In this week’s article, we want to talk about the trend of digitizing expensive and difficult transactions (buying a house).

For the average US consumer, the largest purchase he or she will make is likely the purchase of a home. Because buying a home is a very large ticket purchase, US consumers do this very infrequently. The average US consumer buys a new home once every 8 years or so.

Due to the infrequent nature and large purchase price – there is a lot of friction involved in completing a house transaction.

Buying and selling houses are difficult

The US housing market is massive (US $36.2 trillion market size as of 2020). Each year, about US $1.5 trillion of housing value changes hands. Despite the size of the market, the transaction process is slow and can be uncertain.

Imagine the following scenario:

- You own your own home and are looking to buy a new place. The new house costs US $400,000. You will need to put 20% of the purchase price upfront and finance the rest with a mortgage (long-term loan).

- To afford this 20% down payment, typically you would need to either have the funds saved up or sell your existing home. In other words, to buy your new place, you have to first sell your current place (freeing up your equity).

- So, you put your current house on the market, hoping the timing of the sale matches the timing of the purchase of the new house. In the meantime, you are doing house tours to see what’s available on the market. Similarly, prospective buyers are coming to tour your house.

- Once you find a house you like, you put down an offer and hope that it gets accepted by the seller. Once the offer is accepted, you get into an agreement with the seller to purchase the house. You then hire external agencies to inspect the house to make sure it is in good condition. You will also have to ensure all the paperwork regarding the house and the transaction are in order.

- The same must also be done with the house you’re selling.

As you can see, the process of buying/selling homes in the US is long, complex, and can be uncertain. What if your loan is not approved? What if the sale of your current home failed, preventing you from buying your new home? What if after you sell your existing home, you cannot find a suitable replacement?

This is stressful and very time consuming for consumers (it takes an average 2 months to complete). Because most buyers purchase homes so infrequently, they rely on real estate agents to help guide them through this process, adding costs to the process. Real estate agents typically charge 6% of the home value, split between the buyer’s and the seller’s agents (paid by the seller). This amounts to more than US $75 billion in transactional commissions.

Companies are iBuying homes to solve this problem

Some companies are trying to solve this problem. They want to make buying/selling a house as easy as a typical ecommerce experience. These companies want to provide an instant buy/sell experience, improve the customer experience, and speed up the transaction.

They do this by being the intermediary that buys your home from you when you’re trying to sell, and sell homes from their own inventory when you’re trying to buy. This is called iBuying (instant buying). See Figure 1 that shows the comparison between iBuying by Zillow (one of the biggest players in this space) vs. the traditional method.

In other words, iBuyers provide convenience, speed, and certainty that the transaction will be completed. And for that, they charge a fee.

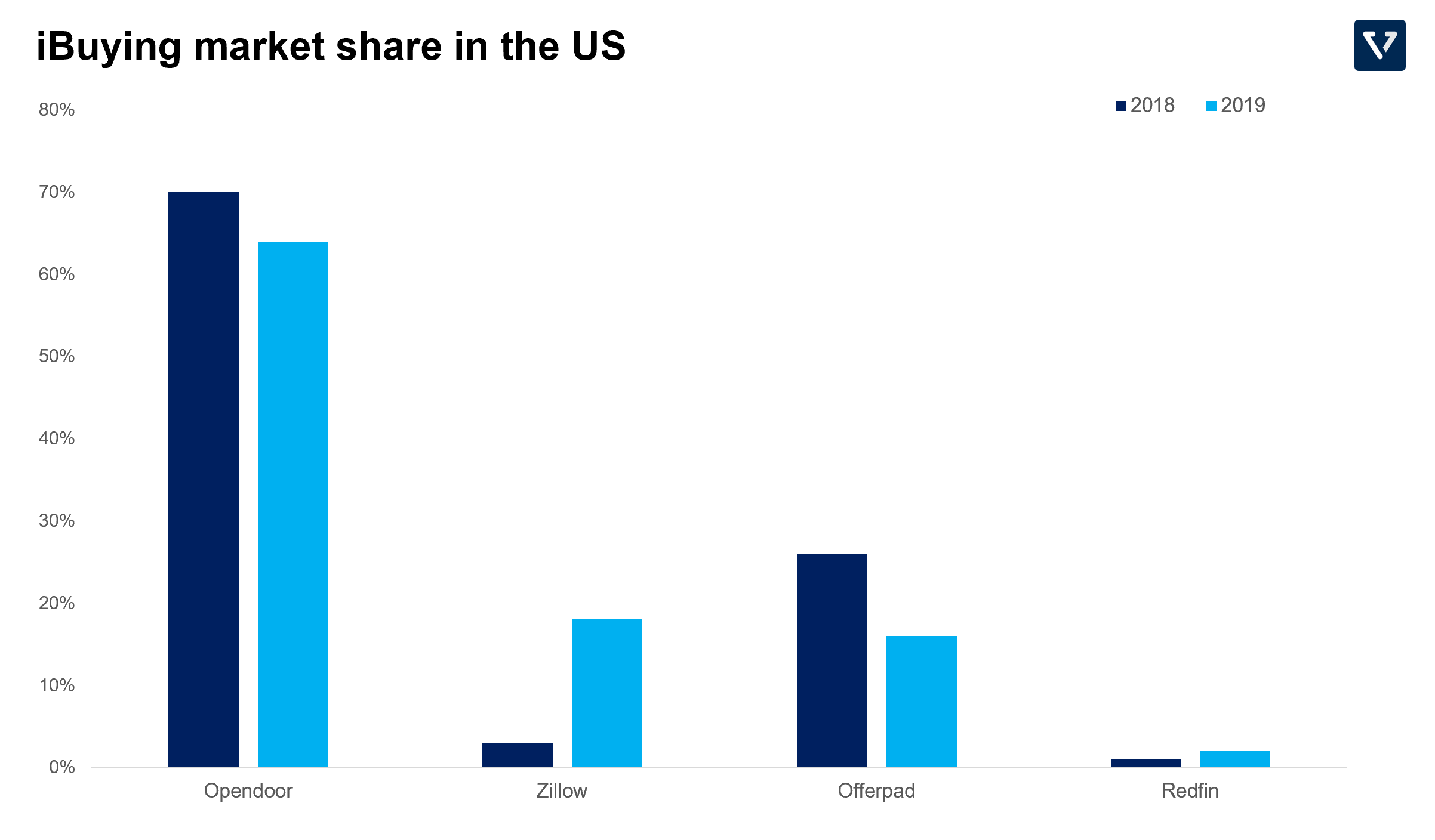

There are three public companies in the space Zillow, Redfin and OpenDoor.

- Zillow started as a housing search tool that generates revenue from ads (primarily from real estate agents listings). It started its Buying business in 2018. Leveraging its vast data of housing prices, Zillow started a service (called Zillow Offers) that buys houses, fixes them up, and resells them, earning a fee for providing a simple and fast transaction.

- Redfin started as a real estate broker firm that charges lower fees than traditional real estate. Its iBuying program is called Redfin now and operates similar to Zillow’s.

- Unlike the two above, Opendoor started as an iBuying company from the get go. It merged with Chammath’s SPAC late last year and is now public.

Of these companies, Opendoor and Zillow are the two largest iBuyers, accounting for about 86% of the iBuying segment (note: iBuying is still in the very early days – contributing only less than 1% of home transactions overall).

How iBuyers make money

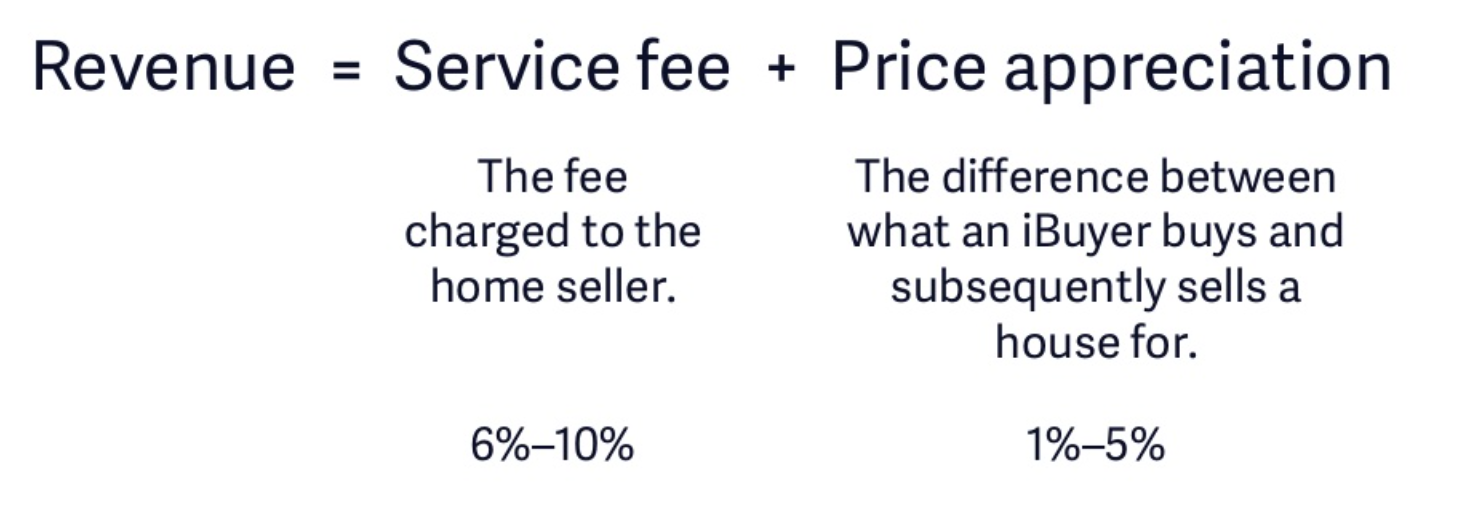

These companies generate revenue from two sources:

- They charge a percentage fee to the home seller (typically 6 – 10%), which is higher than the typical real estate agent fee of 6%.

- If the house appreciates when it is resold, the company generates additional revenue.

Make no mistake though, iBuying is a low-margin business. Companies that operate in this segment require large capital (they need to raise billions of dollars to purchase and refurbish homes) and are able to master complex operations (they need to be able to expand operational capabilities in different cities to maintain and repair homes).

Furthermore, these companies assume market risk, as they hold inventory of houses. If the housing market takes a turn, their inventory would lose value.

Zillow vs. Opendoor

When Zillow made the pivot from a pure ads business to the iBuying model, investors did not like the move, as it is riskier than it’s core advertising model. The share price of the company was depressed for much of 2018. In February 2019, Rich Barton returned to the CEO seat. Barton was the original CEO, and had left in 2010 to become the executive chairman. Barton also founded Expedia and co-founded Glassdoor. As the original founder of Zillow and a serial entrepreneur, he returned to lead the transition to the new business model. This gave investors some comfort, but it is only recently that investors are buying the narrative of Zillow’s transition to iBuying.

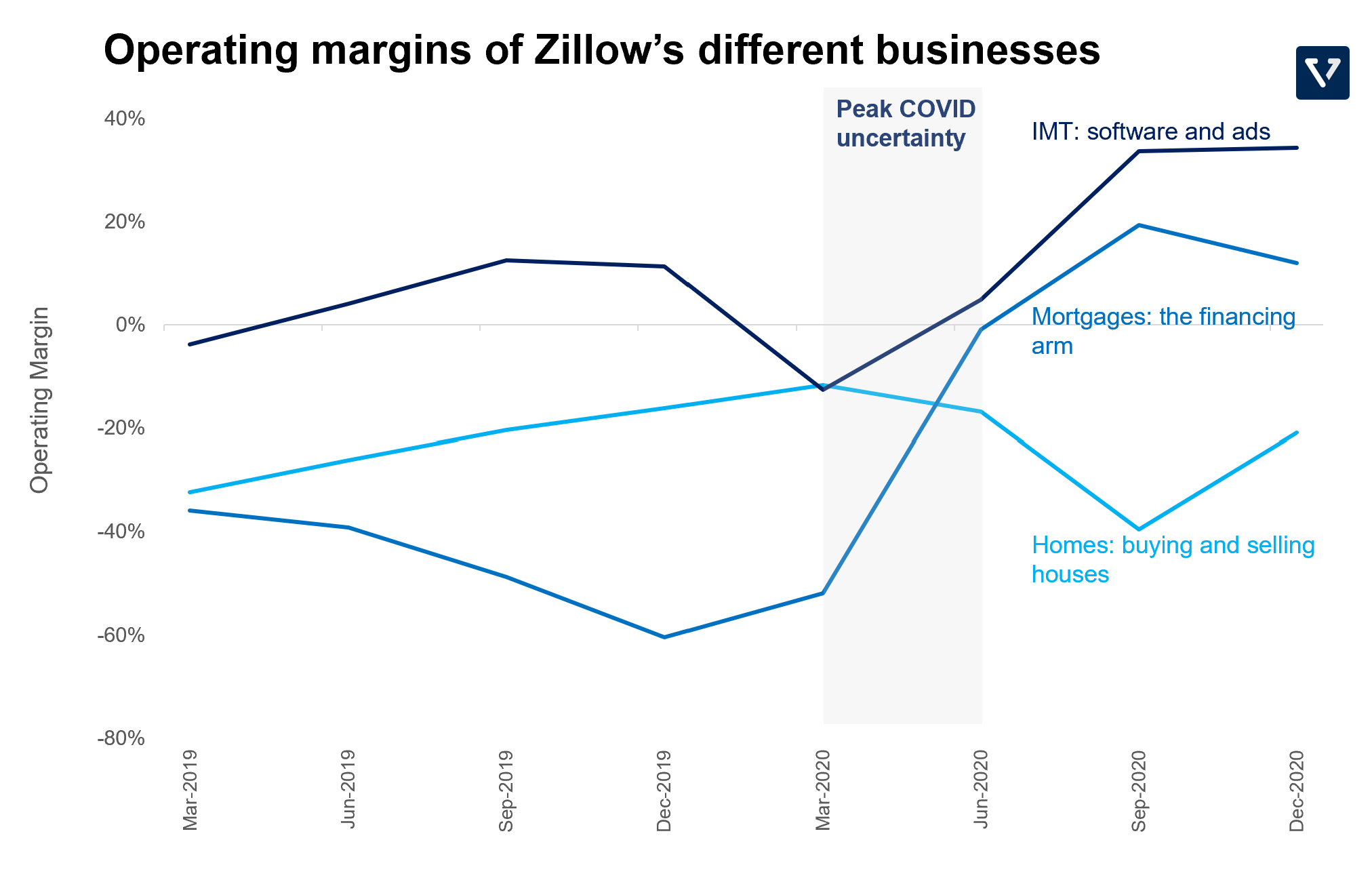

Zillow has three business segments:

- The IMT (Internet, Media and Technology) segment, which sells advertising and software products, has the highest operating margins. It is the most profitable segment, contributing 55% of revenue in 2020, and, in Q4, grew 33% year-over-year.

- The Homes segment (buying and selling of houses) made US $1.7 billion in 2020, or 40% of total revenue. This segment still has negative margins, however.

- The Mortgages segment, which is the financing arm, started around the same time as the Homes segment to complement the purchasing experience by offering home loans to customers (if you are looking to buy and sell your house at Zillow, you are more likely to use their closing and mortgage services). This segment finally became profitable in the second half of 2020. Although it is currently the smallest segment for Zillow (contributing only 4% of revenue), it will be critical in boosting profitability of the iBuying model for Zillow.

Figure 5 shows the operating margins of the different businesses:

As you can see, the IMT segment (advertising and software) is profitable for Zillow. So why did it decide to enter the difficult and low-margin business of iBuying?

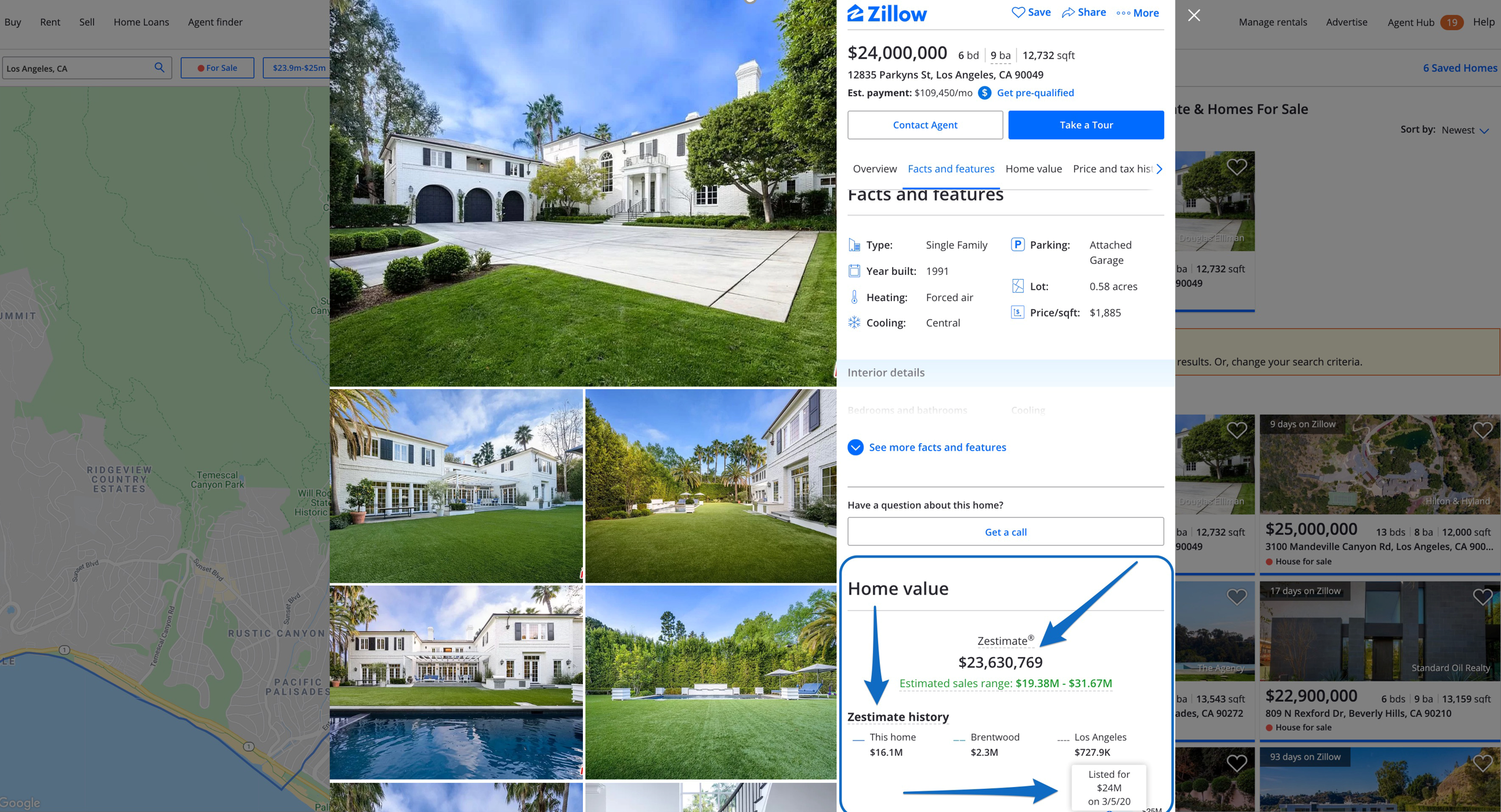

The reason: Companies operating the iBuying model pose an existential risk for Zillow. Zillow’s advertising model is predicated by the fact that it acquires high organic traffic from users who want to buy/sell their homes. The company initially captures internet traffic by providing home price estimates (called the Zestimate – see Figure 6), enabling anyone to estimate the value of their home. It has become a favorite pastime for anyone looking to move to go to Zillow to look up prices.

If companies such as Opendoor are successful in becoming the intermediary in the home buying process, the following may happen:

- Sellers, attracted to the convenience and speed of home selling on Opendoor, will first post their homes for sale there

- Buyers, attracted by the large inventory of homes for sale, will organically begin their home search there

- This dynamic is typical of any two-sided marketplace: abundant supply will attract demand. And having captured high demand, Opendoor can introduce financing products and advertising, which have higher margins than iBuying.

As a result, Opendoor can supplant Zillow as the go-to website when thinking about home transactions. While Opendoor would start with home inventories, they can bolt on other high margin businesses such as ads and financing.

To prevent this from happening, Zillow decided to transform itself into an iBuyer to maintain pole position as the go to destination for real estate search.

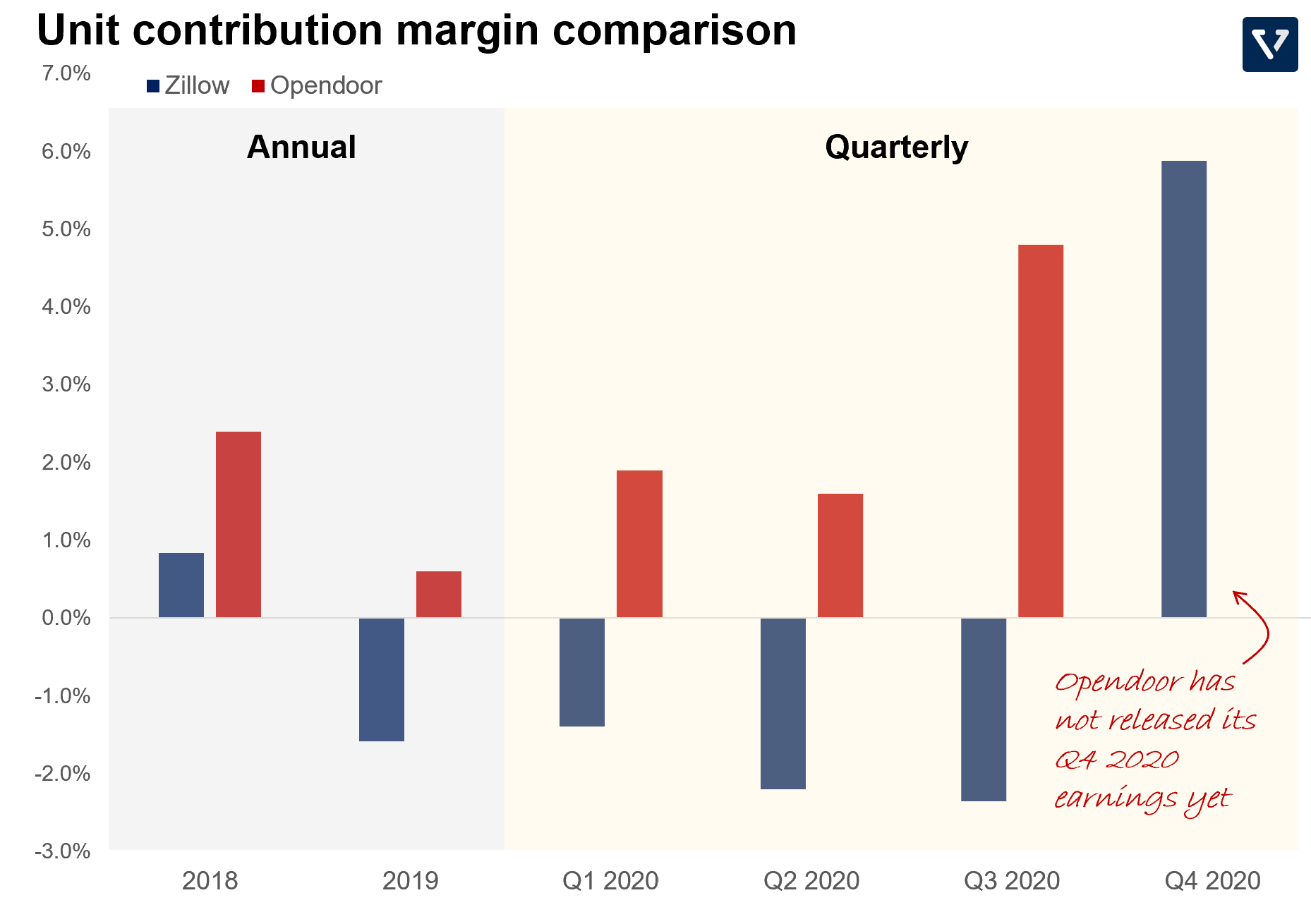

When you compare the iBuying segment of Zillow vs. Opendoor, you can see that Opendoor’s per-house-profitability is better than Zillow’s, who despite being the older company, is much newer in the iBuying space than Opendoor (founded in 2014). In the beginning of the pandemic (Q1 and Q2 2020), both companies halted acquisitions of new homes, but resumed in the second half of the year, backed by a market tailwind (he number of home sales is projected to go up another 21% in 2021 as more people in the US are looking to move). In Q4 2020, Zillow was even able to achieve positive unit profitability (on a per house basis). Opendoor has not announced its Q4 earnings yet – so we do not have that number to compare to.

Over the long term, despite the negative margins, Zillow can continue to operate the iBuying business. This is because the company:

- Has a profitable ads business that generates strong cash flow. In fact, anyone who decides to buy/sell on the iBuying segment but then decides to purchase a home that is not owned by Zillow can easily be funneled to the other real estate agents who have ads on the platform, giving Zillow the opportunity to convert these high intent leads into revenue. Currently, Opendoor does not have this advantage.

- Is already a household name with more than 200 million average monthly users visiting its website.

Nevertheless, it’s a race between Zillow and Opendoor. Can Opendoor become Zillow faster than Zillow can become Opendoor? Both companies want to make buying/selling homes as easy as completing an ecommerce transaction, and the price is a slice of the US $ 36 trillion market.