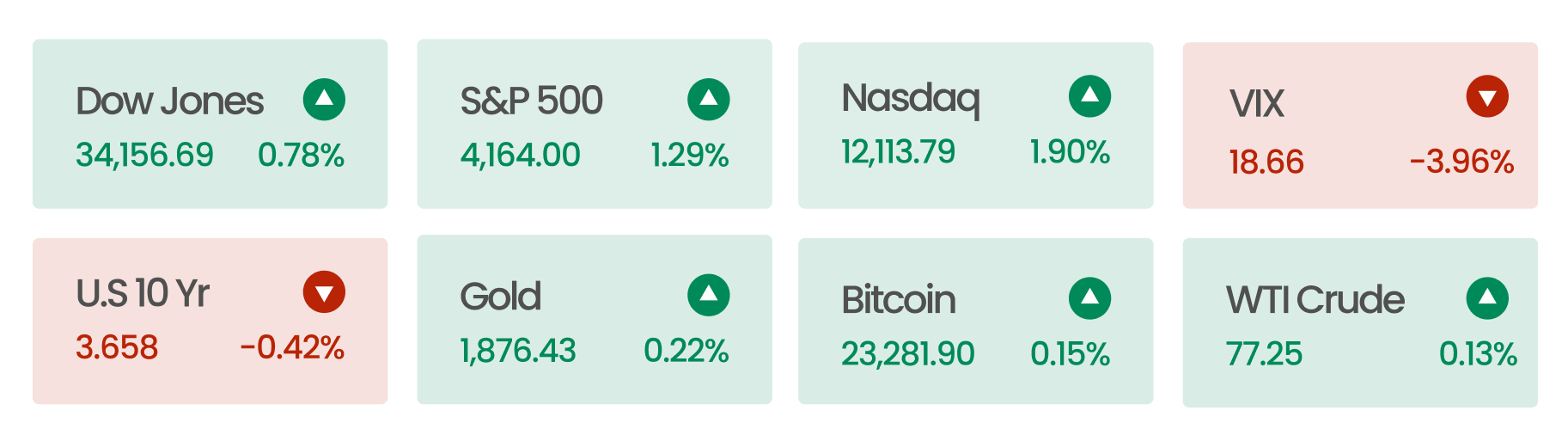

Market Summary

The US stock market finished higher following Fed Chair Powell’s comments. The Chairman stated that while disinflation has begun, interest rate rises are expected to continue. Markets sought additional information on monetary policy, but Powell’s speech appeared to provide little new information on the Fed’s future path on the quantum of interest rate hikes.

On the economic front, the trade deficit increased at a slower rate than expected in December, according to trade balance figures, while consumer credit was expanded at a lower-than-expected rate. Earnings data continues to pour in, with Dupont outperforming profit forecasts but delivering some disappointing guidance and Hertz outperforming earnings forecasts while producing revenues in line with expectations.

In other news

Not made in China

China was considered “the world’s factory,” and for many years, investors believed that Chinese authoritarianism provided a level of efficiency simply not possible in democratic countries. In no other country can one hire 3,000 factory workers overnight, convince them to live in dormitories, to assemble iPhones with redesigned glass screens only weeks before the devices were due on shelves.

However, the same authoritarian government implemented the Zero-Covid policy that resulted in a 40% decline in manufacturing orders from the US. Until recently, entire regions were locked down, and thousands of people were forced to quarantine in heavily guarded government facilities. Unsatisfied workers began protesting at Apple’s key manufacturing hub of Zhengzhou, resulting in a loss of 6 million iPhone pros. The country’s economic growth has dampened and increased unemployment to a six-month high of 5.7% in November 2022.

Companies have started to realize their over-dependence on China and have been shifting toward smaller-scale, decentralized manufacturing in other countries. Nearby Asian countries such as Vietnam, Malaysia, India, Taiwan, and Bangladesh have picked up some of the lost manufacturing and export market shares. Some of Apple’s newest iPhones are already being assembled in India, where that share could grow to potentially 25% of all iPhones by 2025.

In one of our previous article, we discussed how the Effectiveness of central planning could be a double-edged sword for China. The recent developments with their Zero-Covid policy proved this point once again.

China’s EV play

China is rapidly growing into an EV powerhouse, with copious government support and fierce domestic competition. New EV sales in China doubled in the first half of 2022. The market share of EVs reached 21%, significantly higher than 6.5% in the US and 18% in Europe.

Buying a fuel-powered vehicle in China was already difficult. In order to battle traffic congestion and air pollution, the government limited the total number of license plates and issued a handful of new ones each year via a lottery. The odd-even license plate policy significantly decreased the amount of traffic by restricting certain vehicles on each day. The license plates cost more than $13,000 and may take years to be approved. In contrast, the government provides subsidies for new EVs ranging from $10,000 to $20,000, and getting a new license plate for them is free. As a result, people are keener on buying EVs, not for environmental reasons but rather for their affordability and lack of restrictions.

Companies like BYD, Nio, Geely, and BAIC are Chinese car manufacturers that benefited from a combination of state support and access to raw materials. Until 2019, the sales growth was largely driven by government subsidies for companies that made lightweight EV vehicles. This resulted in a proliferation of small-scale EV producers, which was an obstacle to their goal of consolidating the auto sector. Since then, the government has curbed most subsidies, but it will take substantial time and resources for foreign automakers to compensate for the favoritism enjoyed by Chinese companies.