Invest in 10,000+ US Stocks and ETFs

* Offering through VF Securities, Inc. (member FINRA/SIPC)

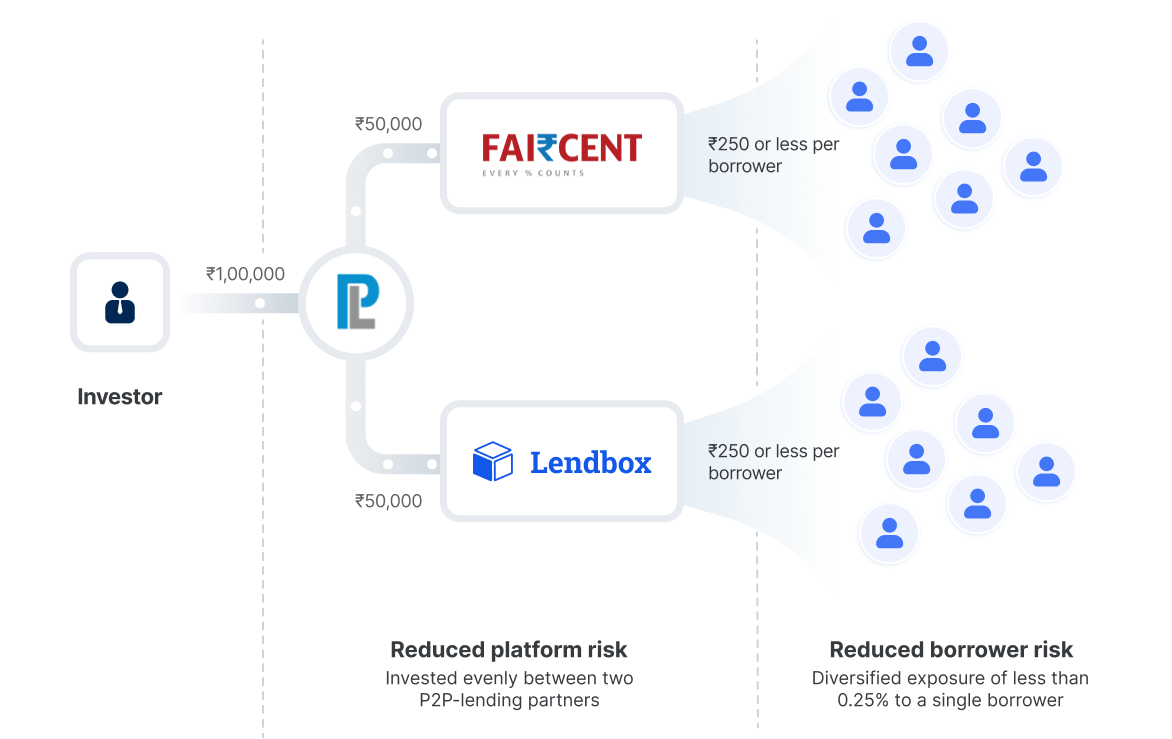

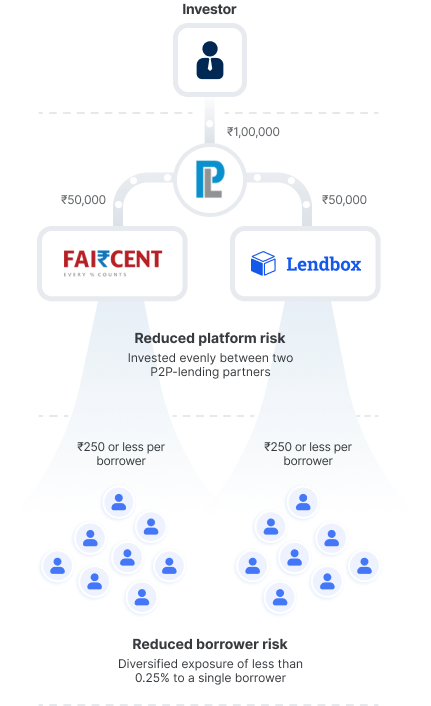

Edge lowers your investment risk in P2P Lending by distributing your investment automatically across multiple RBI-registered P2P NBFCs and further across multiple qualified borrowers. Exposure to a single borrower is less than 0.25%

Select from Liquid or 3-12 months Fixed-term plans

returns p.a.

returns p.a.

Extra Interest

Interest on FD

@6%

Interest from Edge

@%

Reduced risk with multi-platform diversification

Track your investments in real time

Seamless withdrawal process

RBI-registered P2P Lending partners

Vested Edge is an investment product that helps you earn up to 11.5% pa by investing in P2P lending. Vested Edge partners with P2P lending platforms with a track record of quality risk management and borrower sourcing mechanisms, and who have demonstrated consistent returns to a strong investor base while managing significant AUM.

With Vested Edge, you can automatically invest across all our P2P partner

platforms with ease, earning an effective interest rate offered by the different P2P platforms for your investment plan, while reducing risk by diversifying your investments across multiple platforms and borrowers.

Peer-to-peer (P2P) lending is an online lending model where individuals or businesses can directly borrow money from other individuals or investors through a platform. It eliminates the need for traditional financial intermediaries, such as banks, and enables direct interaction between borrowers and lenders.

Vested Edge has partnered with RBI-licensed P2P lending NBFCs Faircent and Lendbox. On opening an account and investing with Vested Edge, you maintain an investment account with all our P2P lending partners, gaining access to the borrower pool offered by each platform. Vested Edge splits your investments equally between each partner, to balance your investment exposure to each platform.

Vested Edge allows you to automatically diversify your investments across

multiple P2P platforms, reducing the risk associated with investing with a single platform and providing access to a broader range of borrowers to diversify your investment. Vested does this automatically without you having to complete multiple KYCs, and allows you to monitor your investment across multiple platforms together

Vested Edge is facilitated via Vested’s NBFC-P2P partners, Faircent and

Lendbox. P2P lending in India is regulated by the Reserve Bank of India (RBI). NBFC P2Ps are non-banking financial companies licensed by the RBI to operate P2P lending platforms. These platforms must maintain a minimum net-owned fund and adhere to exposure limits to mitigate risks. Platforms are obligated to conduct thorough credit assessments of borrowers and disclose relevant information to lenders. Additionally, they must maintain escrow accounts to be operated by a bank-promoted trustee, follow fair practices, and have grievance redressal mechanisms in place, ensuring transparency and protecting the interests of participants.

Vested Edge allows you to automatically diversify your investments across

multiple P2P platforms, reducing the risk associated with investing with a single platform and providing access to a wider range of borrowers to diversify your investment. Vested does this automatically without you having to complete multiple KYCs, and allows you to monitor your investment across multiple platforms together

There are different types of risk that you need to consider when investing in P2P lending.

As with any form of lending, there are some risks, the biggest being that a borrower doesn’t repay, i.e., there is a risk that a borrower may default. The returns on each investment are only indicative, and there is no guarantee of the interest that you will earn. However, Vested and its P2P partners always align with your interests, ensuring that the capital and indicated interest yield are delivered to you before we earn any income and make the best efforts to provide the indicated returns.

You would need to complete your KYC by providing your PAN, Aadhaar, and

bank account details. Once these have been approved by our partners, you

would need to choose among the available investment plans and invest funds via Netbanking or UPI.

There is no fee charged by Vested to invest with Edge.

You can invest up to ₹10 lakhs anytime with Vested Edge. You can also upgrade your investment amount to ₹50 lakhs by providing a self-declaration of your assets, indicating your net worth is above ₹50 lakhs. You can find the self-declaration form on the Vested application or request the same at help@vestedfinance.co.

Yes, you can withdraw your funds anytime from the Liquid Plan. However, you would need to wait for 2 business days before requesting withdrawal of any funds that have been newly invested.