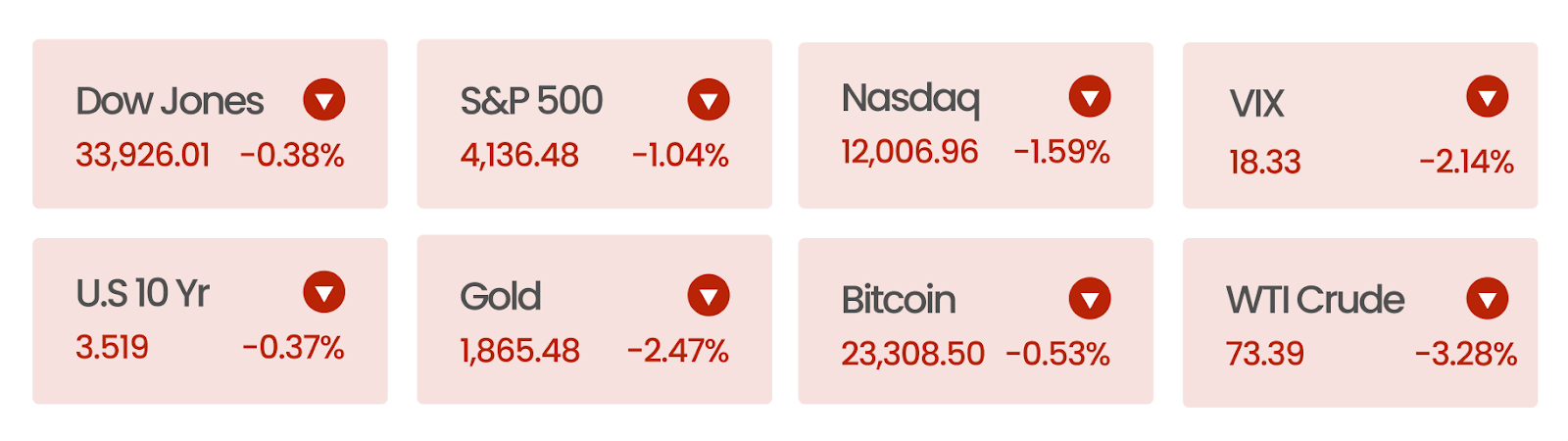

Market Summary

Following a stronger-than-expected January labor report and some underwhelming earnings releases from mega-cap corporations, US shares fell in a choppy trading session. Nonfarm payroll additions exceeded estimates by a considerable margin, and the unemployment rate fell, reinforcing the notion of a tight labor market. On the earnings front, Apple missed projections and reported its first quarterly revenue decrease since 2019. Amazon and Alphabet both reported lackluster quarterly results.

News Summary

Google was served its second antitrust lawsuit from the US Justice Department. The first lawsuit filed in 2020 accused Google of using its monopolistic power as a search engine to cut off competition through exclusionary agreements. This latest lawsuit accuses Google of seeking to dominate all sides of the online advertisements market. According to the Department of Justice (DOJ), Google “could become ‘the be-all, and end-all location for all ad serving.” The DOJ wants the company to divest its network ad business known as Google Ad Manager, which accounts for roughly 12% of parent company Alphabet’s overall revenue.

Facebook Gaming failed in its bid to compete with Twitch. Despite offering creators a 100% cut of revenue and paying them a bonus of $5 – $20 for every new subscriber, Meta was unable to convince them to switch from Twitch. After struggling to take off for 2 years, Meta canceled over 200 contracts with creators and removed the gaming app from iOS and Android in 2022. Meanwhile, Amazon’s Twitch had a much softer landing following the pandemic. Compared to 2020, recent quarterly watch time increased by 1 billion hours.

When Genesis went bankrupt, it still owed $765 million in credit to Gemini Earn. Gemini Earn’s product resembled a savings account. Investors had put in their own cryptocurrency or paid for Gemini’s so-called stablecoin, GUSD, expecting an 8% APY. When customers repeatedly asked the company if their assets were safe, they were led to believe their accounts were insured by the government. They were not, and implying so is illegal. About 340,000 customers have had almost $1 billion worth of assets frozen on the platform. And both companies are facing Securities and Exchange Commission charges for offering unregistered securities.

Comcast is not only a telecom giant but also runs a thriving theme park business which increased ~12% year-over-year to $2.1 billion in the last quarter, a figure which far exceeded its pre-pandemic numbers. Surveys found that Americans are now more comfortable visiting theme parks and are willing to spend much more per visit than ever before. Today, Comcast’s NBCUniversal operates theme parks in the US, Tokyo, Singapore, and Beijing. Planned expansions include a Super Nintendo World in California, a $1 billion Epic Universe in Orlando, and smaller children’s and horror concept parks in Texas and Las Vegas.

The parabolic climb in food prices eased slightly in December, but prices were still up more than 10% year-over-year, as groceries and restaurants consumed a larger-than-usual share of Americans’ spending. Supply chain disruptions, climate change, and higher energy costs are just some of the factors contributing to higher food prices. The cost of food prepared at home was up 11.8%, while food consumed at restaurants was up 8.3%. Businesses have noticed that despite their gripes about higher costs, consumers have little choice but to accept these prices. Some businesses are using this opportunity to increase their profits by raising prices over expected inflation.