Stock market predictions are mostly incorrect

It is a time honoured tradition for all the large investment banks to make a prediction on how the stock market will perform in the coming year. And it is our time honoured tradition to keep track of the accuracy of their predictions.

First, remember that the stock market is not the economy. The market is a reflection of the expectations of how the economy will perform (which itself is a function of GDP growth, consumption patterns, unemployment levels, interest rates, etc). And because it is a function of expectations, it is fallible to rational (and irrational) exuberances.

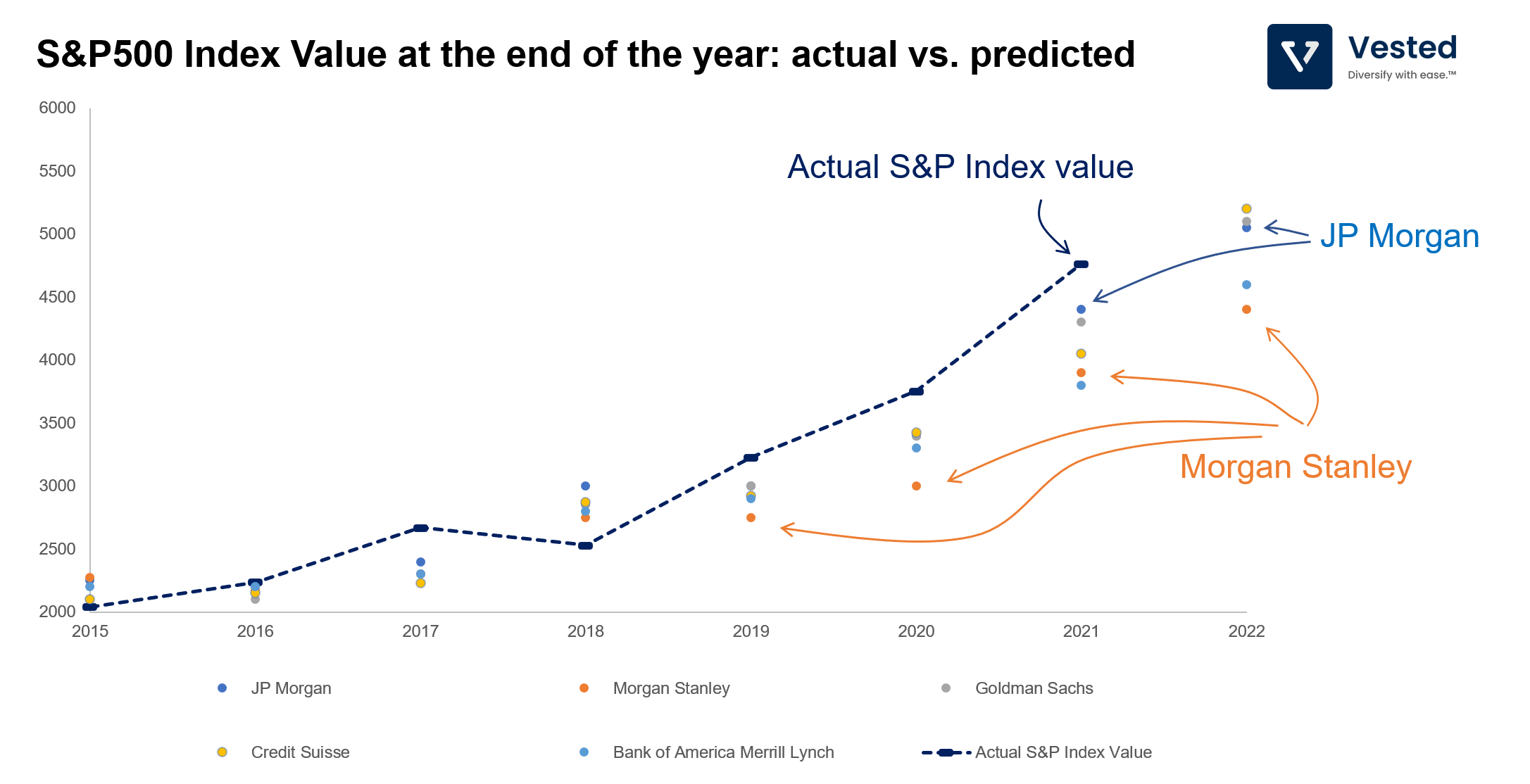

Every year, these investment banks publish their market predictions of where the S&P 500 will close in the following year. And (spoiler alert) they are almost always wrong. See Figure 1 for the compilation of their predicted S&P values (dots) compared to the actual values from the past six years (dashed line).

A few key takeaways:

- In the past six years, the market predictions were off. Predictions (dots) tend to undershoot the real index performance (dashed line).

- Predictions by JP Morgan tended to be the most optimistic, while Morgan Stanley tended to be the most pessimistic. They all looked at the same data, but interpreted them differently, resulting in different market predictions. They both agree that earnings growth will be robust (anywhere between 8 – 10% for 2022), but due to the expected increase in interest rates and the Fed likely tapering down quantitative easing, earnings multiple will come down.

- No one predicted that the pandemic would last two plus years and counting, yet, everyone underpredicted the market performance in 2020 and 2021.

- The prediction spread is becoming even larger in 2022, reflecting more uncertainties in the year to come.

In addition to the expected multiple compression, increasing interest rates in 2022 prompted the investments to be funnelled to less risky assets, which has two other major implications.

US market sell-off

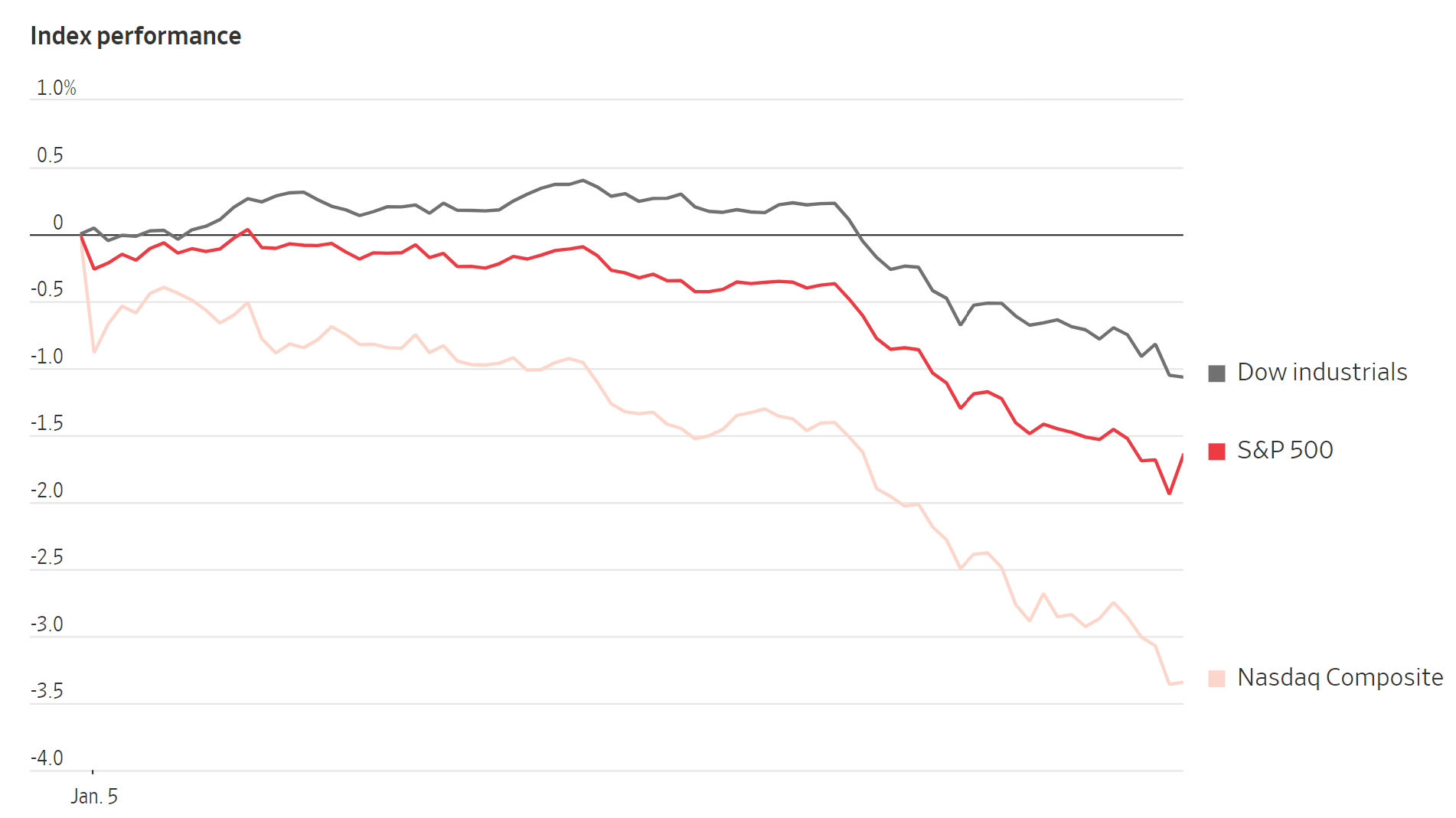

Signs that the Fed will increase interest rates in 2022 have been flashing since last month. But US market sell-off accelerated in the first week of January 2022 after the Fed signaled that it will increase short-term interest rates as soon as March 2022 (Figure 2). High flying tech stocks took the brunt of the hit (represented by the Nasdaq Composite).

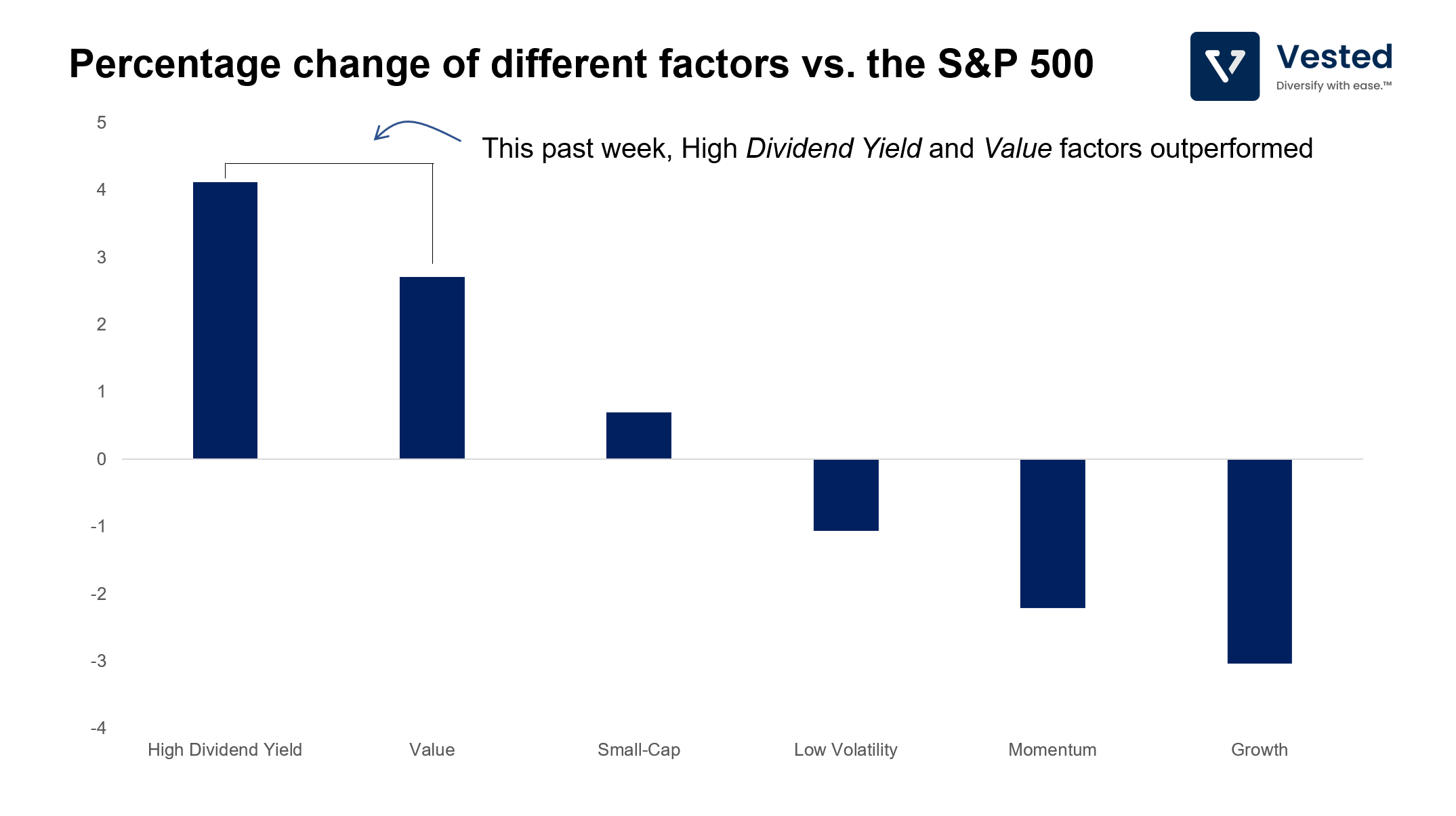

The sell-off in the past week is not equally distributed, however. There are pockets in the market that outperformed the S&P 500 this past week, namely: high dividend yield and value factors (we used Vanguard’s high dividend yield ETF (VYM) and iShares Russell 1000 Value ETF (IWD) as proxies, respectively). See Figure 3 below for the percentage of outperformance/underperformance when compared to the S&P 500 benchmark of the different factors.

Some say that this is the beginning of the long awaited factor rotation towards value investing (a style that has underperformed for more than a decade, thanks to low interest rates and easy money policy by the Fed that promotes fast growing, often unprofitable stocks). Note, however, that a similar move happened early in 2021, only to reverse itself, as the Delta variant surged globally. So the jury is still out if the current rotation is going to be long-lived.

Weakening of emerging market currencies

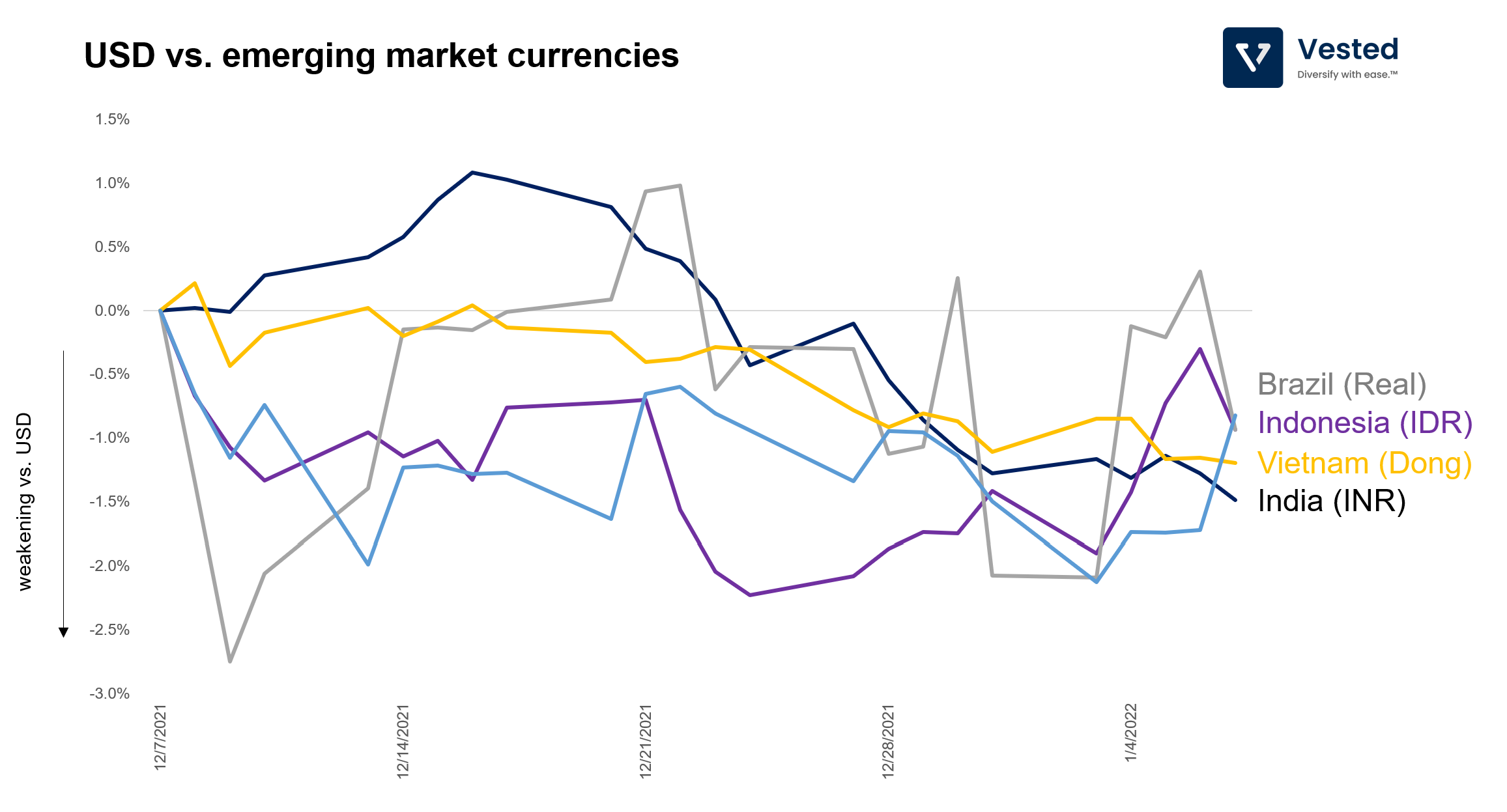

The shift to less risky assets also impacts emerging market currencies. Figure 4 shows the exchange rate of USD against a handful of emerging countries’ currencies. In the past month, they’ve all weakened against the USD (negative % change). Of the ones we plot here, INR depreciated the most.

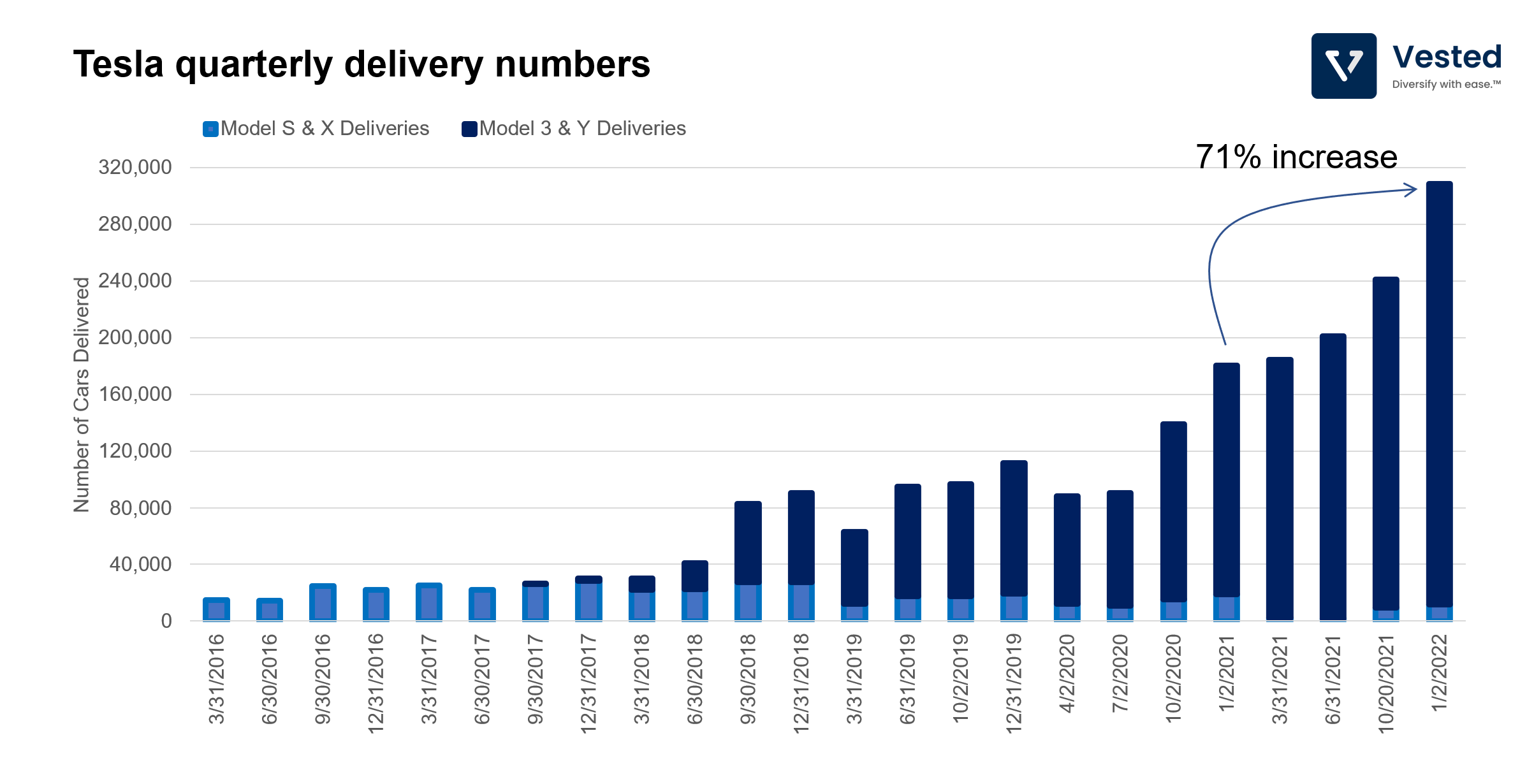

Tesla car deliveries outperformed – again

Despite prolonged semiconductor supply chain issues, Tesla reported record delivery numbers that shattered analysts’ expectations. In the last quarter of 2021, the company delivered 308,600 cars, a 71% increase year-over-year.

This outperformance is thanks to the vertical integration strategy that Tesla adopted from day one. Tighter integration of software and hardware gave the company the flexibility to re-write its software on the fly to accommodate for substitute semiconductor chips. This is in contrast to other car makers who struggled with chip shortage, impacting their bottom line.