In today’s edition:

- Reviving US heavy industry

- The “Magnificent Seven”

- Financial institutions adopting crypto

- Housing market resilience

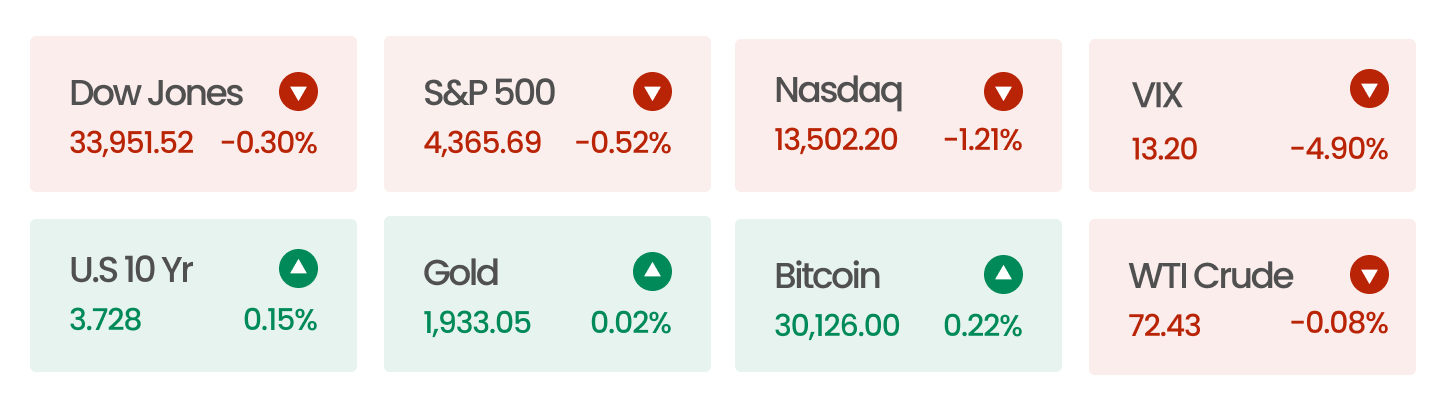

Market Snapshot

On Wednesday, US stocks experienced a third consecutive decline as Federal Reserve Chair Jerome Powell’s remarks suggested the possibility of more interest rate hikes this year. This news disappointed investors who had previously driven the S&P 500 and Nasdaq to 14-month highs.

Data as of market close 21st Jun 2023

Source: AlphaScreener

News Summaries

A surge of investment in US heavy industry is set to reshape the country’s economic landscape in a marked shift from the chronic underinvestment of the 2010s. Buoyed by legislative funding from the Biden administration and pent-up demand, large-scale manufacturing projects for batteries, solar cells, semiconductors, and more are taking off. This trend not only supports job creation and material demand but also provides a safeguard against potential recessions. Current manufacturing construction spending is at $189 billion annually, three times the average of the 2010s, contributing to economic strength. The substantial capital investments could keep interest rates high and increase high-wage jobs, which may further fuel wage growth, impacting inflation.

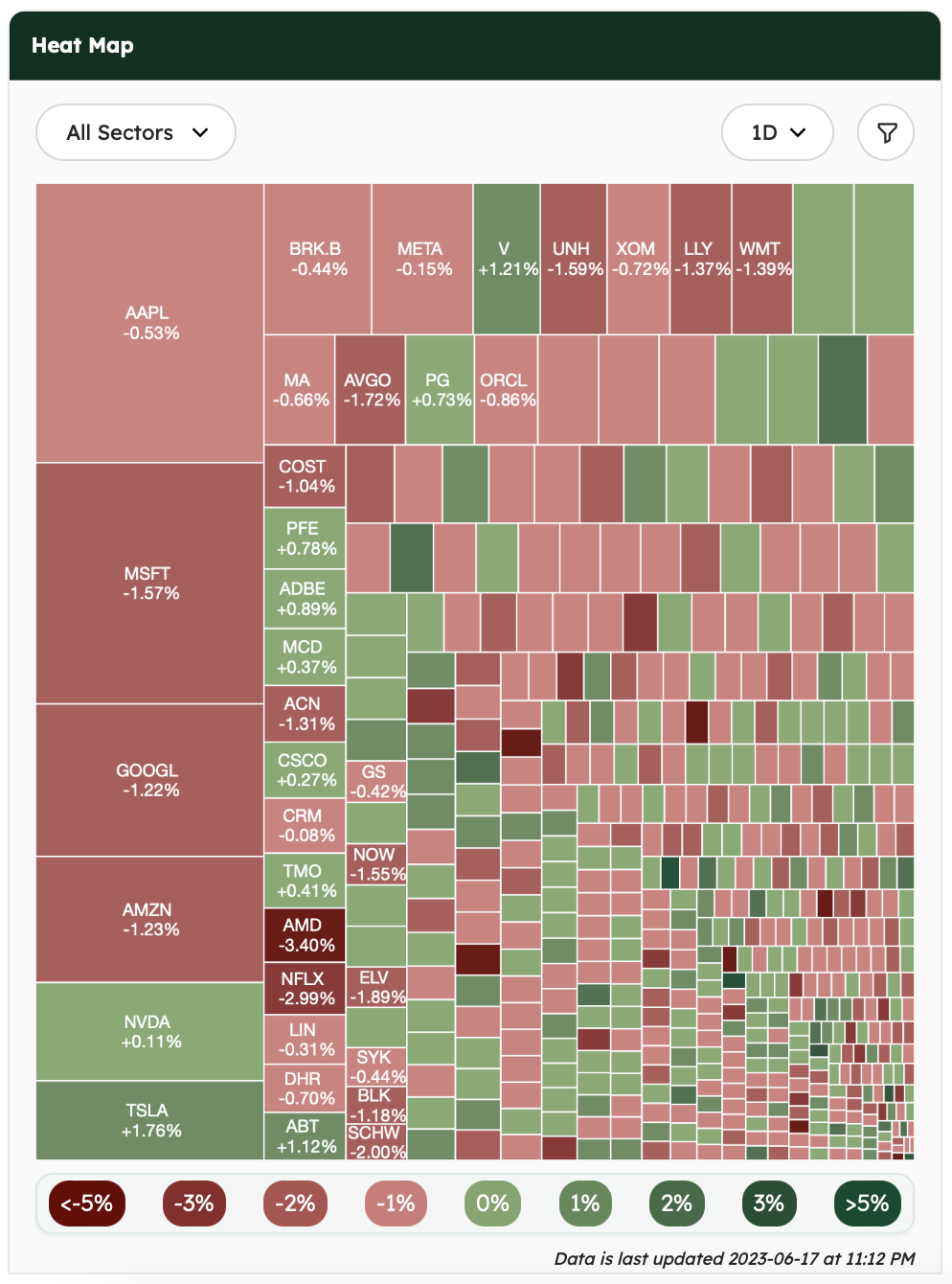

The US stock market is riding the success of the “Magnificent Seven” – Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta – which have collectively soared by nearly 90% this year, becoming the primary drivers of the market’s rise. Their gains are attributed to factors such as advances in AI, a respite from Federal interest rate hikes, and their consistent, substantial profits. This surge in these tech giants witnessed significant outflows from US money market funds into US equities, signaling a robust bull market, despite the inherent uncertainty of the stock market’s future trajectory.

Big names in finance are showing increasing interest in crypto, potentially heralding wider adoption. BlackRock has filed for a Bitcoin trust called iShares Bitcoin Trust. It aims to let investors access Bitcoin indirectly. Meanwhile, another financial giant, Fidelity, is rumored to be eyeing crypto. It might file for a Bitcoin ETF or buy Grayscale. These moves, if realized, could boost crypto adoption. Similar to when SPDR Gold Shares (GLD) launched, BlackRock’s Bitcoin ETF could spur significant price action.

The resilience of the US housing sector appears to be keeping the economy afloat. Since last summer, the housing market has felt the effects of interest rate hikes as mortgage rates soared and demand for new homes plummeted. However, despite mortgage rates exceeding 7%, demand for homes and construction workers is now on the rise. Home prices remain resilient due to low supply, with existing home sales down 23% from a year ago as homeowners hold on to low-rate mortgages. However, new home sales are up by 12%, and builders are creating new properties to meet the recovering demand. The buoyant housing market also supports the broader economy, as construction employment remains steady, and homeowners, enriched by equity, continue to drive consumer spending.