In today’s edition:

- Metaverse real estate bubble

- PCs losing their appeal

- Tesla expands presence in China

- Russia’s oil and gas revenues drop by 45%

- Bitcoin surges past $30,000

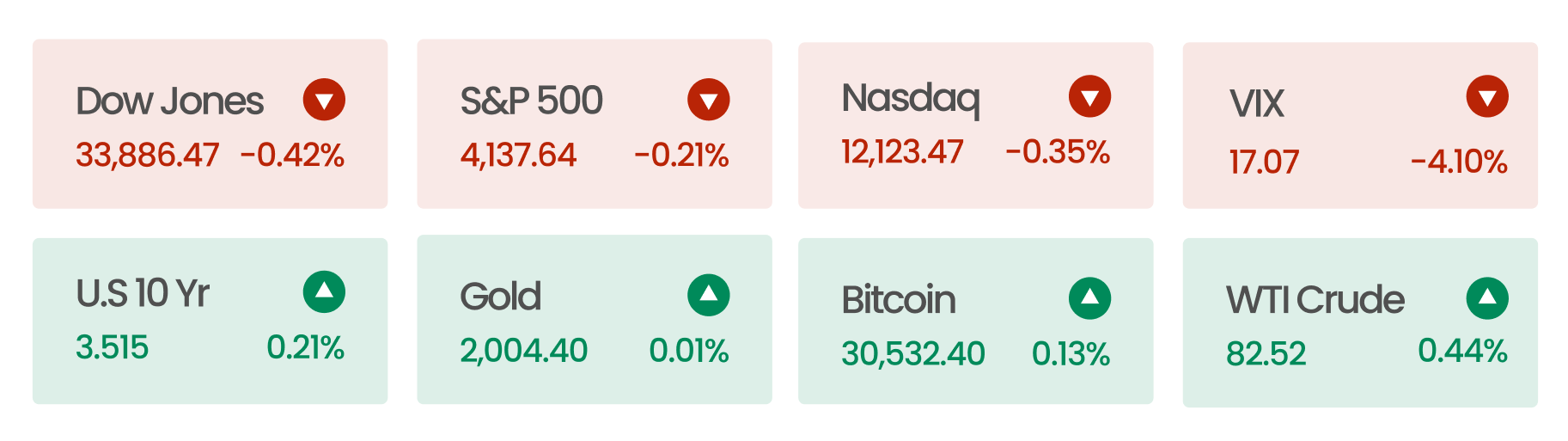

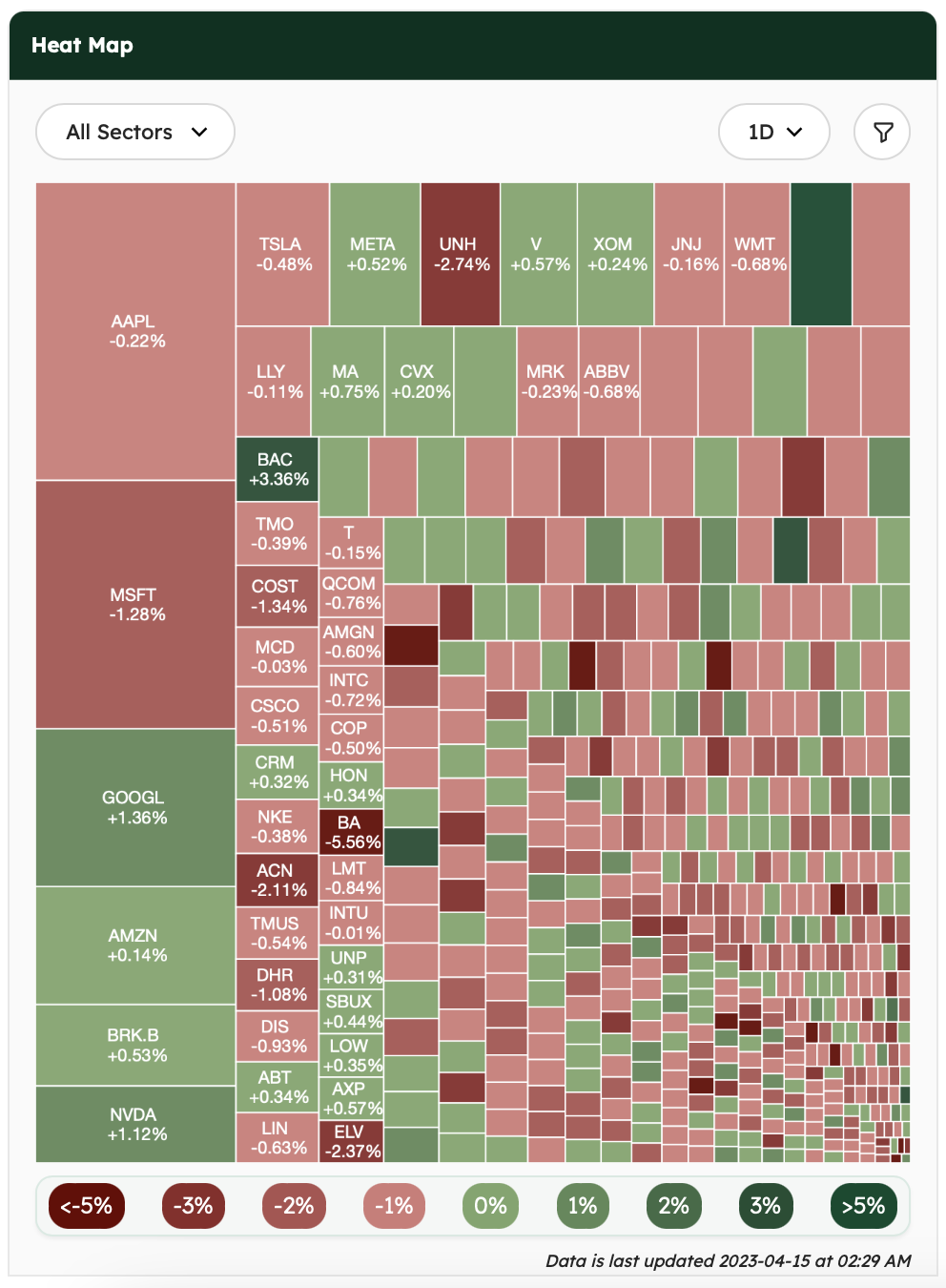

Market Snapshot

A faster-than-expected drop in retail sales figures fueled new recession fears, overshadowing strong bank earnings beats. According to Commerce Department statistics, retail and food service sales decreased by 1% in March from the previous month, casting gloom over the market. On banking stocks, JPMorgan Chase’s (JPM) and Citigroup’s (C) stock rose more than 5% each after the largest US banks posted earnings above analysts’ estimates.

News Summaries

Metaverse real estate is experiencing a significant downturn. Consider Decentraland, one of the most prominent virtual world platforms, where trading volumes dropped from $1 million to $50,000 per week. This decline may be attributed to the popularity of gaming platforms like Fortnite and Roblox, which are fun, and the user usually knows what they’re supposed to be doing on the platform. Gaming platform thus provides a clearer sense of purpose. Additionally, inflation in the physical world has likely encouraged consumers to spend money on tangible products.

Personal computers (PC) are losing their luster! Global shipments of Macs, and other PC heavyweights like HP, Lenovo, and Dell fell sharply in the first quarter of 2023. The 29.3% fall in PC shipments in Q1 from the same period in 2022 is the second highest figure in the last 10 years. The recent drop in PC shipments can be attributed to two main factors. Firstly, the surge in demand caused by remote working and studying has subsided. Second, broader economic uncertainty has impacted overall PC demand. The brief spike in the PC market during the pandemic appears to be over.

Tesla is expanding its presence in China, despite growing tensions between the US and China. The company plans to build a new factory in Shanghai focused on producing Megapack battery storage products. Although US companies have been reducing investments in China due to disruptive COVID policies, Tesla’s relationship with the Chinese government remains strong. Around 22% of Tesla’s revenue comes from China, the world’s largest EV market. However, the company’s dependence on the Chinese market may make it vulnerable to political tensions. Tesla’s CEO Elon Musk has committed to expanding the solar energy and battery business to a scale comparable to its electric vehicle business, and it appears that China will play a crucial role in helping Tesla achieve this objective.

Russia’s oil and gas revenues have plummeted by 45% in Q1 2023, while the ruble has hit its lowest level against the dollar since April 2022. The country’s economic struggles are partly due to a price cap imposed by the US and its allies on Russian crude oil last year. The cap requires Russian oil shippers and insurers to sell below $60 per barrel. This has reduced Russia’s revenue from oil sales but kept oil flowing to markets like China, India, and Turkey. The success of the price cap plan has helped to address concerns about Russia’s position as a major oil supplier amid tensions with the West.

Bitcoin has risen to over $30,000 for the first time since June 2022, doubling in value since its lowest point in November 2022. While the crypto market suffered in late 2022 due to the FTX scandal and the collapse of other crypto companies, digital assets rebounded in 2023, with the top 100 up 48%, outperforming gold, stocks, high-yield bonds, and oil. Investors have been attracted to digital assets as a diversification strategy amid recent banking turmoil and economic uncertainty. However, the total market cap of cryptocurrencies is still down 56% from its November 2021 peak, and crypto investing in dollar terms has fallen significantly. Crypto remains resilient despite uncertainty over the sustainability of the recent rebound and the potential for regulatory crackdowns.