In today’s edition:

- The NYT’s transformation success

- Spotify “Supremium”

- SoftBank’s gamble on the Metaverse

- DoorDash shakes up gig economy

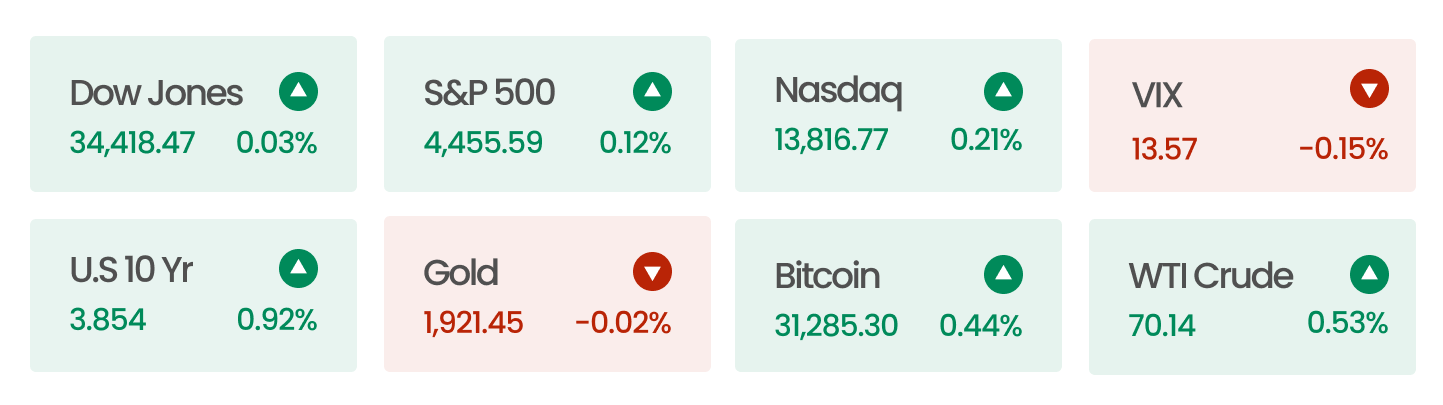

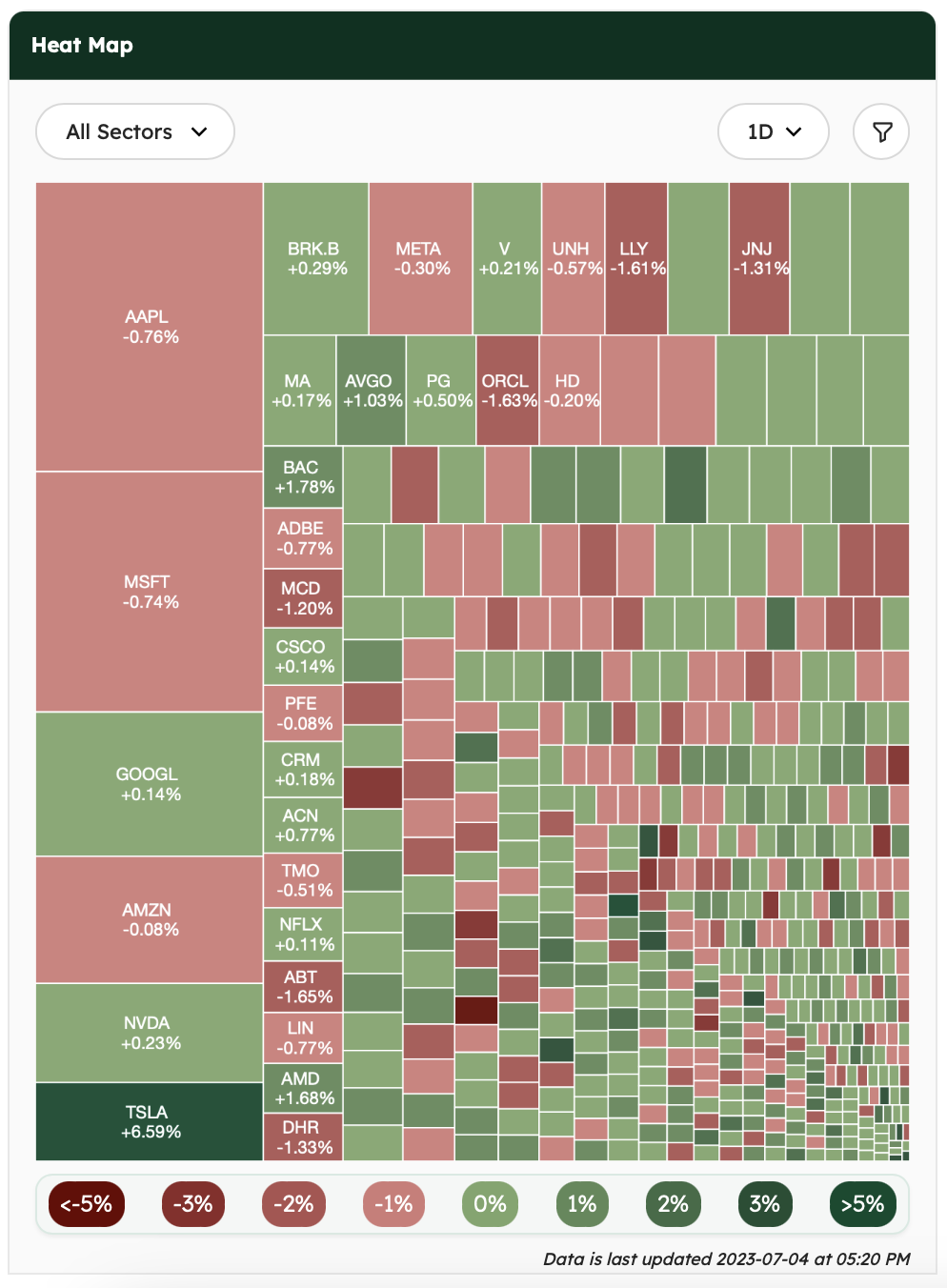

Market Snapshot

US stocks made modest gains on Monday, in a brief yet calm session preceding the July 4 holiday, with investors anticipating employment data to be released later in the week, potentially influencing the Federal Reserve’s future interest rate decisions.

Data as of market close 03 Jul 2023

Source: AlphaScreener

News Summaries

The New York Times (NYT) was once a print giant, but it has successfully adapted to the digital era since 2011. Despite facing initial backlash and a decline in online traffic when it introduced a paywall, the NYT revised its digital strategy. It launched innovative digital-only projects that attracted readers and acquired digital ventures that complemented its core business. Today, digital subscribers fuel 42% of the company’s $2.3 billion revenue, making the NYT’s digital transformation a success story in the news industry.

Spotify is turning up the volume on its subscription services, reportedly introducing a more expensive tier known as “Supremium,” which is set to debut in non-US markets. This change includes a HiFi feature, a crisp and refined audio quality that the company once left on the back burner after competitors like Apple Music and Amazon Music integrated it into their standard packages. With this move, Spotify aims to boost its paying subscribers, who make up 40% of its listeners but generate 97% of its gross profit.

Despite its recent unfortunate investment streak, including a $32 billion loss to its Vision Fund, SoftBank seems unfazed as it places its chips on the next grand wager – the metaverse. Improbable, a SoftBank venture, is working on its ambitious project MSquared, which aims to create a 3D virtual universe for more than 10,000 digital inhabitants who can live, work, and have fun together. The project is a gamble that could either boost SoftBank’s fortunes or add to its list of failed investments. But Improbable is determined to avoid the mistakes that cost Meta $13.7 billion in its pursuit of a digital paradise.

Food delivery giant DoorDash has announced it will offer an hourly pay option to its drivers, marking a significant shift from the traditional pay-per-delivery system. While critics have often equated the gig economy’s pay structure to a bumpy ride, less steady than conventional jobs, DoorDash’s new course offers an intriguing twist in the narrative. However, the change isn’t a magic carpet promising higher earnings but is more like an UberPooL ride, providing certainty and control over income. The option to toggle between per-delivery and hourly pay modes puts the driver in the decision-makers seat, offering an upfront view of the pay journey. Despite critics arguing that the gig economy leaves workers in a ride-sharing predicament and earning less compared to steady jobs, the move is likely to be hailed by those seeking greater reliability and transparency in their earnings journey.