Market Snapshot

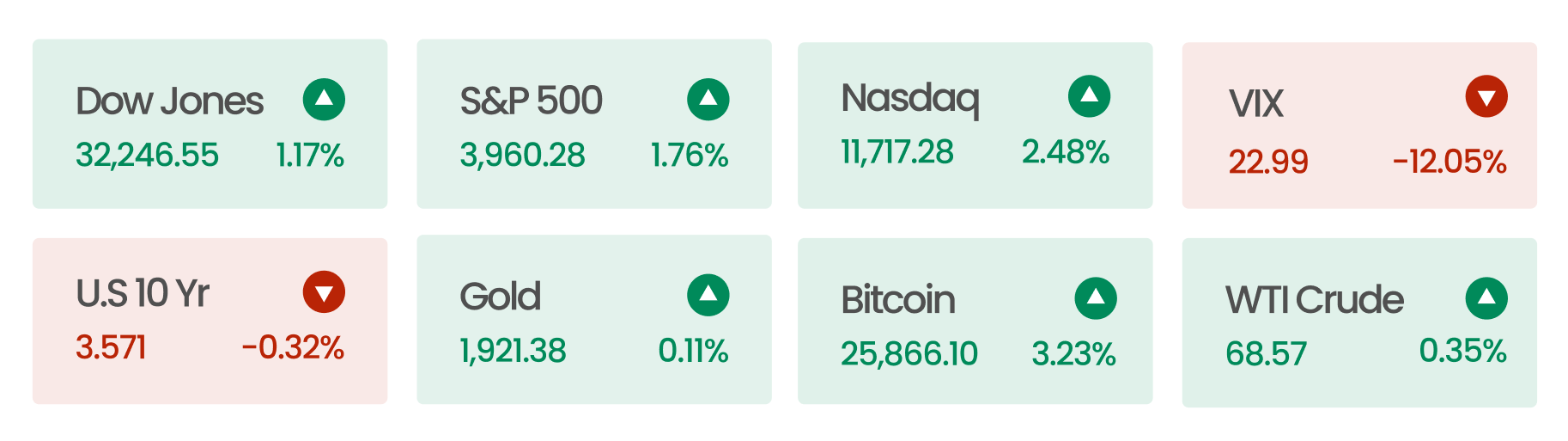

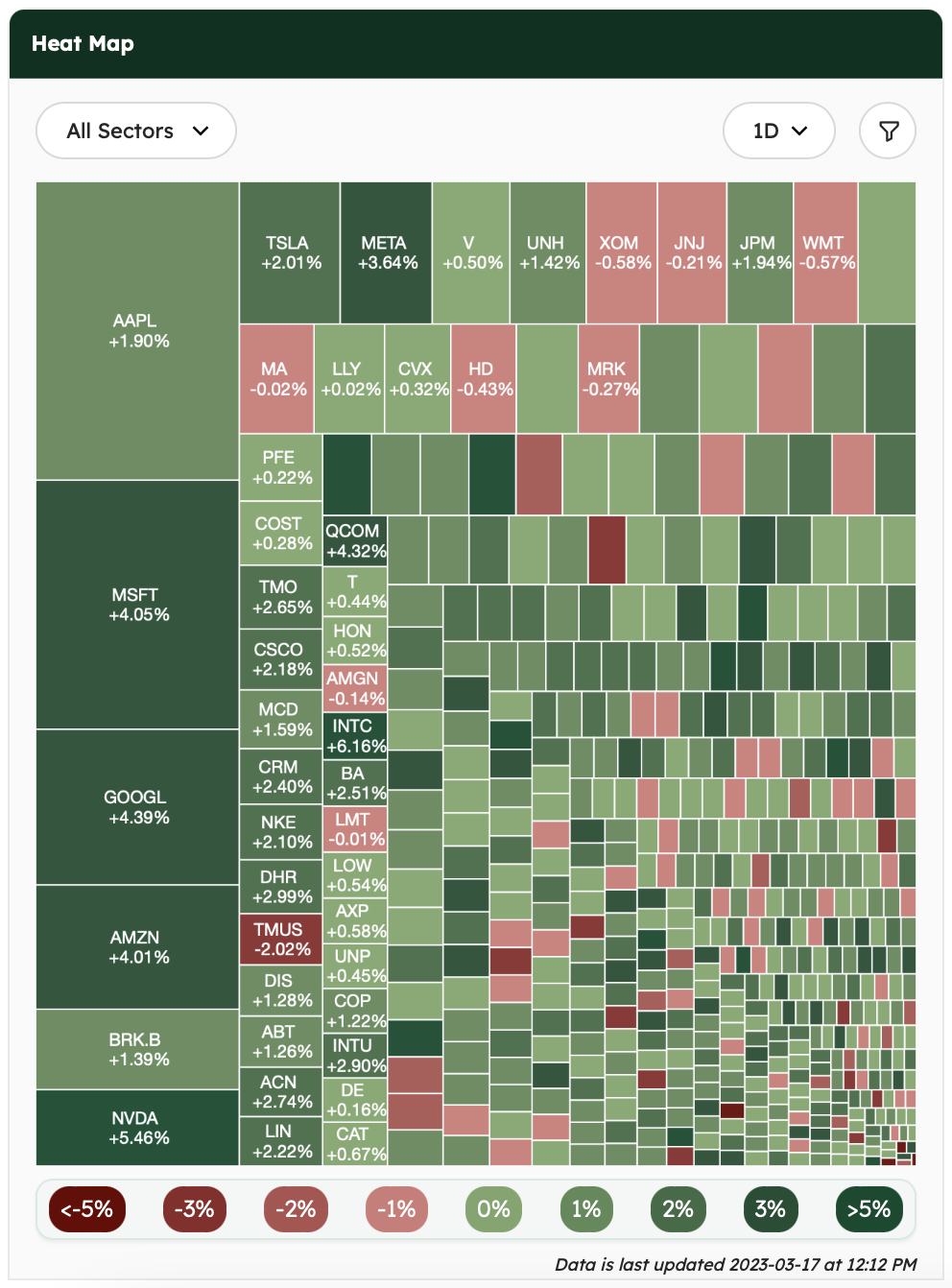

The US stock market showed a notable rebound, reversing its recent losses on the back of the banking sector’s persistent spotlight. First Republic’s stock surged on the news that several major banks are considering depositing up to $30 billion into the firm for stability. Additionally, Credit Suisse saw a rise in its share price following capital support from the Swiss National Bank. Among other equity updates, Adobe reported quarterly results that exceeded expectations and provided a positive outlook for the future, while Dollar General’s financial results had a mixed reception.

News Summaries

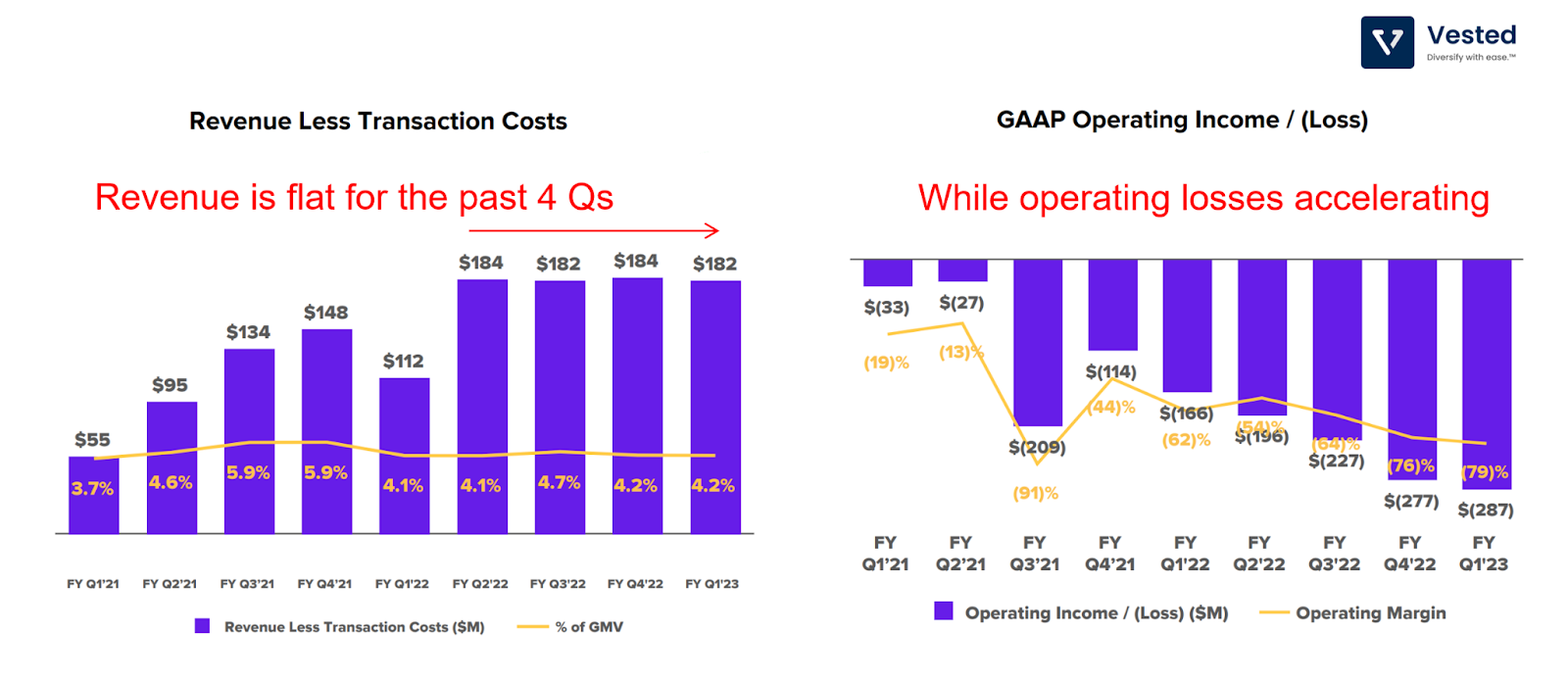

Klarna, a Swedish buy now, pay later (BNPL) company, reported a 71% year-over-year increase in gross merchandise value (GMV) in the US, its largest market by revenue. In December 2022, the company had more than 8 million monthly active app users in the US, a 33% jump from February 2022. However, its report of a $1 billion loss in 2022 has sparked concern about the long-term viability of BNPL providers. Fortunately, BNPL is not Klarna’s only product. The company has launched several e-commerce platforms for commerce search, shoppable videos, and influencers to diversify revenue streams.

Uber is considering spinning off its logistics division Uber Freight. According to a recent Bloomberg report, an IPO is most likely, but it won’t happen until next year. The freight business was started in 2017 as part of the Uber Everything initiative. As the name suggests, it was Uber’s goal to find ways of using its technology to transport everything. Thanks to the acquisition of shipping software company Transplace in 2021, Uber Freight has grown into a $1.5 billion per-quarter business, contributing 18% of Uber’s sales. A spin-off could help Uber narrow its focus on rides and food delivery.

Oil demand will reach a record 101.9 million barrels per day (bpd) this year, according to the International Energy Agency (IEA). Driving the projected rise is China, where the reopening is expected to fuel the country’s daily demand to a new all-time high of 16 million bpd. On the supply side, due to wartime sanctions, Russia announced reducing 500,000 bpd in production for March. With US output waning and OPEC back in control, analysts predict higher crude oil prices and shortages in the second half of the year.

Microsoft achieved the impossible by making everyone want to use Bing. In a recent blog post, the company announced 100 million daily active users on Bing, just one month after announcing the AI-integrated chatbot. The launch resulted in a 6x increase in daily active users, but Google still outnumbers Bing with 10x the number of users. To narrow the gap, Microsoft is pushing its search engine with Microsft Edge updates and Windows prompts to prevent people from downloading Google Chrome. According to Microsoft’s CVP of finance, “For every 1 point of share gain in the search advertising market, it’s a $2 billion revenue opportunity for our advertising business.”