Our coverage of COVID-19 and its impact on the global economy continues in this week’s email.

The US is taking more precautions to slow down the progression of COVID-19. Multiple states have banned large gatherings. Professional sports leagues (NBA, NHL, Premier League) have cancelled games and suspended their seasons. The economic impacts are yet to be fully realized, but panic seems to be spreading in the wider market.

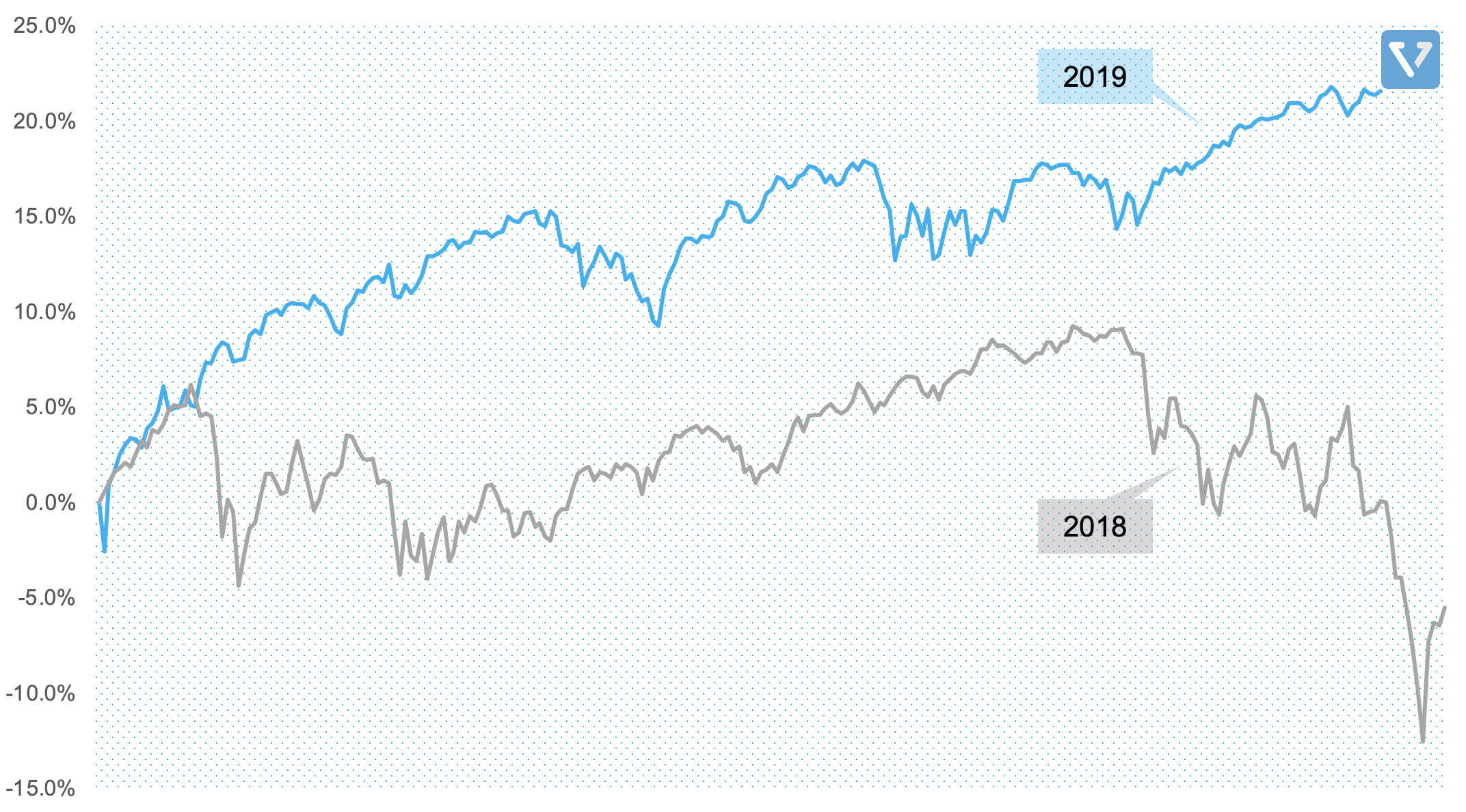

One of the reasons that the market drop is much faster this time around (vs. the 2007 crisis) is because the impact on cash flow of businesses will be immediate. As people are unable to travel, being quarantined at home, revenue to businesses will drop precipitously. Foot traffic to retail shops, restaurants, movies (box office revenue fell to 20 year low) and all the supporting businesses will stop. People will delay discretionary spending, which in turn affect other businesses.

Likely, small and medium sized businesses will be impacted first. These businesses typically have a much harder time accessing additional cash to support operations if revenue falls. Other businesses with poor cash flow or businesses that are highly levered (have a lot of debt) may have a hard time paying down their debts.

In the absence of cash flow, businesses must access funds from elsewhere to ensure continued operations. They typically acquire cash through loans (by borrowing from banks or issuing their own bonds). And in an environment where risk is high, banks are more hesitant to lend businesses money. If this cycle continues, credit will seize, businesses will collapse, unemployment will increase, lengthening the depth of the recession.

Fed slashed interest rate to 0%

In order to help support the market and provide liquidity in the financial system, the Fed (US central bank) announced that it will reduce interest rate to 0%. It will also restart quantitative easing (QE) and purchase US $700 billion worth of US treasury and mortgage backed securities. The goal is to encourage banks to lend to businesses and households that might be affected by coronavirus.

The Fed has signaled that it will use all the tools at its disposal to calm the financial market and prevent the health crisis from turning into a broader financial crisis. Nonetheless, it is still an open question whether this additional credit will trickle down to businesses.

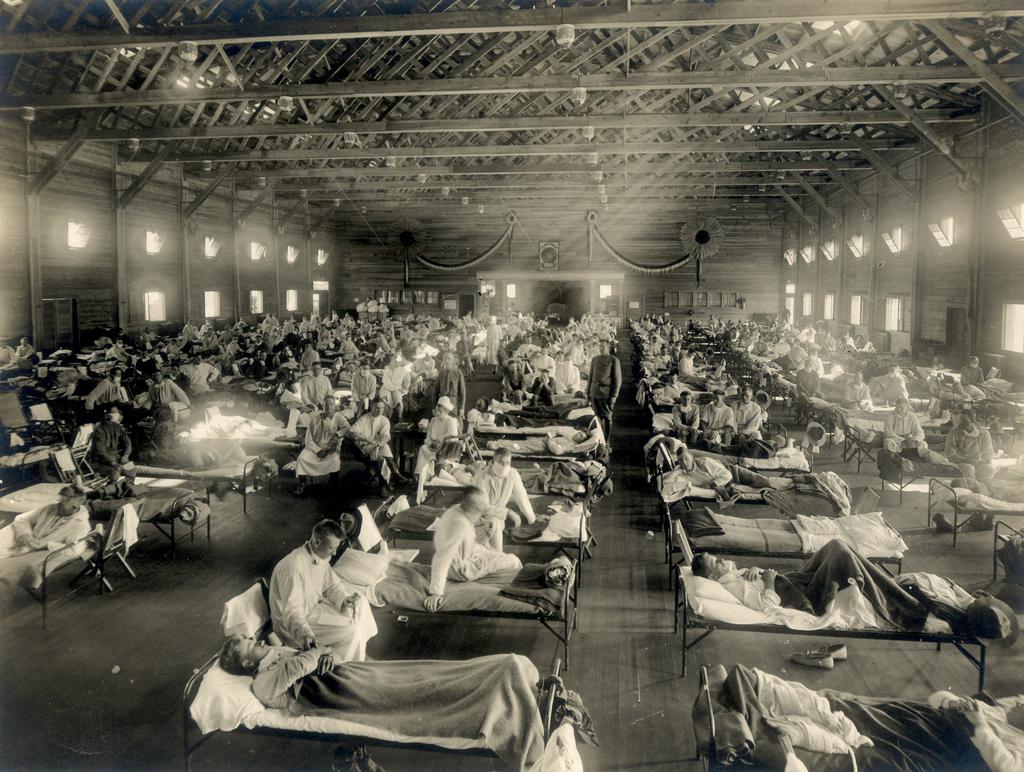

Lessons from the 1918 flu pandemic

Image Attribution: By Otis Historical Archives, National Museum of Health and Medicine – Emergency hospital during influenza epidemic (NCP 1603), National Museum of Health and Medicine., CC BY 2.0

When comparing the COVID-19 pandemic to outbreaks in the past, the 1918 Spanish flu pandemic comes to mind. In many ways, the Spanish flu (lasted between 1918 – 1920) is worse:

- The disease killed 0.8% of the US population at that time (675,000) and more than 40 million people worldwide

- Unlike COVID-19 that affects older people (and people with compromised immunity) more severely, the Spanish flu’s death rate was reported the highest amongst individuals with the strongest immune systems (out of 272,500 male influenza deaths in 1918, nearly 49% were aged 20 – 39)

- The outbreak happened during World War I, and thus, troop movements worldwide helped spread the disease

The responses of the government and communities were similar to today’s response, however. Schools and churches were closed. Large community gatherings were banned. Large cities were shut down. At the local level, the impact to the economy appears to be similar. The service and entertainment industries suffered double-digit losses in revenue, while other businesses that specialized in health care products experienced an increase in revenues. Nonetheless, it is difficult to draw a larger conclusion on the impact of the Spanish flu on the stock market – because the timing overlapped with World War I.

The return of Value Investing?

For a lot of businesses, lack of cash is likely the largest risk during this turbulent period. As such, most investors might be looking to find safety in businesses with good fundamentals (strong cash flow, clean balance sheets, reasonable valuation, etc) that are priced fairly (i.e. Value companies). One way to do this is to return to value investing (which has underperformed when compared to Momentum investing)

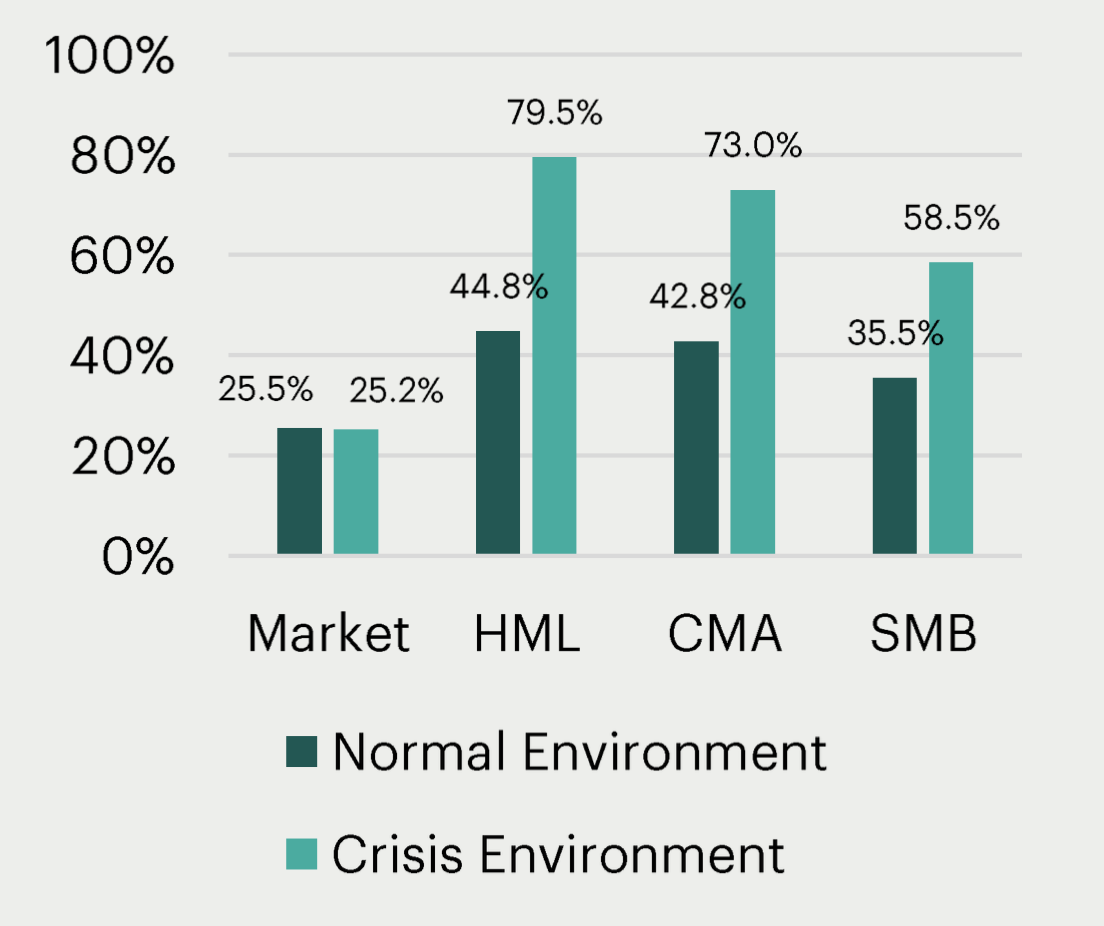

However, a recent study of 8 past economic crises (from 1953 – 2019) have shown that value investing might be the superior approach after a recession (we have written about value investing – see part 1and 2).

Figure 1 shows one of the outcomes of the study – the 2 year forward return (from times of crisis as) a function of different investment factors (Fama-French factors). The factors shown are: HML, which represents value, CMA, which represents conservative capital deployment, and CMB, which represents size. Historical data shows that coming out of a recession, value investing (HML) can provide superior returns.

Figure 1: Average 2 year forward return starting in times of crisis (as defined by the high-yield spread rising above 6.5%). The factors are based on Fama-French factor model where: HML represents Value, CMA represents conservative capital deployment, and CMB represents Size.

Other businesses that are bucking the downward trend

- As consumers are stuck at home, Amazon (ticker: AMZN) seems to be seeing an increase in online orders. The company plans to hire an additional 100,000 people across the US and temporarily boost hourly wage by US $2 per hour.

- Zoom communications (ticker: ZM) shares are up 18% this past month (while the S&P 500 is down 31%). Zoom is a provider of video communications service that is poised to benefit from the pandemic, as more and more workers are working from home, and are trying Zoom for the first time. The company recently reported robust and highly capital efficient growth. However, the current valuation is high: its forward P/E (as of last quarterly earnings release) is 222.22.

- Everyone is stocking up on cleaners and disinfectant. The Clorox company (ticker: CLX) is up 6% this past month.

Thanks to this blog, I never miss out on industry trends. You’re awesome!

Hello, the design of your website is very beautiful and eye-catching. It is also very useful that it is mobile friendly.