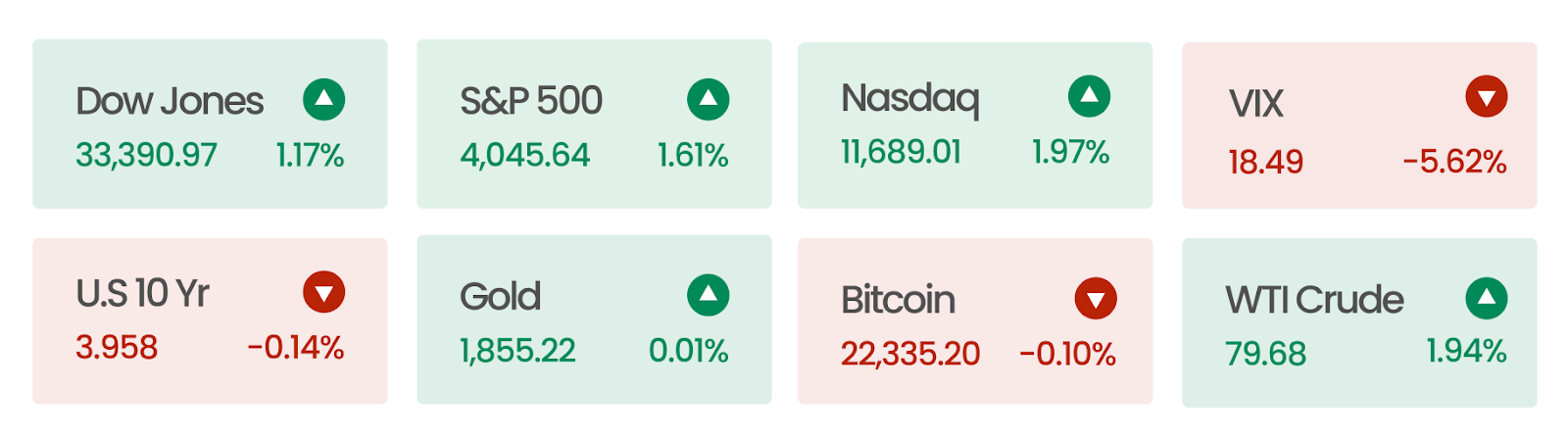

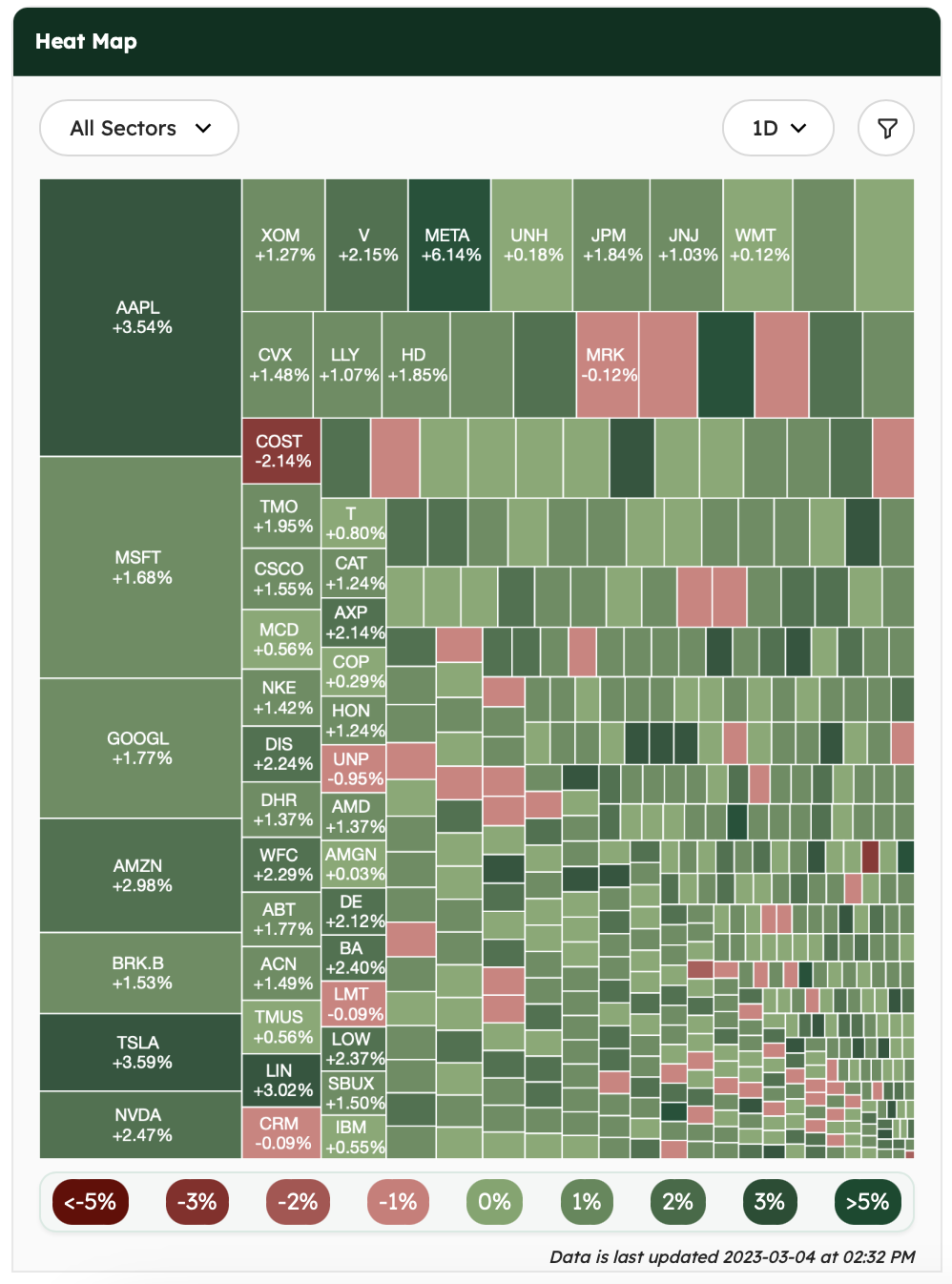

Market Snapshot

The US equities ended a three-week decline with all the major indexes posting gains for the week. Earnings season for the fourth quarter is largely over: Broadcom provided upbeat guidance, while Costco Wholesale reported mixed results. On the economic front, weaker-than-anticipated growth was reported in the services sector, but the economy as a whole showed signs of improvement.

Monster: Unleashed

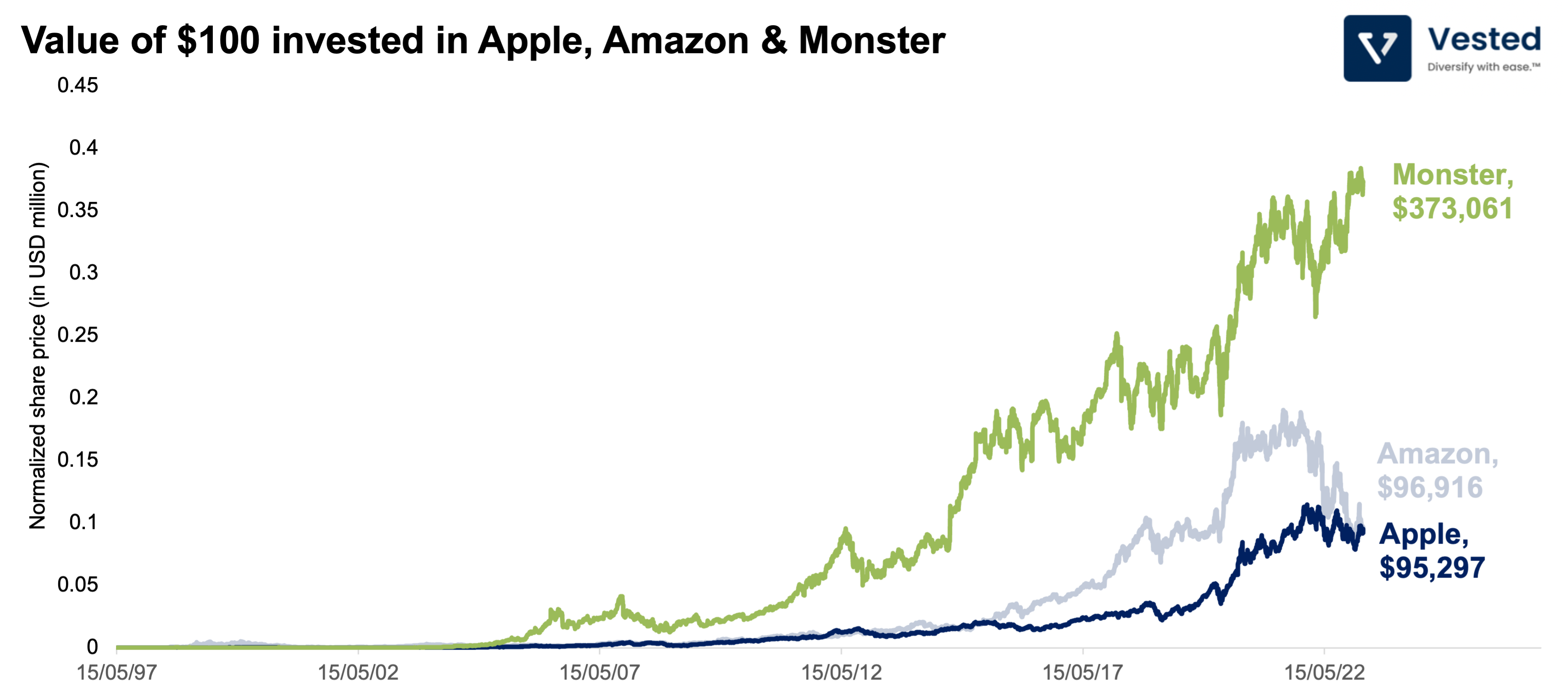

Often referred to as the “century’s best-performing US stock,” Monster Beverage Corporation missed Wall Street expectations with its fourth quarter results. Today, we discuss how this energy drink company outperformed the likes of Apple and Amazon (see Figure 1) and their recent struggle with shrinking margins.

Since its debut in 2003, Monster’s stock has skyrocketed 60,000%, surpassing all other stocks in the S&P 500. The company has been able to boost revenues by 9% every year due to three primary reasons.

- High in Caffeine: Energy drinks tend to be addictive due to their caffeine content. Monster’s drinks double the caffeine amount of Monster’s largest competitor Red Bull (which has 2x the caffeine of Coca-Cola).

- Diverse Products: Despite spending almost $0 on research and development, Monster has introduced 34 different drinks to fend off competition. In 2019, the company introduced Reign – a workout performance drink with six zero-sugar and zero-calorie options. The company is expanding in India and other markets with its “Predator” brand and recently announced its new alcoholic beverage: The Beast Unleashed.

- Partnership with Coca-Cola: The two companies have a strategic alliance. Since Coca-Cola owns 20% of Monster, both companies have decided to avoid competing with each other.

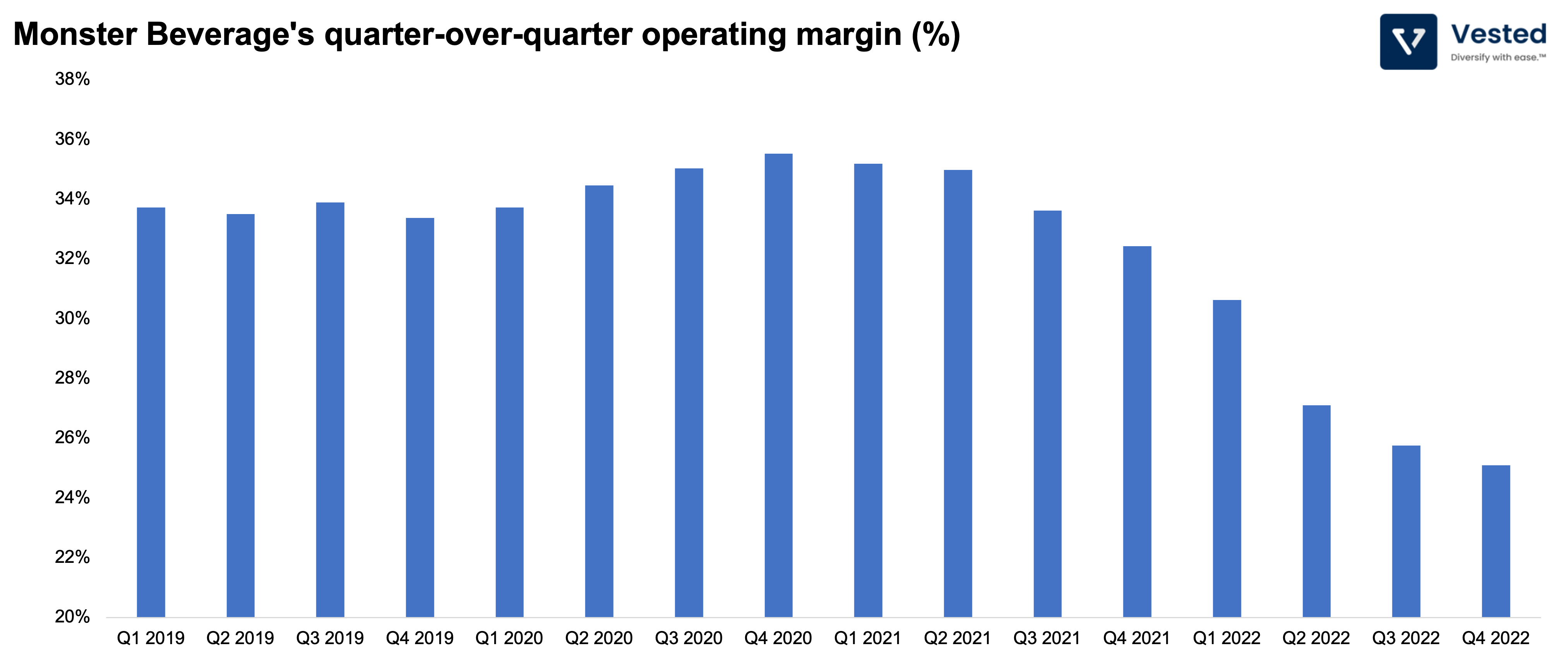

Despite its popularity, the company has seen decreased sales since last year. Sales from outside the US and Canada were just 25.7% of the total in 2018. Despite maintaining revenue growth, net income in 2022 was down 13.5% compared to the prior year. The company spent an estimated $46 million as a result of operating inefficiencies, including an increase in

- Packaging Costs: Port congestion, a lack of shipping containers, and constraints in aluminium supply resulted in a 65% YoY increase in aluminium prices last year. This in turn increased packaging costs for beverage cans, which are primarily made of aluminium.

- Logistics Expense: Gasoline prices have increased since the pandemic and was exacerbated by the war in Ukraine. Disruptions in the supply chain forced the company to move ingredients via expensive air freight instead of traditional shipping containers. Coupled with increased warehousing expenses, the company finds itself spending more on distribution.

Monster has attempted to offset these higher costs by raising prices by 6% in the US and reducing expenditure on promotional allowances. Despite its recent setbacks, the company still controlled 36.4% of the total energy drink market last year, barely surpassing its competitor Red Bull (35.1%).