US, China, and India Bounce – Amazon’s Just Walk Out – FB’s and Google’s revenue to be impacted by COVID-19

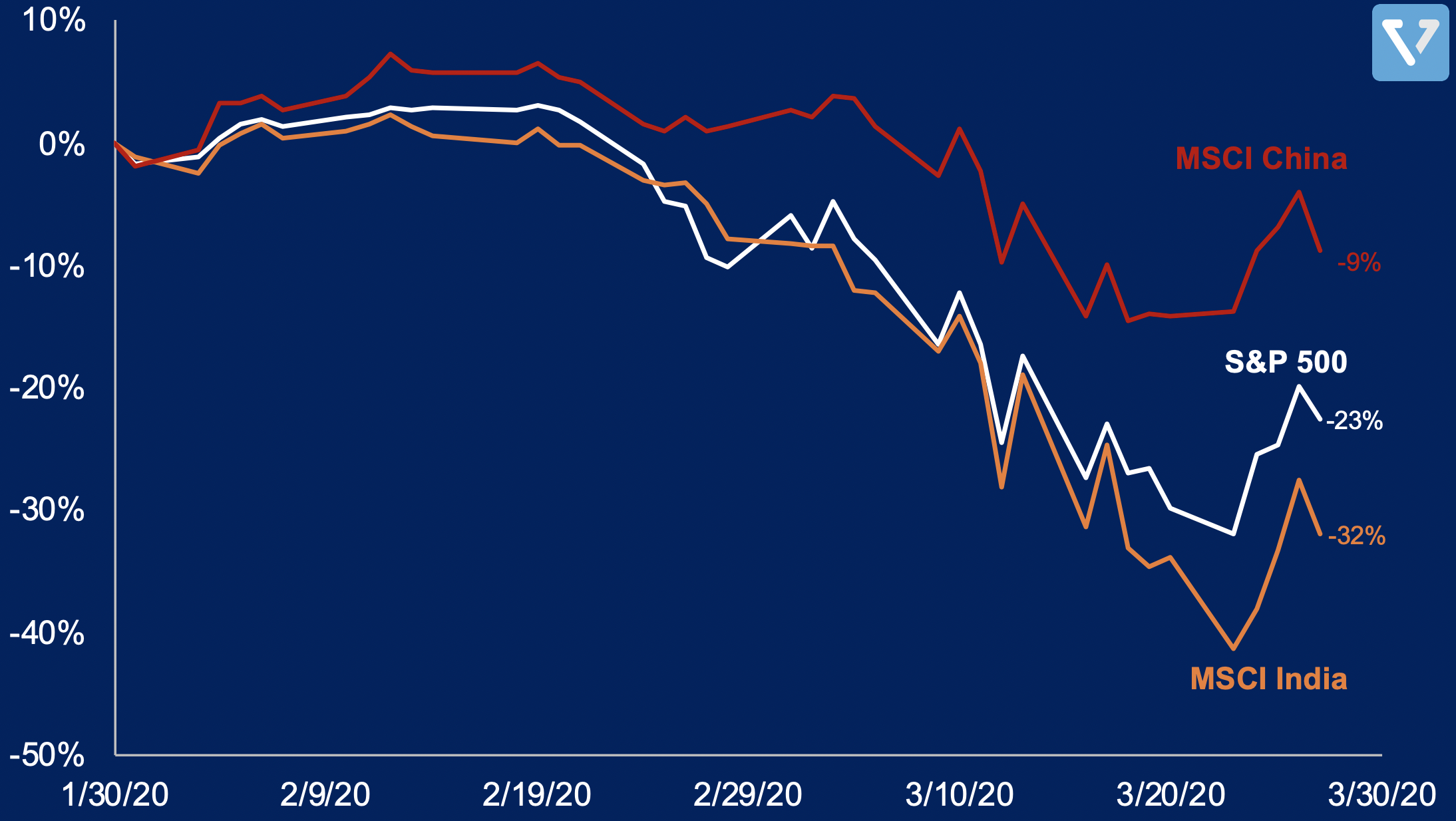

China vs. S&P 500 vs. India

Even though the number of COVID-19 cases continue to increase globally, the equity markets around the world are making a slight recovery, powered by announcements of stimuluses from governments around the world. Figure 1 shows the 3-month return profiles of India, China and the US stock markets (USD based). China is down 9%, while the US market and India are down 23% and 32% respectively.

It is yet to be seen if this is the bottom

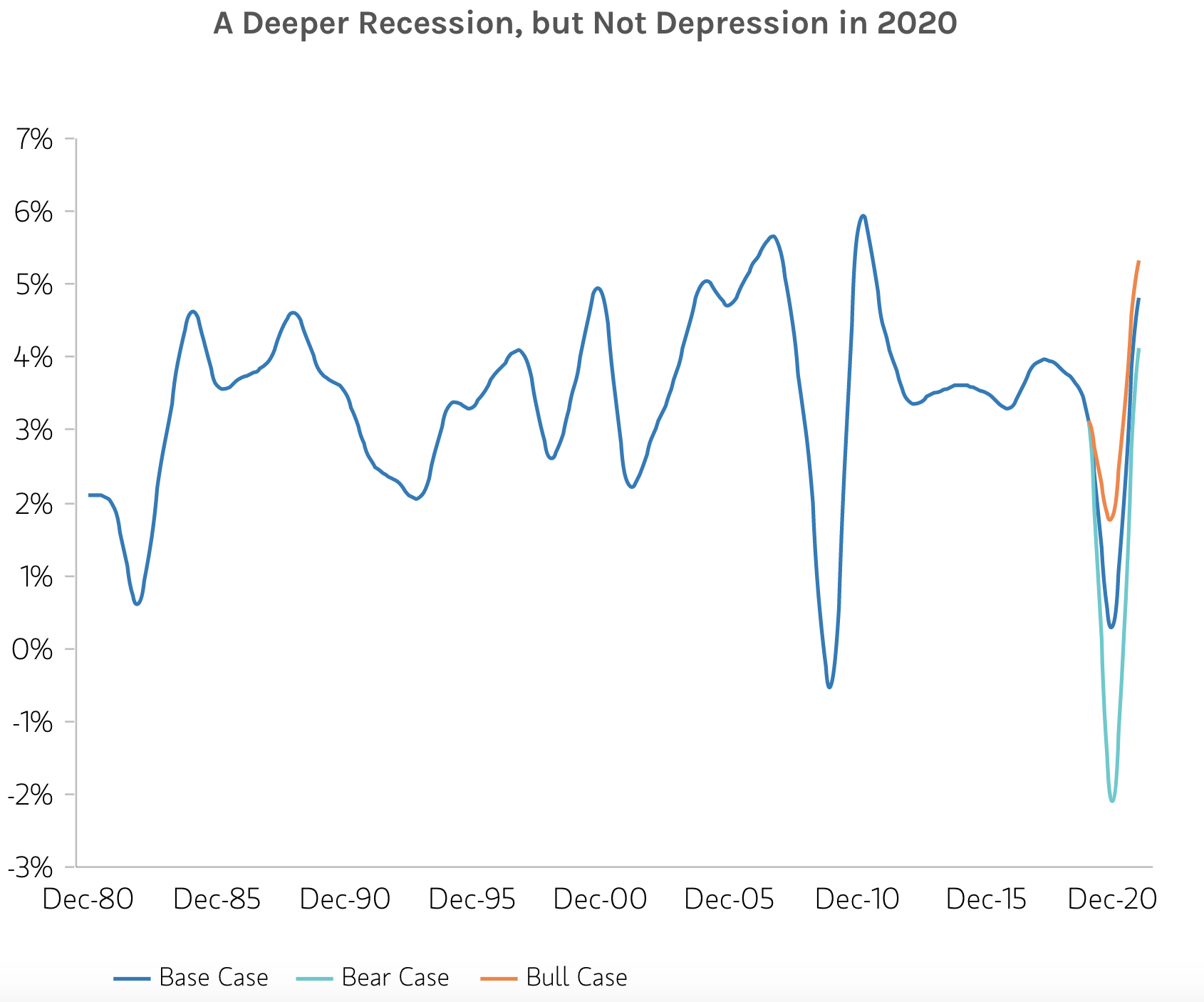

Morgan Stanley Research believes that the economic disruption will be concentrated in the first half of the year, and that the global economy may rebound quickly due to swift policy responses (which are much faster than past crises). One key assumption to their model, however, is that COVID-19 will peak in April/May 2020.

Fundamentally, this recession is caused by a health crisis. Therefore, the fastest way to get out of this recession is to contain the pandemic. If we cannot slow the pandemic, prolonged lockdown and social distancing will be necessary. We have already seen one such case – the US government has extended guidelines for social distancing up to the end of April 2020 – one month longer than the initial 15-day timeline. Prolonged lockdown is damaging to the economy and may cause a deeper recession, and the uncertainty it creates will continue to fuel short and medium term volatility in the global markets.

Another industry to be hit hard by COVID-19

Do you know the first thing a business would do when all things grind to a halt? Stop advertising. Other than travel, services, hospitality and restaurants, it appears that the advertising industry will also be severely impacted by the lockdown. As many companies have halted advertising, companies such as Google, Facebook, and Twitter will see Q2 earnings negatively impacted.

Facebook has given a revenue warning. While the company has seen usage on its platforms go up, it is seeing lower monetization, especially in countries that have been stricken by the lockdown. Six out of the largest ten countries that spend the most on Facebook have been on lockdown.

Meanwhile, Amazon, one of the largest ad spenders on Google search, has ceased advertising altogether.

One of the strengths of digital advertising is how easy it is to get started – but this ease of use also becomes a liability in times of crises, as it is very easy to turn off advertising. Nonetheless. Facebook and Google have a duopoly in digital advertising (these two companies take about 60% of all digital US ad spend) – a position that they will continue to hold in the foreseeable future.

Amazon’s Just Walk Out

Last year, we covered Amazon’s cashierless store technology and strategy. At the time, Amazon’s strategy was to aggressively expand their stores nationwide – up to 3000 stores in 2021. But thus far, the company has only announced 18 new stores and has shut down 87 of its pop-up kiosks.

Is there a change in strategy? Perhaps.

Amazon recently announced a new technology offering called Just Walk Out. It is a technology solution that enables shops and grocery stores to create their own cashierless checkout experience.

Using this technology, any retail store can enable customers to enter the store using only their credit card – no separate account needed. The technology then detects what products shoppers take from or return to the shelves and keeps track of them in a virtual cart. After shopping, customers can walk out of the store, and their credit card will be automatically charged. Because this solution is being sold to third party retailers, the company has taken an approach that preserves customer privacy – Amazon only collects data needed to provide shoppers with an accurate receipt. According to Amazon, the data that it collects during this experience is similar to typical security camera footage.

If we look back in the past, we see that Amazon has a history of purchasing unique technology solutions and using them to make their core retail business more defensible. For example, Amazon acquired Kiva Systems to improve its own logistical operations and stopped selling the solution to others.

It appears that after experimenting with its own stores, Amazon is taking a different approach. The company is making Just Walk Out technology widely available to other retailers. Amazon claims that the technology can be integrated into existing stores within weeks. Furthermore, they announced that they have already signed agreements with several undisclosed retailers.

There are two implications of this horizontal business strategy:

- This strategy is more inline with their AWS business (vs. the retail business). With this strategy, Amazon wants to become the infrastructure and technology provider for retailers rather than keeping the benefits for its retail operations (which likely has slim margins). This may translate to higher margins.

- This new approach can lead to a wider adoption of Just Walk Out, which can accelerate the feedback loop that is needed to improve their underlying machine learning algorithms.