The many Bitcoin bubbles

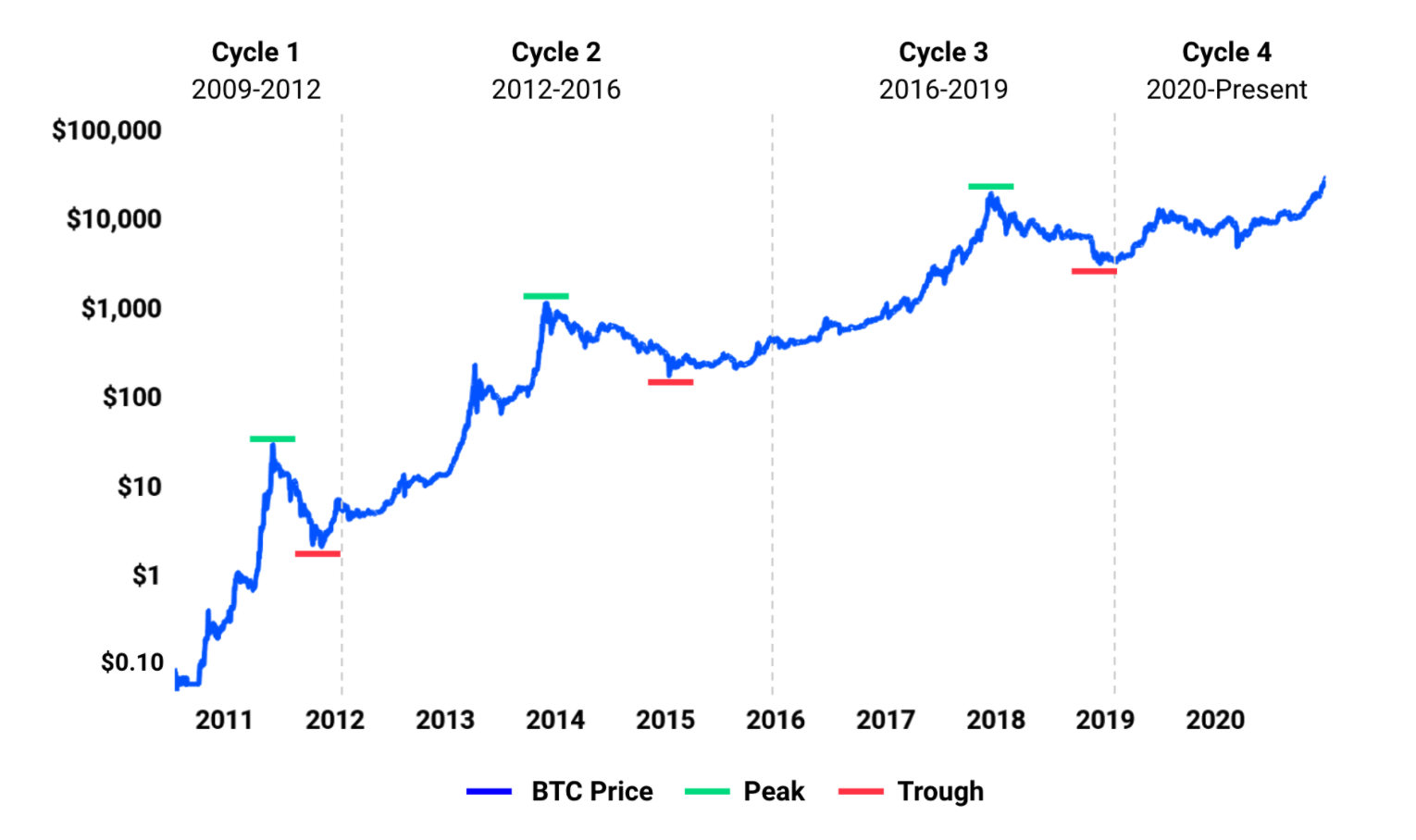

Cryptocurrencies – Bitcoin, specifically – have undergone many boom/bust cycles over the past decade. Since 2014, we can count at least 3, possibly 4 (if we include the latest run-up) Bitcoin bubbles (see Figure 1).

Each cycle lasted between 2 to 4 years, and, on average, after each bubble burst, Bitcoin’s price settled to a level higher than before the bubble. As a result, after each hype cycle, Bitcoin’s market capitalization increased due to increased adoption.

After all, “Nothing so undermines your financial judgement as the sight of your neighbor getting rich.†– J. P. Morgan.

Increased adoption after every bubble?

Maybe so, but what is driving this adoption?

As we discussed before, adoption of Bitcoin as a replacement of money has not taken off:

“As a medium of exchange, Bitcoin is too volatile and too slow (Bitcoin’s throughput is 7 transactions per second, while Visa’s network can handle up to 24,000 transactions per second).

Instead, Bitcoin has emerged as an alternative store of value, a vehicle for speculative investment. And Coinbase was there to take advantage of the trend.â€

With the most recent price rally, Bitcoin seems to continue to grow as a vehicle for speculative investment, with increased participation beyond that of retail buyers.

This has been evident in recent months:

- More and more institutions are bullish in Bitcoin as digital gold. (Note: To be clear these institutions are not impartial when it comes to Bitcoin – they have a vested interest in hyping the asset).

- US bank regulators have declared that banks can hold custody of cryptocurrency for their clients, paving the way for potentially more institution adoption.

- Several public companies have disclosed that they have made Bitcoin part of their treasury holdings. Tesla and MicroStrategy are two companies with the largest Bitcoin holdings. (Note: Since Tesla’s initial US $1.5 billion investment in Bitcoin in early February 2021, the company has likely made about US$384 million in unrealized profits, which is about half of its 2020 profits! Making cars is hard – investing in Bitcoin is easier…).

The increase in investors looking to invest in Bitcoin has contributed to the growth of cryptocurrency trading platforms such as Coinbase. It has been reported that Coinbase’s prime brokerage arm was the one to help both MicroStrategy and Tesla acquire their Bitcoin investments.

Which leads us to how Coinbase makes money…

How Coinbase makes money

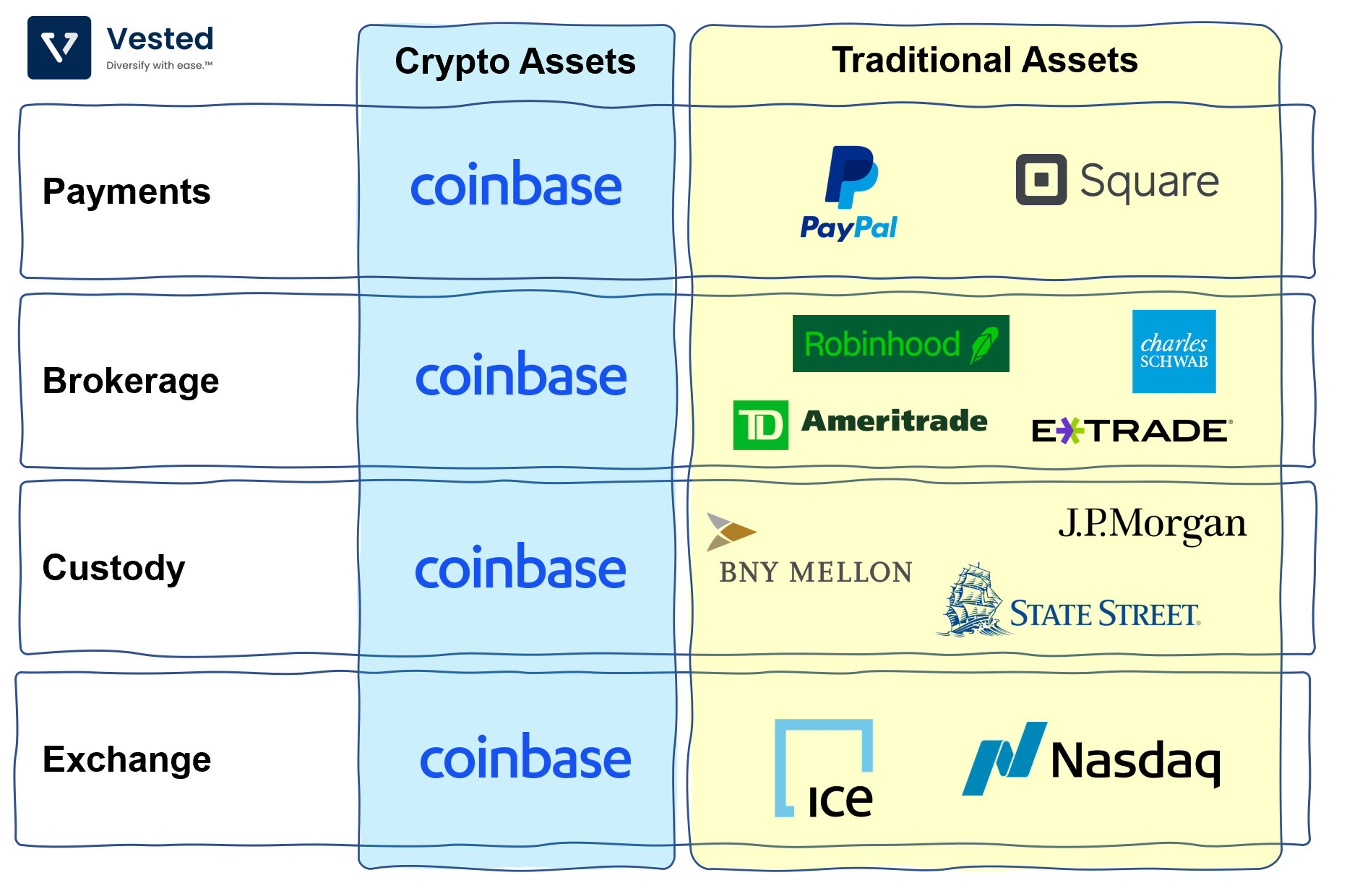

Most retail investors are most familiar with Coinbase as a crypto trading app. In reality, the company is trying to be more than just a broker/trading application; it is vertically integrating across the entire stack of the cryptoeconomy (the term is mentioned 63 times in its prospectus). It has a crypto market-making business, acts as a crypto exchange, as well as serves as a custodian, brokerage, and payments provider (Figure 2). This is unique in the crypto world. As a comparison, in the world of traditional asset class, these functions are carried out by different major companies.

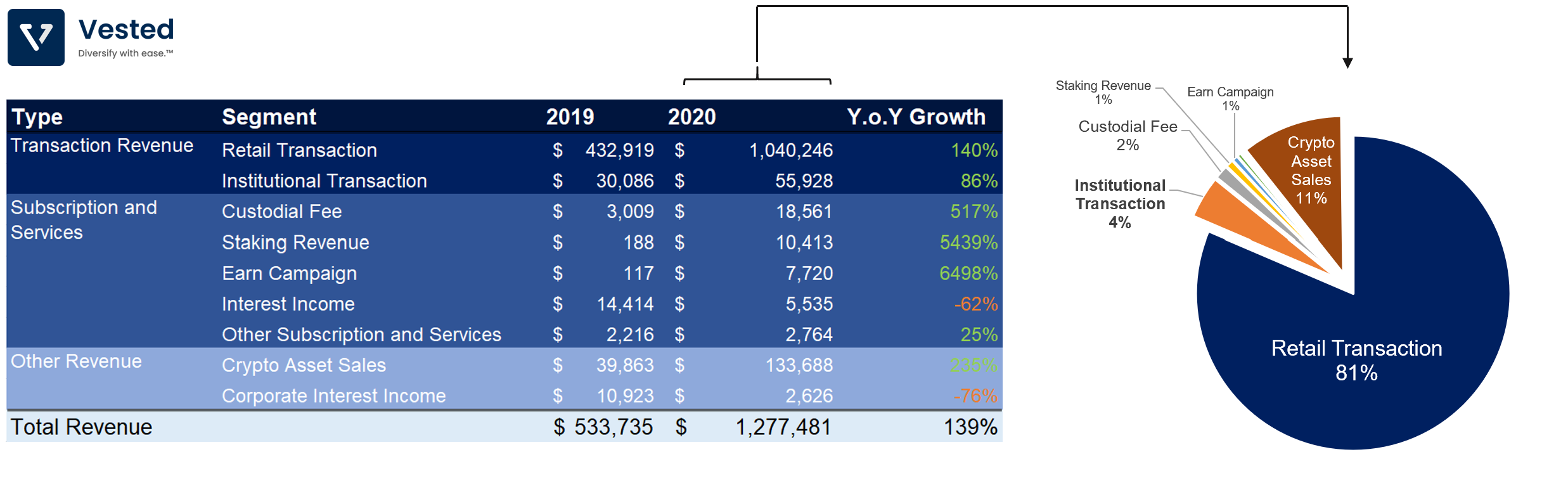

Here’s the revenue breakdown based on the above businesses (Figure 3):

Transaction Revenue: Buy and sell crypto currencies

This is the largest part of Coinbase’s business (about 86% of total revenue in 2020). The majority of this revenue comes from retail investors (81.4%). Notice that institutional investors generated only a minority of trading revenue (4.4% of revenue), despite contributing the majority (or 64%) of the total trading volume in Q4 2020.

This asymmetry means that Coinbase charges institutions much lower fees to incentivize them to trade in order to provide liquidity in the exchange (recently the company adjusted the incentives to institutions to provide more liquidity to less popular crypto), while generating the bulk of their revenue from retail investors (Coinbase charges customers through (i) commission per trade and (ii) adding margin to the buy/sell spread).

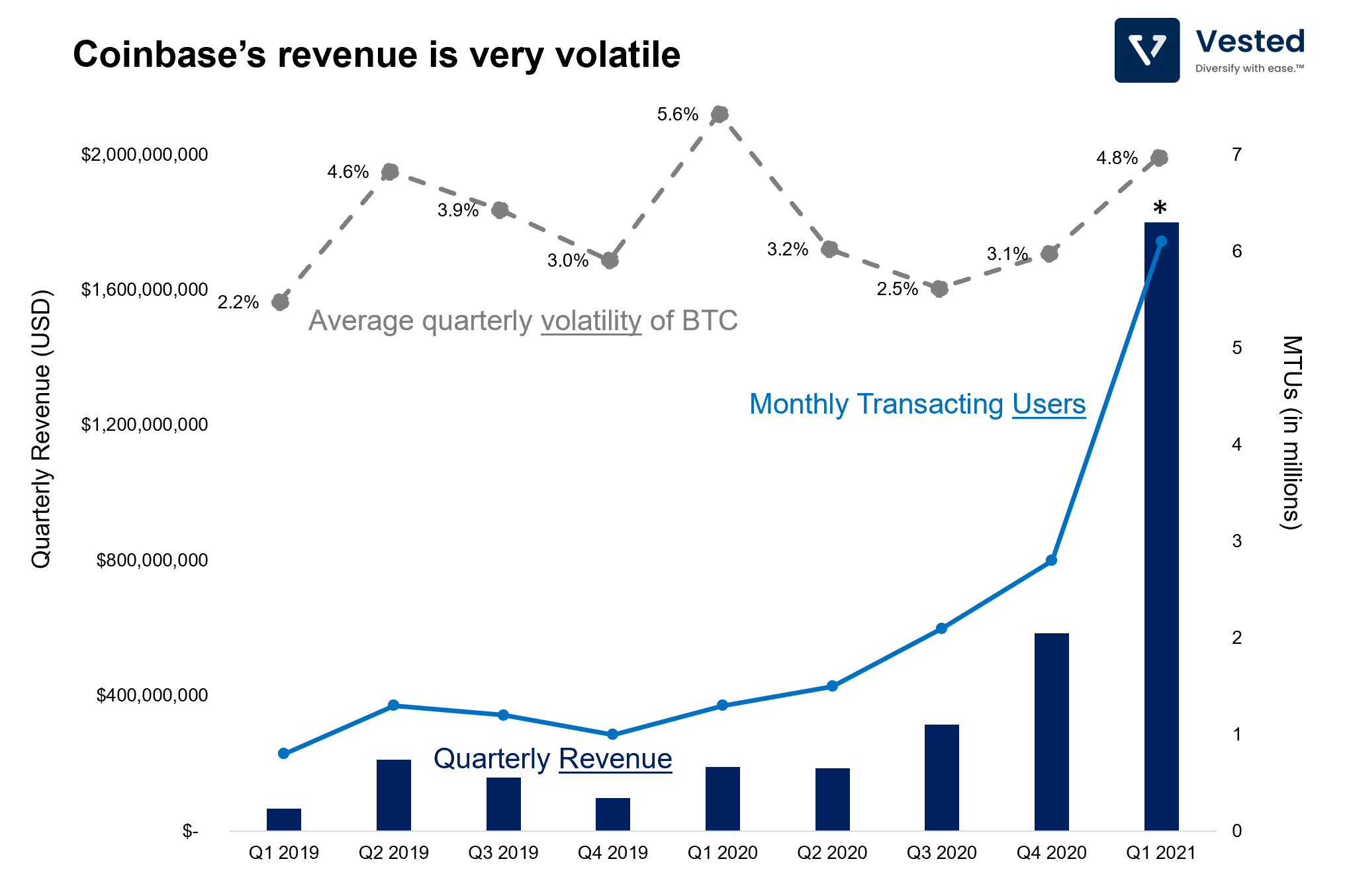

Having retail investors as the primary driver of your revenue means that Coinbase’s revenue varies a lot from quarter to quarter (Figure 4). Q1 2021 revenue is estimated to be US$1.8 billion, almost 3x that of Q4 2021, and more than the entire 2020 combined.

When crypto prices rallies, more users join Coinbase, the number of trades go up, and higher crypto prices translate to more margins and commissions. As a result, there’s a correlation between revenue, volatility and the number of monthly transacting users (MTUs) (Figure 4).

Subscription and Services (recurring revenue)

In order to reduce revenue volatility and increase predictability of its business (which is a must as a public company, otherwise your share price will fluctuate greatly on the whims of public investors), Coinbase is investing heavily in subscription and services revenue.

This segment of the business is the fastest growing (albeit starting from a very small base) and is key for further institution adoption.

- Custodial fee (1.5% of total revenue): This is the revenue that Coinbase earns for holding custody of others’ assets (cold storage solution – where the crypto is held off the internet). Considering the prevalence of hacking in this sector, keeping your crypto assets safe is not an easy task, as Coinbase remains one of the few remaining institutions that has not been a victim of hacks. This service is especially important for large institutions holding billions in crypto assets. A company such as Tesla is not equipped to hold billions of dollars worth of Bitcoin. They cannot store Bitcoin in the bank either, so they employ outside crypto custodian firms to hold their crypto assets.

- Staking revenue (0.8% of total revenue): Staking revenue is the revenue that Coinbase generates when it participates in creating or validating blocks on other crypto networks.

- Earn campaign (0.6% of total revenue): Every company that has a large user base will try to monetize via advertisement. With 56 million verified users, Coinbase starts to monetize its users’ attention by helping promote other crypto assets through educational tools.

- Other (interest income, subscriptions, and crypto asset sales) (11.3% of total revenue): The largest portion of this revenue segment is selling its own crypto assets to customers.

Who are Coinbase’s customers?

At a high level, Coinbase has three customers:

- Retail users: As of Q1, the company has 6.1 million monthly trading users (MTU).

- Institutions: Hedge funds, companies who hold Bitcoins, money managers, etc. As of the end of 2020, the company has 7000 institutions using its platforms (a 7x increase in 3 years).

- Ecosystem partners: Developers, merchants, other asset issuers. As of the end of 2020, the company had 115,000 partners in 100 countries.

As you can see from the above revenue breakdown, the primary driver of revenue currently comes from trading activities by retail investors. But the engine that will likely drive future growth is the institutional side of the business. Institutional investors can act as market-makers, providing liquidity on Coinbase’s exchange and lower volatile revenue through custodial revenue.

Ok, we’ve painted a rather optimistic picture so far. This is the point in the article where we normally take a turn and talk about risks and downside – and with crypto, those are plentiful.

The many risks of Coinbase

Investing in Coinbase might the one of the most direct ways to invest in the rise of cryptoeconomy (without directly investing in crypto currencies themselves). But remember that risks are abundant.

Valuation Risk

As we’ve shown in Figure 1, there have been multiple boom/bust crypto cycles in the past decade. Right now, we are potentially near the top of the current cycle. Investing in Coinbase at the moment it becomes public means that you’re investing near the top of the cycle.

In recent private transactions, the company’s shares were traded at US$344/share, implying a US$68 billion valuation. This is a 12x increase in the span of several months (since Q3 2020), and translates to a price-to-sales ratio (P/S LTM) of 54x (for comparison, here are the ratios for other highly valued companies: Tesla’s P/S currently is 21x, Square’s is 13x, and Paypal’s is 15x).

The US$68 billion valuation was reported in mid-March 2021, a few weeks before Coinbase announced its Q1 2021 earnings, which was strong. So, the valuation is likely even higher now. This level of valuation implies that investors are seeing Coinbase as more than just a retail trading application, but rather as a core infrastructure provider of crypto assets.

Asset Class Risk

For Coinbase to live up to these heightened expectations, mainstream adoption of crypto currencies by individuals and institutions must be achieved.

However, crypto generally, and Bitcoin specifically, is a not proven asset class with real utility.

Why do people buy Bitcoin?

As mentioned above, the primary reason people buy Bitcoin is because it is a tool for speculative investment.

But the word “investment†implies some future utility function. When one invests in shares of companies, those companies sell products and services that generate cash flow (SPACs not included). As a shareholder, you have rights to a portion of that cash flow. When one invests in commodities (oil, metals, etc), those commodities are used in real world applications. When one speculates in FX (speculate is the appropriate term here as ~80% of retail traders that trade FX lose money), the underlying currencies are used in real world, cross border trades.

What is the utility function of investing in Bitcoin? Is it the belief that the value will increase as more people are attracted to the increased value (since supply of Bitcoin is capped)? That sounds like speculative investment.

As digital gold or store of value? Bitcoin’s annual volatility in 2020 was 84%. That is extremely high. Most institutions cannot tolerate that level of variability as storage of value.

For Bitcoin (and other crypto assets) to achieve mainstream adoption, this asset class must move beyond just as a tool for speculative investment.

The geographic concentration and regulatory risk

In a recent talk, Peter Thiel (Co-founder of PayPal, self-proclaimed Bitcoin maximalist) said that Bitcoin can be a tool for China to undermine the USD as the global reserve currency.

“From China’s point of view … they don’t like the US having this reserve currency, because it gives us a lot of leverage over Iranian oil supply chains and all sorts of things like that,â€

“I do wonder whether at this point Bitcoin should also be thought in part of as a Chinese financial weapon against the US where it threatens fiat money, but it especially threatens the US dollar and China wants to do things to weaken it.†– Peter Thiel (source)

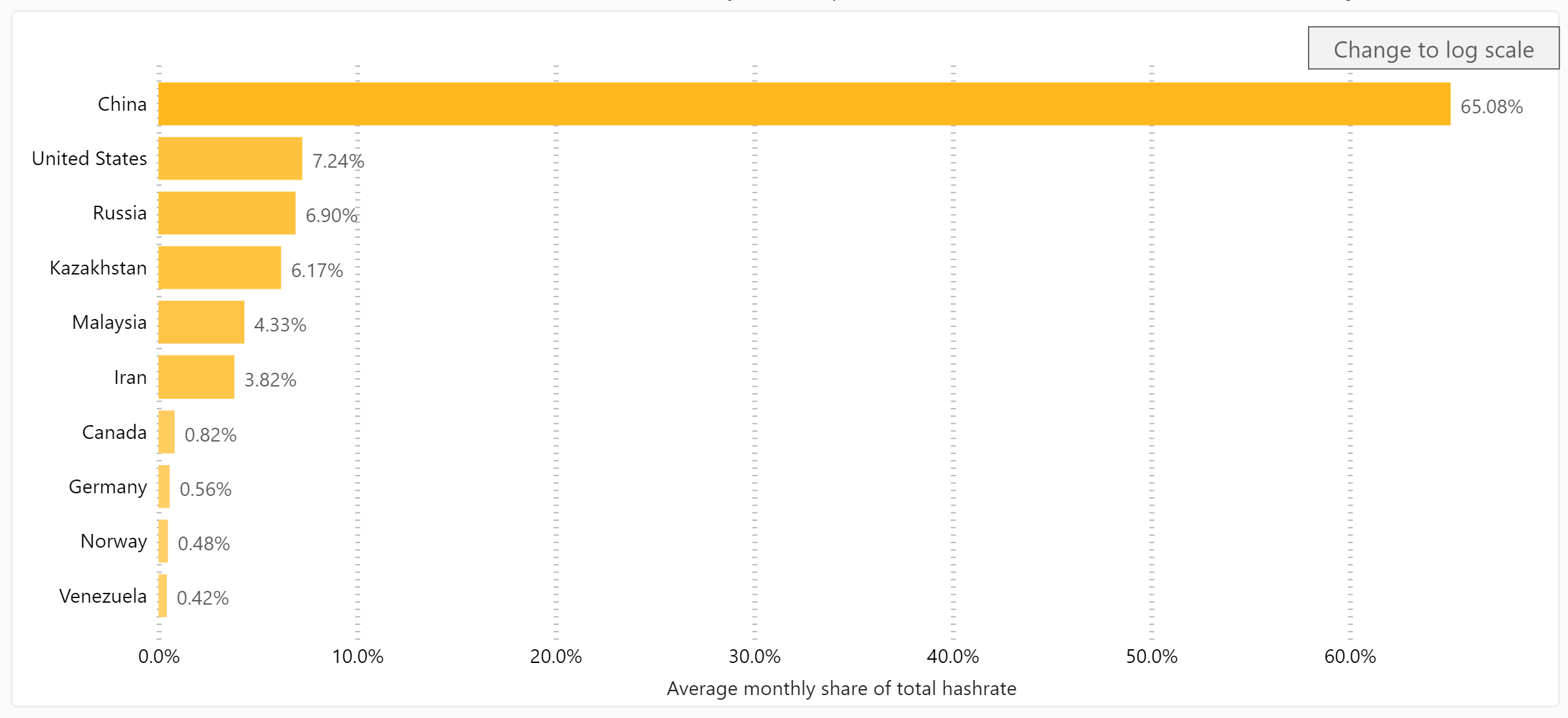

It is true that most compute power used to validate Bitcoin transactions (hashrate) are located in China (Figure 5). The dominance of China as the location of choice is due to the favorable costs of electricity there. Nevertheless, geographic concentration does not mean that the hashrate is controlled by a single entity, but rather an amalgamation of many private entities. Then again, China has a record of exerting control over private industries.

True or not, just the possibility that the scenario is plausible might prompt US regulators to call for more regulations. Regulatory uncertainty will also prohibit mass-adoption.