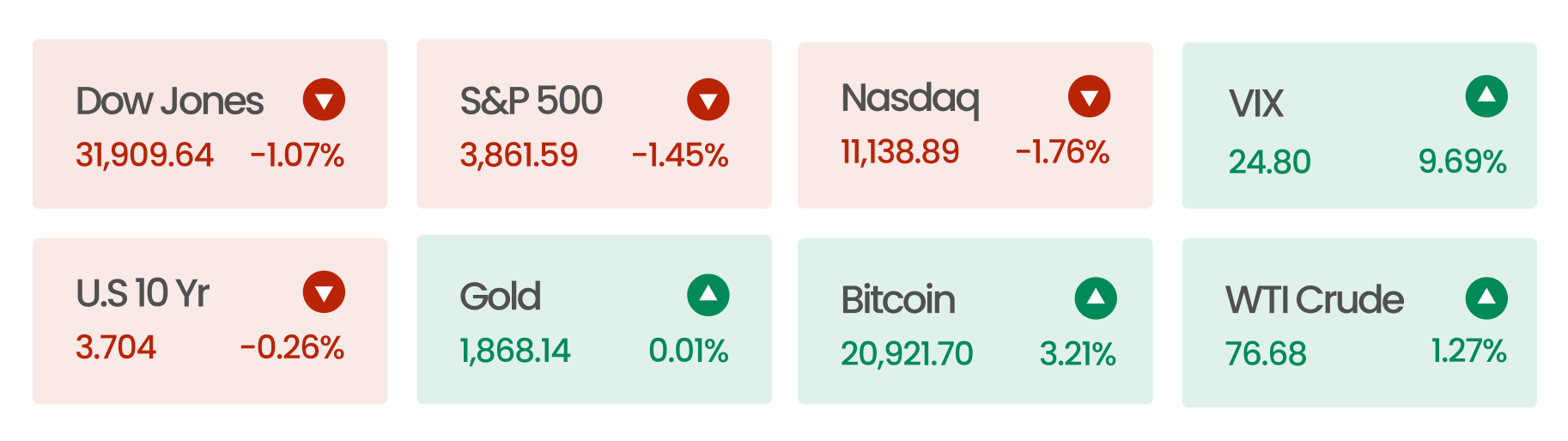

Market Snapshot

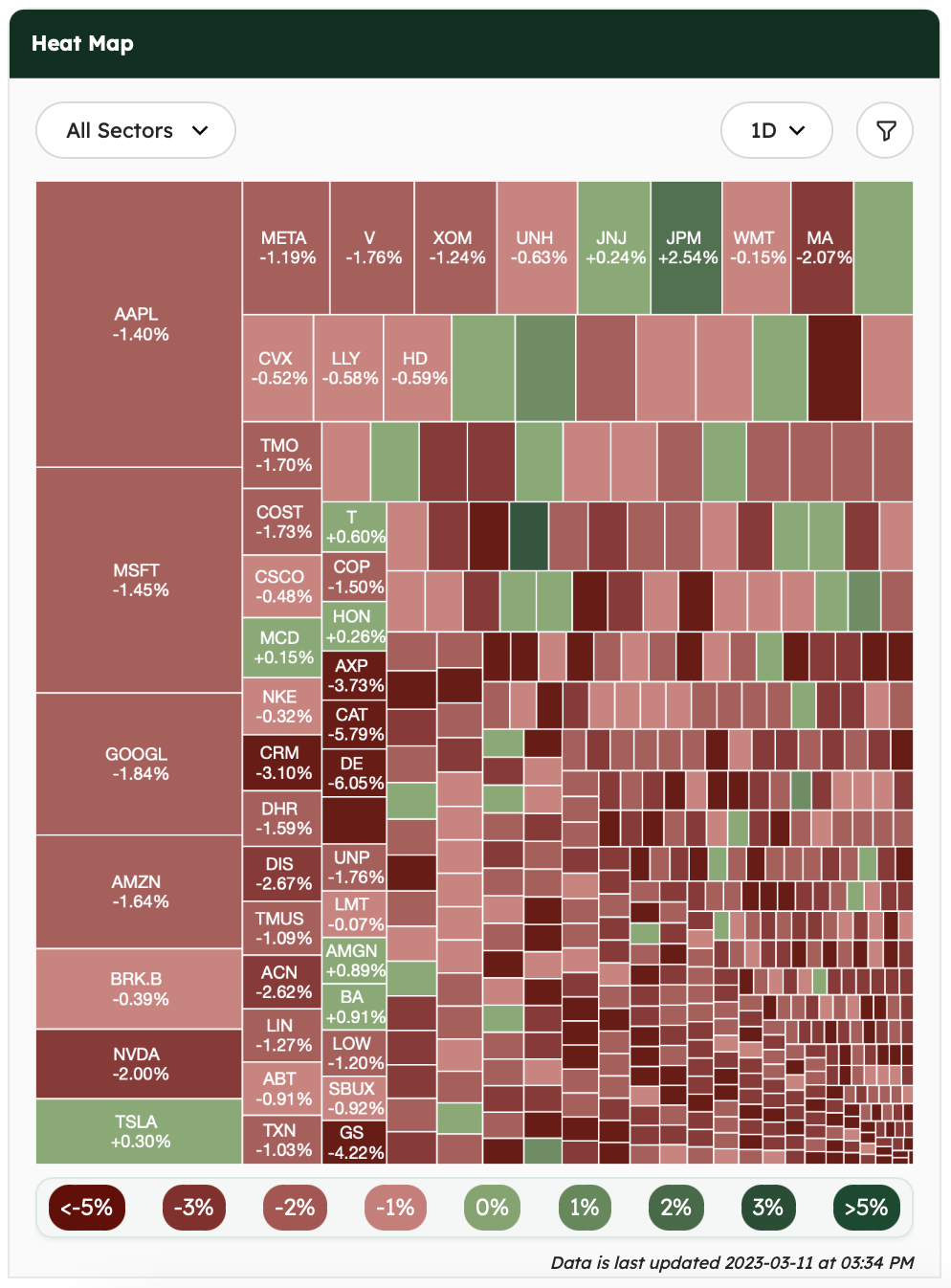

US equities ended the day and week in the red as investors continued to look for clues about future monetary policy decisions. February’s labor report showed stronger-than-expected job gains and a lower-than-expected wage increase but a rise in the unemployment rate. The report may allay some of the fears about the Fed’s future actions. The banking sector is still in turmoil, with SVB Financial reportedly in talks to sell itself after failing to raise capital.

News Summaries

Funding for Pakistani startups fell nearly 80% in Q4 2022. In July 2022, Airlift, Pakistan’s top startup, once touted to become its first unicorn, abruptly shut down when its investors pulled out of a fresh funding round. The world’s fifth-most populous nation is in the middle of a major crisis, with inflation soaring, the rupee plummeting, and a severe energy shortage. The country now faces a dim future with the government ordering malls and businesses in the country to close early every day to save energy.

Increasingly more people are buying iPhones over Android. Gen Z considers them a “must-have,” which has become a great concern for Samsung, Apple’s biggest competitor in the premium smartphone category. For now, the South Korean company is still the largest smartphone supplier by overall shipments and has been so since 2012. This may change, however, as overall smartphone shipments continue to contract (down 10% in 2022) and iPhone shipments remain mostly flat to slightly up.

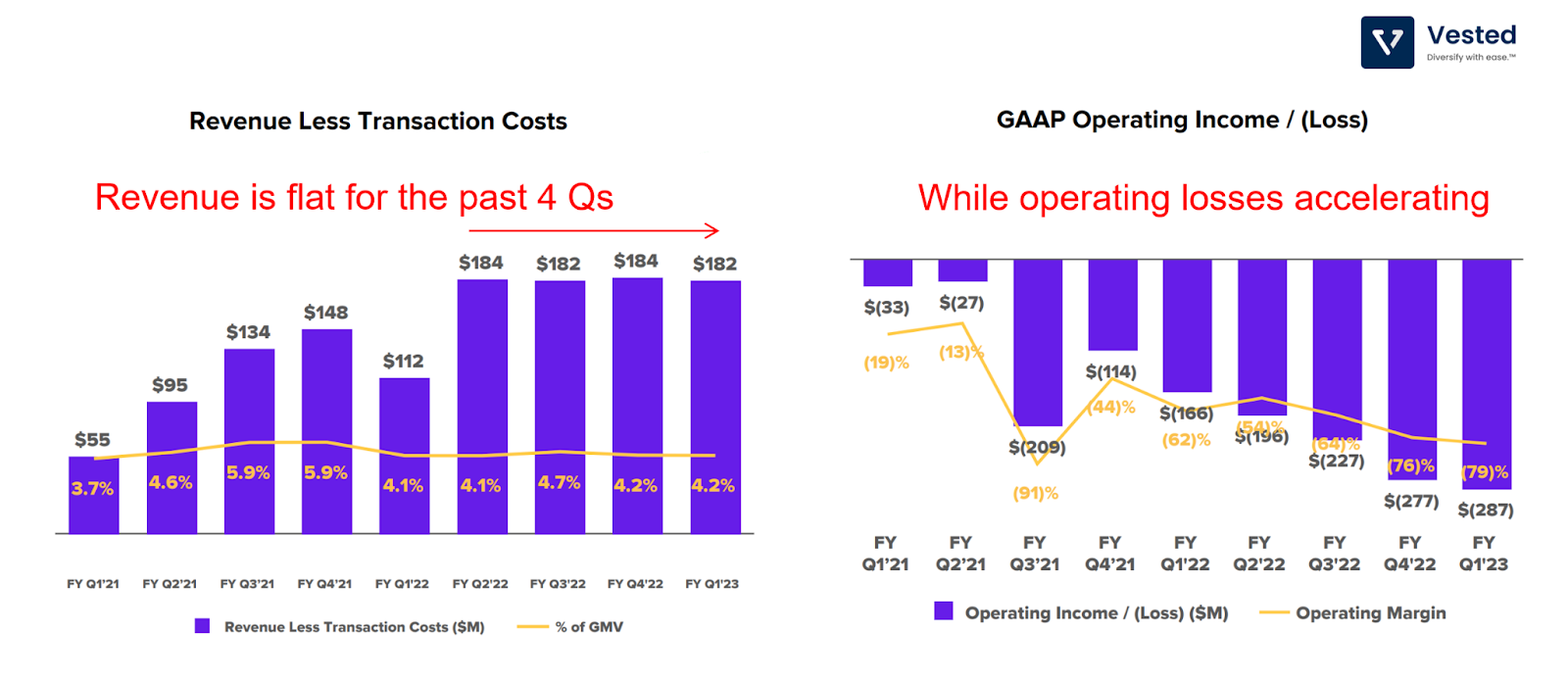

Spotify is changing. Instead of a bunch of album covers, now the home screen will look more like an endless, vertically scrolling mishmash of auto-playing videos. It seems Spotify has taken a page out of TikTok’s book and is trying to attract both your eyes and ears. Until now, although Spotify had videos, they were not the app’s primary feature. With this redesign, Spotify will show video snippets with audio samples allowing the user to preview content and pick what they want to save.