A financial portfolio is a collection of investments, while portfolio management is the process of overseeing those investments. In this article, we will explore the meaning of portfolio, types of portfolios, and what portfolio management entails.

Portfolio Meaning

A portfolio is a collection of investments, including stocks, bonds, commodities, and real estate, held by an individual or organization. It is designed to provide long-term financial stability and help manage and grow wealth over time. The idea of having a well-rounded portfolio is to spread risk and ensure that one’s wealth is not overly impacted by fluctuations in any one area of the market. This means that the portfolio should not be heavily reliant on any one type of asset or investment, but instead should contain a mix of different asset classes.

Having a portfolio can help individuals or organizations achieve their financial goals, such as retirement, buying a home, or supporting their families. Additionally, it can mitigate the impact of market fluctuations and provide a source of passive income.

Components of a Portfolio

- Equity: Equity refers to ownership in a company, typically represented by stocks. Equities are generally highly volatile, meaning their value can fluctuate significantly due to market sentiment and other influencing factors. It has the potential for high returns, but also higher risk.

- Fixed Income: Fixed income investments generate a predictable stream of income through interest payments. They are typically less volatile than equity investments. Examples of fixed-income securities include bonds, treasury bills (T-Bills), and certificates of deposit, among others.

- Cash: Cash refers to liquid assets, such as money in a savings account, that can be readily converted into cash. It is considered a low-risk investment with low returns.

- Bonds: Bonds are debt securities issued by corporations and government entities. They provide a predictable stream of income, but also carry credit risk.

- Alternatives: Alternative investments refer to investments that are not traditional stocks, bonds, or cash. Examples include real estate, commodities, and hedge funds. They can offer diversification and potentially higher returns, but also come with higher risk.

Building a Portfolio

Building a good portfolio is a crucial step in managing your investments. An important question investors often ask is: what factors should be considered before designing an investment portfolio? There are 3 important considerations to keep in mind when building a portfolio, including diversification, risk management, and rebalancing.

Diversification

Diversification is one of the key principles of building a successful portfolio. It involves spreading your investments across various asset classes, such as stocks, bonds, commodities, and real estate. This helps to reduce the impact of market fluctuations on your portfolio and minimize the overall risk. This helps prevent your investment portfolio from being exposed to unnecessary volatility and potential losses.

Risk management: Specific Risk vs Portfolio Risk

Risk management is another important consideration when building a portfolio. There are two types of risk to consider: specific risk and portfolio risk. Specific risk refers to the risk associated with a single investment, while portfolio risk refers to the risk associated with the portfolio as a whole. By diversifying your investments, you can mitigate both types of risk and increase the overall stability of your portfolio.

Portfolio rebalancing

Portfolio rebalancing is the process of adjusting the mix of assets in your portfolio over time to maintain your desired level of risk and return. This can be done on a regular basis, such as annually, or whenever your portfolio becomes significantly unbalanced. Rebalancing helps to ensure that your portfolio remains aligned with your investment goals and helps to prevent you from taking on too much risk.

Factors that affect allocation of investments in a portfolio

When building a portfolio, it is important to consider the factors that will affect the allocation of investments. These factors include an investor’s financial goals, risk tolerance, investment horizon, market conditions, and personal circumstances. Understanding these factors will help investors make informed investment decisions and ensure that their portfolios are properly diversified.

Investment Goals

Investors determine their portfolio allocation based on their financial goals, such as retirement planning, saving for a child’s education, or generating income. These goals serve as a motivation to begin investing and also guide portfolio alignment, making them easier to achieve through strategic investment decisions. Taking investment goals into account and accordingly aligning the portfolio is one of the major reasons behind the need for portfolio management.

Risk Tolerance

Your risk tolerance refers to your willingness and ability to accept fluctuations in the value of your investments. If you have a low risk tolerance, you may prefer to invest in more conservative assets such as bonds and income-generating securities, while individuals with a higher risk tolerance may be more willing to invest in higher-risk, higher-reward assets such as stocks and commodities. Risk tolerance plays a key role in determining which financial securities are selected during portfolio creation and rebalancing and influences the expected returns from the portfolio over the investment horizon.

Investment Horizon

Investment horizon refers to the amount of time an individual has to invest and can also influence the types of investments included in a portfolio. For example, an individual with a long investment horizon of 20 years or more may be more willing to invest in riskier assets such as stocks, as they have a longer time horizon to weather market fluctuations. On the other hand, individuals with a shorter investment horizon may prefer more conservative investments, as they have less time to recover from market downturns.

Market Conditions

Market conditions, such as economic and political factors, also influence portfolio allocation. For example, during periods of economic uncertainty, investors may allocate more of their portfolios to safer assets such as bonds to minimize potential losses.

Personal Circumstances

An investor’s personal circumstances, such as their age, income, and debt levels, also influence their portfolio allocation. For example, younger investors may allocate more of their portfolio to riskier assets such as stocks, while older investors may allocate more of their portfolio to safer assets such as bonds as they approach retirement.

Types of Portfolios

Portfolio types can be broadly classified into two distinct categories: composition and investment goals. Composition refers to the overall structure of a portfolio, including the types of investments being made and the percentage of each investment. Investment goals, on the other hand, are the objectives that an investor is looking to achieve through their portfolio, such as capital appreciation, income generation or capital preservation. Understanding the fundamental differences between these two categories is essential in order to create a portfolio that is tailored to the individual investor’s needs.

Portfolio types based on composition

Some common types of portfolios based on composition include:

Diversified Portfolio

This type of portfolio contains a mix of different asset classes, such as stocks, bonds, commodities, and real estate. It helps to spread risk and provides a greater opportunity for long-term growth, with potentially lower volatility and risk. A well-diversified portfolio often generates better risk-adjusted returns when compared to portfolios with high exposure in one particular asset class.

Stocks Portfolio

A portfolio of stocks consists of investments in individual stocks or stock-based mutual funds or exchange-traded funds (ETFs). Stocks have the potential to provide higher returns over the long term, but they also carry a higher level of risk compared to bonds or other fixed income investments.

Bonds Portfolio

A bonds portfolio consists of investments in bonds, which are debt securities issued by corporations and government entities. Bonds offer a predictable stream of income in the form of interest payments, but they are also subject to credit risk.

Commodity Portfolio

A commodity portfolio consists of investments in physical commodities such as gold, silver, oil, and other natural resources. Commodity investments can provide diversification and potentially higher returns, but they also carry a higher level of risk.

Real Estate Portfolio

A real estate portfolio consists of investments in real estate properties, such as rental properties or real estate investment trusts (REITs). Real estate investments can provide a steady stream of income and long-term capital appreciation, but they also carry a higher level of risk. A real estate portfolio generally lacks liquidity unless it includes real estate-based equity investments, however, this risk is often mitigated by the potential long-term returns these investments may offer.

Portfolio types based on Investment Goals

Next, let’s discuss types of portfolios with different investment goals.

- Growth Portfolio: This portfolio focuses on investing in assets that have the potential for high capital appreciation. It is ideal for individuals who have a long-term investment horizon and can tolerate higher levels of volatility.

- Income Portfolio: This portfolio focuses on generating income through investments in fixed income securities, such as bonds and dividend-paying stocks. It is suitable for individuals who need regular income, such as retirees.

- Index Portfolio: This portfolio is designed to mimic the performance of a specific market index, such as the S&P 500. It is ideal for individuals who want to invest in a broad range of assets and track the overall market performance.

- Balanced Portfolio: This portfolio is a combination of stocks, bonds, and other assets, aimed at achieving a balance between growth and income. It is suitable for individuals who want to invest in a mix of assets and benefit from both growth and income.

Does Vested offer pre-built portfolios?

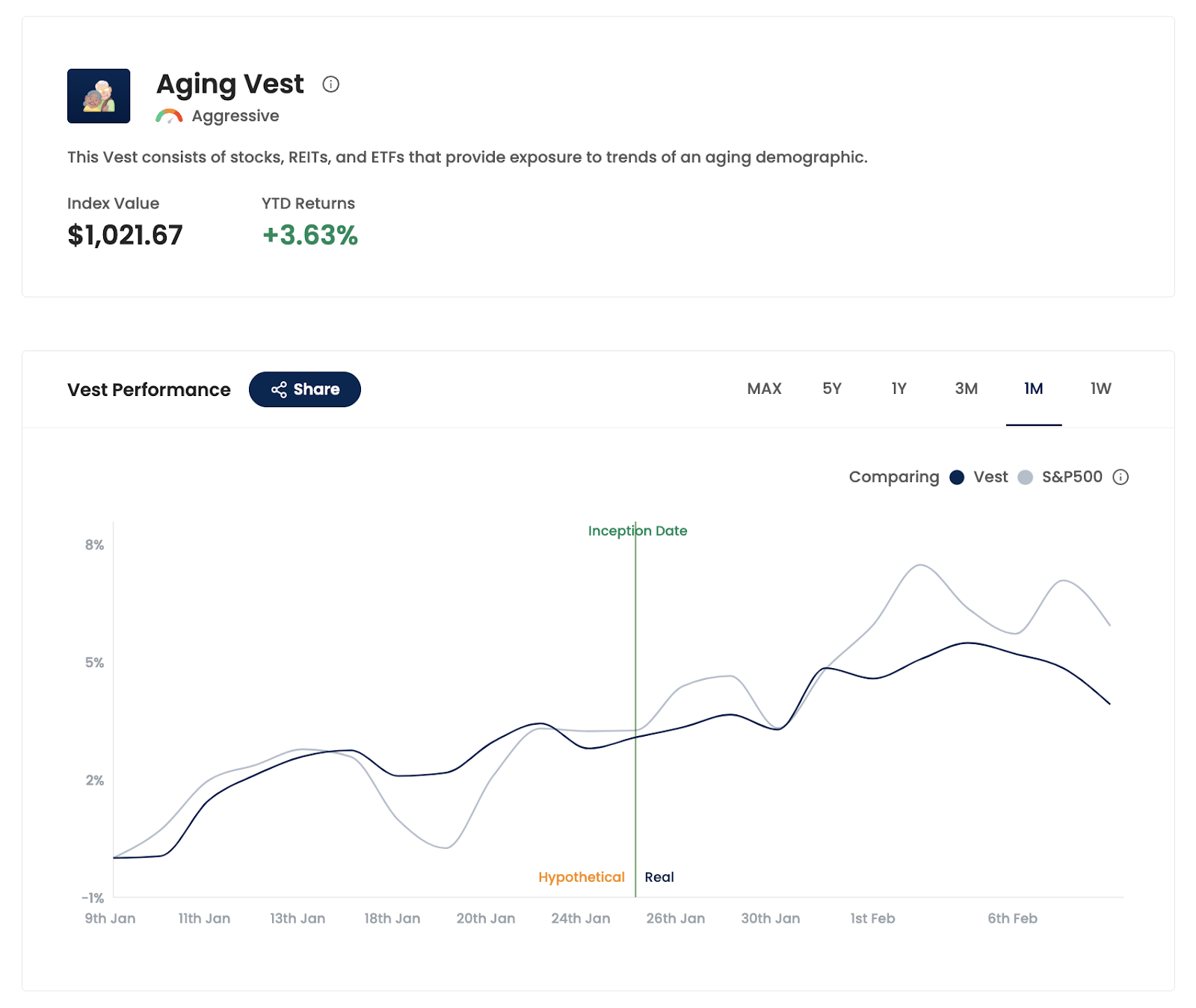

Yes! Vests by Vested are curated portfolios that comprise stocks and/or ETFs. Vests are constructed with different goals or themes in mind. Some Vests are built to enable investors to invest into diversified core assets that balance performance and downside protection, while other Vests are theme based, enabling investors to narrowly focus their investments on specific industries or core themes. There are Vests available for every type of investor – whether you are a high-risk, high returns investor, or a low-risk investor.

Some key features of Vests by Vested include:

- Curated portfolios for different risk profiles

- Dynamic rebalancing

- Research-optimized allocation

What is Portfolio Management?

Portfolio management is the process of overseeing an investment portfolio. It involves making decisions about what investments to buy, sell, or hold, and when to make those trades. Portfolio management also includes monitoring the performance of investments and adjusting the portfolio as needed to meet the investor’s goals and objectives. Portfolio managers use a variety of investment strategies and techniques to manage portfolios and achieve the financial goals of their clients.

Effective portfolio management requires a thorough understanding of the market and the different types of investments. It also requires the ability to make decisions based on market trends and changes in the economic environment.

Why is Portfolio Management needed?

Portfolio management is needed because it helps individuals and organizations to achieve their investment goals by effectively managing their investment portfolios. Portfolio investment management involves selecting the right mix of assets to meet the specific goals and risk tolerance of the investor. It also involves regularly monitoring and adjusting the portfolio to ensure that it remains aligned with the investor’s goals and objectives.

Portfolio management helps investors to make informed decisions about their investments by providing them with an understanding of the risk-return trade-off and the impact of market fluctuations on their portfolio. It also helps investors to achieve diversification and reduce their overall investment risk.

Moreover, portfolio management enables investors to monitor the performance of their investments and make informed decisions about when to buy, sell, or hold certain assets. By regularly reviewing and adjusting their portfolios, investors can maximize their returns and minimize their risk over the long term.

Frequently Asked Questions (FAQs):

What is a portfolio?

A portfolio is a collection of investments, such as stocks, bonds, and mutual funds, held by an individual or an organization. It is used to manage and grow wealth over time and achieve specific financial goals.

What is the purpose of having a portfolio?

The purpose of having a portfolio is to diversify investments and manage risk while pursuing returns. It helps individuals and organizations to spread out their investments across different assets, reducing the impact of any one investment’s performance on the overall portfolio.

What should one keep in mind when building a portfolio?

When building a portfolio, there are several key considerations to keep in mind, including your risk tolerance, investment time horizon, and financial goals. It is important to have a well-diversified portfolio, with investments in different assets and industries, to minimize risk.

What is specific risk, and what is portfolio risk?

Specific risk is the risk associated with a specific investment, such as a stock or bond. Portfolio risk, on the other hand, is the overall risk of a portfolio, taking into account the risk of all of its investments.

What is portfolio rebalancing?

Portfolio rebalancing is the process of realigning the weightings of a portfolio’s assets to maintain a desired level of risk and return. This can involve selling assets that have become overweight and purchasing assets that have become underweight.

What is a diversified portfolio?

A diversified portfolio is a portfolio that contains a mix of different investments, such as stocks, bonds, and real estate. The purpose of diversification is to minimize the risk of any one investment affecting the overall performance of the portfolio.

What does a portfolio contain?

A portfolio can contain a variety of investments, including stocks, bonds, mutual funds, real estate, and other assets. The specific investments included in a portfolio will depend on the individual or organization’s investment goals, risk tolerance, and investment time horizon.