Over the past few years, global markets have performed well.

Since 2021, the S&P 500 is up roughly 90%, and the Nasdaq has nearly doubled. Indian markets have also moved up meaningfully during the same period. But for investors holding US assets from India, there has been an additional tailwind.

The dollar moved from around ₹73 to close to ₹90.

That currency depreciation meant that US portfolio returns looked even stronger when viewed in rupee terms. And because of this, a lot of people ended up building meaningful US exposure over time.

For many, this came through US-listed RSUs.

For Indian employees working at US-listed companies, RSUs were granted year after year. Over time, these grew into a sizeable part of their portfolios. As the value of these RSUs increased, a larger share of their wealth became concentrated in the stock of a single company.

Many RSU holders on Vested were actively looking to reduce single-stock exposure. Years of equity grants had created meaningful concentration in one company, and investors were becoming more intentional about spreading risk and building diversified global portfolios.

Until now, the most straightforward option for many investors was to sell their holdings and transfer the USD proceeds. While direct transfers of US-listed securities were possible, the process was largely manual, involving physical forms, offline signatures, and back-and-forth coordination with our support team.

We heard this in different ways.

“I already have US-listed RSUs sitting elsewhere. How do I make better use of them now?”

“I have stocks on another US broker.”

“My RSUs are on an employer platform.”

“I do not want to sell and start over, but I also do not want my portfolio scattered across platforms.”

With this update, we are taking a step towards addressing that gap.

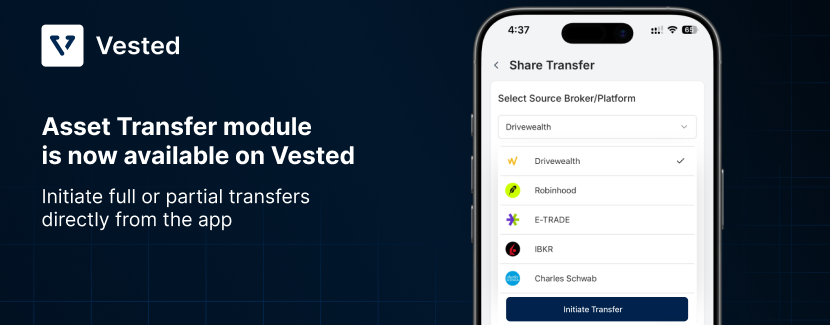

You can now initiate asset transfers directly from the Vested app.

With the new Asset Transfer module, we have made it easier to transfer your holdings or portfolio from another US broker to Vested and manage them through a single platform.

For all brokers, the process is fully digital. You do not need to download forms or coordinate over email. You can initiate the transfer from inside the app and follow the guided steps mentioned.

What this enables

This allows you to bring US stocks, cash, or US-listed RSUs held elsewhere into Vested and manage everything in one place.

You can:

- Transfer your full account, where securities and cash move together

- Transfer partially, by choosing the cash amount or the number of shares you want to move

This works across major US brokers, international brokers, and RSU platforms.

How transfers actually work

A small bit of context helps here.

In India, the market is depository-first. Your assets are held in a demat account held in your own name. In the US, it is different. The brokerage account itself is the main container for assets, and the system evolved to make it possible to move those assets between accounts.

That is why US transfers happen through standard mechanisms such as ACAT, DTC, and DRS.

- ACAT is usually the simplest and fastest option when it applies

- DTC and DRS involve a few additional steps, depending on the broker, but the flow is still digital and clearly guided

Once you select your broker in the app, we show you exactly what applies to you and what to do next.

What to know before you start

A few practical details that you should know:

- Transfers typically take 1 to 10 business days, depending on the broker and whether you are transferring cash or securities

- Vested does not charge for asset transfers

- Your current broker may charge a fee. This varies by broker and transfer type, and is shown upfront in the flow

- Cost basis is not updated automatically with the transfer. After your asset transfer is completed, you can update it directly from the inside transaction history section

Who this is especially useful for

If you:

- have US holdings and are looking for a simpler way to manage them on a single app

- hold US-listed RSUs and want a more structured way to diversify away from a single stock

Getting started

If you wish to see how this works or initiate a transfer, open the Vested app and go to:

Transfers → Transfer from another broker → Select broker → Follow the on-screen steps

We built this because investing is not only about what you buy next.

Sometimes, it is about bringing together what you already own.