Welcome to Vested Shorts.

Each week, we bring you the stories shaping global markets — what’s happening, why it matters, and how it could impact investors like you. Let’s dig in.

US Stocks Extend Weekly Gains Despite Friday Pullback

All three major US indexes ended the week higher, supported by resilient consumer data and hopes of a Federal Reserve rate cut next month. The S&P 500 gained 0.94%, while the Nasdaq Composite rose 0.76%. The Dow Jones Industrial Average outperformed with a 1.72% advance, helped by strength in healthcare stocks.

For investors, the takeaway is that despite near-term volatility in semiconductors and weak sentiment data, the broader market remains well-supported by expectations of easier monetary policy and ongoing enthusiasm around AI-driven growth.

Stock market closing data for the week of Aug 11th to Aug 15th, 2025

News Summaries

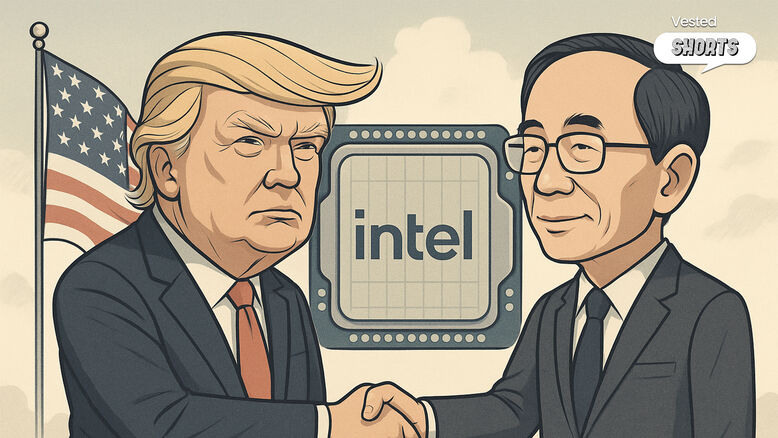

US Weighs Taking Stake in Intel to Boost Chip Manufacturing

The Trump administration is in early talks to use US Chips Act funds to acquire an equity stake in Intel (INTC), aiming to strengthen domestic semiconductor manufacturing and stabilise the chipmaker’s finances. Options include converting part of Intel’s $7.9 billion in Chips Act grants and $3 billion Pentagon funding into shares, allocating new money, or blending with other financing sources. Intel already has access to $11 billion in loans under the 2022 law. The discussions follow a meeting between CEO Lip-Bu Tan and President Trump, easing tensions after recent public criticism.

Investors responded strongly, pushing Intel shares up close to 25% this week. A government stake would give Intel financial breathing space as it manages delays at its Ohio plant, rising debt, and cost cuts.

For investors, this would signal firm government backing for Intel’s turnaround and manufacturing expansion. It could reduce financing risk and improve execution confidence, though political involvement and operational challenges in large-scale projects remain important watchpoints.

Venture Global Remains Worst US IPO Performer

Venture Global Inc. (VG), the year’s worst-performing major US IPO, reported second-quarter revenue of $3.1 billion, ahead of the $2.9 billion estimate, while net income of $368 million missed by 39%.

The stock is down 46% year-to-date and trades at less than half its January IPO price of $25, pressured by volatile LNG pricing, ongoing arbitration, and heavy debt. The $1.75 billion IPO, already priced 40% below its original ambitions, has struggled to gain momentum despite faster project approvals under the Trump administration.

Even bullish analysts now set targets below the IPO level, with Hedgeye Risk Management valuing the stock at $18 to $20.

For investors, Venture Global’s long-term US cost advantage in natural gas offers potential, but short-term headwinds are significant. Arbitration outcomes, with nearly $6 billion in claims pending, could shift sentiment if rulings are favourable.

Until then, volatility, execution risks, and concerns over management and communication leave recovery prospects uncertain, making the next few quarters critical for credibility.

Tencent Price Targets Surge After Strong Earnings Beat

Tencent Holdings Ltd. (TCEHY) delivered a 15% year-on-year revenue jump to 184.5 billion yuan ($25.7 billion) in the June quarter, topping analyst forecasts.

Growth was broad-based across major segments, with advertising revenue benefiting from AI-driven enhancements. The upcoming launch of Valorant Mobile next week is expected to further boost gaming revenue in the second half of the year.

The earnings beat prompted more than two dozen analysts to lift price targets, pushing the consensus up over 5% to HK$688, the second-largest post-earnings jump in five years. Based on Friday’s price of HK$594.50, the new target implies potential gains of nearly 16%. At least 16 brokers now see Tencent rallying past its 2021 all-time high. Shares are up 21% year-to-date, outperforming the Hang Seng Tech Index’s 14% gain.

For investors, stronger forecasts signal renewed confidence after years of regulatory pressure. Execution on new game releases and sustained momentum in AI-driven ad growth will be key in determining whether Tencent can reclaim and hold record valuations.

From the World of Crypto

Ethereum Seen as Play on Stablecoin Growth

JPMorgan analysts say Ethereum is emerging as a direct way to gain exposure to the booming stablecoin market following the passage of the GENIUS Act, which set a regulatory framework for the sector.

With $138 billion in stablecoins issued on its network, 51% of the $270 billion global total, Ethereum dominates the space, either directly on its Layer-1 chain or through Layer-2 networks. The bank expects the asset to benefit as Wall Street begins issuing large volumes of dollar-pegged tokens within its ecosystem, even if they are on L2s.

Year-to-date, the stablecoin market has grown for eight straight months, outpacing the broader crypto market. JPMorgan projects it could reach $500 billion by 2028, while Standard Chartered sees $750 billion by 2026. Ethereum traded at $4,540 on Thursday, down 3.5% on the day but up strongly in recent months, though still below its $4,900 peak in 2021.

For investors, Ethereum’s fee-burning mechanism means higher network activity from stablecoin adoption could support scarcity and long-term value, reinforcing its role as the core infrastructure for tokenized dollars.

Key headlines of the week

Spotify Raises Premium Prices in Global Markets | Spotify Technology SA shares gained after announcing premium price hikes across South Asia, the Middle East, Africa, Europe, Latin America, and Asia-Pacific. Customers will be notified over the next month. Chief Business Officer Alex Norström said the company focuses on “long-term, not short-term gains.”

Chili’s Expands Beyond Core US Regions | Brinker International’s Chili’s is opening restaurants in underserved areas like the Northeast and Pacific Northwest. CEO Kevin Hochman’s turnaround since 2022 includes a slimmer menu, better service, $100 million in upgrades, and viral $10.99 combos, drawing in Gen Z customers and boosting sales.

Birkenstock Beats on Earnings, Maintains Growth | Birkenstock Holding posted adjusted EBITDA of €218 million and sales of €635 million, slightly topping estimates. CEO Oliver Reichert plans to capture more footwear market share as rivals face tariff and supply chain pressures.