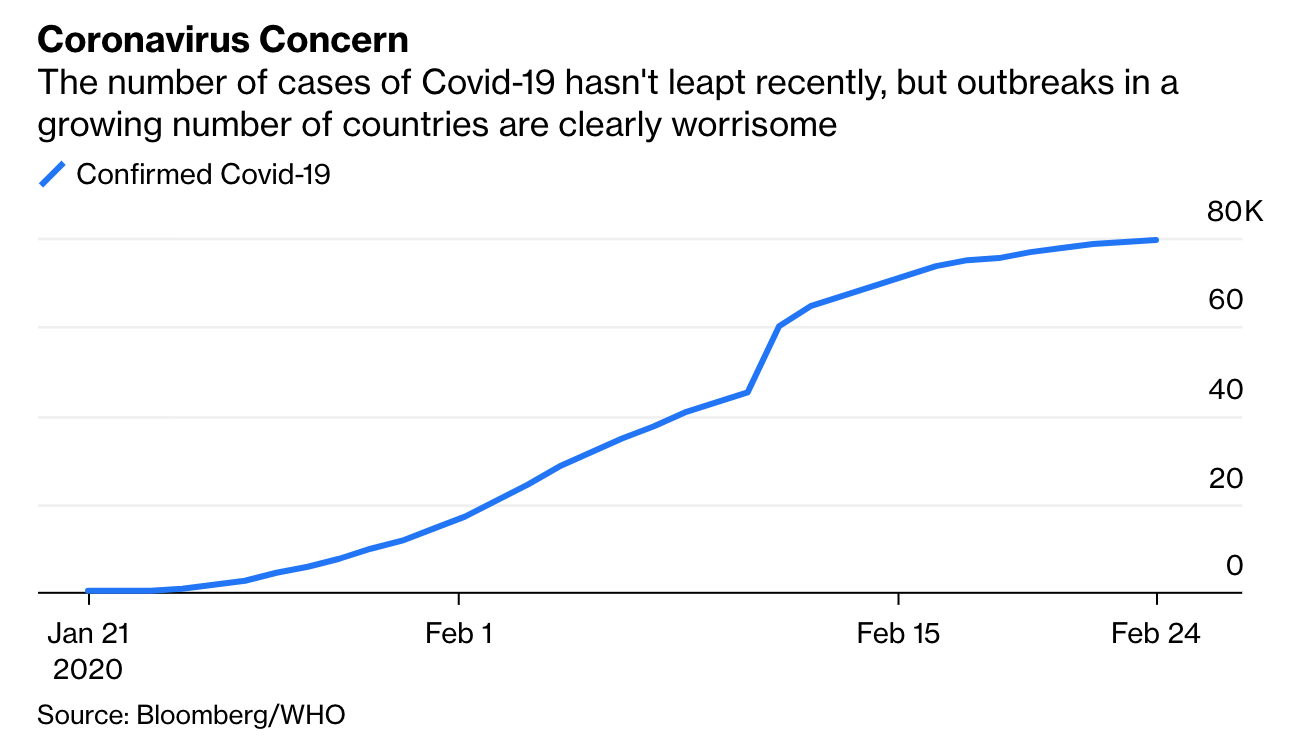

The timeline

Figure 1: the spread of COVID-19. Source is from Bloomberg

After a slew of reports of new cases in South Korea and Italy, and the recent announcement that patients can still be contagious even after recovering from the disease, the global stock market reeled. Investors are re-adjusting their estimates of how fast the global economy can recover from the virus-related disruptions .

In this article, we discuss the potential impact on the economy as a result of this turbulent period.

One possible lasting impact

Diversification of supply chain

If the US / China trade war has not made companies rethink their supply chain strategy (to not be overly reliant on China), the spread of COVID-19 will. Recently, the French government ordered a review of French firms’ “over-dependence†of China (singling out French automakers and pharmaceutical industries specifically).

Meanwhile, Samsung shut down production in China – moving it to Vietnam. The company also announced plans to open the largest mobile phone factory in Noida, India. To be clear, Samsung’s move out of China is not due to the COVID-19 spread, rather, it is a result of a multi-year decline in market share (Samsung hasn’t been able to successfully keep up with local Chinese phones) and wage increases in China (wages for assembly work in emerging Vietnam and in India is about half that of China).

In the short and medium term, what’s going down?

Auto sales

Auto sales in China collapsed this month, with the Chinese Passenger Car Association saying that sales at dealerships plummeted 92 percent in the first half of February compared with the same time last year. Decline of auto sales in China might be especially bad for Tesla, as the company has a big dependence on China, both on the supply (it just opened a new factory in Shanghai) and demand side (10 – 15% of its revenue comes from the greater China region).

Consumer goods

The consumer goods sector will be severely impacted as foot traffic in retail stores have decreased significantly. Adidas, the German sportswear maker, said that its mainland China business had been decimated by the outbreak as sales in the region dropped by about 85% since Chinese New Year.

Hotel, airlines, and oil

The spread of the virus in China has halted travel of Chinese tourists to global destinations. So far, France has seen a drop of 30 – 40% in the number of tourists. This will have a significant impact on the country’s economy, as tourism contributes about 8% towards its GDP.

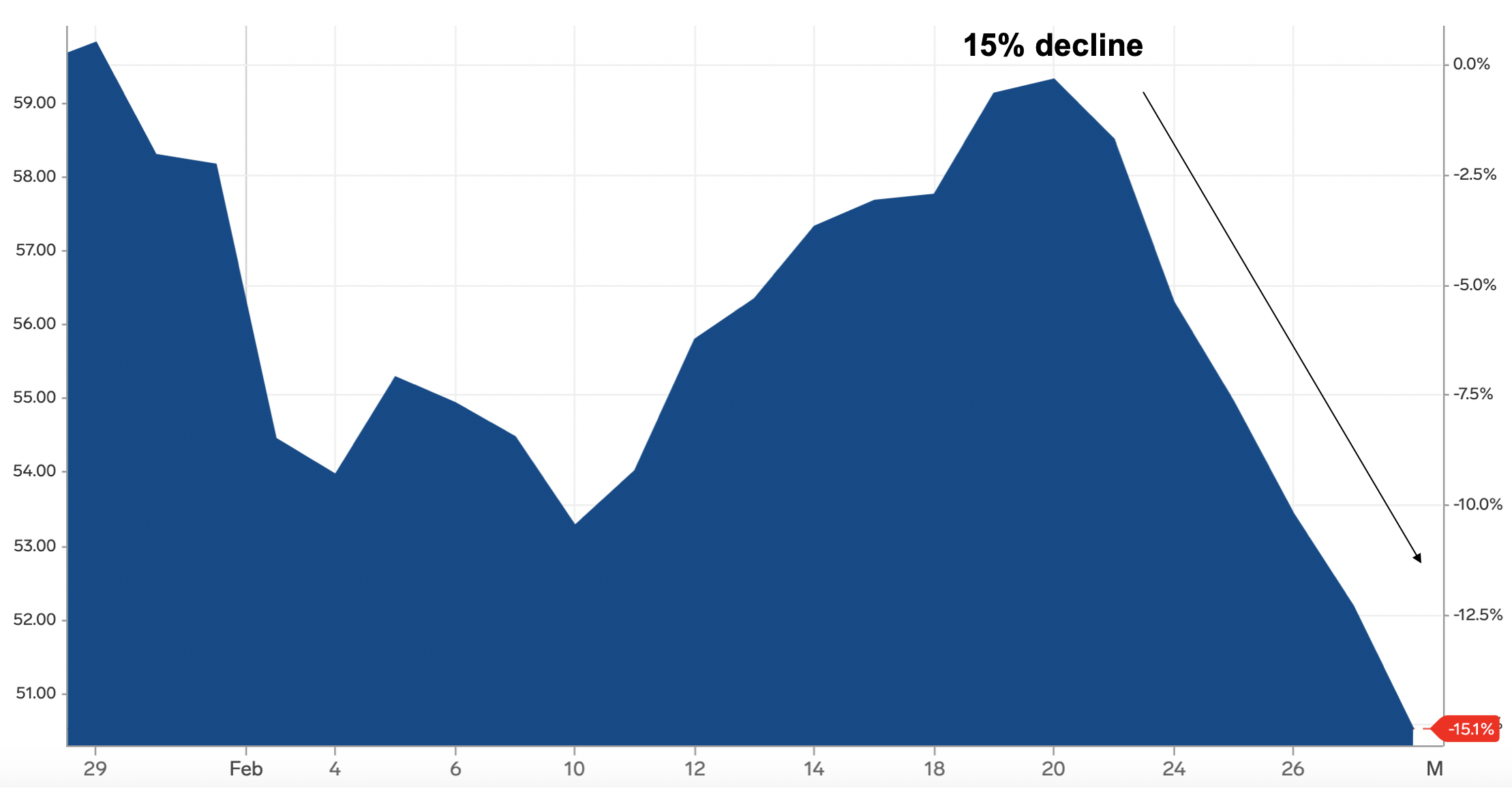

Disruptions in China will severely impact the oil sector as well, as China is the world’s largest oil importer. Since February 20th, Brent Crude prices have declined by 15%. Declining oil prices is good news for India, however, as the Indian economy can be very sensitive to oil prices.

Figure 2: Oil prices (Brent Crude) declined by 15% in the past 9 days

In the short and medium term, what’s going up?

Gaming apps in China

What can you do to fight boredom when you’re stuck at home for weeks? Play games. The average weekly downloads of gaming apps during the first two weeks of February has gone up 40% (compared with the average for 2019). Shares in Tencent, China’s largest mobile games provider, is currently near a 52-week high.

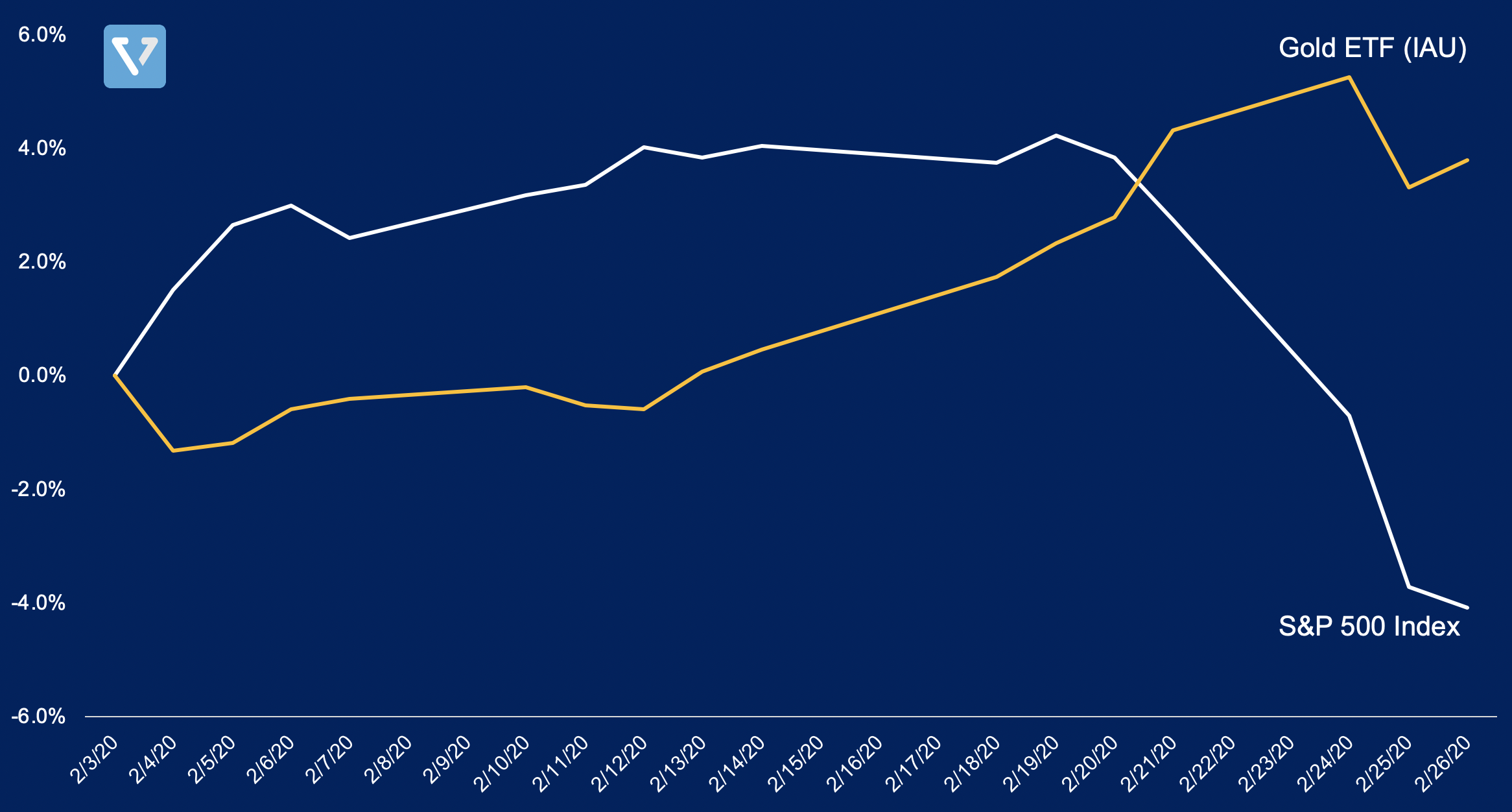

Gold is up

Figure 3: Percentage price change of S&P 500 index vs the iShares Gold Trust ETF (ticker: IAU) for the month of February

The race for a vaccine: Gilead Sciences

WHO officials commented that Gilead’s experimental drug, remdesivir, is a promising candidate to treat the new coronavirus. The drug has been fast tracked to a clinical trial in China. The market might be overreacting, however. Gilead’s market cap jumped US $12 billion in February alone, a figure that is likely far greater than the revenue gain from the drug itself. Analysts project that even if the drug passed clinical trials and proves to be effective, the result will likely be a one-time revenue of about $2.5 billion.