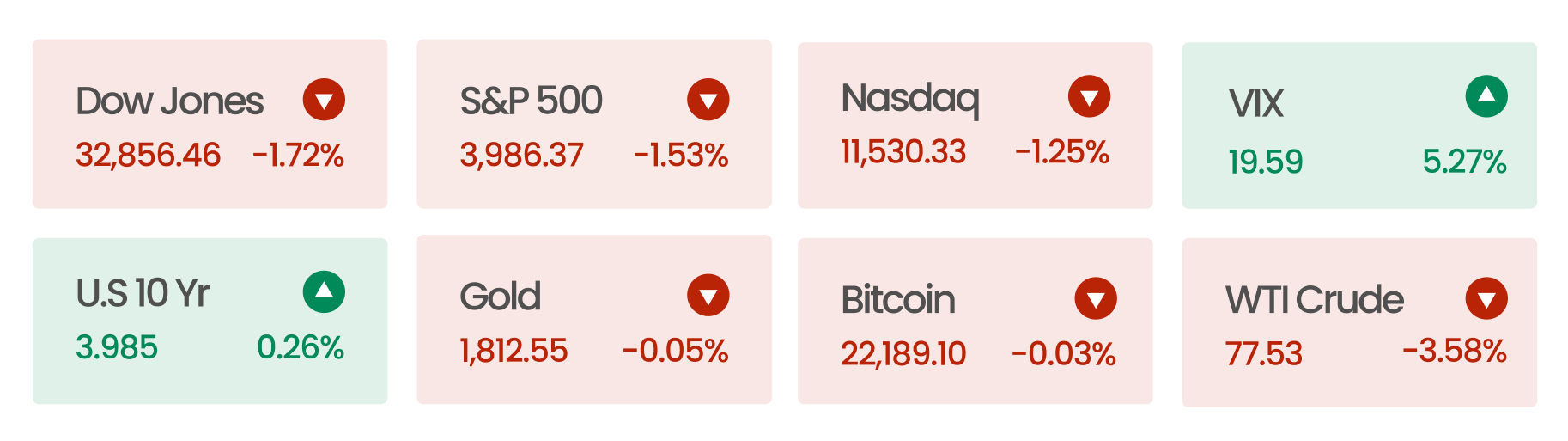

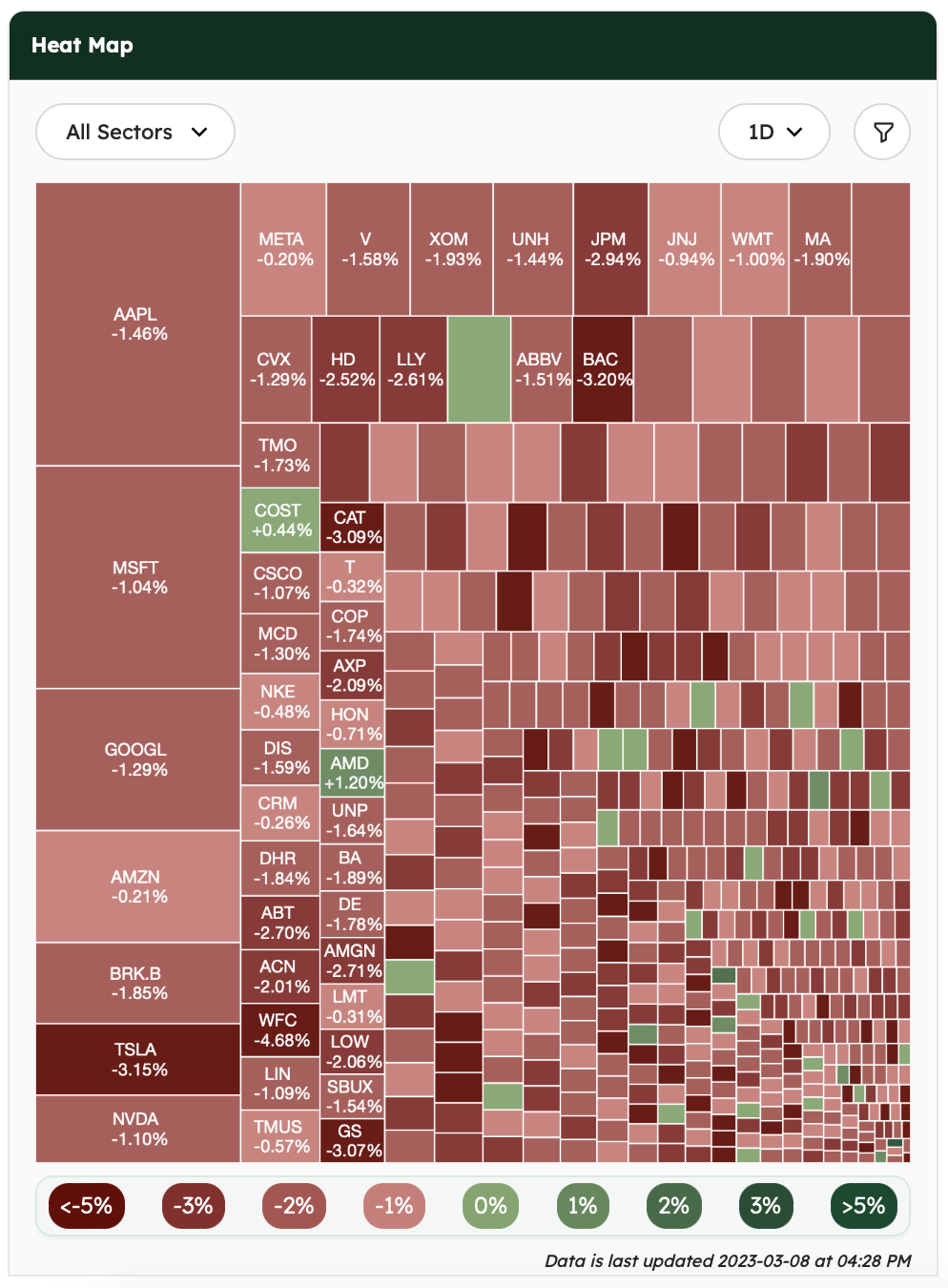

Market Snapshot

On 7th Mar, during his semi-annual testimony to the Senate Banking Committee, Fed Chair Jerome Powell commented on rate hikes, which prompted a negative reaction in the US market. The US consumer spending and the Federal Reserve’s preferred inflation gauge both increased unexpectedly in January, highlighting the resilience of the US economy and the difficulty in taming inflation. If the economic data remains strong, the Fed is prepared to accelerate rate hikes, Powell said.

AI can read your mind

A recent paper published by researchers in Osaka University showed that AI can now read your mind with terrifying accuracy. Using the latest stable diffusion generative model, researchers were able to reconstruct images a person saw by translating brain scan data (from fMRI scans) into images.

The researchers trained the AI model using paired images and fMRI scans. Once trained, the model can be fed new fMRI scans and reconstruct images associated with images viewers saw when the scan was taken. In other words, the AI reads your mind…

This is another example of the surprising capability of the diffusion models. They were trained using data on the internet and are capable of translating the text into images (thanks to the abundance of image annotation available on the web). This capability has enabled them to take limited training input (fMRI brain scans) and produce relatively high-fidelity images without specialized fine-tuning.

AI can not only replicate humans’ voices, and faces (in both picture and video format), it can also reconstruct what humans see. It might be time to stop believing everything you see on the internet and to limit over-sharing (count us out from sharing our latest fMRI brain scans on Instagram).

News Summaries

Crypto-exposed Silvergate Capital (SI) was hit by a bank run. After a delayed annual report, Crypto firms such as Coinbase, Gemini, Crypto.com, and others began distancing themselves from the bank by halting transfers via the bank’s Silvergate Exchange Network (SEN). Put simply, customers of these crypto firms use SEN to buy and sell Bitcoin, Ether, and other digital assets. Silvergate was forced to shut down SEN, which led to a 58% fall in share prices.

EV maker Rivian is selling $1.3 million in green convertible bonds, due in 2029. Green bonds enable companies to attract investors who are willing to accept lower returns in exchange for supporting green projects. However, this move can dilute the company’s shares as these bonds can be optionally converted into shares. Briefly, the world’s third most-valuable car company, Rivian Automotive Inc., failed to meet revenue targets last quarter and has announced expectations to deliver 50,000 vehicles this year, significantly less than Wall Street’s hope of 60,000. The company’s share price fell ~92% from its peak, and it laid off 6% of its workforce last month.