In today’s edition:

- Generative AI: A game-changer for the global economy

- Microsoft’s bid for Activision blocked by regulators

- Toyota’s Chairman re-elected amid EV push

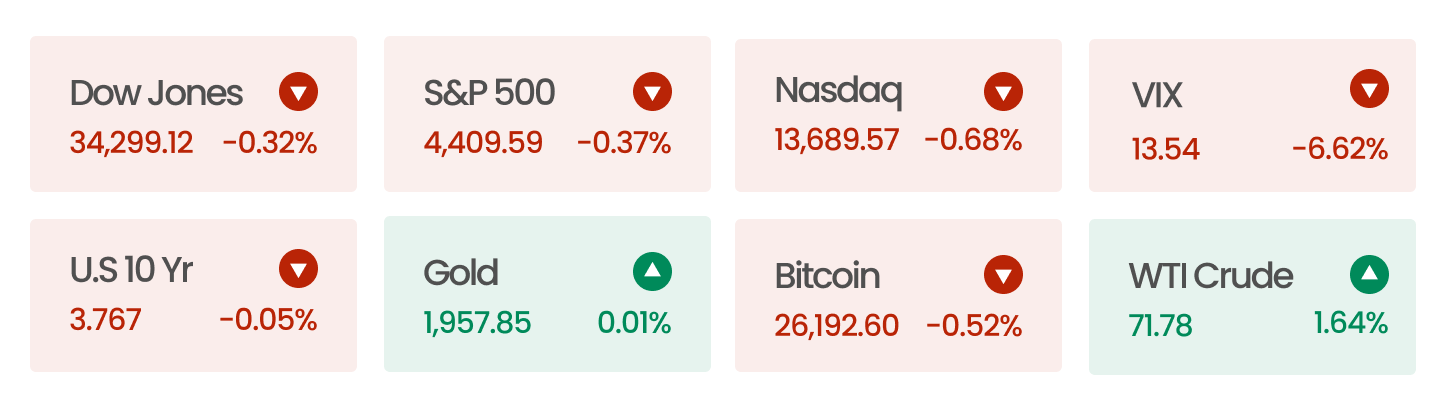

Market Snapshot

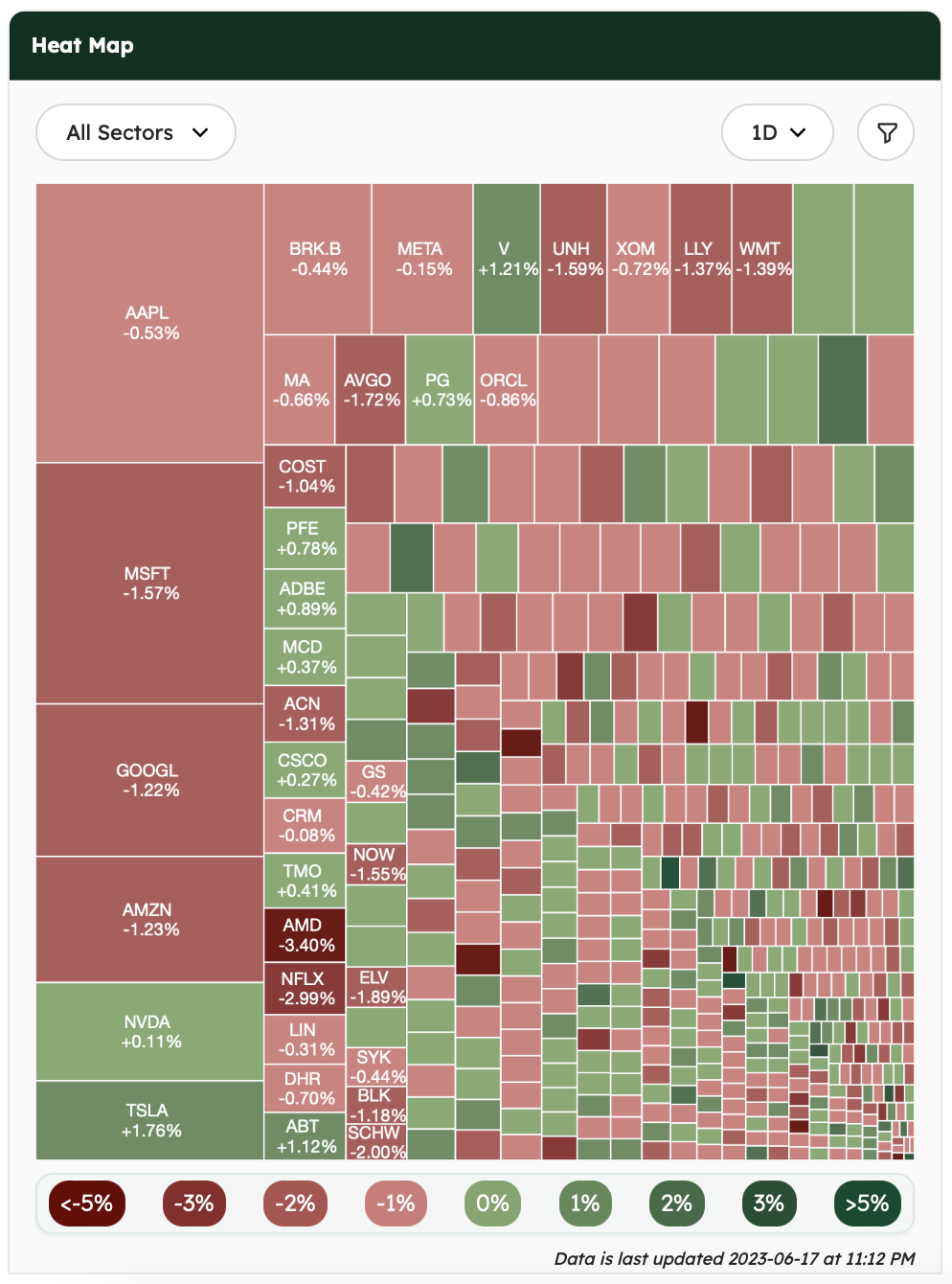

Despite a late drop on Friday, major US stock indexes concluded the week on a higher note as investors welcomed lower-than-anticipated inflation figures and the Federal Reserve’s decision not to increase its key lending rate.

Data as of market close 16th June 2023

Source: AlphaScreener

News Summaries

Generative AI has the potential to boost the global economy by trillions of dollars and increase productivity growth, according to a recent study by McKinsey. It suggests that generative AI could add $2.6 trillion to $4.4 trillion annually to the global economy, comparable to adding a new country the size of the United Kingdom to the world. It can transform sales, marketing, customer operations, software development, and other roles by boosting productivity by 15 to 40 percent. Automating much of the work in these positions will help reverse the decline in productivity growth of the past decade (see Figure 1 below). However, supporting workers through skills training and job transitions will be crucial.

Figure 1: Productivity growth has been the main engine of GDP growth for the past 30 years. Source

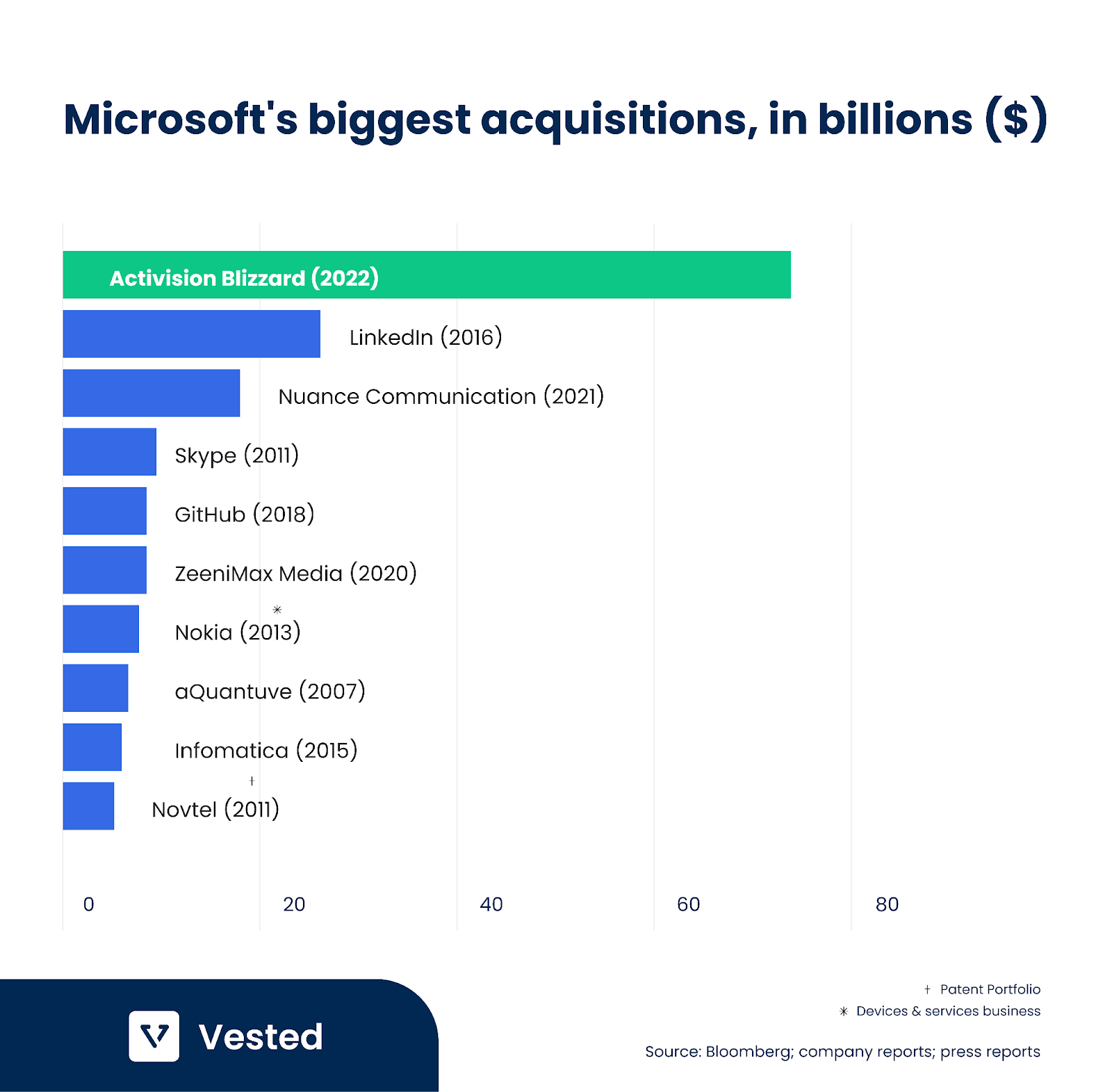

The US and UK have blocked Microsoft’s (MSFT) acquisition of Activision (ATVI), citing antitrust concerns. Announced in January 2022, the deal worth $69 billion would have been the largest acquisition in the video game industry (see Figure 2 below). It would give Microsoft access to some of the world’s most popular video game franchises, including Call of Duty, World of Warcraft, and Candy Crush. Microsoft’s CEO said this deal would “provide building blocks for the metaverse.” However, regulators are wary of Microsoft’s track record of buying video game companies and making their products exclusive to Microsoft’s platform.

Figure 2: The Activision deal is Microsoft’s biggest acquisition.

Toyota Motor Co. (TM) shareholders have voted to retain Akio Toyoda as chairman, supporting the company’s new electric vehicle (EV) strategy. The company aims to revolutionize the EV industry by developing cars with 1,000 kilometers (621 miles) of range by integrating “next-generation batteries and sonic technology.” The Japanese automaker has set ambitious targets of selling 1.5 million EVs annually by 2026 and reaching 3.5 million by 2030. Toyota’s share price soared to a 16-month high following the shareholder vote. Toyota’s diverse vehicle lineup, including hybrids, gasoline models, and EVs, has drawn criticism, yet the automaker believes it caters to diverse customer needs.