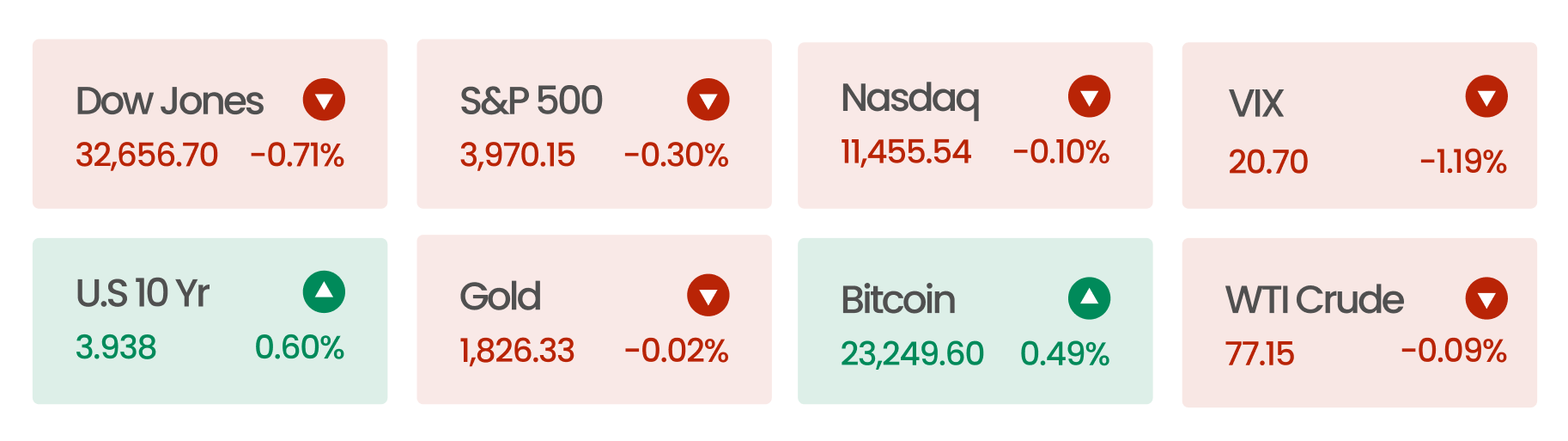

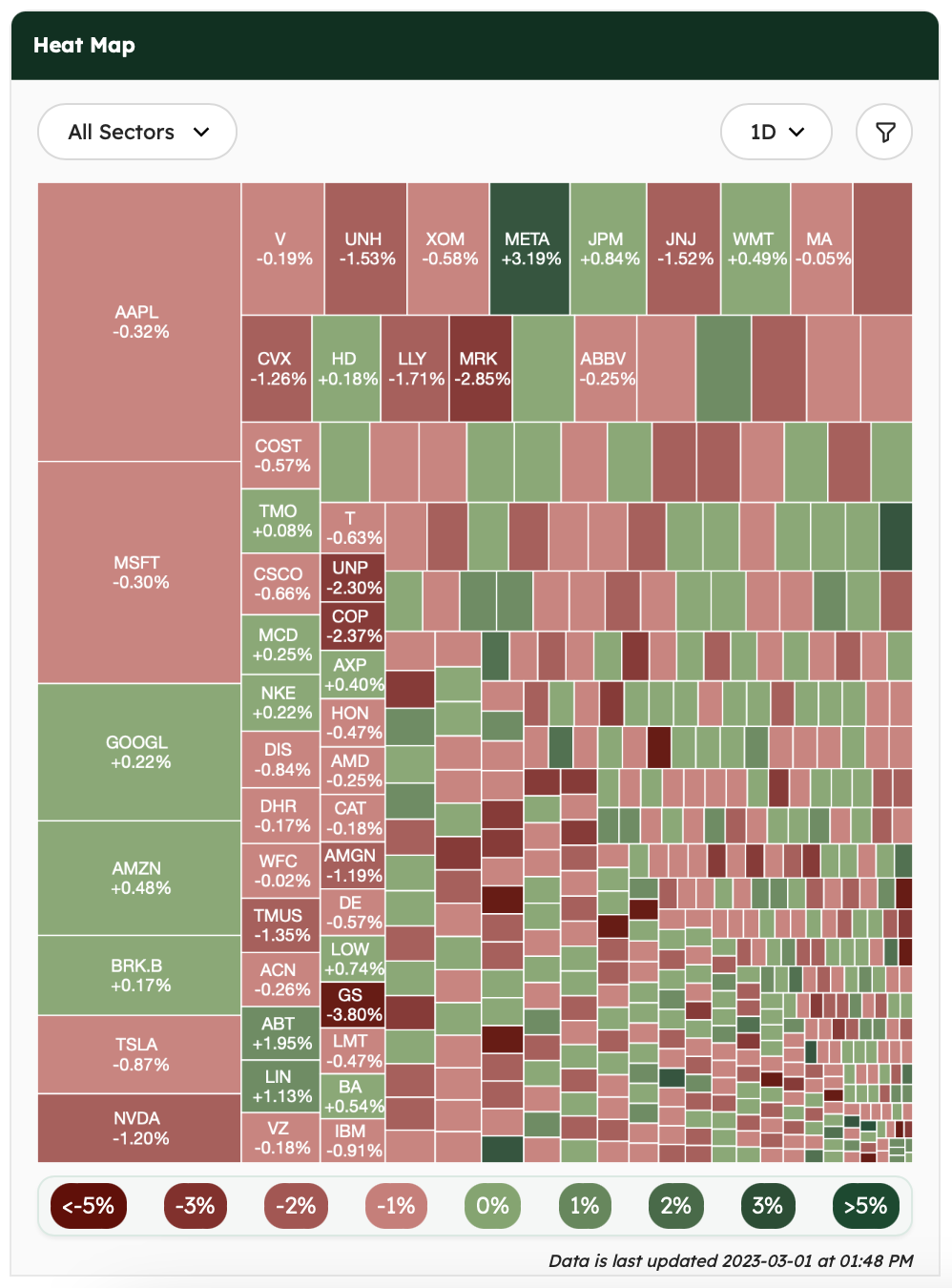

Market Snapshot

The US markets ended with a negative bias against a backdrop of uncertainty regarding the effects of aggressive monetary policy tightening. Earnings season for Q4 is winding down. Target beat estimates this week but provided disappointing guidance. Zoom Video Communications beat estimates while providing a mixed outlook for the upcoming quarter.

News Summaries

Lithium prices have fallen from last year’s record high. Increased demand for EV batteries and supply chain disruptions due to the pandemic pushed prices to $72,000 per metric ton, 9x the 2020 price. Since then, prices have fallen to $61,795 per tonne, owing to oversupply. Chinese mining companies are under investigation due to environmental infringements, impacting a tenth of the global lithium supply. As lithium prices continue to fall, EV batteries will become cheaper.

Intel is slashing dividends by 66%. Less than a month after reporting a disappointing fourth quarter, revenue fell 32% and the chip giant lost $661 million. The company announced it would slash annual dividends from $1.46 per share to $0.50 per share. As net income dropped to $8 billion last year – when the PC market fell by 16.5%, the company was forced to reevaluate its dividend policy which would have cost $6 billion in 2023.

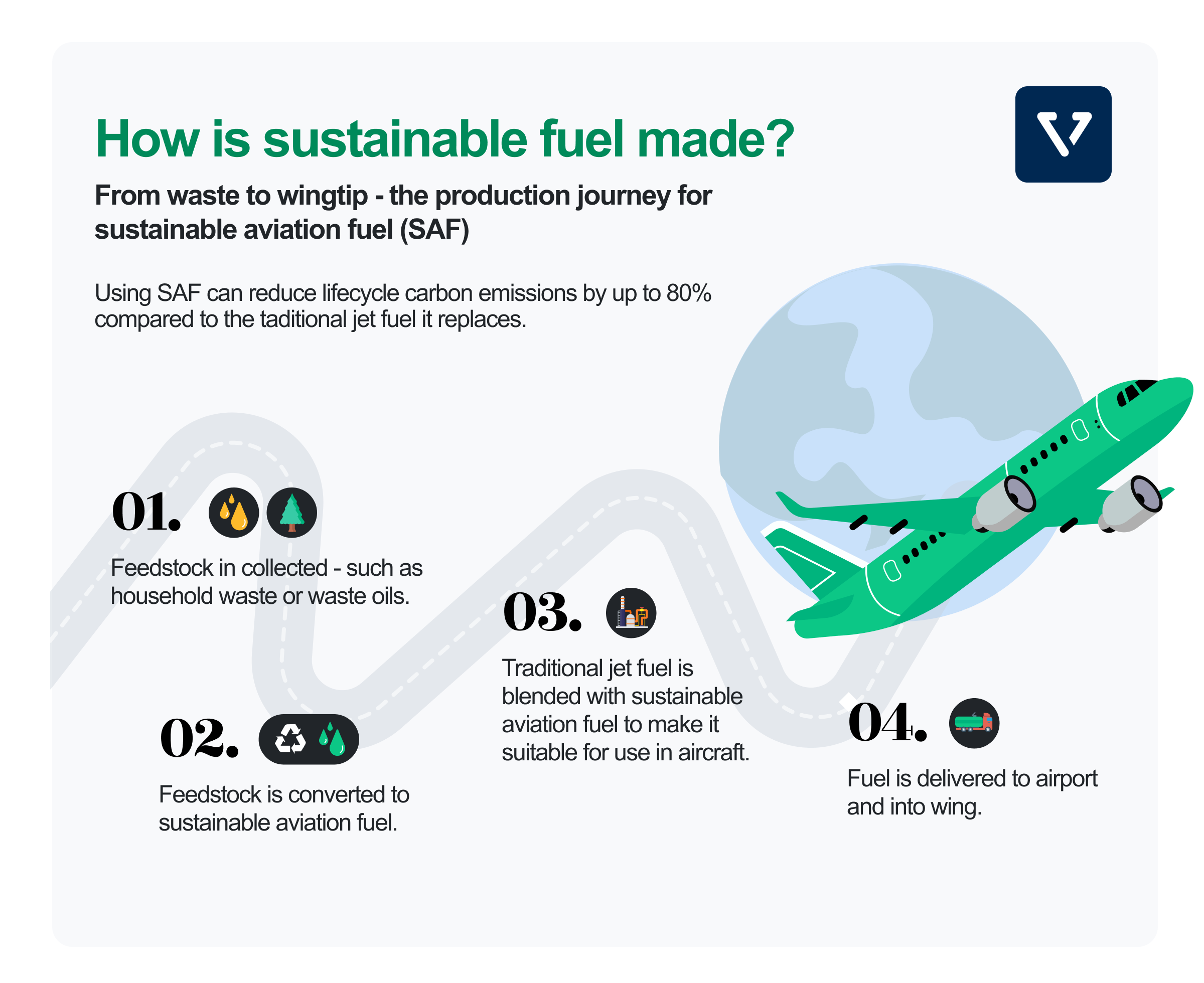

United Airlines announced a VC fund for sustainable aviation fuel (SAF) to help the industry cut emissions. With an initial $100 million investment from United and its partners Air Canada, Boeing, GE Aerospace, JPMorgan Chase, and Honeywell, the fund will invest in SAF startups that produce SAF from feedstocks, including household trash or forest waste. Currently, SAF is made from used cooking oil and agricultural waste, which is tough to source. Thus supply is limited, and is typically two to four times more expensive than jet fuel.

Economic indicators are still signaling high inflation. Any signs of cooling growth at the end of last year proved fleeting. The Personal Consumption Expenditures (PCE) price index, which excludes food and energy costs, rose 0.6% last month — the fastest since June. Food and energy prices increased by 11.1% and 9.6% respectively. This will make the Fed’s goal of 2% inflation harder to reach and may prompt more aggressive rate hikes.