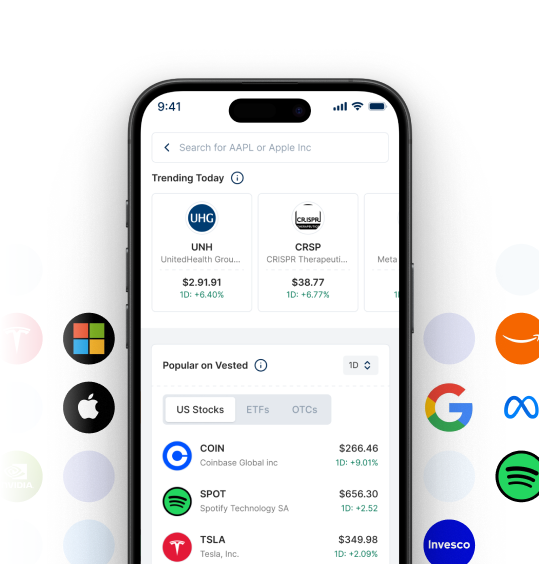

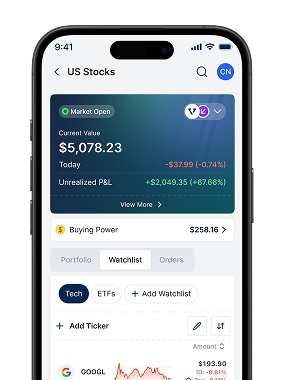

Invest in 10,000+ US Stocks and ETFs

* Offering through VF Securities, Inc. (member FINRA/SIPC)

Assets Under Administration

Trading Volume

Global Portfolios Launched

Average Portfolio Value

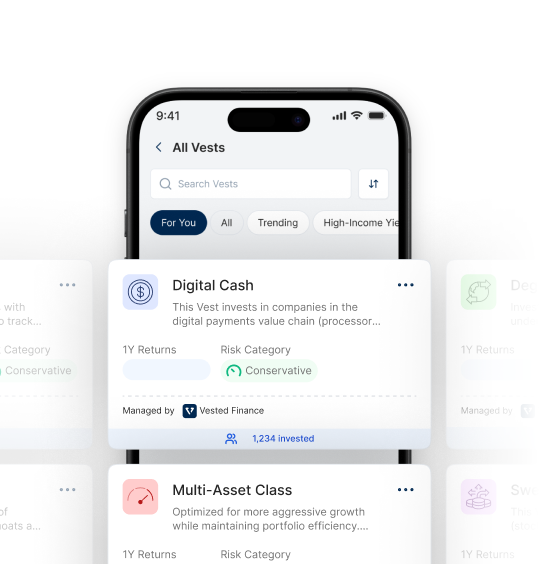

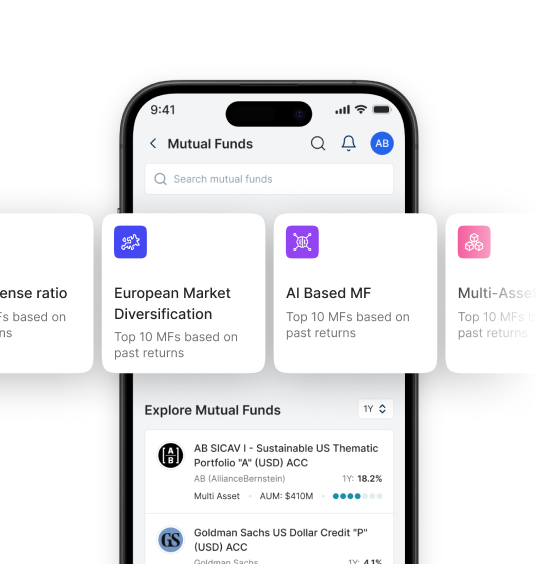

Choose from a wide range of asset classes designed to help you build a diversified global portfolio — whether you're starting small or aiming big.

Diversify beyond FDs, Gold & Indian equity markets

From Apple to Amazon, many of the world’s most innovative and profitable companies are based outside India. Get exposure to these companies by diversifying globally.

The Indian Rupee has historically depreciated against the US Dollar. By investing in USD-denominated assets, you preserve and grow your wealth in a historically stronger global currency over time.

US markets have historically delivered higher INR-adjusted returns compared to Indian markets,helping Indian investors build long-term wealth faster.

Offered by VF Securities Inc. Stock symbols shown here are representative of our offerings and are not meant to be a recommendation

Offered by Vested Finance, Inc

Offered by Vested Finance, Inc

Offered by VF Securities, Inc

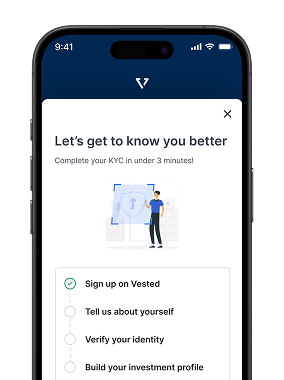

Sign up and complete your 100% Digital KYC in less than 5 minutes

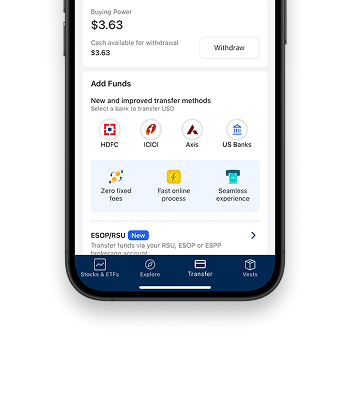

Easily transfer funds via ESOP/RSUs, partner banks like HDFC Bank, Axis Bank or any Indian bank with guided instructions

Build your global portfolio with US Stocks, ETFs or Managed Portfolios starting at $1

Investments are protected under US regulatory bodies up to $500K - $250K for cash.

Funds & securities are held securely in US brokerage accounts.

Vested is registered as a FINRA member and a Broker Dealer called as VF Securities, Inc.

Get access to in-depth guides, smart calculators, and human support — built to help you invest globally with clarity

Get answers to frequently asked questions by our investors or get help on any topic

Stay up to date on the latest investing trends in the markets and other announcements from Vested

Explore our range of financial tools to streamline your investment planning