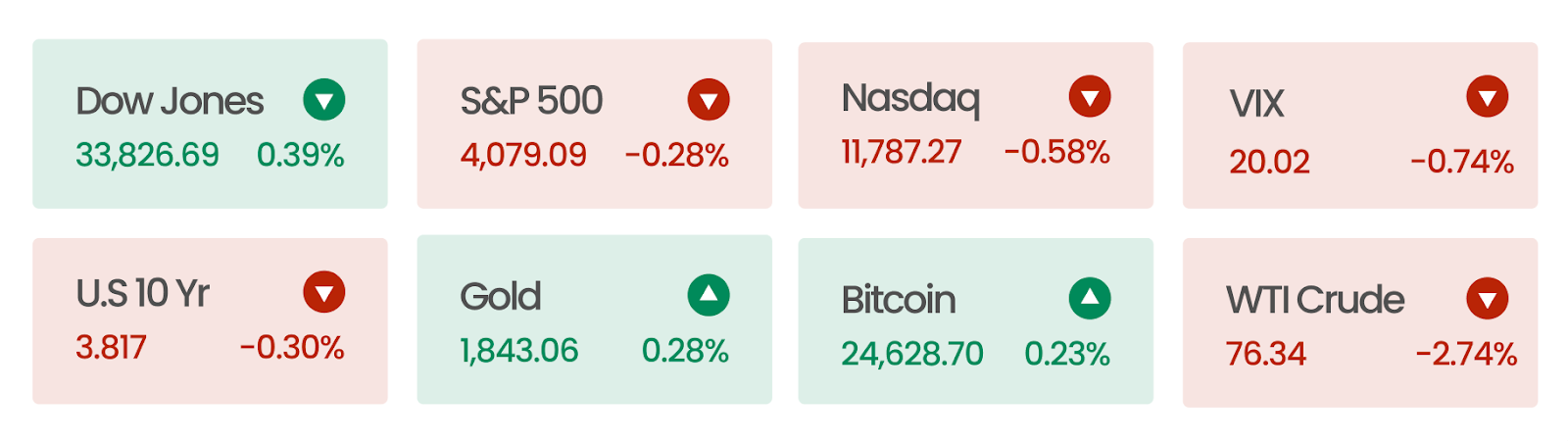

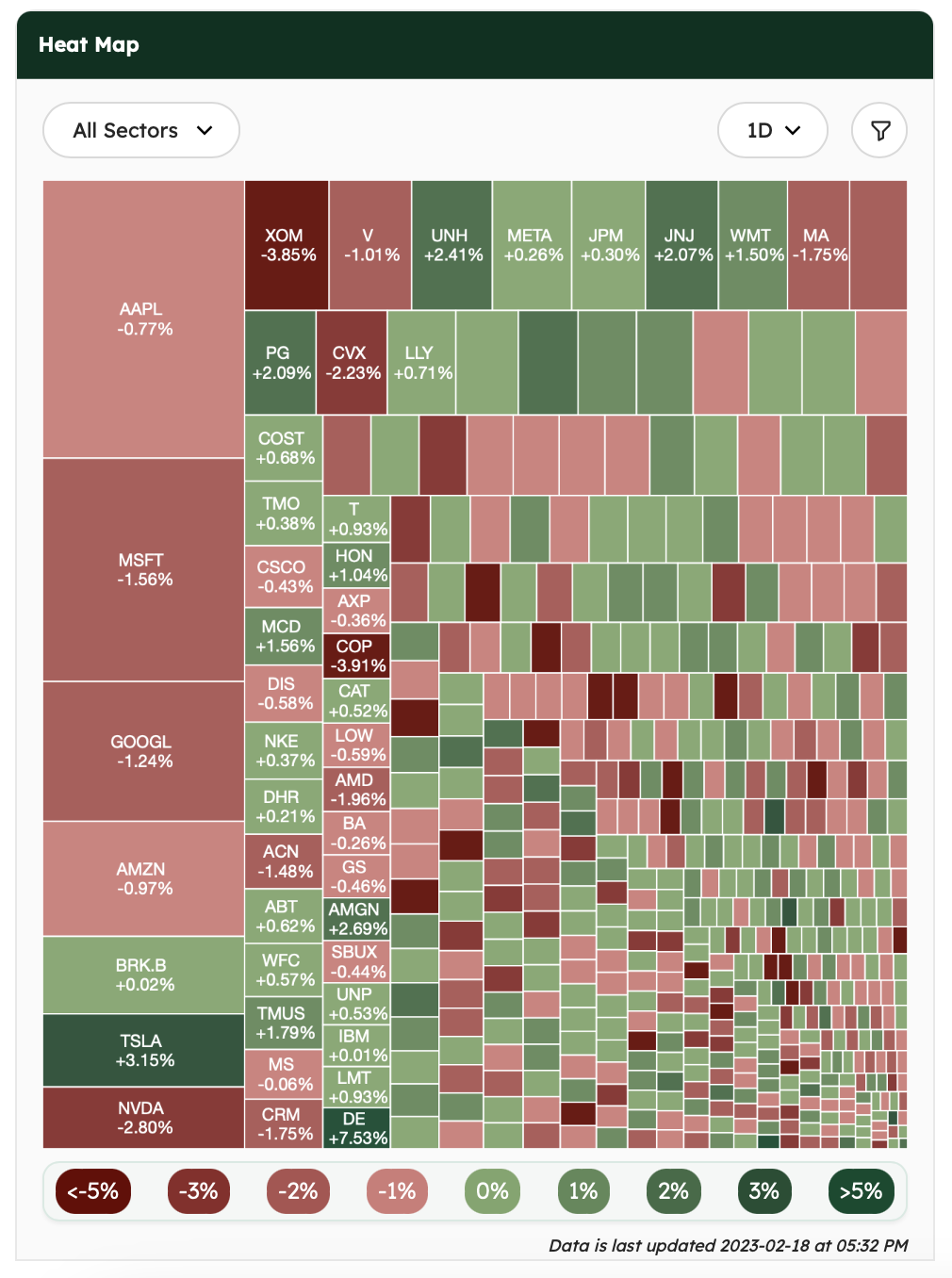

Market Snapshot

US equities ended the week in red, setting the tone for a disappointing holiday weekend. The markets have been attempting to make sense of the Fed’s plan of being more aggressive in an effort to dampen inflationary pressures. This comes after the published reports this week suggested that consumer and wholesale prices have remained at an elevated level.

News Summaries

Live-stream shopping has taken China by storm. Since the start of the pandemic, the live-stream shopping market has quadrupled. However, if you live in the US, it’s highly unlikely you’ve ever seen such live-streams. This is due to cultural differences: Chinese consumers tend to view live shopping as entertainment, while on the other hand US consumers view shopping as a chore. To make matters worse, both Facebook and Instagram’s live-stream shopping features were shut down in the US, while TikTok scaled back its live commerce plans in the US. In China, the market is highly competitive, and streamers will go to great lengths – such as joining boot camps for TikTok sellers or gaming search algorithms by streaming in wealthy neighborhoods with the expectation of higher donations because of the perceived availability of the streamers.

Adidas has $750 million worth of Yeezy inventory it may never sell. After severing ties with the controversial rapper Ye (Kanye West), the world’s second-biggest sports apparel brand is struggling to find a substitute celebrity product. Its strategy over the last few years – centered on partnerships with other artists like Bad Bunny, Pharell Williams, and Beyoncé haven’t always met financial expectations. To put things in perspective, Yeezys were earning $1 billion annually, whereas Beyonce’s Ivy Park collaboration with Adidas is projected to bring in $65 million in revenue for 2023 – a far cry from its initial target of $335 million.

The US 6 Month Treasury bills surpassed 5% in yields for the first time since 2007. As the S&P 500 earnings yield sits at about 5.22%, the narrowing gap between them is making bonds a more lucrative option. If more treasury bonds reach 5-handles, it would suggest investors are expecting a stronger economy compared to 2022, thereby expecting higher interest rates from the Fed in response. As a result of stretched valuations and high rates, strategists at JPMorgan suggest investors should ditch equities for bonds.

Tesla agreed to partially open its charging network to everyone. After intense lobbying from White House aides to help with Biden’s climate goal, Elon Musk agreed to make 7,500 Tesla chargers available for all electric vehicles by the end of 2024. Currently, Tesla’s network comprises more than half of all individual fast charging ports available in the United States and is more than double the size of the closest competitor, Electrify America. This development will help the Biden administration’s plan to build a national network of 500,000 chargers in the country.