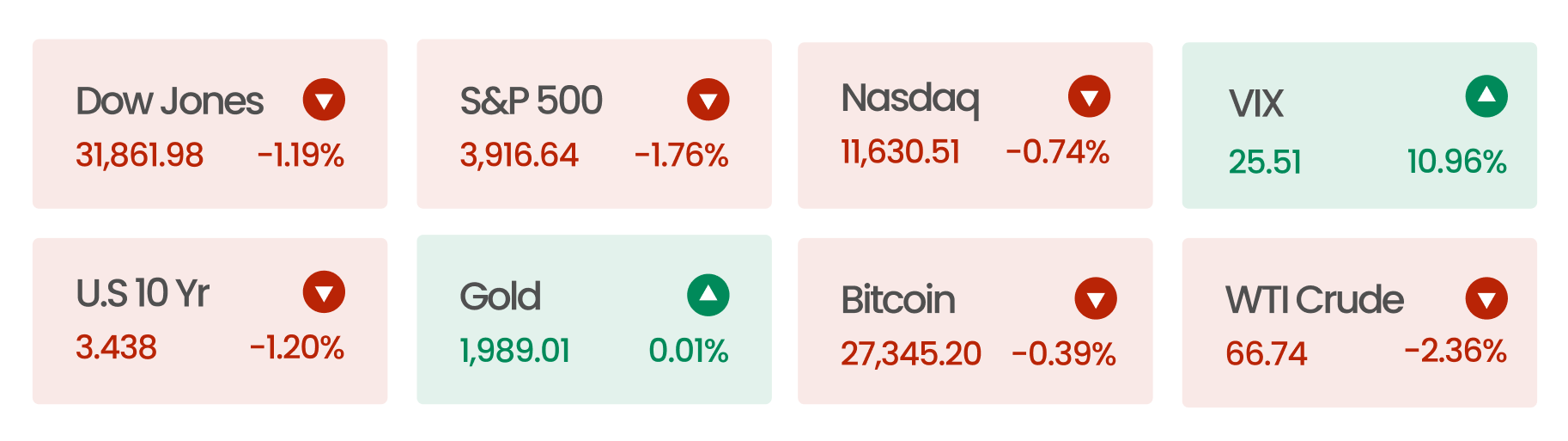

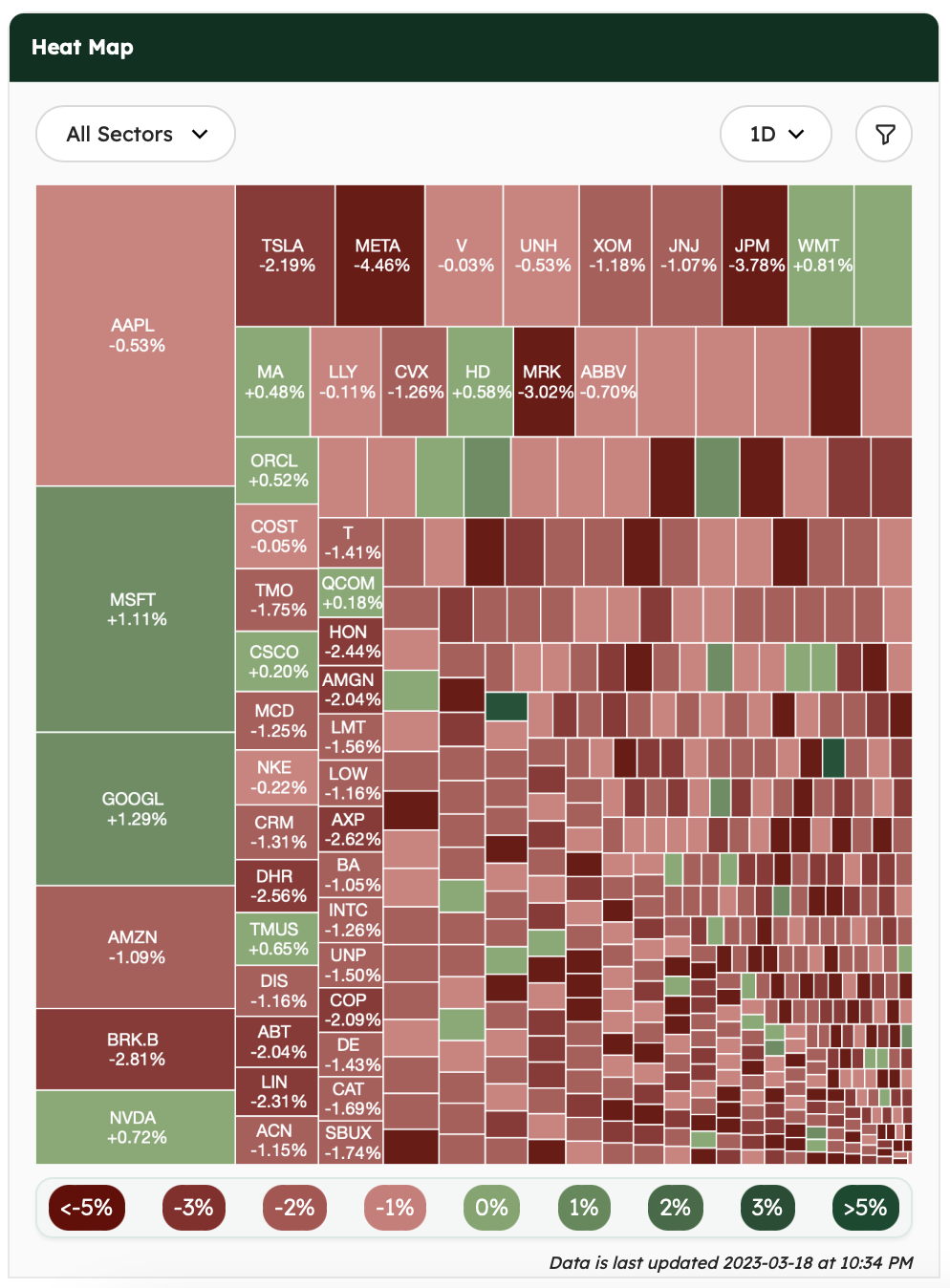

Market Snapshot

US equities ended the day lower as pressure returned to the banking sector. Investors retreated from positions in First Republic and other bank stocks on Friday as concerns about the state of the US banking sector persisted. Despite the recent volatility, the S&P 500 posted weekly gains of 1.43%. Nasdaq posted weekly gains of 4.41% as investors bet on technology and other growth stocks ahead of the Federal Reserve’s policy meeting next week.

News Summaries

The recent failures of Silvergate Bank, Silicon Valley Bank (SVB), and Signature Bank have left many perplexed. Massive deposit influxes, rapid interest rate hikes, and the precarious balance of customer concentration in specific industries have led to the downfall of these banks. This high-stakes banking saga unveiled a tangled web of factors that led to the demise of these once-prominent institutions. Read our latest premium article (without a paywall restriction) to understand their unraveling, where we leave no stone unturned.

As banks fell, yields rose. Money flooded into US government bonds last Monday. The yield on the 2-year Treasury note fell by 46 basis points over a two-day period due to the shutdown of Silicon Valley Bank, leading to a flight to safer assets such as government bonds. The yield, which had previously traded above the key 5% level, fell to 4.58%.

OpenAI has released GPT-4, its latest artificial intelligence (AI) model, an improvement over its predecessor, GPT-3.5. Unlike its predecessor, which only accepted text inputs, GPT-4 can accept both text and image inputs. It is capable of performing at the “human level” on various professional and academic benchmarks. Compared to GPT-3.5, which barely passed the bar exam with a score around the bottom 10% of test takers, GPT-4 performed in the top 10%. In collaboration with Microsoft, OpenAI developed a supercomputer in the Azure cloud, which was used to train GPT-4. This improved model has better factuality, steerability, and the ability to handle more nuanced instructions. However, GPT-4 is still far from perfect; it still “hallucinates” facts and makes reasoning errors. Currently, the model has been adopted by several companies, including Duolingo, Morgan Stanley, and Stripe, for a wide range of purposes. However, the newest version is only accessible to ChatGPT Plus subscribers and developers who can incorporate it into their applications. Interested users can join the waitlist for access. In the future, the company plans to integrate ChatGPT into Microsoft’s search engine, Bing.

Saudi Arabia’s oil giant Aramco announced a record profit of $ 161 billion for 2022, up 46% on the year prior. With a market cap of $1.9 trillion, the state-owned company remains second only to Apple on the list of the world’s most valuable companies. According to CEO Amin Nasser, “this is probably the highest net income ever recorded in the corporate world.” Despite this success, Amin Nasser has warned of “persistent underinvestment” in the hydrocarbons sector and called for additional investment to meet future demand. The company will also continue to invest in increasing its maximum production capacity to 13 million barrels per day by 2027.