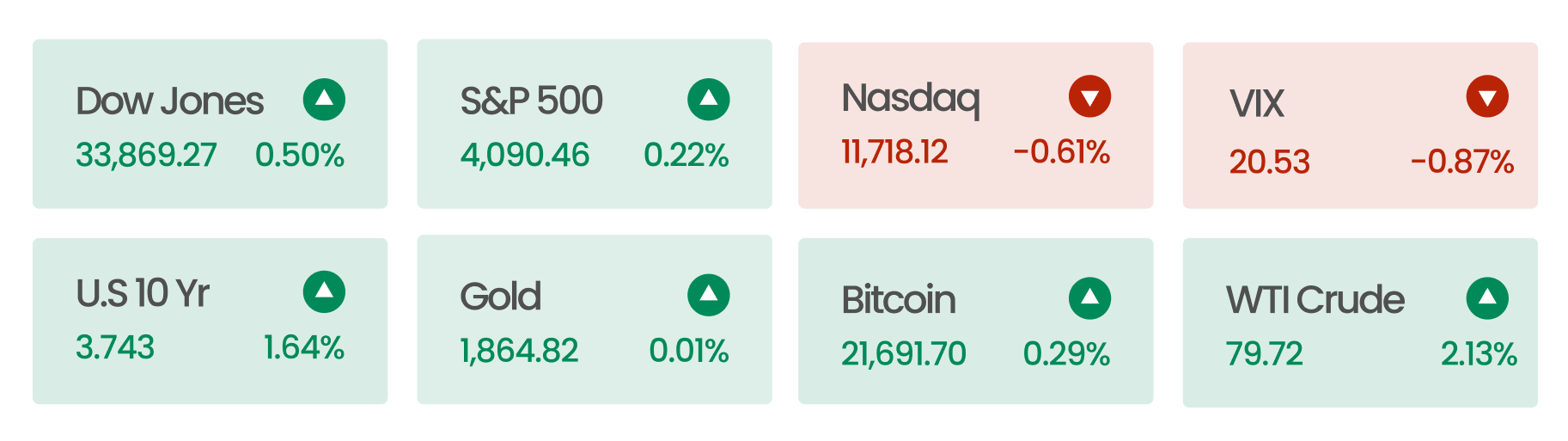

Market Summary

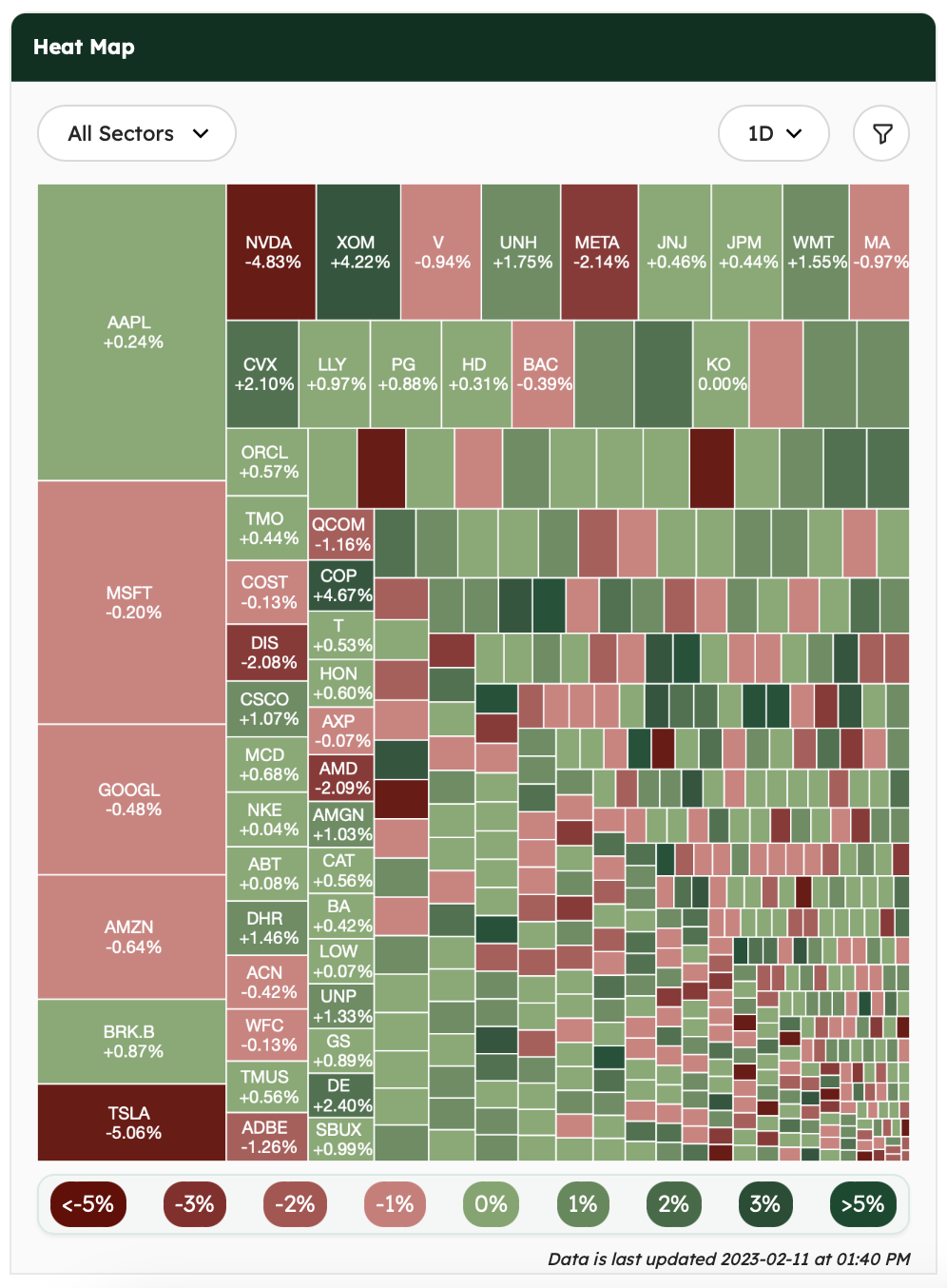

In a quiet trading session, the US equities ended neutral, but the major indices lost ground for the week. Expedia Group and Lyft fell significantly short of Wall Street estimates, with the latter also failing with its Q1 projection, while PayPal Holdings outperformed forecasts and provided a positive outlook.

The lone report on economic news was a better-than-expected boost in consumer sentiment for February. The economic calendar for next week will be much busier and likely get more attention courtesy of the Consumer Price Index (CPI), the Producer Price Index (PPI), and the Import Price Index.

In other news: Are we in another AI bubble?

Since the inception of Artificial Intelligence (AI) in the 50s, the field garnered significant attention and investments and gone through multiple AI bubbles. Between 1956 and 1974, the U.S. Defense Advanced Research Projects Agency (DARPA) funded AI research for developing functional projects. Support and excitement eventually waned when these projects fell short of expectations. By 1974, DARPA cut off funding from AI projects, an action that ushered in the first AI winter. The cycle repeated in the 80s when interest in AI was revived by the advent of expert systems. These expert systems relied on if-this-then-that, rule-based reasoning. The goal was to replicate human reasoning. However, the AI software proved hard to maintain as a rules-based system was overly complex and brittle. DARPA cut off its funding again in 1987, leading to another AI winter. All these fluctuations within AI meant that progress in the field stagnated.

“In no part of the field [of AI] have the discoveries made so far produced the major impact that was then promised.” – James Lighthill of the British Science Research Council 1974

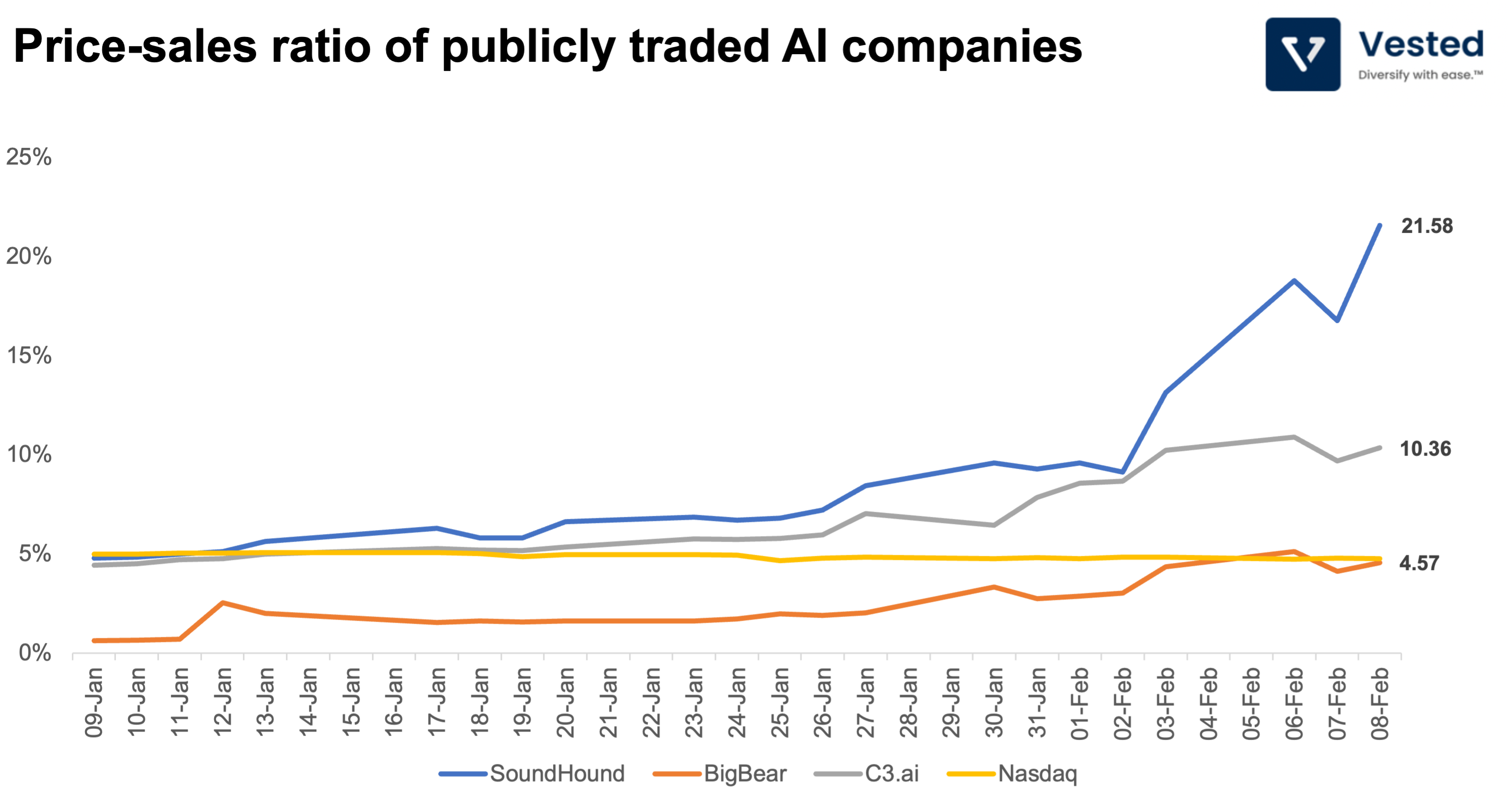

Since 2020, AI hype has been revived, with its effects bleeding into public equities. Traders have been bidding up the stocks of small AI companies. Here are three examples:

- C3.ai provides software solutions for banks and financial institutions.

- SoundHound makes speech and audio recognition software.

- Bigbear.ai is an AI analytics company that curates data to support decision making.

Shares of these companies have doubled this year – we are only in the second week of February! Bigbear’s share price surged nearly 260% after a $900 million deal with the US Airforce was announced. Both SoundHound and C3.ai are trading at 21.58 and 10.36 P/S ratios, much higher than the Nasdaq benchmark of 4.71. The run on the share price is likely pure speculation, as the fundamentals of these businesses have not changed.

A similar pattern can be seen in the private market. VC investment in AI hit $1.37 billion in 2022 globally, a figure that almost equals the combined total of the preceding four years. Many generative AI startups have seen sky-high valuations but have not demonstrated any significant revenue or business traction. To put things in context, startups such as Jasper AI and DeepL received valuations of $1.5 billion and $1 billion, respectively, a 20x revenue multiple for both companies.

Bubbles tend to appear when the narrative and momentum take over, which results in rapid price appreciation that is often divorced from fundamentals. In looking at the rapid appreciation of prices mentioned above and in seeing share price jumps over feature announcements – BuzzFeed announced they would use AI for content creation, and its stock jumped 150% – a new AI bubble may be forming.