Outcome of the US Election

In this article, we will be discussing the outcome of the US election and its implications on the market, and average revenue per user (ARPU) tech giants generate in the US.

This past week, the world’s attention was on the US election. For our readers abroad, the control of three bodies of the US government is at stake:

- The US Presidency: Joe Biden has been elected as the 46th President of the United States. Despite unsubstantiated claims of voter fraud by Trump and possibilities of recounts (in the states of Wisconsin and Georgia), it is unlikely that the outcome will change. Biden’s lead in vote count is insurmountable.

- The US Senate: for the remainder of 2020, the Republicans will hold on to the senate. In January 2021, a run-off election will be carried out for two senator seats in the state of Georgia. If the Democrats win these two seats, then the senate will be evenly divided between the two parties, and the new Vice President Kamala Harris will be the tie breaker – which would give the Democrats control. The run-off elections are the Democrats’ last hope to regain control of the senate – at least until the midterm elections in 2022.

- The US House of Representatives: even though they lost several seats, the Democrats will hold on to the control of the House.

As it stands, the scenario for the next few months is a divided government where the Democrats control the presidency and the house and the Republicans control the senate. This means:

- More gridlock in Washington next year. Although the release of the next stimulus bill can still be expected this year, which will buoy the stock market further, the passing of a much larger government spending plan (the US $2 trillion spending in green energy and infrastructure that Biden wants to roll out) will be much slower. In the short term, investors may seek safe haven in gold.

- Unlikely that tax increase will be passed. We discussed previously that if elected, Biden wants to increase corporate taxes and taxes for rich Americans. It is unlikely that this will happen immediately, which is good for corporate profits.

- Good for big tech. Both parties want more accountability for the content published on social media platforms. But their desire for censorship deviates. The Democrats want YouTube and Facebook to censor more, while the Republicans feel that their voices are being muted by the tech giants – and therefore want less censorship (despite evidence to the contrary). This means that both parties will be at an impasse in enacting new regulations and policies around the issue, which means business as usual for YouTube and Facebook.

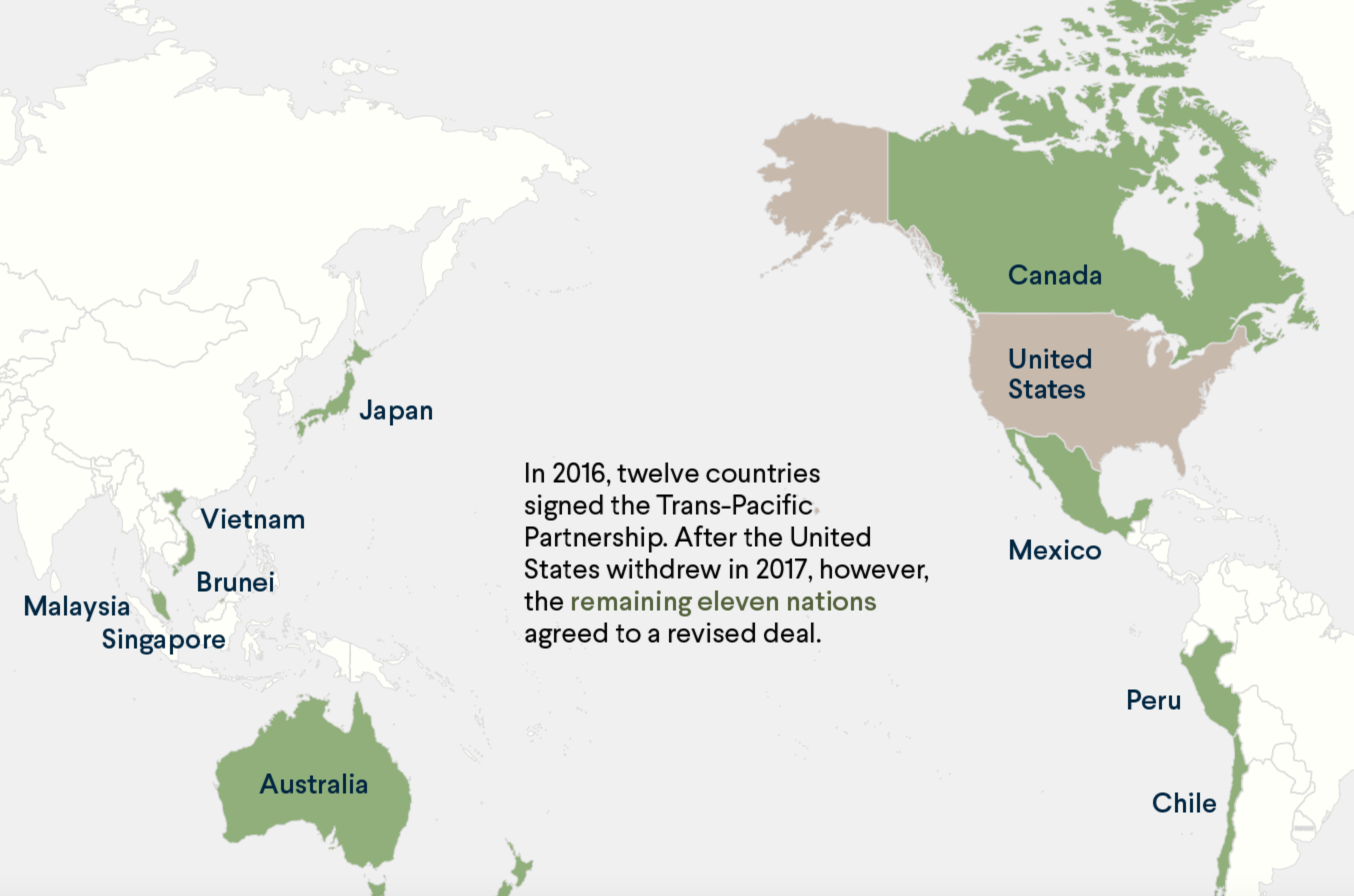

- Good for Free Trade, immigration and the Paris Climate Accord. Biden has a much more open view on these issues, and he can influence these issues through executive orders (and would therefore not be affected by the divided government). He has talked about re-committing to a modified Trans-Pacific Partnership agreement (a trade agreement between 12 countries covering 40% of the global economy, notably excluding China. See Figure 1), which could be a positive for emerging market economies. Biden also has the ability to push the US to quickly rejoin the Paris Climate Agreement, which pledges to limit global warming to 2 degrees celsius. This can be a boon for the renewable energy sector.

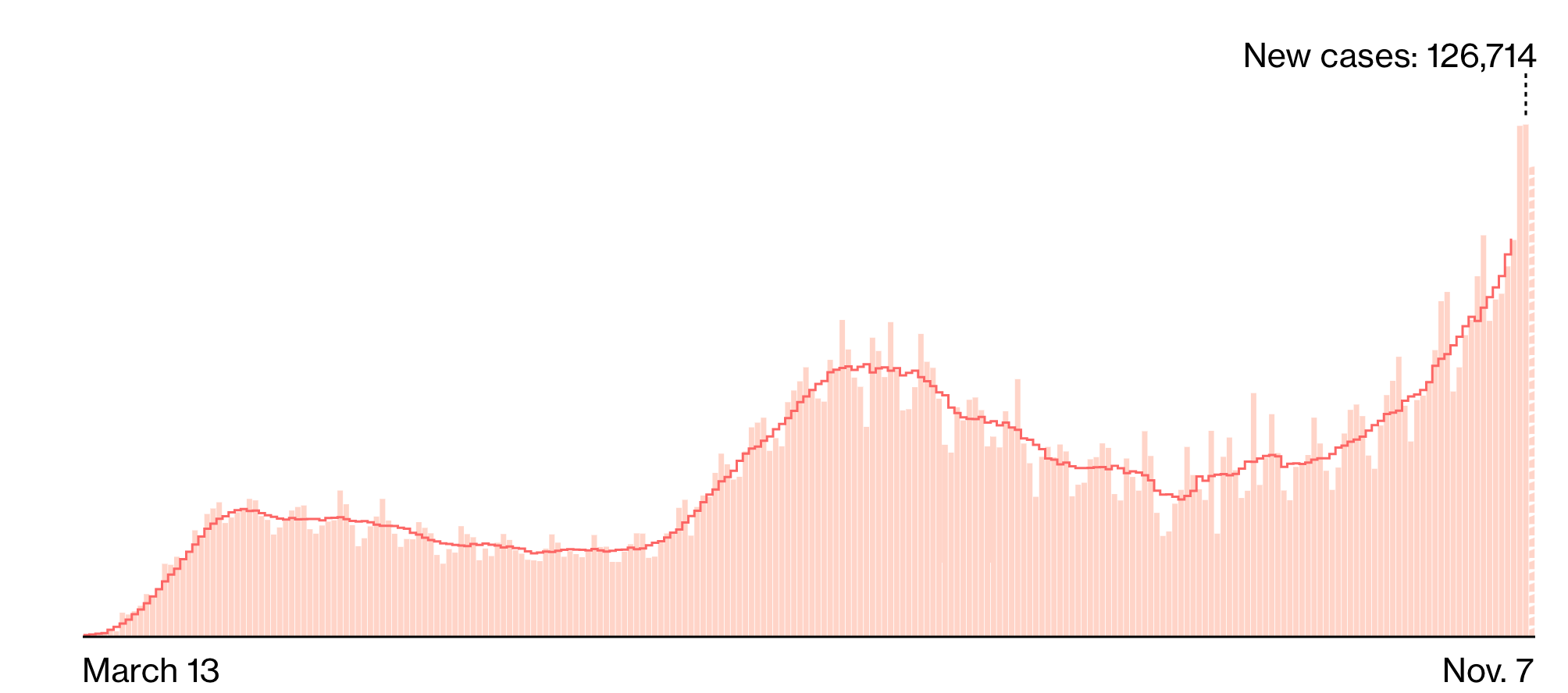

- Weakening of the Dollar. This is not because of Biden’s victory, but more so due to the continuous increase in COVID cases, which reached a new all-time high in the US (see Figure 2 – daily new cases is about 80% higher than its peak in July 2020). To revive the economy, the government will pass more stimulus, and with the Fed committed to keep interest rates negative for the foreseeable future, the USD will weaken. Who benefits from a weaker dollar? Riskier assets such as stocks, export-focused industries in the US, and emerging economies.

Average Revenue Per User

Some countries (most recently China) have used access to their vast domestic market to gain leverage in negotiations or force technology transfers.

Note that although China is the most recent country to do this, the practice is decades old (Japan used the same playbook in the 80s), and, as outlined in Joe Studwell’s book, How Asia Works, is employed by emerging economies to accelerate domestic technology development.

But, for most companies, users in the US are still the most valuable. Consumers in the US spend a lot – they contribute to about 70% of the US GDP.

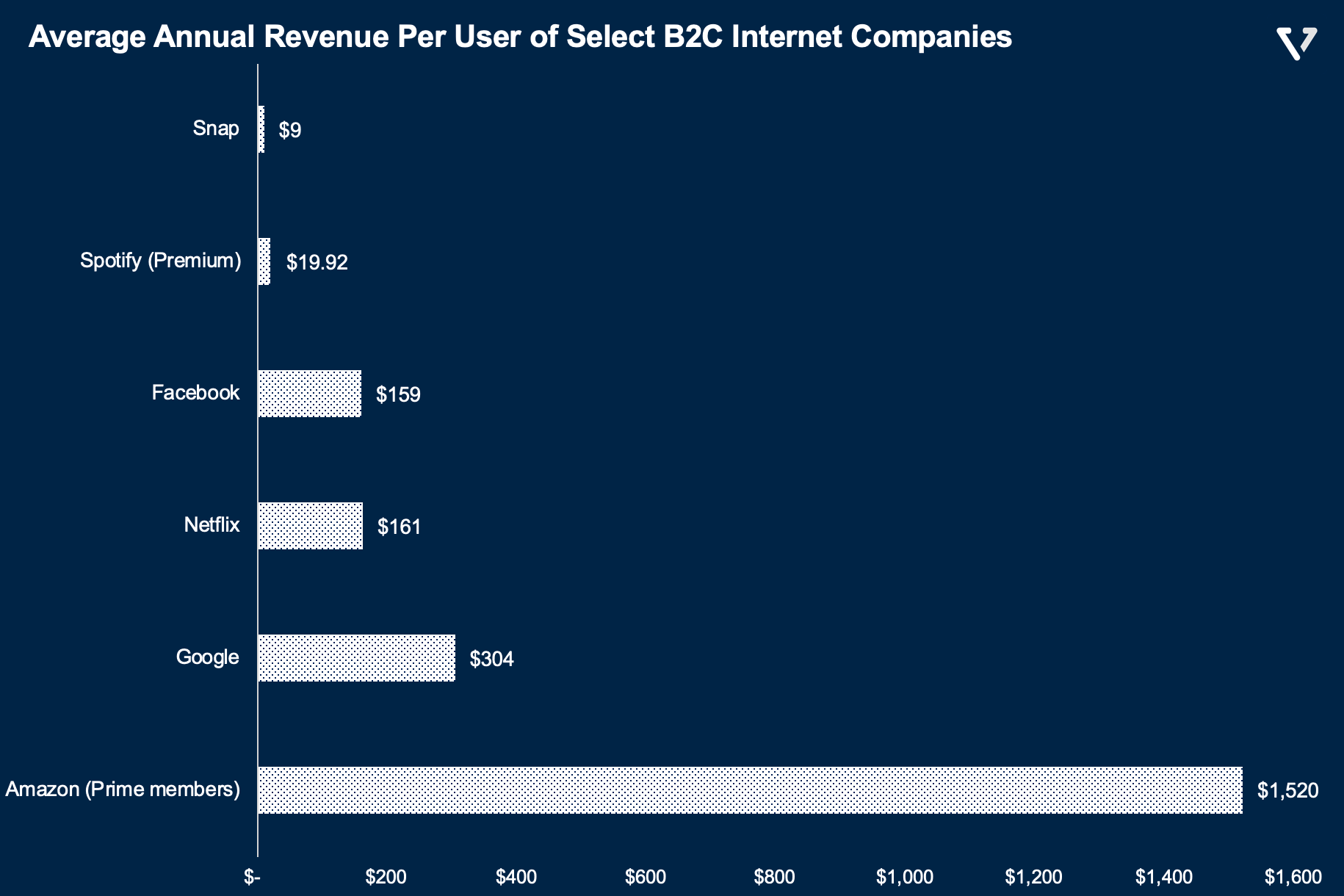

In Figure 3 below, we summarize the US Average Annual Revenue Per User (Annual ARPU) of the different technology companies that serve the US consumers directly (B2C).

Some thoughts:

- Amazon generates a lot of revenue on a per-prime-member basis. With more than 126 million Prime members in the US, these users spend more than US $1,400 per year on ecommerce on top of the US $120/year they pay in membership. But since this is ecommerce, the profitability per user basis is likely much lower than Google’s.

- Google still generates the bulk of its revenue from advertising. It commands more than 88% search market share in the US. This translates to almost 250 million Google users.

Both Facebook and Google form a duopoly in digital advertising in the US (and globally). Nevertheless, Facebook’s ARPU is still half that of Google.