In today’s edition:

- Binance faces regulatory pressure

- Hinderburg Research targets Block

- Microsoft Teams is introducing avatars

- The Federal Reserve’s weekly report

- UberEats will remove virtual brands

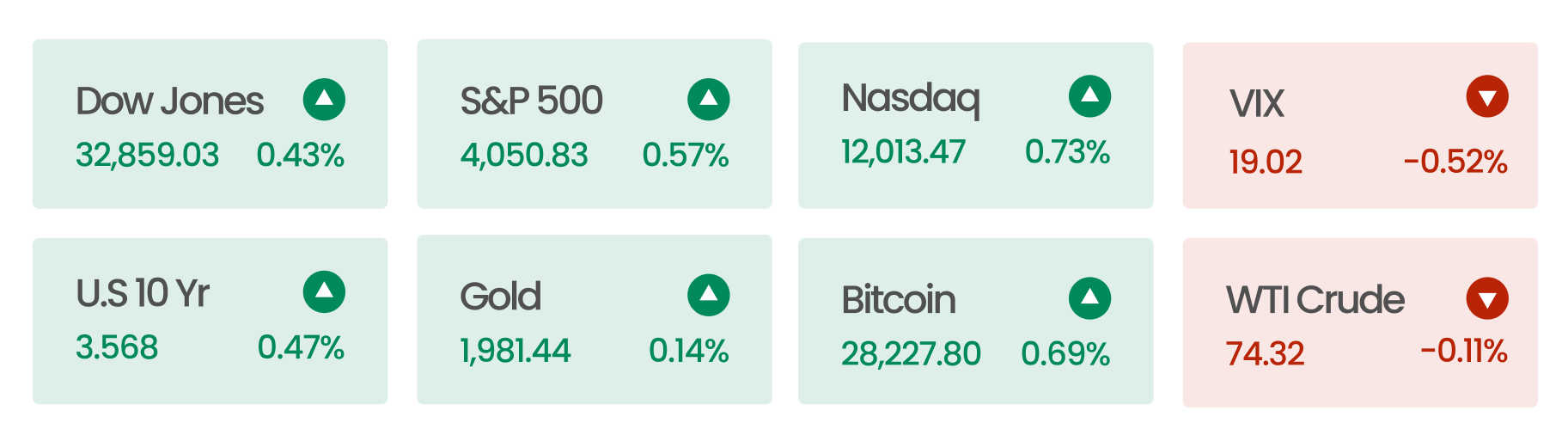

Market Snapshot

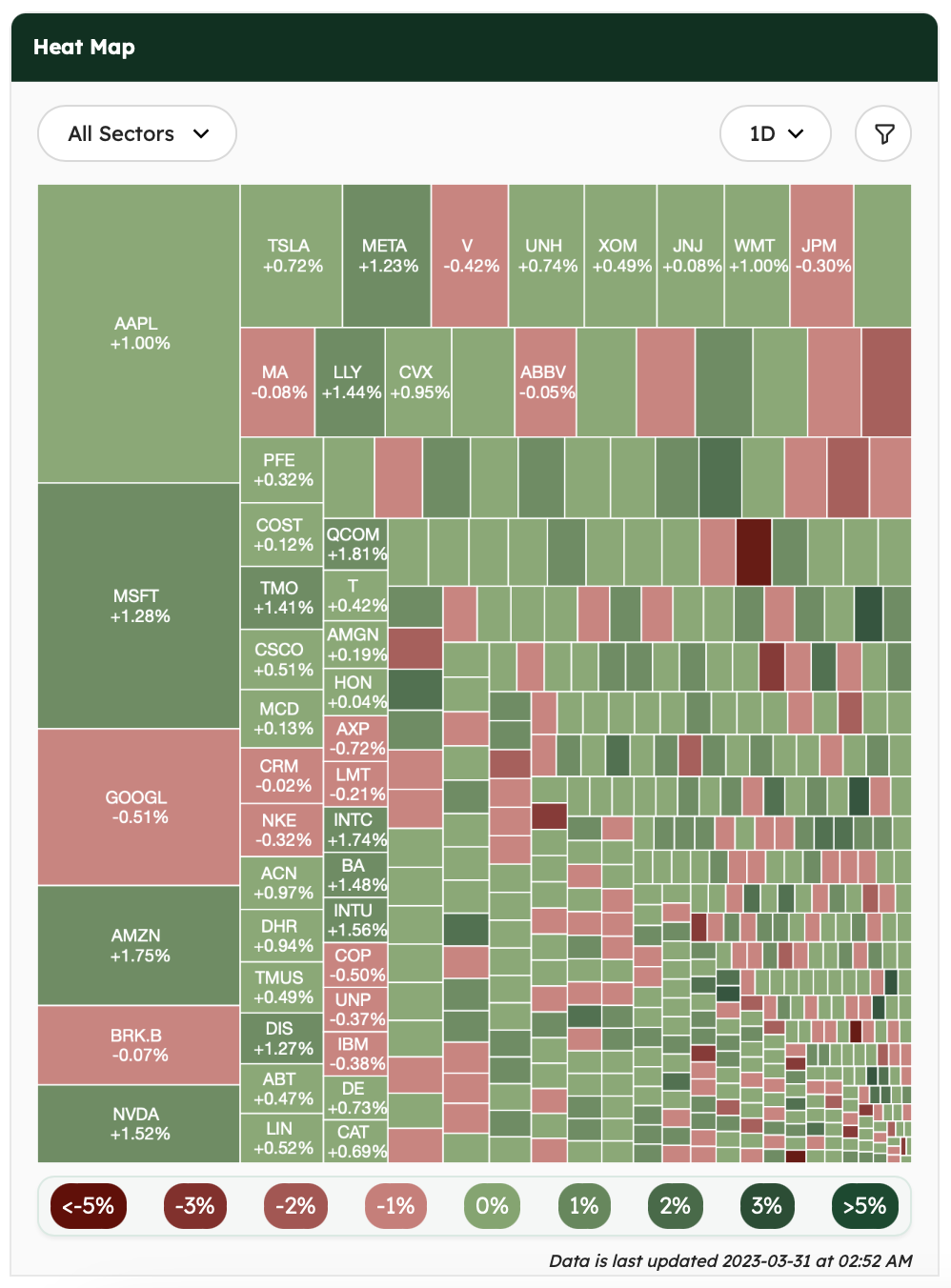

As concerns about a banking crisis subsided, major US stock indices inched higher on 30th March, putting them on track for a third consecutive week of gains. Except for the financial sector, other sectors that make up the S&P 500 Index rose. With Treasury Secretary Janet Yellen urging for stricter regulation of the banking industry after the failure of Silicon Valley Bank earlier this month sparked fears of a global economic meltdown.

The improved sentiment has benefited technology stocks. The Nasdaq 100, which includes big names like Apple, Google parent Alphabet, Amazon, and Microsoft, has entered bull market territory after recovering 20% from its late 2022 low.

Source: AlphaScreener

News Summaries

Microsoft Teams is introducing a new feature that allows users to create 3D avatars to use in meetings instead of being on camera, which can alleviate video fatigue caused by staring at faces for hours on end. Teams have also been redesigned with a new interface and updated to be faster and use less memory. The new feature comes after competitors Slack and Zoom introduced premium features powered by OpenAI earlier this month.

Binance was sued by the US Commodity Futures Trading Commission (CFTC), which alleged that it violated derivatives trading rules and anti-money laundering regulations. The lawsuit claimed that Binance secretly allowed US customers to use its platform using VPN, traded against its own customers, faked a compliance audit, and had knowledge of criminal activity on its platform. In addition, Binance CEO CZ is accused of maintaining control of Binance’s corporate structure through opaque means. In response, CZ denied all allegations, calling the lawsuit “unexpected and disappointing.”

Hindenburg Research has targeted Block, Jack Dorsey’s fintech company behind payment platforms Square and Cash App. Hindenburg’s report includes screenshots of internal systems and employee messages, highlighting alleged financial misreporting and a deficient compliance program. The short seller also alleged that up to 75% of accounts were fake, fraudulent, or additional accounts tied to a single individual. Despite Block’s denial of the accusations, over $8 billion of Block’s stock was traded, and its share price dropped 15%. The company said it would explore legal action against Hindenburg for the “factually inaccurate and misleading report.”

The Federal Reserve’s weekly report on the US banking system showed a 1.9% drop in deposits at smaller banks, amounting to $108 billion. Deposits at the top 25 banks rose by $120 billion during the same period, suggesting that large depositors are moving their money to institutions deemed too big to fail.

UberEats will remove around 5,000 virtual brands (VBs) from its platform due to oversaturation and duplicate menus, which will likely lead to frustration for users. VBs have grown in popularity for restaurants to diversify their revenue streams amid the pandemic, offering unique online-only menus under different names. However, delivery apps like UberEats, DoorDash, and Grubhub have implemented guidelines to prevent VBs from spamming their apps with identical menus. While VBs have quadrupled on Uber Eats since 2021, they currently account for less than 2% of orders, indicating that interest may have peaked.