US Market Year in Review

As 2019 is coming to an end, we thought it would be good to look back and compare the performance of the US market this year vs. previous years.

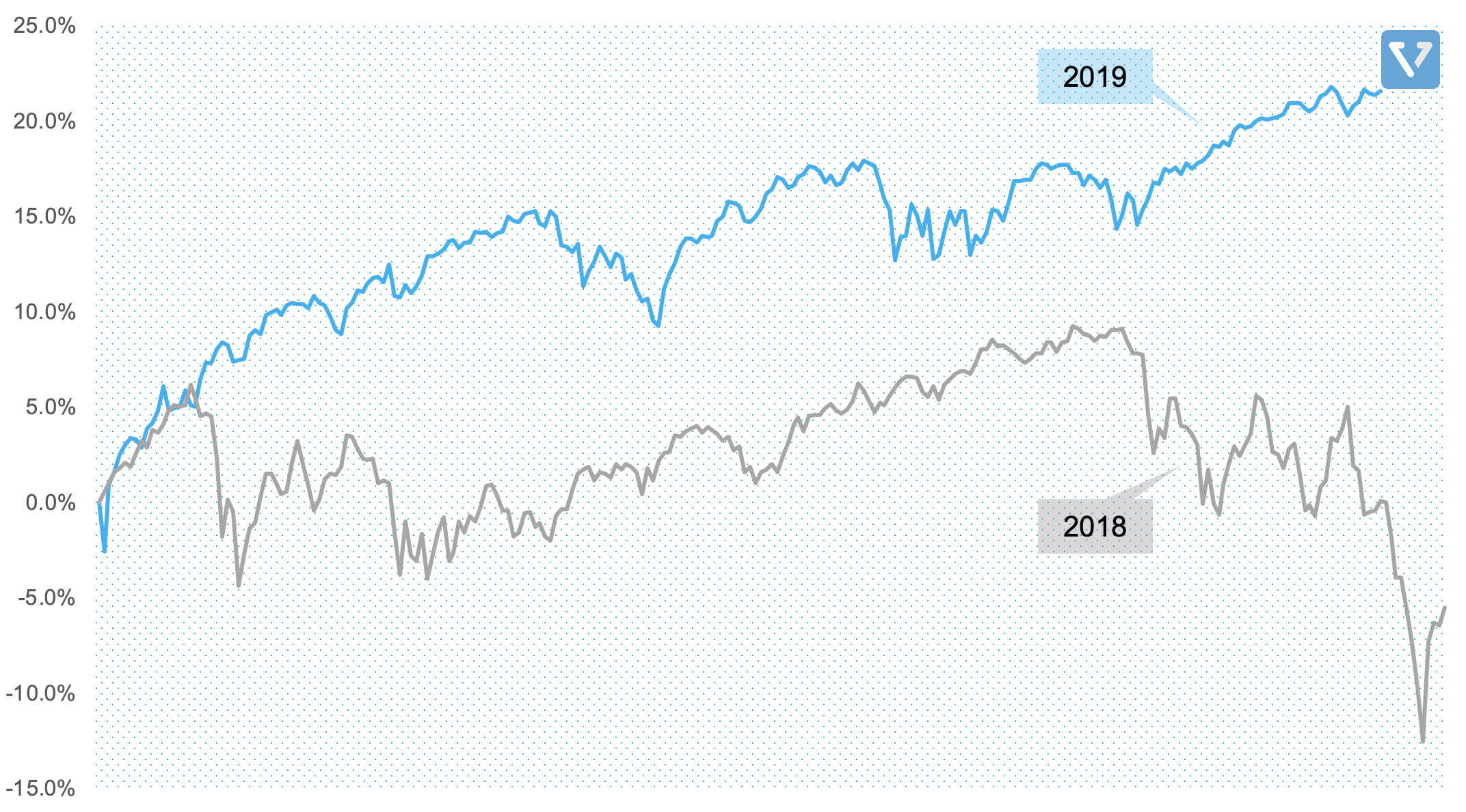

Despite the trade war and concerns over the inverting yield curve, the US market performed fairly well in 2019. Overall, the market (S&P 500) has returned 22% to date. This is much improved when compared to last year, when the market returned -5% (the stock market didn’t perform well in Q4 2018). And today’s news of a partial trade agreement between China and the US may breathe a fresh wind of optimism. See Figure 1.

Figure 1: 2019 vs. 2018 S&P 500 one-year return

How does the 2019 one-year return compare to past returns?

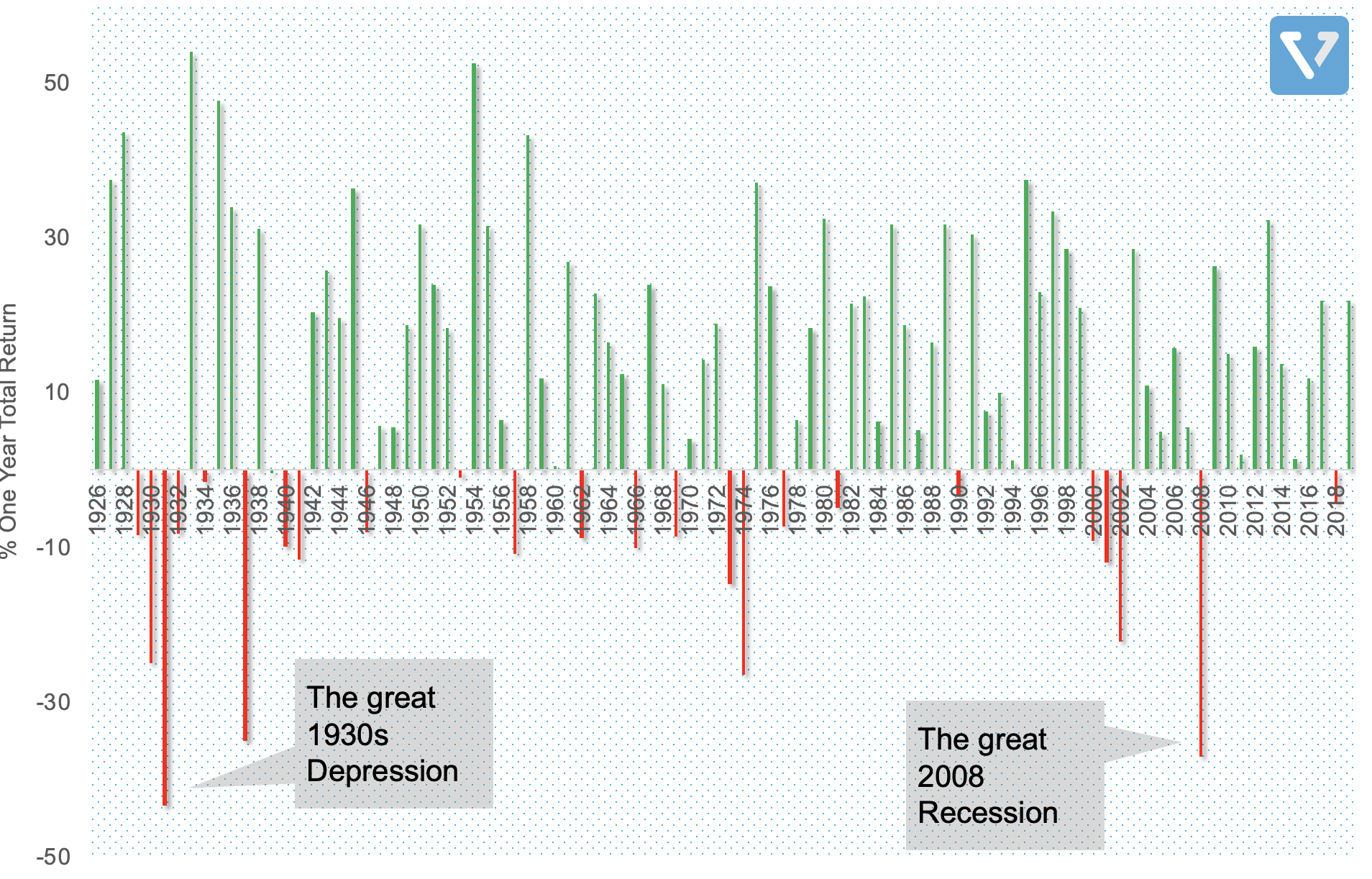

Compared to previous one-year returns for the past 94 years, 2019 returns are above the long-term average (see Figure 2). The average S&P 500 one-year return (since 1926) is 12%. At the time of writing this article, the S&P 500 is almost double this average. Notice in Figure 2 that there are far more years with positive returns than negative. Statistically speaking, this is why long-term investing tends to produce better results.

Figure 2: Long term S&P 500 one-year returns

So what has propelled the returns this year?

The Good

Apple. Apple is one of the largest constituents (about 4.4%) of the S&P 500. Its share price gained 70% this year. This growth has been driven by strong wearables sales and progress in its transition into services business, which relies more on recurring revenue.

Microsoft. 2019 is shaping up to be another strong year for Microsoft. Their stock price has gone up almost 50% this year. The company’s share growth is propelled by strong expectation-beating earnings and continued growth in the cloud business (where it is projected to be the company’s largest business by 2023). The company also recently won a US $10 billion contract to serve the Department of Defense. If you’re interested in Microsoft’s story under Satya Nadella, we did a deep dive.

Semiconductor Sector. After a relatively weak 2018, the semiconductor sector performed well in 2019. The SPDR S&P Semiconductor (ticker: XSD) returned over 50%, or 2X the S&P 500 index. Four companies stood out as strong performers: AMD, NVIDIA, Applied Materials, and Qualcomm, which to date have returned 122%, 64%, 80%, and 54% respectively.

Target Corporation. Who says physical retail is dead? Target Corporation is the eighth-largest retailer in the United States, and is a component of the S&P 500 Index. Its share price has rallied more than 90% this year, backed by consistent same-store growth and a new strategy of hybrid online/offline order pick ups that helps the company reduce shipping costs and increase foot traffic to its stores.

The Bad

The energy sector has been the worst performing sector this year. Take the Energy Select Sector ETF (ticker: XLE) for example; the total 2019 return of this ETF, as of the writing of this article, is only 3.92%, 5.6X lower than the broader S&P 500. The Energy Sector comprises of companies whose businesses are dominated by the construction or provision of oil rigs, drilling equipment and other energy related service and equipment, which includes Exxon Mobil (4%) Schlumberger Limited (5%), Chevron (7%) and others. Prolonged decline in oil prices have put pressure on the US energy sector.

Thanks for reading! Until next time.