The backstory:

In the last week of November, Microsoft briefly overtook Apple as the most valuable company in the world. This is a far cry from a few years ago, where Microsoft was seen as a lumbering giant. It was profitable. It was large. But it was not innovating.

Under the leadership of Ballmer, who was CEO from 2000–2014, and Bill Gates before him, Microsoft was a Windows company, first and foremost (“a PC on every desk and in every home, running Microsoft softwareâ€). Although this business model proved to be extremely profitable for three decades, the focus had caused Microsoft to miss on many technology innovations in the 2000s. The company missed out on the growth of mobile computers, despite having a windows phone as early as 2003 (a full four years before the iPhone) and despite having acquired Nokia for US $7.2 billion. Its preoccupation on fitting windows into the mobile form caused Microsoft to fail in this market. It also failed on social (remember MSN? Yeah — me neither) and music (Zune). Furthermore, due to the desire to combine touch and mouse interfaces, the company hastily released the short lived Windows 8 into the world (which followed the abominable Windows Vista).

As a result, the company was beginning to become irrelevant. In 2005, Microsoft’s market capitalization was US $202 billion. By 2012, its market cap was US $215 billion. This was a stark underperformance, especially when compared with one of its chief competitors, Apple. In 2005, Apple’s market cap was US $27.5 billion, and by 2012, it was US $507 billion, a whopping 18.4X increase over the same time period.

The aforementioned misses by the company was not solely a result of poor strategic decisions. It was also due to a culture riffed with bureaucracy and internal knife fights. New products had to operate with Windows and Office, limiting new innovations. Stack ranking systems pitted employees against one another, causing an unhealthy cut-throat environment.

The present:

In February 2014, Satya Nadella was appointed CEO. Nadella’s first order of business was to transform Microsoft’s culture and business. To be less windows centric, he revised the company’s mission to “empower every person and every organization on the planet to achieve moreâ€. In other words, to focus less on the tools people use (Windows PC), but rather focus more on the ‘jobs to be done’.

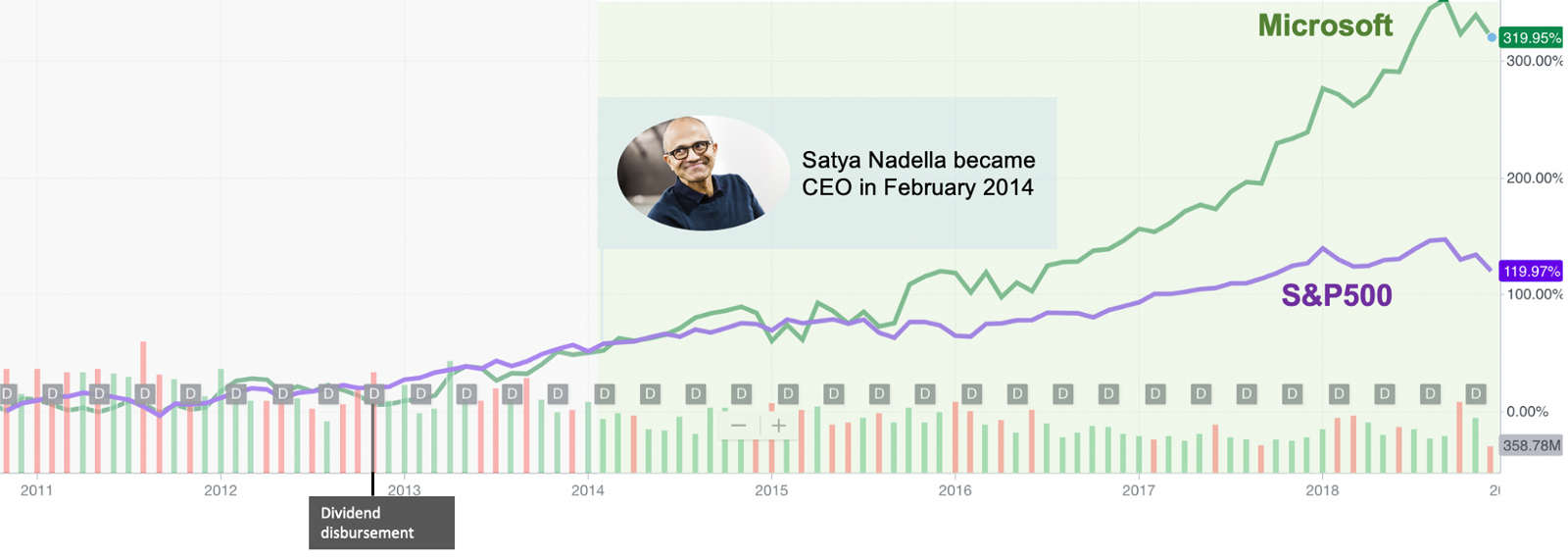

As a result, Microsoft has been on a tear. In the years preceding Nadella’s tenure, Microsoft’s share price grew at roughly the same rate as the overall stock market (Figure 1). Since taking over, the company’s share price has significantly outpaced the market.

What led to this change? Let’s go deeper to see what is powering this growth.

Once a cloud man, always a cloud man.

Although Microsoft started offering a cloud computing solution in 2010 (four years after Amazon), the business was not a focus under Steve Ballmer’s leadership. Before he was appointed to be CEO, Nadella had been the head of the Server and Tools division (Microsoft’s Cloud business). By choosing Nadella as successor to Ballmer, Microsoft’s board made it clear that the cloud business would be a focus.

Why was this cloud strategy so important?

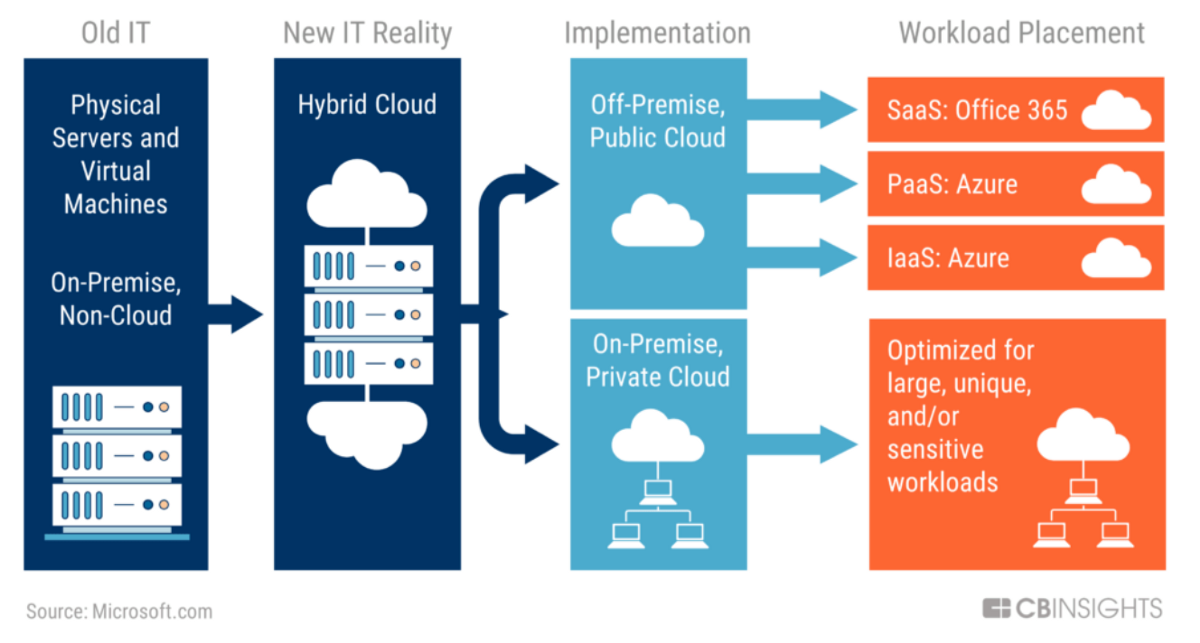

Cloud computing is one of the fastest growing segments of the tech sector. It is projected to be a half a trillion dollar market by 2022. So what is cloud computing? At a high level, there are two types of server compute infrastructures: on-premise and cloud computing.

- On-premise computing: you buy the servers, rent/lease the location where the servers will be hosted, and hire the IT staff to install and maintain both the hardware and software. This requires domain expertise, large initial capital expenditures and longer implementation cycle. However, your data can be more private, as it is stored within your system. This is the old way of doing things.

- Cloud: you rent computing in the cloud. The cloud is a series of servers which are hosted remotely and are connected to the internet. These remote servers can store data and run various applications. With the Cloud, users no longer have to purchase, build and maintain their own server infrastructure. Applications can be installed as needed, and you only pay for what you use. This requires no initial capital expenditures and doesn’t require domain expertise.

The paradigm shift to the cloud has led to the explosion of new startups, as the cost of starting a new technology company has decreased significantly. Migration to the cloud is not only for startups however, as large corporations and government services are migrating to the cloud as well.

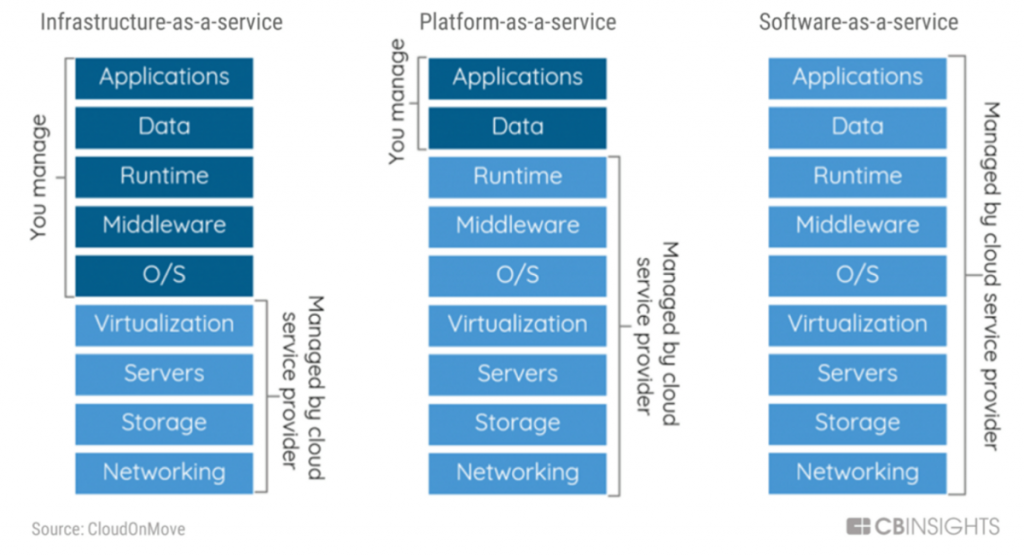

At a high level, cloud computing comes in three flavors, depending on the level of outsourcing and functionality the user desires (see Figure 2 (taken from here)):

- Infrastructure-as-a-service (IaaS): customers manage their own operating systems and run their own applications. The rest is managed by the cloud provider.

- Platform-as-a-service (PaaS): customers manage their own application and data. The rest is managed by the cloud provider.

- Software-as-a-service (SaaS): customers just use the software. Everything else is managed by the various vendors. Typically the software is delivered through the internet and not installed locally. For example, Adobe delivers its image editing software through the internet, users pay a subscription fee, and in the back-end Adobe uses AWS to manage the everything else.

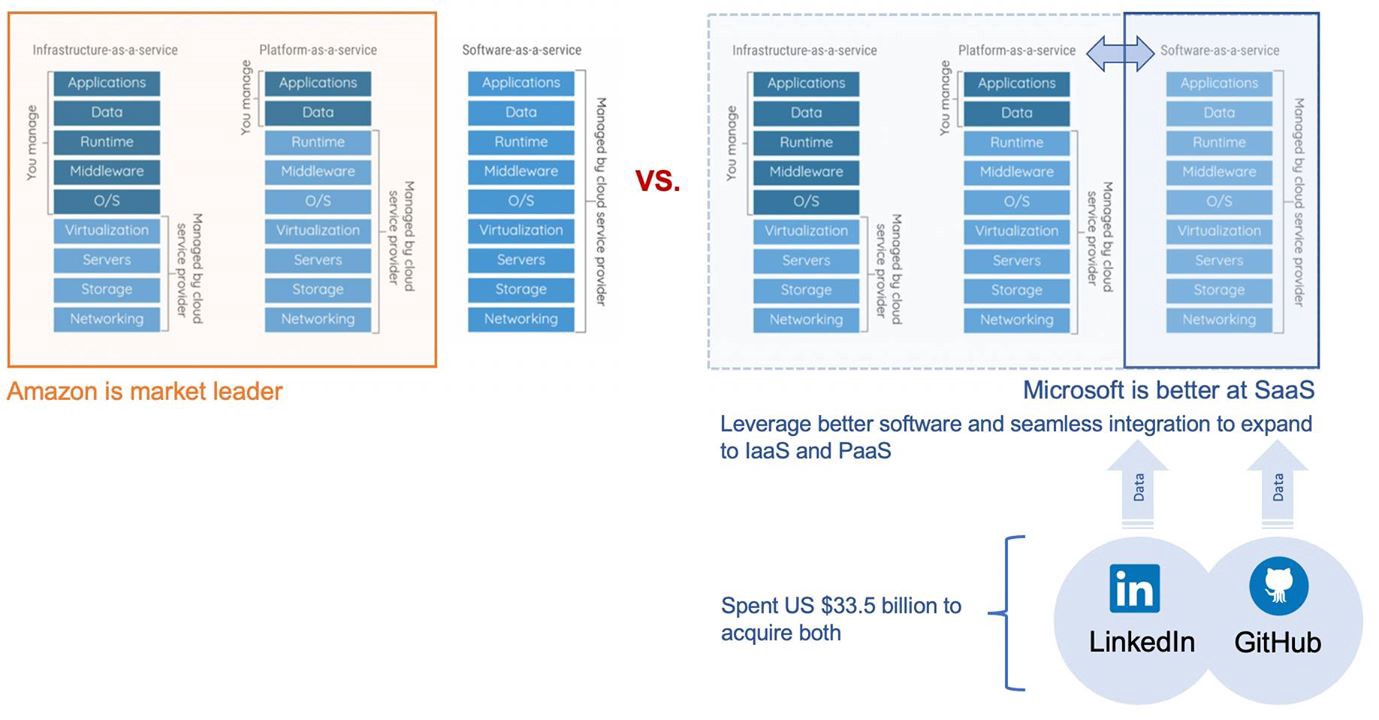

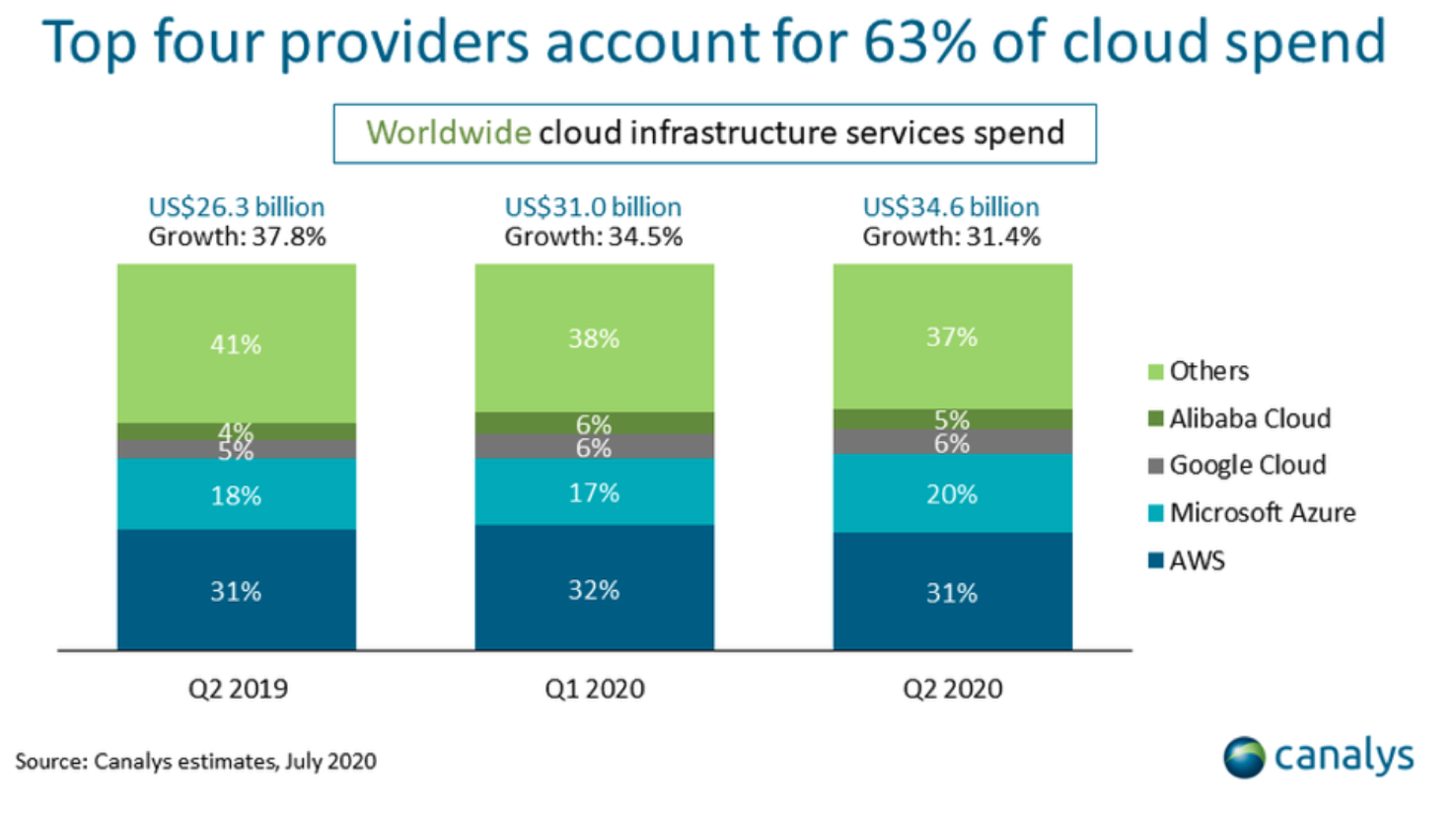

In the cloud computing market, Amazon is the leader in infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS), with more than 33% market share (vs. Microsoft’s 13%). Despite this, Microsoft has been making headway to catch up. The company has two key strengths when compared to Amazon. First, it has the benefit of more software solutions in the software-as-a-service (SaaS) stack (see Figure 3), and second, it has the relationships with CIOs, as Microsoft is the incumbent in many of the traditional on-premise solutions.

Utilizing these two core strengths, Microsoft has focused on the hybrid cloud as its unique selling point. Hybrid cloud is a solution that is suitable for both legacy on-premise and cloud architectures. Microsoft’s approach is to offer a seamless transition between the two — helping companies with legacy IT to transition to the new paradigm, or to enable clients to use both on-premise and cloud together at the same time. These are a crucial selling points, especially for industries that want to leverage cloud infrastructure but have sensitive data that must be stored on-premise (such as banking, government, etc).

During his tenure, Nadella has made several strategic moves to lay the groundwork to successfully execute this strategy:

Giving the people what they want

Focusing on being a cloud provider meant Microsoft had to embrace open source and provide solutions that clients want, in whatever form that they want (which does not have to be Windows):

- One of Nadella’s first acts was to embrace open source services on Azure (Microsoft’s cloud offering). This started in 2014, with the release of Cloudera Hadoop package and the CoreOS Linux distribution, and was followed with Microsoft officially joining the Linux foundation as a Platinum member in 2016. This is a far cry from Ballmer who once called Linux a cancer. Linux now represents 40% of Azure’s workload.

- In 2016, Microsoft acquired Xamarin, a cross platform app development tool that allows developers to deploy native apps on multiple operating systems (Windows, iOS, Android), using a single shared codebase.

Being strategic means making difficult decisions

- To refocus its efforts on high growth opportunities, the company abandoned its pursuit of mobile, writing off its US $7.2 billion acquisition of Nokia, and laying off 7,800 employees. It also shut down Zune services in 2015.

- Nadella also conducted a series of reorganizations in the company. In the last reorg, he split the Windows group to focus more on ‘Cloud+AI’ and ‘Experiences+Devices’. This led to the departure of Terry Myerson, a powerful executive who was the head of Windows at the time.

Better software needs big Data

Microsoft also made a series of strategic acquisitions to bolster its SaaS offerings:

- LinkedIn, the largest social network for professionals, was acquired by Microsoft for US $26 billion (7.2X revenue multiple). This acquisition has allowed Microsoft to incorporate LinkedIn data to its various ERP and Sale Service software (Dynamic 365) — enhancing its functionalities.

- Github, the largest repository of code (or sometimes called Facebook for programmers) that is used by more than 28 million users, was acquired for US $7 billion (an astonishing 30X revenue multiple). This acquisition should enable Microsoft to more easily push Azure and other services to programmers, via seamless native integration.

With these two acquisitions, Microsoft is the proud owner of two of the largest world’s professional network sites.

Not being Amazon also helps

In 2018, Walmart signed a 5 year agreement with Microsoft Azure around AI, machine learning, and data management. Walmart did not just sign a partnership with Microsoft, but went as far as to encourage its technical vendors not to use AWS, as AWS is Amazon’s primary growth engine. Other companies that compete with Amazon on the e-commerce front seemed to follow suit.

The (Early) Outcome:

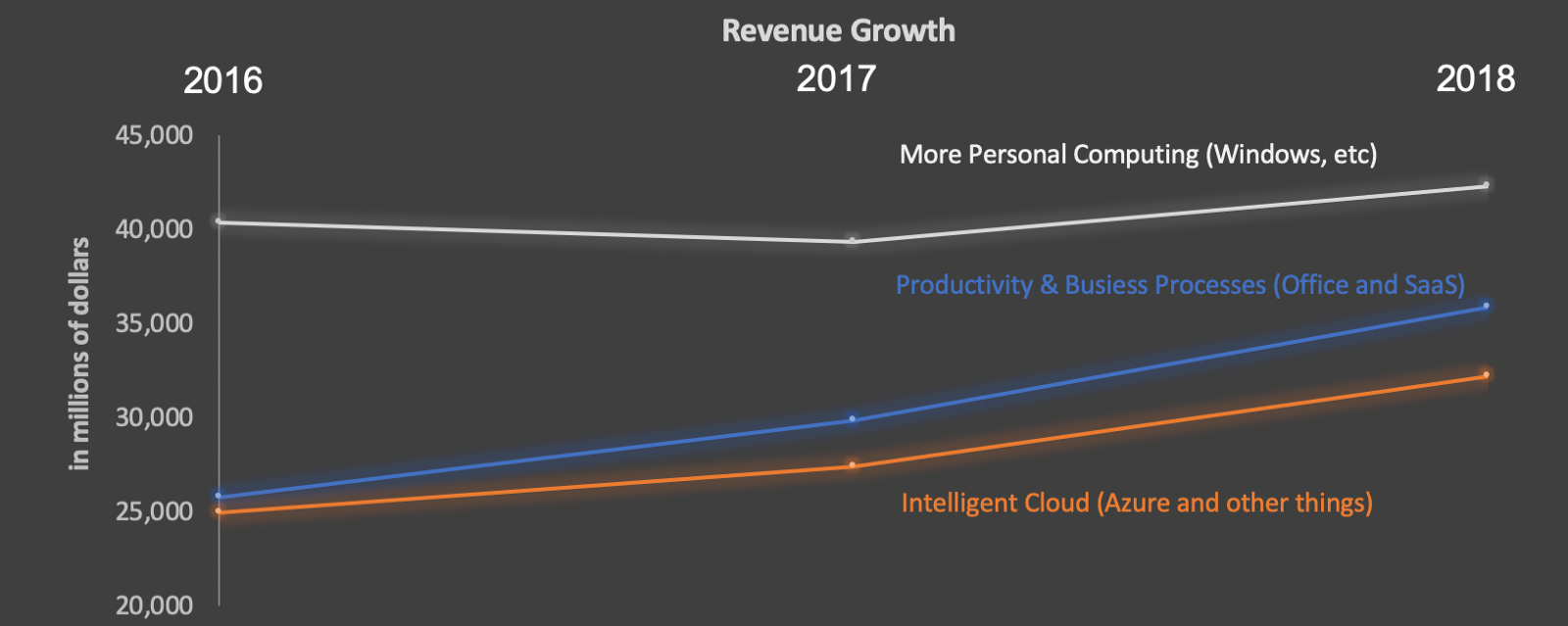

After the aforementioned recent reorganization, Microsoft currently has the three business lines:

- Intelligent Cloud: comprises public, private, and hybrid server products and cloud services.

- Productivity and Business Processes: comprises of SaaS products such as Office 365, Linkedin, ERP software, etc.

- More Personal Computing: comprises of Windows, Devices (Surface), and Gaming (XBOX etc).

As you can see in the Figure 5 above, Microsoft’s SaaS (blue line) and Cloud offerings (orange line) are growing faster than its personal computing (grey line), which has remained largely flat. All in all, Microsoft is enjoying a 56% growth in commercial cloud business, hitting its revenue target nine months early. Not only are these business lines growing fast, they are also very profitable — gross margin for commercial cloud is up 7 points, to 57%.

Furthermore, Microsoft Azure is enjoying the fastest market share growth in the segment (2016–2017 figures shown in Figure 6, source). It is important to note that AWS has the largest market share, so it is to be expected that its percentage growth is lower than its competitors.

In response, Amazon goes hybrid as well

In response to Microsoft’s threat, Amazon recently announced a hybrid solution as well, called AWS post. With AWS post, clients can purchase the same hardware that would be used in a AWS cloud environment, but install said hardware on-premise, in their own data centers. This would allow enterprise customers to enjoy a consistent set of hardware, software and services (similar to Microsoft’s offering). This move represents a big acknowledgement by Amazon, who has always promoted the end of on-premise data center in favor of a 100% cloud environment, that some workloads may never move to the cloud.

It is too early to tell how these strategic moves will pan out for Microsoft, but so far, in the eyes of investors, Microsoft has returned to being a growth company again, and has withstood the recent tech stock sell-off better than its competitors.

[mc4wp_form id=”1064″]

Thanks for reading!